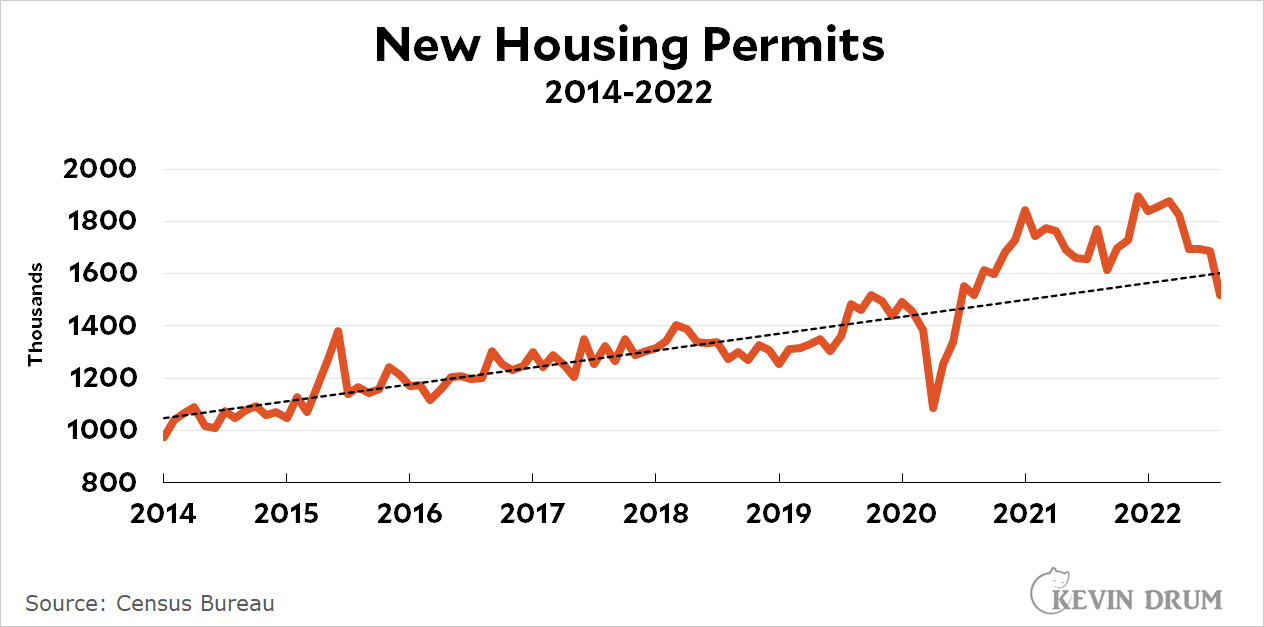

Housing permits, the earliest leading indicator of the housing construction market, were down for the fifth straight month in August. Permitting has now fallen below the pre-pandemic trendline and is headed almost straight down:

In the bellwether region of Southern California, the housing market has cooled down considerably:

In the bellwether region of Southern California, the housing market has cooled down considerably:

Sales of new and existing houses, condos and townhomes dropped 28.3% from a year earlier.

....The Southern California median price — the point at which half of homes sold for more and half for less — is 2.6% less than the all-time high reached this spring. And compared with the white-hot market of recent years, the buying experience could be less stressful, without the need to bid on dozens of homes before either securing one or giving up altogether.

“That maddening competition is gone,” said Jeff Lazerson, president of brokerage Mortgage Grader, noting sellers are more open to low down payment offers they previously would have ignored.

For technical reasons, this slowdown has yet to show up in official inflation figures, but that doesn't mean it's not happening. It is. Inflation in the housing market peaked earlier this year and is now declining.

Rent is still a problem, though up-to-date information is hard to come by. It's probably settling down, but we won't know for sure until the end of the year.

No, it's not. For the umpteenth time. This data doesn't say what you think it says.

The number of sales has dropped 28%, but the price is only down 2% (in that particular market, I guess?) since the all-time high. That's still pretty goddamn close to the all-time high! A 2% change from the all-time high does not a tumble make, and it's almost certainly just noise.

Also consider that if less housing is being built, supply remains constricted and prices will remain higher than otherwise. If housing were being built much more rapidly or in increasing numbers, then we might expect price pressure to be alleviated.

You're basically saying that supply is going down and velocity is going down, while the price is essentially unchanged, and therefore prices are going to go down.

Further, rents provide a sort of price floor for housing prices, and rents are going up. Rising rents = more demand for purchasing housing, as it changes the breakeven point. If you only have to own a place for a few years as opposed to 10 (or even 5!) years to break even vs. renting, then buying becomes much more attractive. This is especially true in the highest-cost rental markets in the country. In the big cities with high rent, people can pay the same monthly cost for their own home (even if it's functionally the same as the apartment/townhome/condo/whatever they're renting) - or maybe even less. Often the only impediment to this is having enough for a downpayment. If sellers are more willing to consider offers with lower downpayments (TBH, why a seller would care about downpayment amount is beyond me, it makes zero difference to a seller unless it's a cash purchase vs. financed purchase...), then that means that they're more willing to meet the demand that is still there.

Housing prices like OER is a lagging data feature. Also the fact much of the investor bought property will be now turned into rental property is deflationary. Prices and rent are going down.

