We've heard a lot about how COVID-19 has devastated the commercial office market as more and more people work from home. And it's true that the vacancy rate of office space has gone up over the past couple of years. But the Wall Street Journal tells us the pandemic was not really to blame:

America’s office glut has been decades in the making, real-estate investors, brokers and analysts say. U.S. developers built too many office towers, lured by federal tax breaks, low interest rates and inflated demand from unprofitable startups. At the same time, landlords largely failed to tear down or convert old, mostly vacant buildings to other uses.

....The U.S. office glut traces its roots to a 1981 change in the tax code, brokers and analysts say. In a bid to boost the economy, the Reagan administration allowed investors to depreciate commercial real estate much more quickly than before, among other changes, lowering their tax bills.

Savings-and-loan associations showered developers with easy loans, brokers say. That helped ignite an office-development boom in the 1980s that drove up vacancies to record levels and contributed to the savings-and-loan crisis, when many such institutions failed. Vacancy rates slowly fell in the 1990s, but surged again after the bursting of the dot-com bubble and the subprime mortgage crisis.

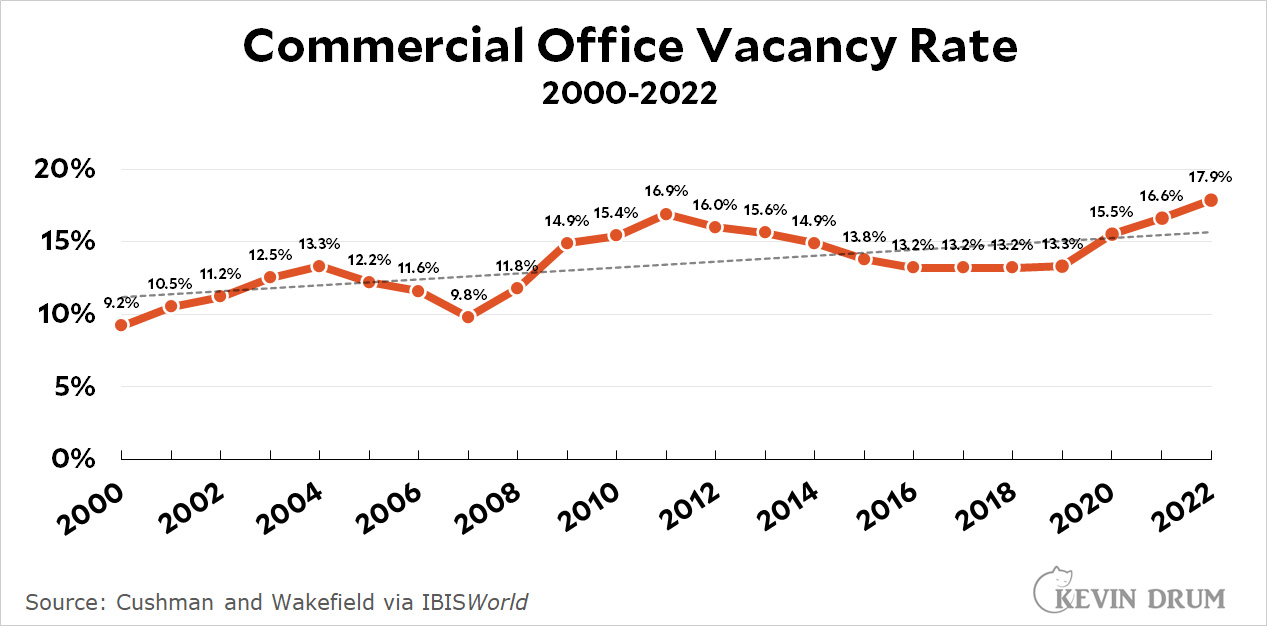

This got me curious. The office vacancy rate was about 7% before Reagan took office and exploded to nearly 20% by 1986. Then it declined during the Clinton presidency, though it never reached its pre-Reagan level. Here is the office vacancy rate since 2000:

Using my usual technique of drawing a trendline through the start of the pandemic¹ and then extending it, it's obvious that the current vacancy rate is higher than we'd expect. But not that much higher: about 18% vs. 16%.

