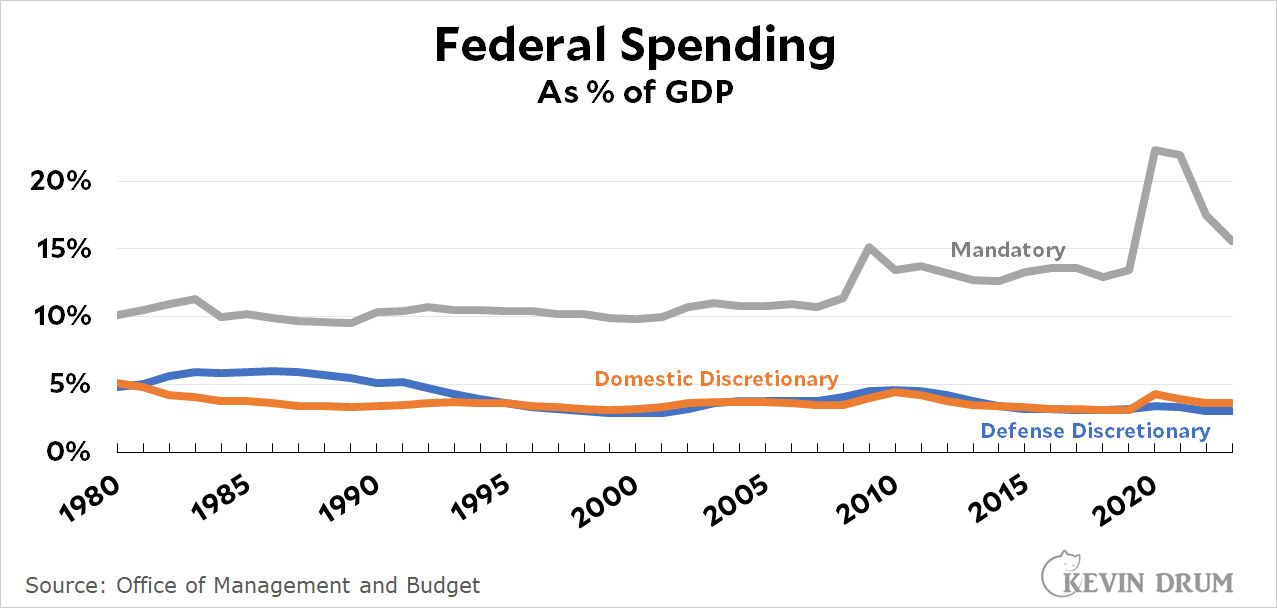

Just to remind everyone, here's the basic shape of the federal budget:

The orange line is the one that has Republicans tearing each other apart. It is lower today than it was in 1980, and about the same as it was in 1990, 2000, and 2010. But for some reason it's an intolerable problem.

The orange line is the one that has Republicans tearing each other apart. It is lower today than it was in 1980, and about the same as it was in 1990, 2000, and 2010. But for some reason it's an intolerable problem.

In fact, discretionary spending isn't a problem. It's been slowly but steadily declining for decades. What's more, there's simply not very much there to cut, even in the fever dreams of hardcore right-wingers. Even the zealots in the House Freedom Caucus, for example, are demanding only $120 billion in spending cuts. That's a lot, but it's less than a tenth the size of the federal deficit. It's a pinprick.

If you're serious about reining in the federal deficit, you have two choices:

- Take a meat axe to mandatory spending. This means big cuts in Social Security, Medicare, Medicaid, and a few other smaller entitlement programs.

.

or

. - Raise taxes. This means repealing both of the Bush tax cuts and probably the Trump tax cut too.

That's it. Unless you want to continue living in fantasyland, those are your only choices. It doesn't matter if you hate them both. This is all we've got.

"If you're serious about reining in the federal deficit ... "

If.

I'm fine with rolling them all the way back to the Reagan tax cuts, too.

I have read that Reagan wound up raising taxes after he was forced to realize just how much his cuts had blown up the debt. Bush and Clinton also raised taxes so I’m not sure if those tax cuts are still affecting us today.

