Today Mother Jones re-upped an interview from 2021 with Dorothy Brown, a law professor at Emory University who argues that the US tax code is rigged against Black people. The example she gives has to do with the so-called "marriage penalty," which in some cases makes taxes higher for married couples than if they had stayed unmarried and paid separate individual taxes:

When Congress passed the joint return, they set the stage for the marriage bonus/penalty to exist. Single-wage-earner couples, who are most likely to be white, get a tax cut when they marry, and equal-earning couples, who are most likely to be Black, pay the marriage penalty. The key is which couples are likely to be single-wage-earner households and which are likely to be co-equal earners. Black Americans need two earners to make ends meet because the labor market doesn’t compensate Black Americans the way it does white Americans.

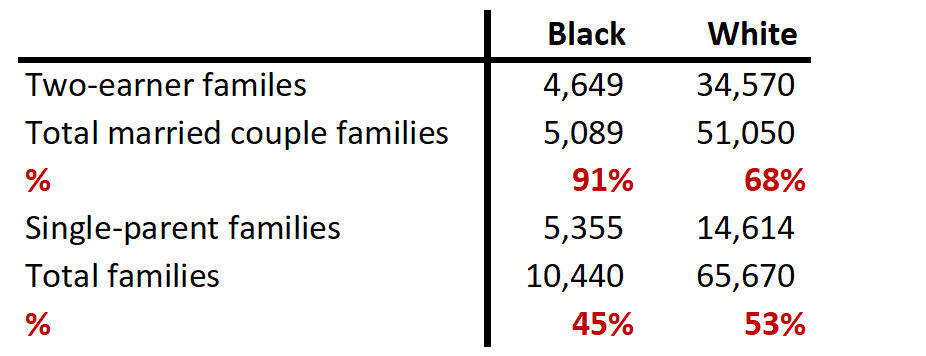

This is not the whole story. Brown is right that among married couples, Black families are more likely to have two earners than white families, by 91% to 68%. This makes tax penalties larger and more likely for Black families. According to the Tax Policy Center:

Among those with penalties, relative to white couples, Black couples paid less in dollars ($1,804 versus $2,091) but paid more as a share of income (1.8 percent versus 1.4 percent).

This is not a huge difference. Moreover, it doesn't take into account the fact that Black women marry at much lower rates than white women. If you look at all families, it's Black families that are less likely to have two earners:

It's true that there's a slightly bigger penalty for getting married among Black couples compared to white couples, but if you look at all families it's Black taxpayers who come out ahead. Overall, there's not much evidence here of a racial bias in the tax code.

It's true that there's a slightly bigger penalty for getting married among Black couples compared to white couples, but if you look at all families it's Black taxpayers who come out ahead. Overall, there's not much evidence here of a racial bias in the tax code.

POSTSCRIPT: This is an example of doing a deep dive into some aspect of life and discovering a disparate impact on Black and white people. But while this might be a reason to change things, it doesn't necessarily show evidence of any racial animus. It took 50 years for anyone to notice this, and it's unlikely in the extreme that anyone in Congress in 1969 had the slightest idea that the creation of a new tax schedule would have any racial impact at all.

Of course! This is why lots of average Americans roll their eyes at progressive identity politics that attribute everything to "institutional racism."

And it's one of the reasons that the insane clown posse called the Republican Party and their leader, Azathoth, are still competitive in our elections. Swing voters just cringe at this stuff.

They roll their eyes because tiny institutional things can have outsize impacts on people?

Do you think it would take upper middle class white folks 50 years to discover that a provision of the tax code disproportionately and adversely affected them?

"It's true that there's a slightly bigger penalty for getting married among Black couples compared to white couples, but if you look at all families it's Black taxpayers who come out ahead."

No. The non-penalized families come out even (all else equal), no matter how many there are. There is no marriage penalty (or bonus) by definition for those families. 45% of zero is still zero, which is equal to 53% of zero.

The point from the interview stands, regardless of your assertion. You were so eager to be contrarian on this one that you forgot how to do the math, I think.

Unfortunately for the article, zero research strikes again.

The problem was, until the irony of all ironies, the Trump tax act, that the brackets were not doubled when you got married. Now that they are, the "old" marriage penalty which applied to two-earner couples (there was a marriage "bonus" for single earner families) is no more.

So, the professor was correct in that historically, two earner couples were worse off, but you had to factor in the level of earnings too. For many decades the absolute worst was a two professional couple. Believe me I know.