Homesellers couldn't care less what your down payment is: it's the mortgage lenders (and Fannie Mae & Freddie Mac, who guarantee the conventional mortgages).

Why is destroying the housing market so important to the fed? I thought we had a housing shortage. Meanwhile, a multi state developer and property management company (they own lots of apartment complex) is trying to build 120 units nearby to me and they were tuned down by the zoning commission! Really awful decisions due to NIMBY protests. It’s not even low income! Crazy.

I don't know what kids are supposed to do... It doesn't seem like we build nearly enough. I was thinking about this though, isn't there supposed to be a big generational shift as the baby boomers start dying off? I wonder if there won't be surplus housing if that happens? Hard to tell with immigration, I guess.

I just know life as a Gen Xer couldn't be easier. Giant wave in front of me and a giant wave after me, but I'm in a comparatively small demographic. Jobs, housing, etc. has been pretty easy to come by, for the most part...

How is this destroying the housing market?

I'm not sure who this is directed at, but for me, the lack of housing being built makes it too difficult for people (especially young people) to buy homes.

I own rentals, so I'm not too good to believe in housing as an investment, but I feel like the lack of supply is shifting the balance way too much in the favor of older, wealthier generations that can afford to buy at the expense of the young that can't.

I think that a young couple making 20-25 bucks an hour each should be able to buy a starter home, but they can't in a lot of the country... Maybe we're saying the same thing?

It's all regional, but it could stand to drop out here in "Alabama, California". I had dinner with a former student last night that has 100k saved at the age of 21 (pretty remarkable, imo), but he can't afford to buy anything locally. Prices coming back to earth to help young people get into something is definitely not the worst thing, imo...

What's inane about all this isn't that buyers have dried up. It's supply.

Buyers can't afford these huge prices, especially with interest atop it.

I imagine all the people who are waiting for the market to crash to scoop up properties like 2008 are now wondering if they can afford an 8% *still low by historical standards LOL* interest rate.

Could young people now be any more screwed? High as fuck prices, AND high as fuck *still low by historical standards LOL* rates. If I were looking to sell a house, I'd put it on AirBNB and wait until interest rates go back down or just make bank renting it out. I doubt people are going to start defaulting on their 2 and 3% loans. Maybe. Who know.

I'd put it on AirBNB and wait until interest rates go back down or just make bank renting it out.

My brother and his wife did that. Bought a townhouse condo in N. 'burbs of Boston in 2004. Turns out that was just about the peak of the cycle in that market. Tried to sell in 2010 after birth of second kid (wanted a real house with backyard). Not enough equity (Great Recession was baredly over). Tried it again two years later (2012). Still not quite enough equity to make sense selling, but by that point (after eight years of ownership, during which rents were headed ever upwards in Metro Boston) they could easily get a modest positive cashflow by renting it out. Fortunately for them, they had saved enough for small downpayment on a larger house with a good-sized yard a bit deeper in the suburbs. So that's what they did: they become landlords "by accident" (that definitely wasn't the original plan). But it's worked out great for them.

Most people in SoCal probably already know this.

The problem with Kevin's post is that its too academic of a way of looking at housing. True economics requires, I would say, elasticity, because if buyers and sellers, especially buyers, don't have the ability to just say "I'm not buying" at $X unless the price goes down to $Y, is all just speculation.

For starters, for many buying a house is completely optional, maybe aspirational, but optional for sure.

Second, there isn't some constant supply of homes to buy, right now in my neck of SoCal, inventory is crazy low from two years ago, if it wasn't for higher interest rates the market would be up like 30% again. But maybe not, because maybe a sense that there isn't going to be a bidding war induces sellers to hold on.

Next, as some pointed out you can rent. But if rents go up so much that "you might as well buy" then people will buy regardless.

The interest rate rise would have eliminated any other normal market, I have a client selling a tear down in West LA for $2.3 Million and it was multiple bids, no problemo. I guess the doubling of interest rates only kept it to six all cash bids from 26.

Circling around to the beginning, there is no way you could predict that if you don't buy house "A" now that you will be able to (i) buy it at all, or (ii) buy it for less a year from now. That's not a normal market and shouldn't be analyzed like one.

Interest rates Can be gotten around and don't always follow the primary dealers.

Multifamily housing has most units under construction since 1986 -- https://fred.stlouisfed.org/graph/?g=TVtg

Vacancy rates are still super low, multifamily starts aren't going down and the time to complete both single family and multifamily projects is actually coming down finally. All that's happening now is too many Boomers who were willing to list their somewhat or mostly paid off units to downsize now are putting it off because the market is softening again, meanwhile all of the younger folks who increased household formation and reduced household size in the past 3 years are re-upping their leases with the 8-12% increases that are hitting renters throughout the year rather than specifically in the month that apartments.com data indicated was the peak. The delta for housing is spread out in the CPI but that's reflecting to a large degree when renters are experiencing that increase as opposed to when available units reflect that increase in rent and which measure matters depends on who you are. In terms of the impact on aggregate effect I think CPI has it right because it's measuring the income effect on renters, but for the Fed to make decisions for what needs to happen or if you are graduating from school and moving out on your own then you will care much more about the more timely data. So rents won't go down and the current decline in house prices is all because of the effect of high interest rate depressing demand, literally none of it is because of the supply of housing.

I disagree rents are going down.