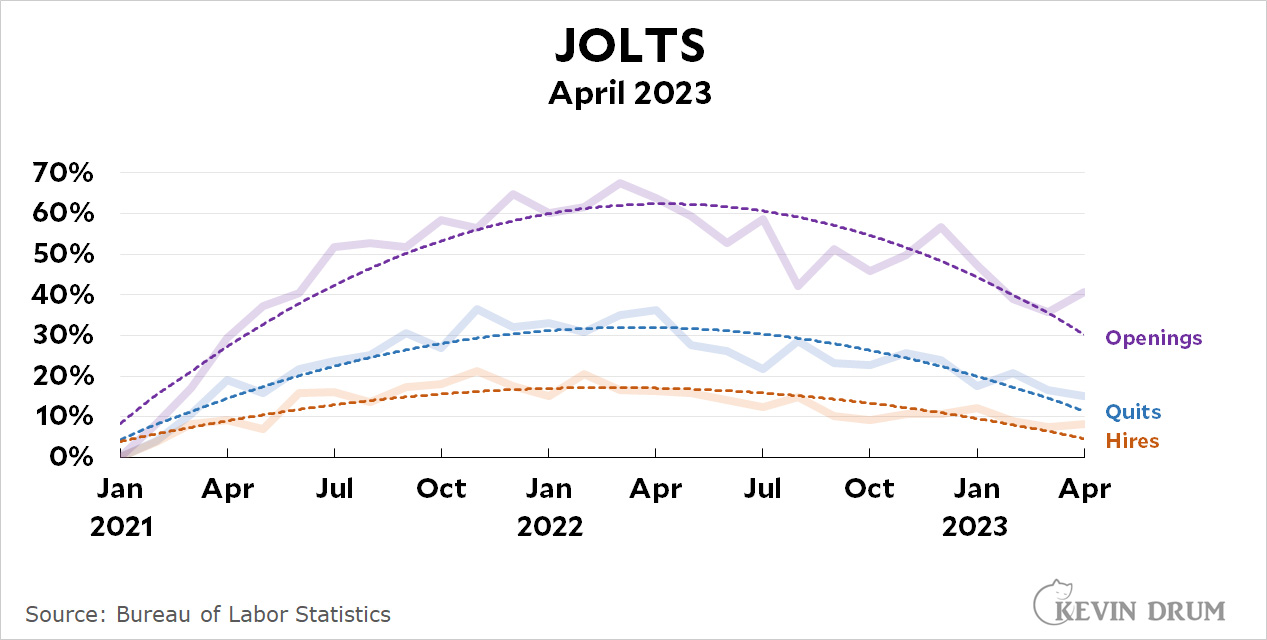

Today is JOLTS day, which provides a snapshot of the employment market. Here's what it looks like through April:

Job openings were actually up a bit in April but were down by 30% from their peak a year ago. Quits are steadily down, an indication that workers are afraid they can't leave for a better job. And actual hires, though flat in April, are down considerably since last year.

Job openings were actually up a bit in April but were down by 30% from their peak a year ago. Quits are steadily down, an indication that workers are afraid they can't leave for a better job. And actual hires, though flat in April, are down considerably since last year.

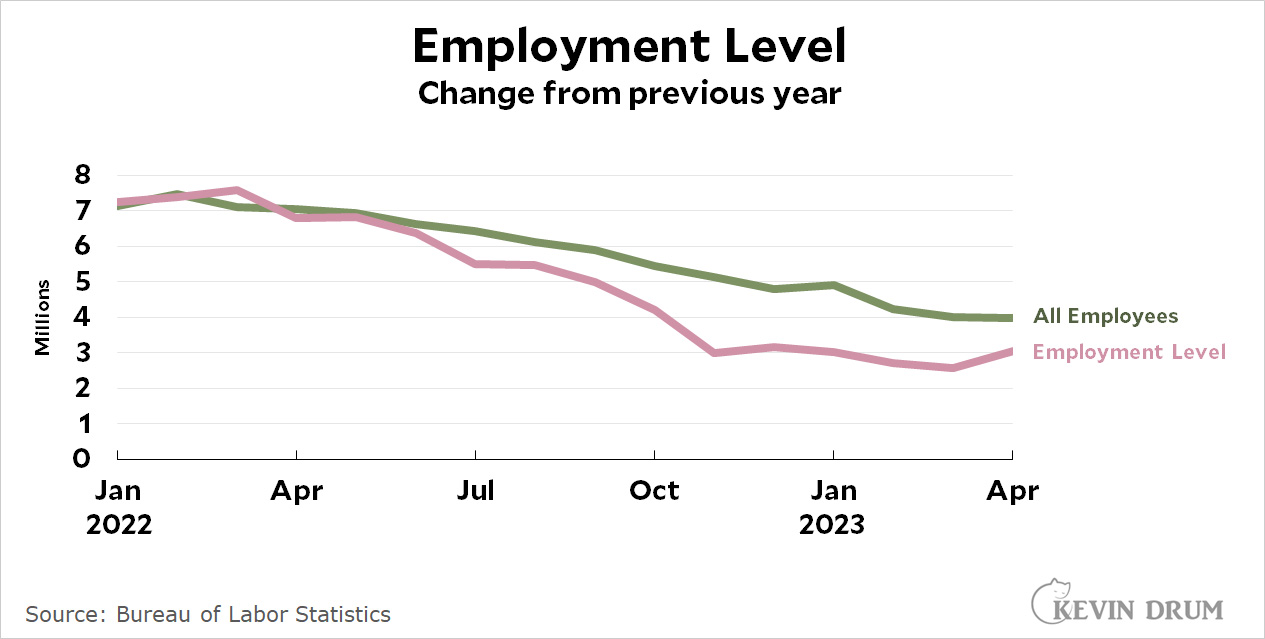

This isn't the only bad news on the employment front. A couple of years ago employment was at record levels and anyone who wanted a job could get one. But those days are long gone:

