Paul Krugman is annoyed with Mohamed El-Erian, who says that inflation is here to stay and we should start responding to it. It's not entirely clear why El-Erian thinks this, but I suspect that it's yet another example of the trauma suffered by people who lived through the '70s.

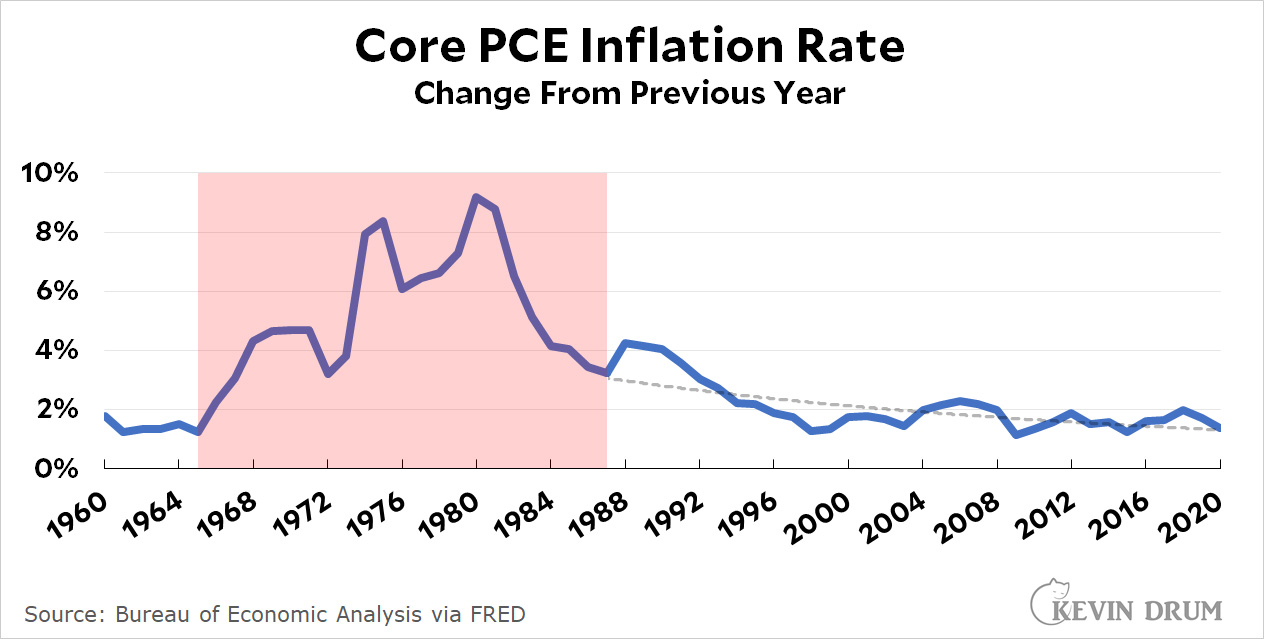

This is a syndrome similar to beliefs about rising medical costs. As it turns out, it's not true that medical costs have been skyrocketing forever. They've been relatively restrained for the past 60 years with the exception of a 15-year spike in the '80s and '90s. Likewise, inflation has been relatively restrained over the past 60 years with the exception of a 20-year spike from the mid-60s through the mid-80s:

Since that spike ended, inflation has been trending steadily down. High inflation is neither normal nor inevitable in postwar American history.

The next line of attack is usually to highlight some particular commodity that's displaying very high rates of price growth. Chlorine tablets, for example. Or softwood lumber. But by definition, there are always a few items that top the price list at any given time. That fact means less than nothing.

And then we turn to food, a staple of nightly news shows. For some reason, it's been a favorite of NBC News lately, and even my own wife has turned against me on this. "Prices are sure up at Gelson's," she told me yesterday, knowing that I couldn't argue because I never look at prices. But whatever anecdotal evidence you have, the numbers just don't back you up:

Food has followed a trend similar to overall inflation: It spiked from the mid-60s through the mid-80s, but has been in the range of 1-3% for the entire rest of the postwar period.

But wait! What about that little spike at the very end of the chart. Let's zoom in:

This is a monthly look rather than an annual look. As you can see, food prices have been extremely restrained for the past five years, spiking only in April 2020, just as the pandemic hit. Food prices almost immediately began to fall after that, and the most recent monthly reading shows food inflation at 3%.

I would not be surprised if we saw some short-term inflation as we emerge from the pandemic faster than suppliers thought we would and consumer demand outstrips supply. I also wouldn't be surprised if $6 trillion in federal spending generates some short-term inflation.