However the Bush and Trump tax cuts did little to grow our economy contrary to what Republicans promised but according to this report by the Center for American Progress:

“ Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio:

Without the Bush and Trump tax cuts, debt as a percentage of the economy would be declining permanently”

https://www.americanprogress.org/article/tax-cuts-are-primarily-responsible-for-the-increasing-debt-ratio/

Funny how our mainstream”liberal” media doesn’t acknowledge the fact that we could have a decreasing debt ratio just by getting rid of those unproductive tax cuts. They much prefer to go along with the Republican push to decrease spending on social programs than to take anything away from the rich.

During the Reagan era, taxes were, overall, largely flat. However, there was an enormous shift, with income tax rates going way down, while FICA taxes went up by a roughly corresponding amount. So, the tax burden got slashed for the rich, while it increased for workers.

How does mandatory spending decline? Particularly by > 5% of GDP in only two years? Is there mandatory, Mandatory, and MANDATORY spending?

Covid-associated relief spending classified as mandatory? The mandatory line peaks 2020 and 2021, so that would fit, at least. Presuming here that mandatory =/= entitlements only.

You can see that mandatory costs really jumped in 2008 also, so these costs must come from things that food stamps and Medicaid that kick in when poverty increases. Or perhaps people retiring early and starting to use Social Security and Medicare.

I'm really curious about how mandatory spending *dropped* 7% over the last two years. That's not due to people unretiring, so some of it must be due to people coming off of income support programs as the economy recovered.

So, growing the economy faster probably also can reduce mandatory spending as a percent of GDP.

But yes, we also have ridiculously low taxes on the wealthy. I know a number of people who make more from capital gains and dividends than their day job, and the Federal taxes on that income varies from between 15 to 24%.

Depending on how the rest of your income is configured, the tax rate on the first $75,000 in dividends and capital gains can be as low as 0%. I refer to that as "Republican nirvana."

You are aware that percentages can jump if the denominator falls, right? So if GDP fell during 2020-21 - because you know lots of businesses were closed - then even if the numerator remained constant, the numerator would show as “peaking.” Same with something like the Great Recession: if lots of businesses went bankrupt, the denominator (GDP) would fall and everything measured against the denominator GDP would “peak” even if it remained the same or fell less quickly.

Math. It’s hard but in real life, both numerators and denominators change over time.

You are aware that percentages can jump if the denominator falls, right? So if GDP fell during 2020-21 - because you know lots of businesses were closed

GDP only shrank by 2.9% in 2020. That's not nearly enough to generate a spike in mandatory spending of the size depicted by Kevin's graph. Mainly what happened in 2020 on that front were large increases in Medicaid spending and unemployment insurance, and/or other pandemic-related programs classified as "mandatory" spending.

Numerators and denominators may change over time, but some pompous assholes never change.

Unemployment insurance is considered mandatory spending. Basically, "mandatory" means that the fluctuations in spending happen automatically as conditions change, without need for Congress to appropriate more or less funding. Congress simply authorizes everyone who meets certain criteria to receive payments without appropriating a set maximum for the program. So, even many of the emergency provisions passed during the pandemic qualify as mandatory spending, and as those programs came to an end, mandatory spending fell.

There is no reason to decrease mandatory spending unless it is unproductive or wasteful as is the case with drug costs. Paul Krugman has written lately about the fact that since 2010 Medicare costs have flattened out for some reason.

The other way to deal with debt is to grow the economy. After WWII the US had an enormous debt — 120% of gdp — yet Eisenhower spent on programs like the interstate highway system which the economy. We never paid of that debt, it just became such a small percentage of our national wealth that it isn’t a problem. Biden’s bills to spend on infrastructure, green energy, etc. will definitely grown our economy.

Pretty obvious the Republicans prefer to continue to live in fantasyland. As they say, de nile is not just a river in Egypt.

Ever since I started paying serious attention to politics, which was sometime around Reagan's tenure, I've seen that Republican politicians will promise you anything in order to get your vote, but once elected, they can only be expected to do one thing consistently and reliably, and that is to reduce taxes on the wealthy.

So, they are not going to raise taxes. On the wealthy, at least, and the wealthy are the only people who have significant money.

"Reducing the deficit" is their deceptive term for reducing money for social programs, and for "making poor people poorer, so we have someone we can look down on." If they can increase inequality by making out-groups poorer, well, that's icing on the cake. But the real plan is to make themselves richer, not you.

Amen, brother!

Well, they operate from a philosophy that if you keep feeding the animals they will never develop the skills to fend for themselves. So, it's both an aversion to making the rich pay for supporting the lazy poor and "concern" that supporting the poor is disincentivizing them to up their game and join the economy at a higher level.

