I just got an email asking me something about state taxes in California and Texas. The link was to an article behind a paywall, but I can pretty well guess what the issue was: Are taxes in Texas really lower than they are in California?

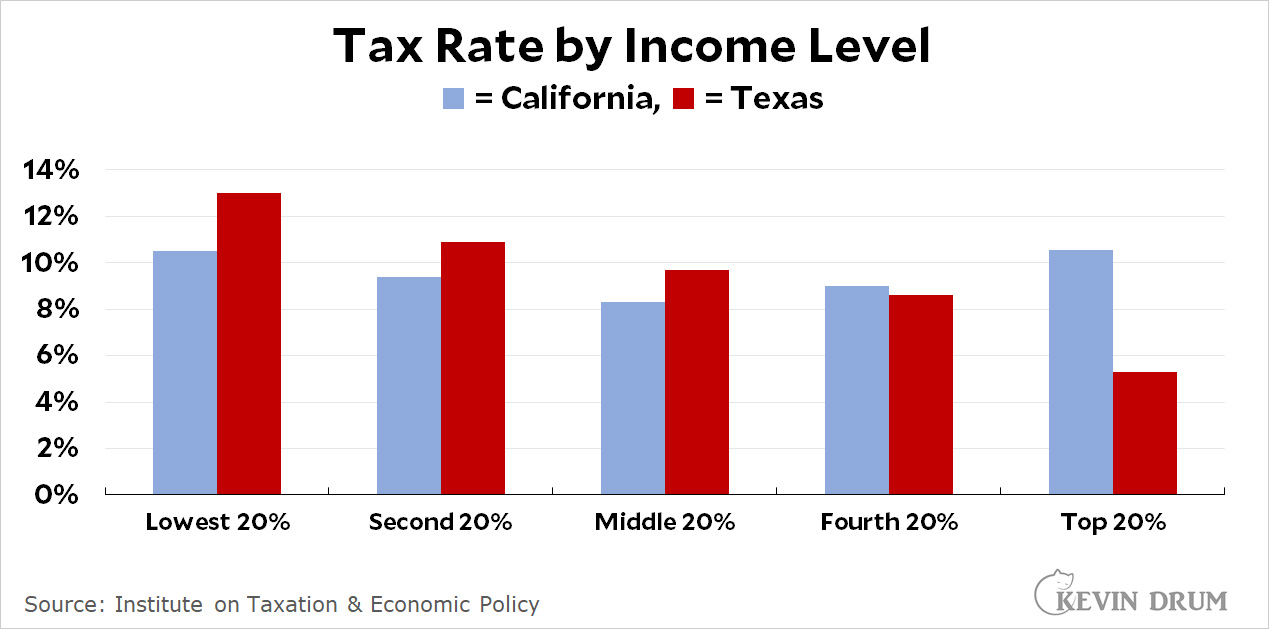

The simple answer is yes. Texas has no state income tax and raises far less tax revenue per capita than California. But before you get too excited about that, it's worth taking a look at just who it is that pays lower taxes in Texas:

As you can see, for 80% of its residents, the tax rate in Texas is higher or about the same as it is in California. This is because the California income tax is quite low for most residents, while sales and property taxes are higher in Texas. When you put it all together, you're better off in California unless you're in the affluent top 20%. Then you're better off in Texas.

And you're really better off if you're in the top 1%, where California taxes run to about 12% compared to 3% for Texas.

Anyway, that's the story. Yes, the total tax take in Texas is far less than in California. But that's solely because Texas has very low rates on the rich. As usual in red states, the Texas model is low taxes (on the rich) and low services (for everyone else).

This no doubt explains why Texas's economic growth (2017-18-19 = 2.9-3.9-2.8%) is so much better than California's (2017-18-19 = 3.4-3.1-4.3%), or why their basic infrastructure (electric grid comes to mind) is so much better.

Too funny (in a sad way) yet well said. Poor Texans should quit acting like slaves and protest. As can be seen, the rich certainly do not have a lock on intelligence and congratulate each other for acting like wild animals. I have always envisioned a blockaded Texas with flights to the only sane place, Austin, a la East Germany during the Cold War.

Yeah, they should demand that Texas be just as fucked up as New York. LOL

Did you go to Cancun with Ted last February? And like ted, did you have regrets almost immediately after you got on the plane?

What does New York have to do with a Texas-California comparison?

Also, NYC seems to be doing quite fine. It’s the redder parts of the state that have been doing terribly for the last half century.

Finally, fuck off troll.

Right back at ya, "progressive" racist. If NYC is doing so well, why can't they even run a municipal election? LOL

That's how regressive taxes work.

The catch is that if you’ve in that super rich category, the requirement for benefiting from the lower income tax is that you’ve got to live in Texas. There’s very few billionaires in Texas who weren’t born and raised there. And a goodly number of them arrange their lives to spend as little time as possible in Texas.