It was always more of a blind eye to women working than race targeted, though.

How do unmarried, cohabitating couples figure into this? I got hit with a tax increase when I got married, because previously I had taken on all the expenses that counted for itemizing.

Why weren't you able to itemize them after?

Here are made-up numbers to illustrate:

Let's say the standard deduction is $5,000 for an individual and 10,000 for a married couple.

Mortgage interest, property taxes, charitable giving and state income taxes for single person A add up to $11,000. Single person B just has their state income taxes of $1,000, so they won't want to itemize.

Single person A claims an 11,000 deduction and single person B claims the 5,000 standard deduction. Total deductions across two single-filer tax returns: $16,000.

They get married. The itemized deductions grow slightly, because now Person B's state income taxes can also be added in as a deduction. Total deductions for married couple $12,000.

IOW, you cheated on your taxes. If you owned the property jointly, then one person can’t take all the deductions for it.

I'm confused by this analysis too: You say that "If you look at all families, it's Black families that are less likely to have two earners", but doesn't the data say the opposite (91% of black households vs 68% of white households are dual earners)?

Also, the data seems to imply that while black households are less likely to be married than white households (48% vs 77%), black households with kids are more likely than white families to be married (55% vs 47% - the converse of single parent households). It's confusing because of the chart's use of "families" versus "parents".

Either way, I don't really get the scorn for the argument that black households pay a penalty. (Not to mention that a marriage tax differential of .4% is the least of the penalties they pay: From much higher mortgage rates, worse credit terms, poor value for money in education and social services, it's hard to argue that there isn't institutional unfairness against them).

Yeah, I didn't even get to these things, but they're good points too.

The 91% vs 68% is married-couple households. Black households are more likely to be single-parent households. (The 45% and 53% are "percent of households that are two-earner", not "percent of households that are single-parent." The labeling is confusing, but look at the total numbers instead of percentages and it's easier to see.)

Why does this keep coming up? We kill the penalty - why does it keep coming back?

Yes, I thought you could choose "married filing separately" and thus eliminate the penalty. Also, after the Trump tax "reform", the great majority of people get no benefit from itemizing deductions, so that doesn't enter into it for most people.

It’s a fundamental element of a progressive tax system with joint filing that your taxes will change when you marry. It can be rigged so they always go up, always down, or as is the case in practice, some couples go one way and some the other.

This seems a little like an academic saying “look at me!” or “grant my tenure!”

Digging through the tax code to find something that has evolved over half a century to favor some people over others?

It’s not like there aren’t blatantly clear and egregious examples of bias against minorities anyone, even without a PhD, can see every day. But I guess you don’t get published in a peer reviewed journal for calling that out.

It hasn't "evolved over half a century to favor some people over others" - it's that because of other characteristics (which are at least somewhat the result of racism), the tax code ends up penalizing Black couples more than it does white couples, for reasons laid out in the research.

You get published in a peer reviewed journal for doing rigorous statistical analysis. That's present in this case.

But I guess you'd be someone who could get published in a peer reviewed journal, if only you could do the work.

I’ve published at least a couple dozen times. I’m close enough to retirement that I finally realize it’s silly to know the exact number

The point is that the tax code has, as you say, ENDED UP (in other words, evolved) to be discriminatory. No argument there. But that just seems less egregious to me than, I don’t know, stop and frisk, driving while not white, border policies. . . and therefore oh so perfectly academic.

And no, I’m not in academia. I’m in public health

“ But while this might be a reason to change things, it doesn't necessarily show evidence of any racial animus. It took 50 years for anyone to notice this, and it's unlikely in the extreme that anyone in Congress in 1969 had the slightest idea that the creation of a new tax schedule would have any racial impact at all.”

i mean, does parsing the intent mitigate the impact? i would say it does not.

I think what makes this something "average Americans roll their eyes at" is the implication that the marriage penalty was "rigged"* for racial reasons. Professor Brown provides no evidence for this and just showing that the effect of the rule can have differing impacts on different groups is not such evidence.

However, that said, pointing out the racial disparity is a reason to reconsider the tax code in this instance.

*rig (verb); to manipulate or control usually by deceptive or dishonest means

I don’t understand the argument here - there’s no marriage penalty or bonus for single-parent families, by definition, so is the idea that because single parents get more tax benefits than individuals without children, and Black parents are more likely to be single parents than white ones, therefore Black people come out ahead in some broader sense? But the relevant decision there is having children, not getting married, so this is an unrelated feature of the tax code - and if we’re dragging unrelated stuff in there obviously there are a whole lot of other less-equitable aspects of the tax code. Also I think there’s an error in the charts, as the white single-family percentage appears to be too high.