There are tons of contradictions buried in their philosophy, like "We, and only we, are the true Christians - but we're Tough Love Christians."

They inherently believe that love of money is NOT evil and business innovators should be allowed to make themselves and everyone around them rich.

Supply side economics: The odd notion that the poor are not working because they have too much money, and the rich are not working because they don't have enough. -- J.K. Galbraith (paraphrased)

Well, they also said they would (work to) repeal Roe, and last year, they did! So there's that ....

Uncap FICA

Social security is funded separately from the rest of the budget and does not contribute to the deficit, no matter how much the GOP likes to pretend otherwise.

Still a good idea to uncap FICA. Social security faces its own deficit problem and there’s no good reason why all income can’t be subject to FICA tax the same way all income is subject to Medicare tax. Oh a millionaire might pay in more than they receive in SS checks later? Boo hoo, lots of working people in hard jobs die before their 60s and collect nothing at all despite having paid in for 40+ years. Life is unfair - suck it up and pay FICA tax on everything.

Actually, Social Security is not, and cannot be, in deficit. If nothing is done, projected benefits will drop by about 20% in 2023, but that's not a deficit.

As for raising the tax ceiling without raising the benefits, then it turns into welfare, and we know what happens to welfare. FDR had the wisdom to set up a system where people pay for their own retirement insurance, instead of depending on the goodwill of others.

Raising the SS taxable-income ceiling without raising benefits would make SS more like a traditional annuity, actually. Annuities are a gamble on actual longevity vs actuarial longevity and there have to be "losers" to offset the "winners." Anyone who buys an annuity is making that gamble. SS makes that gamble too but the payments are made on a very different basis.

I didn't pay into SS during my working years to cover my own retirement-- that's the fiction about SS. If I did, that would have been an actual annuity, building up a personal capital account for a stated lifetime payment based on what I put in there and whatever market return it got. Instead, that money went to people who were already retired or disabled, and to build up an excess fund per the Greenspan commission.

My current benefits come from people who are working now, plus some amount from that actuarial excess that's getting close to depletion. The benefits are defined in law and based on many factors; one of them is how much I contributed, but others are things like inflation and actuarial experience that are totally exogenous to me. My working contributions were the ticket that granted me entitlement to the current benefits.

All that said, I'm willing to concede a cap on SS-taxable income, but at something more in the range of 400,000 to a million. There are already plenty of people who don't get benefits proportional to what they put in, so that's a less persuasive point than it might have been in 1939 and makes this a utilitarian question.

On that basis 160,000 is way too low for today's economy, and I think there's social benefit to transfer taxes aimed at assuring at least some income to people who can't work or are past working age. A Hobbesian or Randian world has no charms for me.

If you are a boomer you did pay into the SS program for your own retirement. That money is being held in the Trust Fund and you should get it back when you retire.

But this is only a part of or addition to SS, designed to cover the excess population of the baby boom. SS is primarily a pay-as-you-go program, and it will be back to that more or less completely when boomers are gone.

That's the "actuarial excess per the Greenspan commission" that accounts for part of my benefit, yes, and I did pay into that for most of my working life. But it's what, 20% or less of current benefits? Certainly not the bulk.

"Pay-as-you-go" is a way to say that money received by current beneficiaries comes from people who are now working and paying SS taxes, with the program intention that those amounts would be in a rolling balance, and will be after the long boomer bulge (including a period where the surplus won't be available to supplement SS tax revenue and fully cover the formula benefits).

For the record, I have no problem with that rolling financing. I was disagreeing with the popular fiction that SS is a system of people saving for their own retirements, which would be an annuity system, and specifically with Joel's contention (or warning) that if people don't get out what they put in, SS will become politically vulnerable welfare.

I think it's demonstrable that there are already a lot of people who get less than they contributed (it's just that they'd be mostly at the lower-income end now and dying younger, but if you raise the cap then more of them will be middle and upper-middle income). And whether SS taxes are thought of as a ticket for future benefits or as paying for retirement insurance probably amounts to the same thing.

The problem with your lexical distinction is that the amount someone receives in SS *is* dependent on what they paid in, and so in this very simple sense, it already walks and talks like an annuity.

