Fears that Israel’s expanding military operations in Gaza could escalate into a regional conflict are clouding the global economy’s outlook, threatening to dampen growth and reignite a rise in energy and food prices.

....“This is the first time that we’ve had two energy shocks at the same time,” said Indermit Gill, chief economist at the World Bank, referring to the impact of the wars in Ukraine and the Middle East on oil and gas prices.

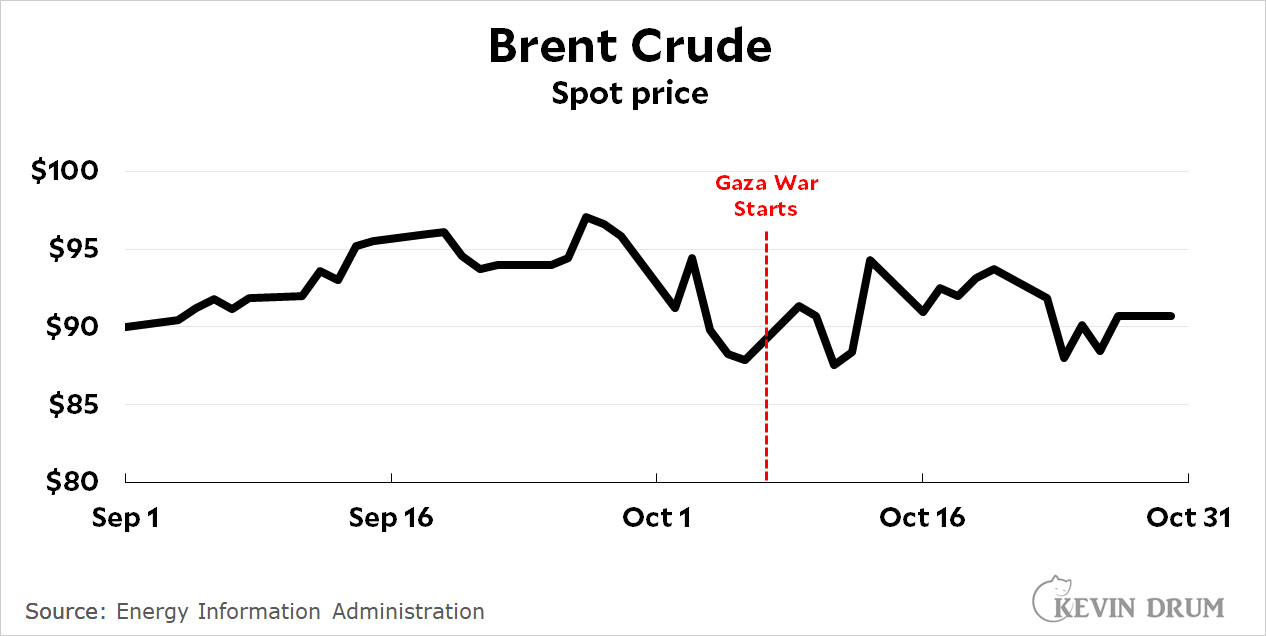

Am I the only one shaking my head over this? The war in Gaza is important for lots of reasons, but even if it expands it's far too small to affect the global economy. Just for the record, here's the price of oil over the past few weeks:

There's no telling what could happen if the war escalates, but the oil market sure doesn't seem to be worried about it. The price of crude has barely budged since the war broke out, and there's no reason to think that OPEC countries are willing to risk their own economies by starting up an embargo over the fate of the Palestinians in Gaza. Nor does the text of the article provide any evidence for this.

There's no telling what could happen if the war escalates, but the oil market sure doesn't seem to be worried about it. The price of crude has barely budged since the war broke out, and there's no reason to think that OPEC countries are willing to risk their own economies by starting up an embargo over the fate of the Palestinians in Gaza. Nor does the text of the article provide any evidence for this.

On the other hand, I'm more or less in the more general camp that believes the world economy is fairly fragile right now and could easily be pushed into recession. In fact, I continue to think it's likely. I just don't see the war in Gaza having anywhere near the heft to influence things one way or the other.

Thee would only be a major problem if Saudi Arabia and Iran went at it. But this will not cause that.

One of the things that can very strongly support an economy is investment. I would suggest that investment in "green technology" at steadily increasing scale is propping up an economy that might otherwise be sliding into recession. Since the scale of that investment can be expected to continue to increase (sensible people give decarbonisation the same priority and urgency as a major war) a recession is no more likely than one would be during a major war.

This is trite, and no, you're not the only one shaking their head on this.

Iran wouldn't directly get involved. It has no logistics chain capabilities for such a war. Almost all of its strike capabilities come from shorter-range missiles. Lebanon won't get involved on account of its fragile internal peace, though Hezbollah might. Syria can't unless Assad wants to lose control of his country again, though religious factions within it might.

Will Hezbollah get involved?

Previously, US intelligence assessed that Hezbollah wouldn't get involved.

Besides, with two US carrier strike groups in the area, who would tempt fate? Iran's not that dumb.

OTOH, if it is perceived that the US is hedging -- for instance, a delay in aid caused by the House GOP putting poison pills into bills and the continued threat of a shutdown -- Iran and Russia might ramp up pressure and throw whatever they have to the militants.

... and then there's the carbon footprint of dropping a zillion tons of ordnance and blowing up whole towns.

Gas prices at my local gas station are down to $3.09/gallon.

Russia's gas exports to Germany have fallen off a cliff, and Germany's economy is fine.

Reuters reports that gas prices "surged 4%", after falling for the previous week. Their writer says the surge is because of the Hamas-Israeli war (you should Panic! Panic! Panic!), but he really has zero idea why prices go up or down. He just used the most exciting headline he could think of, and probably thinks that it is up to the reader to call bullshit or not. The "surge" looks like an ordinary market correction to me. It is noise riding on the signal.

Carbon-based energy seems to be a Buyer's market.

Oil prices are not reacting to Middle-East wars the way they used to react.

Something in the world has changed.

If the conflict in the Middle East expands so as to restrict the supply of oil, there will be inflation. That is mainly what has caused inflation in the last 50 years and what will do so in the future. This is a reliable prediction.

As to whether oil supply will be restricted at any particular time, that is unpredictable. Actions may not be rational. Arabs embargoed supporters of Israel in 1973 and could conceivable do it again. Who knows what Hezbollah or West Bank Settlers would do to provoke conflict?

I've been reading that Hamas are all very upset that Hezbollah and Iran haven't declared war on Israel. The tenor of the remarks seems to be that they were put up to this then left hanging.

If that's correct it would suggest the whole purpose of it is a massive distraction.

Early speculation was that it was intended to disrupt and possibly end Saudi/Israeli rapprochement. Iran may have deceived Hamas, which has no choice now but to get bloodied by Israel, along with a lot of Palestinian bystanders.

My working guess has been that it links back to Russia who wanted it to distract US munitions and world attention away from Ukraine, going through Iran.