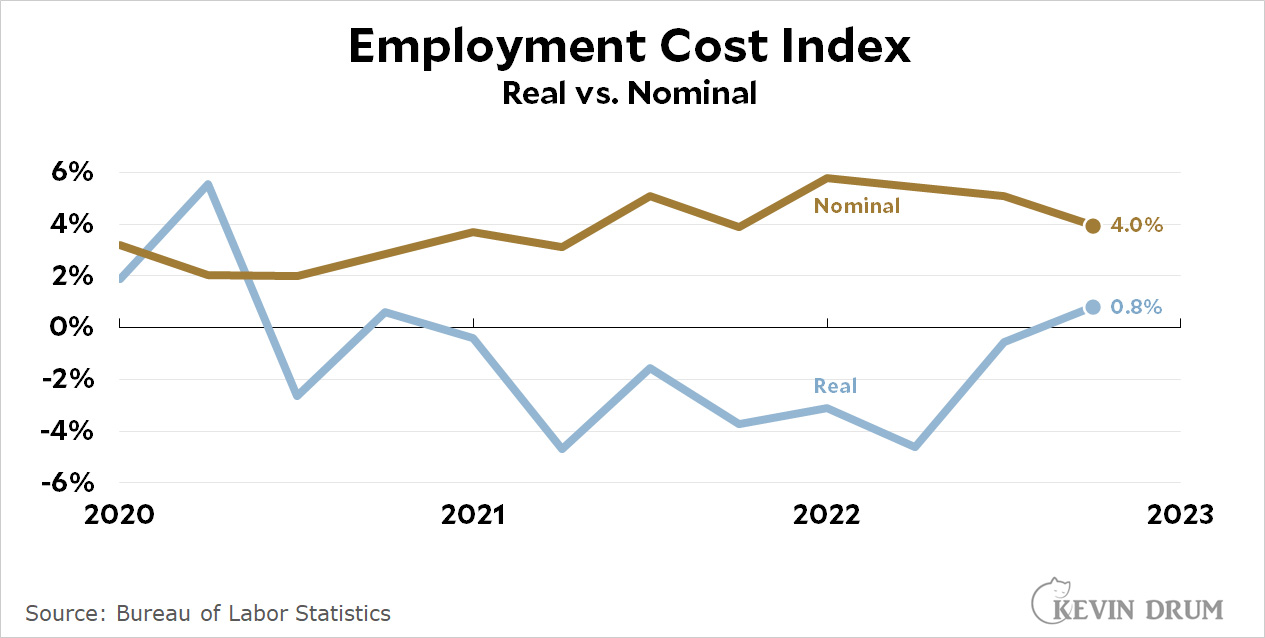

Are wages skyrocketing so strongly that the Fed needs to continue crushing the economy until workers understand who's the real boss? Let's look at today's latest data:

The Employment Cost Index measures the total cost of employing someone: wages, taxes, office space, health care, etc. In the last quarter it went up at an annualized rate of 4.0%. Adjusting for inflation, it went up 0.8%.

The Employment Cost Index measures the total cost of employing someone: wages, taxes, office space, health care, etc. In the last quarter it went up at an annualized rate of 4.0%. Adjusting for inflation, it went up 0.8%.

Both of those seem pretty reasonable. Nominal growth has been sliding downward ever since the beginning of 2022, and real growth remains low despite a couple of recent increases.

From the Fed's point of view, the ideal rate is around 3% nominal growth, with 2% inflation producing 1% real growth. We're getting pretty close to that.

The Fed wants a labor surplus, full stop. They have no other goal or objective. They also have no tools, except the old ones: the only ones they can understand, but no longer effective. They will double down on using them until a labor surplus is somehow created, but it will be only because the entire economy has been destroyed.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://createmaxwealth.blogspot.com

Positive real wage growth isn't going in the right direction for the Fed. Rate hikes will commitment until the proper order is maintained.

They will keep hiking until even Eve is out of a job.