I understand the factual basis for saying that it actually isn't, but it's a distinction without a difference for most of the people who will rely on it during retirement (plus a few who will not).

I think the distinction for most people is that they'll be entitled to the income stream without having had to build up a principle value they didn't dare tap into unless willing to shrink their retirement incomes, so more of what they made was available for what they needed day-to-day.

For low-income people I think that's pretty crucial about their working years, though it isn't something people will likely think about with gratitude (and as many here are saying, wages really need to be higher, especially at the low end-- by at least enough to match 1973 in real dollars).

In terms of payout, which is what I think you're pointing to, I agree that SS will behave like an annuity with unusually generous cost of living provisions (check out the difference in payouts if you want COLAs with privately-issued annuities).

How much people start with does depend largely on what they paid to SS over their working lives, which I've said upthread. I don't see a way out of that beyond something like a guaranteed annual income.

Social security...does not contribute to the deficit

This isn't a supportable proposition in 2023, although I like the spirit of your comment. The FICA tax no longer supports the program in its entirety (that was planned long ago) and the program's IOUs (the trust fund, accumulated during the days of FICA surplus) are turned into the government in exchange for cash to pay retirees, which in turn comes from the same pool of money (borrowing or tax revenue) it uses to buy aircraft carriers and maintain national parks.

Bullshit. Social Security is no more a ‘contributor’ to the deficit than any other buyer of Treasuries. The Trust Fund is held in special-issue bonds; if FICA hadn’t had generated the surplus revenues to purchase them, the Treasury would have sold more bonds to investors. Congress alone controls revenues and spending, and the voters elect Congress.

Social Security is no more a ‘contributor’ to the deficit than any other buyer of Treasuries.

Social Security doesn't buy Treasuries. Those days are over. Which was my point.

The Social Security trust funds are invested entirely in U.S. Treasury securities. Full stop.

Buying Treasuries doesn’t cause the deficit; the deficit is caused by the Congress spending more than it is willing to tax. That forces Treasury to sell bonds to finance the difference. Who the bonds are sold to makes not a whit of difference; they are obligations of the Federal government and must be honored.

Yes, Social Security has taken in almost $3 trillion more than it has paid out. It is in surplus, not deficit. That money is now on loan to the rest of the government. The money was mostly paid in by boomers and those who paid it in should get it back when they retire.

As to what should be done when the SS surplus (most of the Trust Fund) is paid out in a couple of decades as has always been the plan, that is actually something that does not need to be addressed now and has nothing to do with current deficits. The tax base for SS can easily be expanded by taxing capital gains, dividends, interest and rents (not now taxed) or just raising the salary cap.

Discretionary spending IS the problem. Cut the discretionary budget, starting with the elephant in the room: the military. Cut 10% and you've saved 100 billion dollars. Cut 10% per year for 10 years and the military budget will have dropped to about 35% of what it is now, saving 650 Billion dollars per year.

That won't happen because the military industrial complex has been very strategic in locating their bases and headquarters in states where they have friendly legislators who will fight for them. Cutting military budgets ends up cutting jobs in those states, which Senators and Congress Critters will fight to the death over.

Military spending is what shows that even the most small government, anti tax Republican at an intuitive level gets that Keynesian economics are right. To prove it just suggest cutting defense spending in their district.

It's more than this. Domestic US military expenditure is the closest this country has ever come to socialism. It's a jobs program, it's a public housing, education and health program. It's an economic investment prgoram (even the investment part is done very badly).

Take it away and you're doing way more than "closing a base" or buying cheaper toilet seats. It is literally how we help America.

We should still take it away.

How does Krugman put it? If you look at outlays, the US government is basically an insurance program with an army? Doesn't seem that far off what I'm seeing here.

Maybe the gop could begin to think about taxes more benignly if they thought about how much of that outlay goes to their own voters.

"Maybe the gop could begin to think about taxes more benignly if they thought about how much of that outlay goes to their own voters."

That assumes that they care about "their own voters". I don't think we have evidene for that.

Yehouda is right -- the GOP clearly doesn't care about their own voters.

The reddest states don't let you get Medicaid unless you're dirt poor, don't expand Medicaid via the ACA, don't fund their schools, and let companies pollute to their hearts content.

Their national politicians vote against things like the ACA, expanding the EITC and the child care tax credit. They vote against increasing the minimum wage even to keep up with inflation.