A year ago the economy was gaining about 7 million jobs per year no matter how you measured it. We're still gaining jobs today but the rate has plummeted. By one measure we've added about 4 million jobs; by a different measure it's only 3 million.

A year ago the economy was gaining about 7 million jobs per year no matter how you measured it. We're still gaining jobs today but the rate has plummeted. By one measure we've added about 4 million jobs; by a different measure it's only 3 million.

These aren't horrific numbers, but they are down substantially. No matter what our shiny 3.4% unemployment rate tells us, the job market is sputtering. A recession is coming.

"A recession is coming." As per the Fed's expressed wishes.

Biden was never more than even money for re-election. This way, he's sure to lose.

Mission accomplished.

So the half of the Fed board of governors who are Democrats are just Quislings?

A recession is coming.

It's clear a slow down is coming (indeed it's ongoing). But I'm not so sure we can't avoid an actual recession in favor of a mere soft landing. But, as to the decrease in job creation: wouldn't some of that be a mechanical, inevitable result of a very low unemployment rate? As employers begin to approach the theoretical limit to the supply of available workers, they have no choice but to reduce the pace of hiring. You can't give jobs to non-existent workers.

One would think so on the mechanical point. There's going to be something baked in here even though this measure includes job openings. Just like some workers get discouraged and leave the work force when it's tough to find a job, some would-be job openings don't get posted when it's tough for employers to find employees.

Also, a recession may be coming, but if so it's certainly not because of a slowing rate of job creation. It's kinda like saying it didn't rain today so the sun is going to rise tomorrow.

some would-be job openings don't get posted when it's tough for employers to find employees.

It’s the same strategy the Democratic Party uses: don’t run any candidates in rural areas and then later wonder why there are no Democratic voters showing up to vote in those same rural areas.

Nothing helps an employer (or political party) fill empty positions faster than not advertising them as being open in the first place. As Homer Simpson would say: Give up before you even try, that’s the key to success!

“Quits are steadily down, an indication that workers are afraid they can't leave for a better job.”

Exactly how the owner class wants it: employees afraid to dump them for treating them poorly.

Strong low-income job and wage growth (in real terms) certainly has many in a panic. This is the primary economic problem that the Fed is 'addressing'.

I certainly hope you don’t think 7 million new jobs a year was a sustainable proposition. The last thing the planet needs is for the country with the highest per-capita emissions on the planet to increase its population, let alone by seven million people a year.

Last week you questioned all of the nattering nabobs of negativism...

only to follow up with a handful of glass half-empty posts about the direction of the economy?

To get a better picture of what the economy is actually doing, we should be looking at a longer time series:

- The current rate of new hires, quits, and job openings is still higher right now than 19 of the 22 years of JOLTS records.

- There is no possible way for the increase of job openings, new hires, and quits to continue to grow; the bump in your version of the data is the short-term distortion caused by the pandemic.

Is this a sign of an impending recession? Maybe. But your foreshortened chart hides just how hot the economy is right now, even if you think it's slowing down.

Well said!

Am I looking at the same JOLTS report?

Openings shot up last month. Hires and quits were both flat. In what world does this mean the job market is looking weaker?

Meanwhile, your second chart shows that we're "only" adding 3-4 million jobs per year, and compared to the rate at the beginning of 2022 (7 million), it is lower. But goodness gracious, of course it's lower! We added 7 million jobs during 2021 (i.e. from January 2021 to January 2022) because large swaths of the economy were still shut down in January 2021. Almost no one was vaccinated in January 2021. The unemployment rate in January 2021 was 6.3%. OF COURSE we added a lot of jobs in 2021.

Saying "we're no longer adding jobs at the same rate we were back when the economy was still coming out of an unprecedented disruption" just isn't a very strong statement. What's more relevant is: are we adding jobs at a good pace in the context of a tight labor market?

And the answer is yes! You post the jobs report every month with the caveat that we need to add 90,000 jobs each month to keep up with population growth. 90,000 a month is ~1.1M a year. If we're adding 3-4 million a year, that means we're adding 2-3 million more jobs than we need to keep up with population growth. Wow! That's great!

When almost everyone who wants a job already has one, it is very hard to add new jobs. But somehow we're still doing it! This is great!

If you want to convince me that this is actually a bad JOLTS report, please actually find something bad. Make an argument. Don't just draw concave trendlines and show me a negative second derivative and hope I don't pay attention to the underlying numbers. Good grief.

I can make $200 an hour working on my home computer. {h42 I never thought it was possible, but my closest friend made $25,000 in just five weeks working on this historic project. convinced me to take part. For more information,

Click on the link below... https://GetDreamJobs1.blogspot.com