Using my usual technique of drawing a trendline through the start of the pandemic¹ and then extending it, it's obvious that the current vacancy rate is higher than we'd expect. But not that much higher: about 18% vs. 16%.

As this chart makes obvious, vacancy rates generally go up during (and after) recessions and then go down during recoveries. This makes sense, and it also makes sense that vacancy rates went up during the pandemic. They might go up again in 2023. But I think it's likely that they'll then go down as the economy recovers and employers push for more employees to go back to working in an office instead of from home.

Basically, the pandemic added a little bit to a longtime upward trend caused by an office glut. I think it will probably go back to trend growth before long, but that's largely because I don't think that working from home will stay at its current high levels. Reasonable people may disagree on this point.

¹That's 2000-2019 in this case, since the data is annual and 2020 was obviously affected by the start of the pandemic.

A lot of this turns on there being things to do in offices that are more profitable than doing them elsewhere. Of course I expect some bounce-back, but a lot of other trends are pulling in the other direction.

Pure anecdata, of course, but two small-business owners I know dropped their offices/storefronts respectively, during the plague years and have no intention of renting again. They just don't need it, so why spend the money?

In my field (I'm a career technical-side dot.communist), at least among the smaller startups, there's a divide forming - the good ones are mostly full-remote. I think part of that is them seeking experienced employees that can perform in a higher-trust context - it is a pattern I've seen with a particular type of founder. But a much bigger part is the good employees have leverage and want to work from home.

Anyway, I'm not reaching any real conclusion here. I do think there's too much office space when a lot of things are moving the other direction, but maybe I'm not thinking creatively enough.

I don't know much about commercial real estate, but that graph sure looks like it shows a market artificially stimulated by a tax code subsidy. The eyeball test would appear to show a long-term, year-in-year out vacancy rate of at least 12% on average for two full decades. That's a lot of wasted resources. Also, it's a pity we can't use some of it to convert into housing: I know this has been done a bit, at the edges, but given the affordability issues in some of our cities, it seems like it's worth doing a lot more of, and the rate is current up to 18%. That's a of wasted space—nearly a fifth of all the office space in the country. I bet that would translate into a couple million apartments, easy.

It’s basically a full gut job conversion. Which might cost more than building from scratch. Plus how many grocery stores et al does one see in office building land…

Pricey, I know, but have you seen what they're getting for apartments in Palo Alto?

And how many vacant office towers are there in Palo Alto?

There's plenty of office space in that area. Not sure how relevant it is if said office is in a 50 story tower, or in a sprawling, 6 story buiding in an office park.

(My narrow point here is: conversions might be expensive, but A) they're feasible and B) they make the most sense from a market perspective in those areas where housing is priciest).

The country definitely has a robust construction sector. If these figures are to be believed, over the last couple of decades it would appear that, incredibly, something like one out of eight offices on average is vacant. That's a crazy-ass quantity of wasted resources.

But residential inventory is tight: rents in blue cities are stratospheric (average one bedroom in Mountain View is three times what it is in Tokyo).

What could possibly be driving the disparity between our residential and commercial real estate sectors?

This figures point to the difference between A) making it against the law to build one type of structure and B) lavisly subsidizing via the tax code a different type of structure.

Modern amenities--each cubicle has their own shower, so it should be easy.

/s

Cubicles? Luxury!

When I first started out of college, the “old timers” (who were then perhaps the age I am now) talked about how it used to be free-standing desks. Full size. And a book case. I started in an 8x8 cube. Then we got 8x10. Then back to 8x8. Then 6x8. Then four person “pods” with about 48 sq feet per person. Then six per.

Then I shifted employers. Free standing desks. Smaller, no drawers. And a small pedestal filing cabinet. Now it is hot-desking…

Cubicles with showers…

“We used to dream of living in a box …”

Office building conversion to residential is happening here in northern Virginia. But it’s very difficult for multiple reasons:

1. The shape of the typical office building (a big square when viewed from above) is usually completely inappropriate for carving out apartments/condos. Most office buildings have lots of interior space with no windows where the lower-rung employees toil away at rows of desks or cubicles. However, most residential buildings are long rectangles, in order to ensure that every room has windows (except perhaps the bathroom and/or kitchen). Most people who can afford it will not want to live in an apartment or condo with lots of windowless rooms.