But are there reasons to think that either food inflation or overall inflation will suddenly defy history and spike upward for years at a time? I guess you never know. Go ahead and make your case. But it better be a good one.

Thank God meat packers were able to crush unions in their plants via mass immigration; that has really helped to keep protein prices down. As has the development of those lovely CAFOs.

I'm new here, though I've read K. Drums stuff on and off for a decade.

Mid-Corona was there a nice, cheerful post about how its only 500,000 dead, less than .2% of the population and besides they were mostly really old or sick and so the impact isn't all that much?

Well, but see, all that data is BACKWARD-looking, but there may be an EXPECTATION of inflation going FORWARD, and if people expect inflation then they start pricing it in and that starts the whole cycle and OMG Inflation Monster is coming to EET US IN OUR BEDZ!!

And ok, nobody actually expects inflation, neither the Fed nor the overwhelming majority of economists nor the bond markets -- who are actually putting money behind their forecasts -- but see, those things can CHANGE, and when they change sometimes they change SUDDENLY, and OMG Inflation Monster really IS coming to EET US IN OUR BEDZ!!

And ok, if neither data nor current expectations backed by professional reputation or money can be any guide, then this all becomes an exercise not just in proving a negative but in proving a negative about a totally speculative hypothesis and hence little more than a Rorshach inkblot. And that brings us to the real problem, i.e., a wealthy rentier class who are so sociopathically greedy that they oppose any action at all to relieve the real, present and substantial suffering of a large portion of the nation --many of whom are facing things like starvation, eviction, and/or lack of even essential medical care -- because they are worried that someday the real value of their assets might be eroded by a few percentage points.

Anyone who whines about inflation right now needs to be bundled aboard a black helicopter and taken to a FEMA re-education center for a long long stay.

This is your periodic reminder that there is no such thing as ‘food inflation’, or ‘inflation’ within any other single sector of the economy. Inflation is a decrease in the value of a currency, evidenced by a rise in the price of a large and diverse ‘market basket’ of goods and services. That is how governments define and measure it. A rise in food prices is just a rise in food prices.

Furthermore, a one-time, general increase in prices requires adjustments in the economy, but that is a different phenomenon from an inflationary spiral, in which some positive feedback loop continually drives the value of the currency down. For example, if workers have substantial bargaining power (not the case in the US in half a century), they can demand higher wages to be able to pay higher prices, inducing employers to raise prices to cover increased labor costs, inducing further wage demands .... This is not going to happen.

When are high prices inflation rather than industries just looking for an excuse to jack up prices? The cost of lumber is crazy right now, and the owner of the local lumberyard said prices will never go down once people are used to paying more.

Does help to see Warren Buffett making headlines today saying that inflation is here.

Sorry -- meant "doesn't" NOT "does"

There's some fundamental psychology at work here. A 5% increase in prices gets about 3x the amount of attention from a human being than a 5% decrease in prices. This is a corollary to a much more general idea - bad stuff happening gets about 3x the attention as good things of roughly equal impact happening.

This is probably beneficial for the human race, honestly. However, it can lead to problems in a life that's as complicated as ours are.

Look at the time series...5% decreases don't happen, except in electronic geegaws .

Food prices fluctuate - a lot. And I can remember gasoline prices falling precipitously on more than one occasion, notably last year.

I just pulled 5% out of the air. The principle applies to 1% increases, too.

And yeah, some things have prices that will go up fast, and drop slowly. Keynes called this "sticky prices". Which adds to perceptions. If it goes up 5% in one month, and drops 5% over the next 11 months, you're gonna remember the increase a lot more.

Uh, food inflation could be normal but still much higher on your area so.... both right.

As for medical costs they were rising to fast and even though they aren't rising much now they are still too high. That probably effects some of the answer.

For some it feels like medical costs are rising faster due to "cost sharing" causing out of pocket expenses to skyrocket.

Housing prices are inflating, much more than food prices which will show major yry deflation the next 3 months. Asset inflation is the bad inflation now.

Kevin, how are you certain that inflation is naturally low in the current era or is that way only thanks to the actions of those in authority who do remember the 1970s?

What action has been taken ‘by those who remember the 1970’s’ in the last dozen years to restrict the money supply? Volcker raised interest rates sky-high in the 70’s. Real rates have been near or below zero since the Great Recession, while the Fed employed novel strategies to expand the money supply even further. Conventional wisdom would predict runaway inflation for the last decade. It isn’t ‘naturally low’ IMHO, it’s low because workers don’t have the bargaining power to demand higher wages when prices increase, and there isn’t another mechanism to drive an inflationary spiral.