They do, always, vote for tax cuts for the wealthy.

Rather than just repealing the Bush and Trump tax cuts, we need to make the tax code "smarter". Why have a tax preference for profits made when selling pre-owned securities. While, yes, such transactions provide a "price signal" which values the treasury shares a company has and can sell to raise revenue, it doesn't give the enterprise one red cent directly. If there is to be a tax preference for stock transactions, it should be limited to persons who buy IPO or treasury shares. They actually provide the enterprise with investible funds.

The Federal Gas Tax needs to rise to however much is required to fund all the transportation projects for which it's used. The "Carried Interest" shelter obviously should be removed and the profits the the "General Partner" makes should be subject to FICA and Medicare taxation. It's the JOB of the General Partner to manage the fund.

The tax deduction for charitable giving should be applicable only to the portion of the activities that the recipient organization provides for people outside the "membership of the organization,", defined to include people who purchase seats for performances or who attend a religious community.

And finally, add a carbon tax which is perfect for funding clean energy projects, because as the projects are completed, the income from the carbon tax will shrink.

Uh huh. And the political party who introduces all this sees itself immediately frozen out of power for a generation or more. Almost none of the stuff you’ve listed has any popularity whatsoever. You’ll piss off the rich (securities, carried interest, charity deduction) AND piss off the middle class and the poor (gas tax, carbon tax), especially because all of these taxes aren’t even going to lead to more services or infrastructure. They’re just all in service of reducing the deficit, which I understand polls well but revealed preference has shown literally nobody cares about the deficit when it comes to voting back in the same politicians who blew it up in their prior term.

Well done: it’s really hard to come up with a bag of policies that will garner approx 0% of the vote, but you’ve done it!

Sorry you don't give a shit about the future economic stability of the country, Mr. Campaign Consultant.

Sometimes there have to be adults in the room. This doesn't have to wipe out the deficit, but close to gap so that the percent of GDP that the accumulated debt represents stops rising.

Adults in the room. Good.

Adults in the room with a majority in both houses of Congress. Better.

Rule by technocrats in possession of the latest FRED stuff out of St. Louis. Best.

Is it not already the case that the charitable deduction cannot include the value of any services received by the donor from the receiver?

This has always been the danger inherent in “Make America Great Again”; that someone would notice what tax rates were like in the 50s when America was “Great”.

It’s little mentioned that this is part of Trump’s power; that he might go full populist and get his cult to support big tax increases for the wealthy. In the end it’s why the GOP has to buy him off. He’s holding a gun to their low tax rates.

Most of the people voting for Trump have no idea what current tax rates are, much less what they were before many of them were taxpaying adults themselves - to have been an adult paying taxes in the 1950s, you’d have to be well over 80 years old today.

I’ve heard people tell me they pay effective rates of 30-40-50% in “taxes” on 5-digit incomes when - if you continue to question them - you find out they’re counting all deductions from their paycheck as “taxes.” You know, including shit like 401k contributions or health/dental/vision/life/disability insurance premiums. And they invariably leave out that every April they get a refund, sometimes a substantial one in the thousands. They don’t adjust what they pay out to account for that.

People can be incredibly stupid, especially if being stupid reinforces their priors that “taxes are bad” and “taxes are too high.” It doesn’t help that there isn’t a single class in high school that teaches you how to calculate your own tax return, so you learn the difference between marginal and effective tax rates.

The guy who does my taxes always adds a sheet showing the actual percentage of our income we paid. I used to laugh at how low it was - it took years to break 10%.

I agree with your point Austin, that most people have no idea what actual tax rates are, but what I would argue is that that cuts both ways. Just as "I'll cut your taxes" sounds good because few understand how low taxes on the rich are now, similarly "I'll make Wall Street pay their fair share, and I'll close the hedge fund guys' loophole" sounds just as good because no one really knows the numbers. It's all about "feelings" and it's easy to stir people up to feel that Wall Street global elites are not paying their taxes. Trump, if he had any real political instinct other than "win the day's news cycle" could easily take advantage of this, and McConnell and company surely know it. That's why they didn't impeach him when they easily could have in Jan. 2021, and that's why they're hoping now that he fades before the primaries.

The famous "90%" or "70%" tax rates of the late 40's-early 60's were top marginal rate of income tax.