2. The few windows that do exist are sealed shut. However, people prefer windows that open in their homes. And fire codes often require windows that open for residential properties.

3. The plumbing is also completely inappropriate. Office buildings have pipes to handle toilets and sinks… and not much else. Residential buildings need pipes to handle bathtubs, showers, washer machines, dishwashers, etc. all of which use a lot more water than just once daily visits to the toilet or break room sink. Fixing the plumbing issues requires a lot of tearing up of the inside of the building.

4. The buildings have no amenities. People like pools, courtyards, dog relief areas, BBQ areas etc but a lot of existing office buildings have no place to put those, as they have little to no surface yard space and their roofs have a lot more utility equipment on them than a residential property built from scratch would have had.

5. The buildings are surrounded by other still-occupied office buildings that are vacant for 16 hours overnight on weekdays and all weekend long. This creates a situation in which it can feel unsafe being outside if the newly created residences attract “too many” undesirable types, which (given everything above) sometimes happens as wealthier people self select into “nicer” residences elsewhere.

It’s not impossible to overcome all these issues of course. Like I said NoVA is doing it now with the abundance of empty office buildings from all the outsourcing the Feds now do. But I would never live in any of the ones that have opened up… and the people who do live in them appear to be either poorer than average or younger/older than average for this region… which suggests that they have limited appeal to the public at large.

While generally true, retrofits will tear out a portion of the center of buildings in order to create double-loaded corridors, allowing inner units to have access to daylight.

This applies strictly to the residential building code, which is used for single-family and attached. The commercial building code would apply to a refit of an office building, in which case, operable (escape) windows would not be used. Rather, the commercial building code requires fire-rated construction for horizontal and vertical egress.

This is a mere formality. Electrical and HVAC would also require a full revamp. The exception would be if these spaces were used more as a group shelter, in which case, most of the existing MEP would remain in place.

OK. Just telling you that, in most places, it'll be cheaper to simply implode the existing building and build brand new than to rip out the interior (where the existing elevators and utility lines likely are) and retrofit everything residences need (like sunlight). It's being done here in NoVA because land values are high and the economy is strong. It's not going to be done in midsize metro areas with lots of land... nor in declining metro areas with lots of simpler buildings that can be repurposed much more cheaply.

That's really hard to say, though.

In general, changing occupancy types does make it more likely than not that deconstructing and building new is cheaper than refit. And one cannot simply cut a post-/pre-tensioned concrete floor, of which many office structures may take advantage of.

However, there are many exceptions:

- Lots of jurisdictions have generous enough tax incentives to tip the balance towards reuse rather than rebuild.

- A brand new spec office building but never occupied is relatively simple to refit for a changed occupancy to residential. You don't have any interior finishes, very limited electrical, plumbing, and HVAC, and anything that needs to be refitted is accessible.

- Quality of construction often makes office buildings significantly better than most new residential structures, particularly rental apartments and group living.

If you're in a midsize metro area, your rents are cheaper. The flight of businesses to smaller metro areas is often driven by this, making it likely that the vacancy rates in these areas lower than large metro areas.

This applies strictly to the residential building code, which is used for single-family and attached. The commercial building code would apply to a refit of an office building, in which case, operable (escape) windows would not be used. Rather, the commercial building code requires fire-rated construction for horizontal and vertical egress.

You've never met a zealous code enforcer. Here in metropolitan DC, all the municipalities/counties/states require every bedroom to have a window that opens, just to provide another escape route for occupants blocked by fire from getting to the hallway/staircases. Even in buildings that are too tall to reasonably escape out the window.

There is no modern commercial building code requirement for operable exterior windows. After all, there is no fire ladder that can access floors above the 14th, and there is no point to opening a window on the 15th floor except to jump out to your death.