Since Kevin loves data, he can take a look at this series: https://fred.stlouisfed.org/series/T5YIE

This is the expected breakeven inflation rate predicted by 5 year TIPS bonds. It is a measure of the market's expectations of inflation over the next 5 years. TIPS haven't been in existence all that long, so there are no numbers for the 70's or 80's. But in the 2000's this rate hovered in the 2-3% range up until the 2008 crisis, when it crashed. After that, it resumed a 1-2% range, up until the pandemic, when it crashed again. But since the mid-2020, it has been rising steadily and recently exceeded the previous highest post-2008-crisis level. I wouldn't call it high -- it's still under 3% -- but it gives a little support to those who think that it is at least worth thinking about whether inflation might be ready to return.

One possibility is alot of people on the California and East Coast are going to come off the sidelines and there is going to be a surge in job growth and tightness in the labor market hidden by furlows. If that is the case, 2% unemployment may be here by 2022. I consider 3-4% unemployment to be what 5-6% unemployment was in the 90's and 2% to be the same as 2000's peak. 1-2% unemployment is thus inflationary.

In my midwestern town, they think ending the 300 extra dollars may help spur more "cheap" hires but I think the real problem is the labor market is too tight for the wage they are offering, so some price hikes are necessary. Think if the "Covid Recession" never happening and the 2%+ trend in growth never stopped. That is where we are heading+the money supply inflation of fiscal stimulus which is going to drive growth to 3%+ for several years on average.

I think there's a lot to this argument. Demographic trends have been predicting tightness in the labor market which we haven't really seen much of ... yet.

Meh. Check out the Learned Academic Debate about the NAIRU, noting especially how the absolutely assuredly lower bound of the range of even barely possible estimates has bounced around over the last, say, 40 years or so.

Ain't no one number. Ain't that simple.

The rise of the boomers caused N to rise in the 60's to 80's, level off in the 90's into the 00's, fall rapidly in the 2010's. That is why I find the 3.5% peak not that impressive. Get it down to 1-2%. That is a huge boom. Even the 90's expansion didn't get the job done with a inflationary wave when adjusted for demo.

There are good reasons to think that inflation might increase in the short term. The usual reason for high inflation is high government spending, especially in war when there is a shortage of consumer goods. The reason for the inflation of the 70 was not that, it was commodity prices, grain and then oil. If the infrastructure bill goes through there will be more spending, considerably more than usual in peacetime, possibly combined with a shortage of building materials. But it's not looking good for passage of any further big spending bills. Furthermore huge infrastructure spending in Japan, leading eventually to debt/GDP over 230% did not lead to inflation, even combined with very low interest rates. Even if there is some inflation, within a couple of years things will most likely return to normal in the US, as Kevin's graph shows they have been since the 80's. To cause major inflation there would probably have to be war or another oil crunch, and we are less reliant on oil than in the 70's.

Going into the pandemic response meant a lot of supply chain disruptions. And we'll have the same things happening while re-opening.

These disruptions have also provided a cover for price increases.

We'll be suffering ripples from the pandemic and the economic effects for years. And Republicans will blame Biden for anything that is not perfect--with the media following along.

Not sure if anyone monitors older posts - Kevin? - or Joe these things are handled here don't want to post OT on a current thread not this is in the new Thursday morning re:inflation:

"In another sign of stronger consumer and commercial demand for goods that adds to the inflation argument, shipping giant Maersk reportedly said there are not enough ships in the world to meet container shipping demand. Maersk handles around 20% of global container traffic. The shortage of container ships and problems with the location of many containers has helped to more than triple container rates over the past year".

It is very clear that manufacturers are facing supply shortages/disruptions that are raising input costs - this will eventually show up as higher prices for their goods.

Additionally, I follow the markets for and trade in Metals contracts futures. Yhe price of copper - which has myriad uses on manufacturing and construction - is generally considered a proxy for global economic activity. Currently, the copper market is going nuts - prices are at10 yea highs ad threatening all-time highs - which from an economic point of view is wonderful to see. But, the flip side is that all of these rising commodity input prices are inflationary. It might not be showing up yet on the sectors that you are montoring,but it is coming and it's coming soon. And, from a political point of view, has very little direct relationship to Bidens programs - demand is up in the rest of the world also and it's already affecting global supply and input prices.