The whole ballgame is, what is subject to it. Wages? Passive income? What kinds of passive income? What measures can you do to move your income out of the reach of income tax.

And that's just income.

The little people have income. From wages.

The rich have lots of income, and if it's mostly wages, they're not doing it right.

The wealthy have wealth.

Present Constitutional doctrine puts the latter out of reach, except for nibbling around the edges in the form of death duties.

We briefly had a debate about wealth taxes, until the exact shape and funding of a national health insurance scheme that would never be enacted anyways become the biggest issue in the 2020 Democratic primaries.

https://www.americanbar.org/groups/taxation/publications/abataxtimes_home/19aug/19aug-pp-johnson-a-wealth-tax-is-constitutional/

How is a massive cut to Social Security or Medicaid going to change the deficit? They have dedicated revenue and these funds cannot be used for anything except Social Security and Meidcaid.

Actually, it would perversely increase the deficit to cut spending because it would grow the trust funds for these programs, allowing for increased investment in federal bonds to pay for federal services without dedicated funds.

There's only one place to cut spending, and that's the military. You can also raise revenue by charging more for mineral and oil leases.

But the real answer, as you note, is to raise taxes on the private corporate and individual pools of wealth that are sitting there and not being invested in our economy.

How is a massive cut to Social Security or Medicaid going to change the deficit?

A) That's not going to happen. B) In the parallel universe where something like this were politically feasible, the amount of deficit reduction would depend on the specifics of the "cuts" legislation. If the bill in question authorized cuts to benefits without cuts to payroll taxes, the deficit would decrease because the government's cash flow would improve, and it wouldn't have to borrow as much from investors. Under current law, of course, the Treasurly has to account for excess payroll revenue not required to pay current benefits by issuing IOUs to the Social Security Administration. But the revenue covered by those IOUs isn't burried in the ground. It's used to buy jet fighers or pay bond interest or provide foreign aid.

But I see no prospect of massive cuts to any of our entitlement programs. Even if the SS Trust fund dwindled to zero I think "massive cuts" are hard to envisage because not many members of Congress (even those of the MAGA persuasion) will sit idly by while the living standards of old people take a huge hit. I hope I'm right.

Ooookay, there you libruls go again with your "facts" and your "math" and your "logic." I suppose next you'll be getting all "science"-y about it.

Real Americans don't bother with any of that elitist stuff. We have our (ample) guts and we have Faith. In particular we have faith that Real President Trump will bring Business Sense to the government and fix it the way it oughta be, starting with not giving any more of my Hard-Earned Tax Dollars™ to Those People, and also rebuilding our Hollowed-Out Military and securing our Border. And if we're gonna cut expenses, we should cut my taxes, cuz they're too high!

I want to point out that Social Security was always expected to grow over this period due to demographics, and we planned for it by overpaying payroll taxes for decades. Wisely or not, part of what the SS trust fund did was allow our income taxes for the general fund to be artificially low over that period. Now we're at the point where SS costs will grow (eventually leveling out) and the general fund is expected to cover that, and Republicans want to renege on that part of the deal.

The overpayment was because of the baby boom, and it was realized that the birth rate was not going to be as high as during the boom time. The main reason that there is projected to be a shortfall in revenue for SS is that wages have not grown as expected - real wages are lower now than they were in 1973.

There is no current plan for the general fund to cover SS payments when the Trust Fund is paid out, although there is no good reason why general revenues couldn't be used for retirement benefits. The current structure is not in the Constitution and Congress could just pass a law changing the program. Alternatively it could pass a law eliminating the requirement that the SS budget always be in the black. Why should it always be positive when the government is $33 trillion in debt?

Yes — wages and salaries for non-supervisory employees, that is. Managers and owners have managed to keep essentially all the gains from increased productivity, and since most already had compensation exceeding the FICA cap, or exempt from the FICA tax, so revenue stalled.

First explain why you want to cut the deficit. All the reasons I've heard make no sense. (The national debt has never burdened anyone's children and grandchildren and it never will., and on the rare occasions that the debt has been significantly reduced a recession has resulted.)

Although I agree deficit hysteria is a thing, at our present juncture (higher inflation and an indefinite rising debt/GDP ratio based on current trends) it probably does make sense to bring borrowing down over the longer term. Still, there's absolutely no reason to actually balance the budget. We simply need to hold federal borrowing to an amount smaller than the growth of the economy most years. That would be trivially easy to do in way the vast majority of Americans would barely feel, assuming a legislative branch capable of the most basic kind of fiscal housekeeping.