If a building has an external egress, such as an external stairway, then windows may be a part of that means of accessing that external egress, but not necessarily so. And even then, there is a floor limit to this. You can't have a 14 floor residential structure relying on external egress.

There may be other reasons for adding operable windows, but there is no literal rule in the commercial building code requiring operable exterior windows. That exclusively exists in the residential building code and again, this would not apply to a refitted office building.

In any building permitted under the commercial building code that contains two stairs, you already de facto meet the required minimum number of exits. The only remaining question is whether you have a fire-rated corridor to provide access to both stairs.

If you want to, here's the specific DC building code section that you'll want to read up on: https://bityl.co/Dz1p

Four decades ago I was working at Honeywell, Inc., which in its earliest days was run by two generations of the Sweatt* family. I was told that these practical men had designed the original building, both factory and offices, to be easily convertible to apartments, just in case the ‘heat regulator’ business didn’t succeed.

*They were certainly practical enough, after merging with Mark Honeywell’s company, to use his name for the firm. Who would buy a ‘heat regulator’ from Sweatt, Inc.?

Suppose some personage drops by and you want to show off your bustling office, --can't do that if no one's there.

Is there a market for a show office, where actors pretend to work diligently while the real work takes place at home?

Now that the Deep State ATF cannot use crisis actors to stage shootings after exposure by InfoWars, those actors will need work.

Potemkin Cube Farms will do.

Industry of the future? When the housing market crashes all those Home Stagers can become Office Stagers. Will be weird seeing offices bedecked with Life Love Laugh signs. At first.

Whats the average length of a commerical lease? If the world changed in mid or late 2020, when would that show up in foregone lease renewals?

You have a glaring flaw. Plot alongside the number of employed and you'll see it.

Business incubators

Micro warehouses for same day delivery

Community centers (nah, just kidding)

Server farms

Indoor "vertical" gardening.

Ok, most of these go into unused industrial buildings...

Daycare, hospitals, clinics, arboretums.

Here in Boston it would just become more biotech lab space. Which will be fun when that industry goes the way of old mill towns.

tree museum...

https://www.youtube.com/watch?v=94bdMSCdw20

Commercial RE lobbyists will solve this problem. The big question is which party do they convince that WFH is borderline criminal? Be on the lookout for NYT editorials such as "Working from home hardest on BIPOC and Trans communities" or Hannity/Tucker ranting that "Working from home is for Coddled Woke Communists"

They are already working with the GOP for that. If the GOP takes over they will eliminate telework for Federal Employees.

And then move the offices to the middle of no where....

Not necessarily related to the vacancy rate, but I live near the Financial District in San Francisco and it is still pretty much a ghost town, certainly relative to pre-COVID, during the work week. Again, that doesn't necessarily translate to vacancy rate since companies have likely not reduced their footprint. But, there are a lot fewer people coming to those offices now than before COVID.

When I've been in Europe, I always marvel at the amazing number of small businesses, restaurants, and bars that exist in busy, expensive cities. Something we should support in our tax codes in place of empty office buildings

Whenever I hear mention of the S&L crisis, I like to remind people that the vast majority of failed S&Ls were in Texas. When we bailed out the S&Ls, the rest of America gave Texas a huge real estate subsidy (both commercial and residential) that has boosted its competitiveness with other states ever since.

All the "red" states that like to yell about the federal gov't. spending "your" money are dependent on that money....talk about biting the hand that feeds them...

Anyone who talks about the government taking "your" money has never looked at a dollar bill. Mine has US Government marked all over it.

There was also Proposition 13 in California and similar laws limiting property taxes elsewhere. These usually protected residential properties but allowed tax increases on commercial properties. This led zoning commissions and building departments to encourage commercial development and suppress residential development which would not increase tax revenues.

https://www.constructioncanada.net/wp-content/uploads/2021/08/MA_Calgary.jpg

The office vacancy rate in Calgary is well over 30% due to it being an oil town and hence a victim of the typical boom and bust cycle of that industry. The city has plans to convert some building to residential but as many in this comment trend have pointed out it is an expensive and complex process. I have seen some of the green vertical garden highrises built in Singapore and they are very impressive but I doubt it would be easy to convert existing buildings.