But there’s lots of rich people living in California who are willing to pay more to live in a better place with better weather. We’re always being told that this rich as just a tantrum away from packing up and fleeing to a low tax haven like Texas. But, in the end, the rich like it here much better than in Texas.

Hence, my ID. Texas is a net “taker” of federal income taxes. California is a giver. My home state of NJ gets hosed the worst on a per caponata basis. Those state taxes wouldn’t have to be so high if they didn’t siphon off the money to finance the Red states. NJ loses over $2000/person. That’s criminal.

TX is a net contributor. See, unlike you, I'm not a lazy "progressive." Took me 3 minutes to look it up. So you must be one of the lazy "progressives" who's pissed at having to return to work.

p.s.: Stop telling lies that are so easily traced, moron. LOL

Got to love it. Texas has the same sales tax rate as California but no income tax, and Kevin Drum tries to call it equal. Hey, Kev, look at the census numbers. Seems like not everyone has your arithmetic phobia. LOL

So what do you get out of writing immature comments here? Its a small pond. Why not comment some other place where you don't come off as such a dolt?

It comes off as a stupid dolt. Reading comprehension seems an unreachable goal for him/her.

It's a troll. It leaves its droppings to get attention. Please don't feed the troll.

Awww, can we at least make fun of it, and poke it with sticks?

Howdy, "progressive" Anglo racist!

Texas tends to hide its taxes on the poor by having businesses and landlords pay it in the form of excise and property taxes. You'd know that if you'd taken the time to click on the link Kevin posted and scrolled down to the state-by-state breakdowns.

California has the highest poverty rate in the U.S., when adjusted for the cost of living. Kev and you are fine with that because you're rich.

When I moved from NYC to the OC, it was like moving into a tax haven! While my state income tax is slightly higher here in California than it was in New York, that was way more than offset by two things: no more New York City income tax, and a huge decrease in property tax. The latter was truly mind boggling: my property tax for a year on my 2000+ square foot home in California is less than I paid per quarter on a 700 square foot apartment in NYC.

Ya gotta love it!

This is the real impetus for corporations "moving" their headquarters from California to Texas. In reality, nothing moved but some paperwork and the C* executives who continue to work much of the time in California, but by owning a home in Texas, they avoid California income tax. Hey, you have to figure out some way to compensate the guys at the top when they haven't done a very good job of running the company so their stock compensation isn't what it used to be.

https://www.google.com/search?q=HPE+stock&oq=HPE+stock&aqs=chrome..69i57l2j69i59j0i271l2j69i60l3.1807j0j4&sourceid=chrome&ie=UTF-8

If it got Elon Musk to move out of California, I'm basically in favor of it.

It's unclear whether the quintiles are based on state income or federal income. The median household incomes of the states are disparate, with CA at $78.1K and TX at $67.4K, while the country overall is somewhere in between, at $68.7K. If based on state-level quintiles (as opposed to federal income quintiles), the chart misrepresents and artificially deflates the tax rate in favor of CA and makes CA's tax system look more progressive than it actually is.

But even if the chart's horizontal axis is constructed using national income metrics, it relies on a number of contestable assumptions relating to spending patterns. Most impactfully, a much larger portion of TX households own their homes whereas renting is dominant in CA. Homeownership results in property taxes, but CA renters are still ultimately paying property taxes, just with a landlord as a middleman. This again skews the analysis in favor of CA, as a greater mix of CA households in any quintile pays $0 in direct property tax, which brings down the reported effective tax rate.

Further, even smaller lifestyle differences can cause vast differences in sales tax. What a household spends money on and how much of its income it saves is a key driver of sales tax. If you spend 75% of your income and sales tax across your purchases averages out to 10%, then you end up spending 75% - 75%/(1+10%) = 7%. Certain goods &services are taxed at higher rates or not at all - for example, groceries and residential rent are not taxed in various states and in Manhattan where I live, clothing purchases under ~$100 are not taxed. The conclusion is that if TX households spend more than CA households, particularly on highly taxed goods, that would have a large impact on their effective tax rate, or vice versa.

Now the data in fact necessarily implies that TX households spend more on taxable goods. Savings rates are similar between the states while non-taxed necessities are far cheaper in TX, as the main cost for households is on housing (rent or mortgage). A quick search on Zillow can show you that regardless of whether your move is from Newport Beach to Highland Park or from Compton to Laredo, you would save money on a similar quality house in a similar quality neighborhood.

All that being said, even if the % effective tax rates are higher in TX, because goods & services not provided by the government are much cheaper in TX versus CA, households have more money left over to pay the taxman. Quantitatively, the formula for the chart likely is tax payments (T) divided by adjusted gross income (AGI). To more accurately reflect the cost of living, we should subtract housing, food, gas, utilities, insurance and other essential costs, and then add back any state and local taxes implicit in those costs, to calculate a net discretionary income figure. The formula would be AGI less housing, plus property tax, less grocery bill, plus any sales taxes on grocers, less gas, plus state & local gas taxes, etc. Only then can we see if the taxes are truly progressive or regressive.

Texas education system is financed primarily though property taxes