The constraint on what we can do as a nation is the real economic resources that are available to us: labor, materials, infrastructure, technical know how. We need to use those resources wisely because they are limited. Money is not a limited resource for the Federal Government unless we choose for it to be, specious arguments about debt/GDP notwithstanding.

It's true the only real constraint on government (or the private sector for that matter) is the quantity of available resources. But government consumption of those resources rather obviously leaves less for everyone else. So, while money can be created in unlmited quantities, resources are unfortunately anchored by the limitations of our phystical world. If any of this is unclear to you, try getting a mortgage right now.

Obviously, whatever real resources the Government uses can't also be used by the private sector. But that's a different argument than the Government can't do something because it doesn't have the money, or the debt/GDP something.

Some resources are limited, but the efficiency with which we use them is not fixed — labor productivity, yield from material inputs, energy efficiency all have seen significant improvement. Arguments about the rate of growth of debt are not specious — growing debt is not a problem in an economy that is becoming more productive at a fast rate.

*faster* rate

Yes, the efficient and effective use of labor and other real economic resources is absolutely the key to a society's prosperity. But a connection between society's prosperity and the amount of public debt or the debt/GDP ratio has never been shown.

The "national debt hurts children" argument is silly.

Ive never understood how children will benefit from less education, crappy roads, crumbling bridges, unfettered growth of foreign authoritarian regimes, impoverished grandparents, hunger when their parents get laid off, homelessness, decreased scientific research, or any of the many other things that government spending provides.

How much better off would I be if my parents had not gone to high school (let alone college), all advancements due to NIH and NSF funding never happened, we all drove on crumbling roads with top speeds of 40 mph, we had to pay for my grandparents' retirement out of our own pockets, and the Nazis controlled Europe? Other than the Nazi bit, that's the world my grandparents were born into. There's a reason they really loved FDR.

Whenever someone starts comparing the federal budget to a household budget you can quit listening to them because they are either an idiot or a liar.

"on the rare occasions that the debt has been significantly reduced a recession has resulted."

Wrong. The national debt shrank substantially throughout the 1950's-1960's, as that 91% top marginal tax rate enabled us to pay down the enormous debts incurred during WWII. No recession.

The debt shrank again in the last two years of the Clinton presidency. No recession.

This is easy to look up on FRED.

There was a very few years when we ran a budget surplus in the postwar years. The norm was small deficits. The national debt grew slowly, but it did grow. I haven't looked it up, but I think there might have been a mild recession in '58? And yes the Clinton surpluses in FY98-00 did cause a recession starting in March 2001, which ended when GWB cut taxes and restored the budget to deficit.

A better example is the budgets in the 1920's, which preceded the Depression.

The framing in terms of mandatory and discretionary is deceptive and illogical. The big bump in 2020 was because of pandemic payments, but why are these "mandatory"? They certainly weren't planned years in advance like Social Security (although SS does not contribute to the debt or deficit). If Congress had exercised its actual discretion not to pass these payments they would not have contributed to deficits (although a bad recession would probably have reduced tax revenue). The end of the child tax credit expansion was sort of mandatory and will reduce deficits, but that again was only passed during the pandemic. Most of Bidenomics is in the mandatory part.

Republicans are not confining their efforts to the "discretionary" part, they definitely going after the "mandatory" expenses where they can. They are going to prevent extension of the child tax credit. But they have learned from experience that really trying to cut SS is dangerous. They may realize that even another try at Obamacare would be a negative for them.

But of course the current shenanigans of the extreme right probably don't have real budgetary objectives, they are just for show.

Per melancholydonkey above, they're "mandatory" essentially because they're set by formula rather than direct appropriation of a stated amount. That seems to be the convention for talking about the federal budget.

So "mandatory" is like a lot of terms the IRS uses for different categories of income-- a label Congress (or somebody) came up with because they needed to distinguish between formula spending and specifically-appropriated amounts.

I agree, no real budgetary objective here, just shouting out names that Everybody Knows are really Bad Things that just happen to benefit Those People We Despise. Tribal signaling, in other words.

Cutting the war budget is off limits for Democratic liberals as just like it is for Republican conservatives.

Shades of David Stockman.