Anyway this certainly isn’t something that took fifty years to notice, we talked about it when I took tax law 20 years ago, though I’m sure the data is new. As others have said, to a certain degree this is just a mathematical function of having a progressive tax code, though on the other hand it would be quite easy (and relatively cheap because it is the case that in raw dollars, this isn’t a big deal) to build in a failsafe to eliminate the marriage penalty (even if couples with disproportionate incomes would continue to disproportionately benefit) so the fact that that hasn’t happened isn’t great.

The labeling is very confusing: the 45%/53% at the bottom is percent of households who are two-income, not percent who are single-parent.

This is a good example of what can be called "structural racism". There's no particular malicious intent behind it that we can observe, but the impact on wealth of black people is the same. Sometimes there was malicious intent 50 years ago, or 80 years ago, none now, but the impact is still there.

An impact doesn't have to be big to accrue over a long time, either.

In some ways the claim that "they didn't think of black people at all when developing this policy" is exactly the problem.

Bear in mind I don't think this makes white people evil. I think it makes them normal, really. However, we *are* trying to do better. For me, I want to do better for the sake of all the black Americans I've known and who have enriched my life.

There are different flavors of "structural racism." In some cases, like redlining, there is an intent to discriminate inherent in the policy. In others, like this example, no discrimination was intended, as far as we know.

The question remains, what to do about it? Do we need to scrap or fix the policy because its effects fall unequally across racial groups? Maybe. I can understand why people would think so. But if the policy is in place to support some societal good (not always clear but let's assume that), then should the "cost" of scrapping the policy or changing it be part of the calculus? Seems it should be. That makes the job of fixing structural racism harder than a blanket repeal of any policy where it exists. It probably needs to be done on a case-by-case basis.

If you look at almost any policy closely enough, you'll find disparities in how its effects fall on different races. That's likely true even in cases where race was not the driver in getting them passed. Does racial equity have to be a consideration for every policy that's now on the books or that now passes? How big do the disparities have to be to nix or force a correction of policy?

The more you analyze, the more inequity you find. Even assuming government acting in good faith to pass effective and fair policies, there will always be some winners and losers.

The point, I guess, is that it's complicated. Ideally, we'd have good-faith conversation about the pluses and minuses about the policy and proposals to change it. But it's easier to "take sides" and argue one versus the other, which is par for the course in our politics today.

The problem, at least politically, is that when you define systemic racism as things that can effect some disparities in outcomes unintentionally it is important not to elide this with things that are intentionally racist (like efforts to restrict voting rights have been most of the time) many people respond negatively. This too is normal but leads to bad outcomes when it benefits Republicans in elections.

I agree with Kevin’s overall argument but this - “it's unlikely in the extreme that anyone in Congress in 1969 had the slightest idea that the creation of a new tax schedule would have any racial impact at all” - is very deluded. As if nobody in 1969 was aware of how to do things that sound racially neutral but have disparate impacts on some racial groups. This was the era in which Lee Atwater openly said:

"You start out in 1954 by saying, 'N—, n—, n—.' By 1968 you can't say 'n—'-that hurts you, backfires. So you say stuff like, uh, forced busing, states' rights, and all that stuff, and you're getting so abstract. Now, you're talking about cutting taxes, and all these things you're talking about are totally economic things and a byproduct of them is, blacks get hurt worse than whites.… 'We want to cut this,' is much more abstract than even the busing thing, uh, and a hell of a lot more abstract than 'N—, n—.'"

https://prospect.org/power/gop-s-racial-dog-whistling-social-safety-net/

Sounds like there were some people in DC in the 1960-1970s who knew *exactly* how to do things that look racially neutral to suburban voters like Kevin Drum, but end up economically hurting some races more than others. Weird how these people keep admitting their strategies out loud and the Kevin Drums refuse to believe they’re being honest about their strategies.

As commentators have pointed out, “marriage penalty” is a political misnomer. Now, if one wants to reduce the amount of taxes on a married couple, go ahead, state the case as to why we should have a “single penalty”, or better yet let’s have a “divorce penalty”. The point is that in any tax system one will always be able to construe “winners” and “losers” and there will always be ways to game the system.