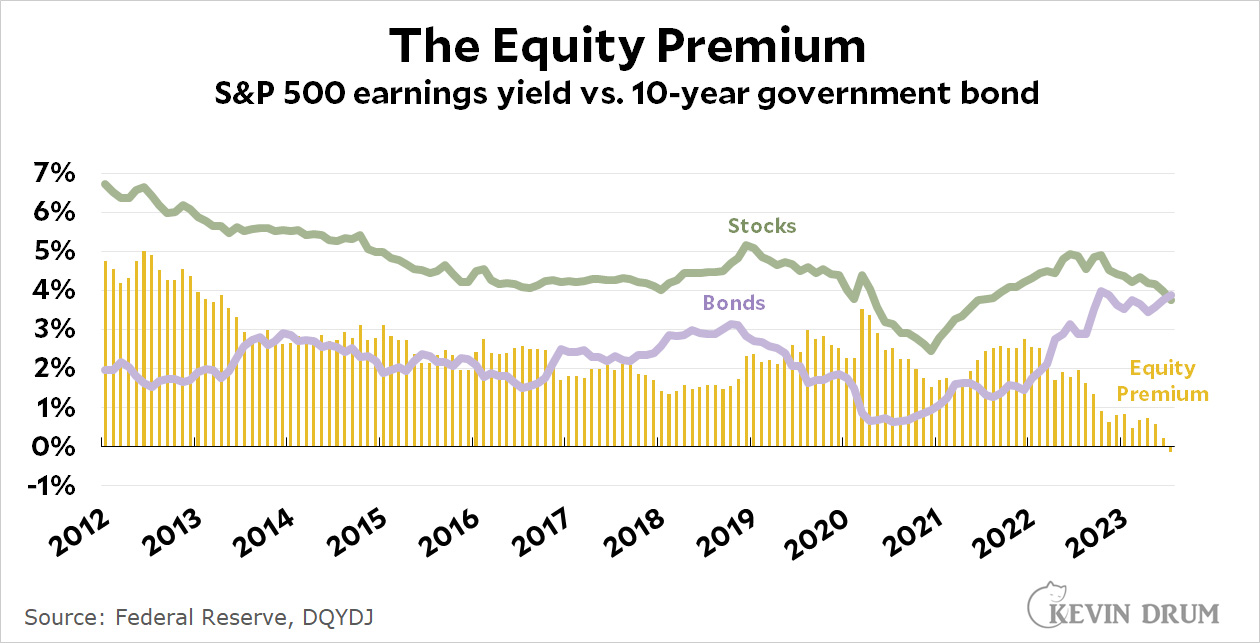

Conventional wisdom says that, on average, you should earn more from an investment in stocks than an investment in government bonds. This is the equity premium, the reward you get for making a riskier investment.

But the equity premium has been drifting lower for the past year and a half. As of today, it's negative.¹ You can earn more from 100% safe government bonds than you can from the stock market:

If you discount, as you should, the possibility of a red-hot economy that sends corporate earnings soaring, this can correct itself in two ways. First, a recession could cause the stock market to tumble, which would produce higher yields compared to stock prices. Second, bond yields could go down, which will happen if the Fed thinks a recession is imminent and begins to reduce interest rates. Or both.

If you discount, as you should, the possibility of a red-hot economy that sends corporate earnings soaring, this can correct itself in two ways. First, a recession could cause the stock market to tumble, which would produce higher yields compared to stock prices. Second, bond yields could go down, which will happen if the Fed thinks a recession is imminent and begins to reduce interest rates. Or both.

The equity premium is a pretty core feature of the economic system, and it's likely to correct itself one way or another. Unfortunately, both ways this can happen involve recessions. Stay tuned.

¹This is using trailing 12-month earnings to calculate the earnings yield. It will come out a little differently if you instead calculate it using projected earnings over the next year.

The stock market is not the economy.

Likely, the issue, is just your measurement period.

The equity premium, when viewed over time is real: of course, over short periods, one can find exception to the historic, superior returns to equities (when compared to debt).

The equity premium compares bonds to the total return on stocks, not just their earnings yield. Earnings have declined in recent decades because of companies shifting to stock buybacks, but if you correctly use total return the equity premium remains.

I have no idea what statistics you're using, but the S&P500 has gone up by a factor of 3.1 in the last 10 years. That's an 11.9% annual growth rate. On top of that, the S&P 500 pays 1.5% dividends these days, so the total return over the last decade of an S&P500 fund is something close to 13.4%.

The 1 and 3 year returns are even higher.

PS: I now see you're not using total return, but some other stats. My point remains -- there's a real, huge, equity premium.

During most of that time, corporate bonds have paid much less, more like 3.5% for about 5 year maturities. Short term bond funds pay even less.

On top of that, the after tax yields of the stock funds are boosted by the fact that your long term capital gains rate is 20%, as is the dividend tax rate, which is about half the peak regular income rate. And interest from mutual fund bond funds is almost always taxed as regular income.

The comparison isn't even close.

There is a fundamental error here:

"Unfortunately, both ways this can happen involve recessions."

No, the Fed lowering rates does not guarantee a recession.

Kevin clearly thinks the Fed isn’t going to lower rates unless the economic starts a downturn. Probably a reasonable bet, since real rates are very low still. Causality running the other way.

From Delong:

Suppose that you had started in January 1871 and had invested your wealth in the stock market—in a broadly diversified set of common stocks. Suppose that, as dividends rolled in, you had reinvested them in your portfolio. Suppose that every January you had rebalanced—sold winners and bought losers so as to maintain your diversification. Suppose that you had paid no taxes, and had incurred no transaction costs. Then, for Robert Shiller's version of a diversified stock portfolio, and adjusted for inflation, as of last January you would have 65,004 times your initial wealth investment. By contrast, if you had performed the same portfolio investment experiment, but with long-term U.S. Treasury bonds, you would have 41 times your initial wealth. 65004 to 41. An average geometric real return for stocks of 7.3% per year, and for long bonds of 2.5% per year: an average gap of 4.8%-points per year. This is the "equity premium puzzle" of Rajneesh Mehta and Edward Prescott.

I may be wrong but I don’t think the chart is corrected for inflation. Bonds pay just a tad over inflation (my impression) so over the long term equities will provide gains and government bonds will provide safety but not much real growth.