Michael Burry, one of the investors who became famous for predicting the epic collapse in the housing market in 2008 that was chronicled in the book and movie "The Big Short," has a new favorite stock to bet against: Tesla.

Burry's firm, Scion Asset Management, revealed in a Securities and Exchange Commission filing Monday that it held bearish put options on more than 800,000 Tesla (TSLA) shares, worth about $534 million...No reason was given in the filing for why Burry thinks Tesla's stock is due for a fall.

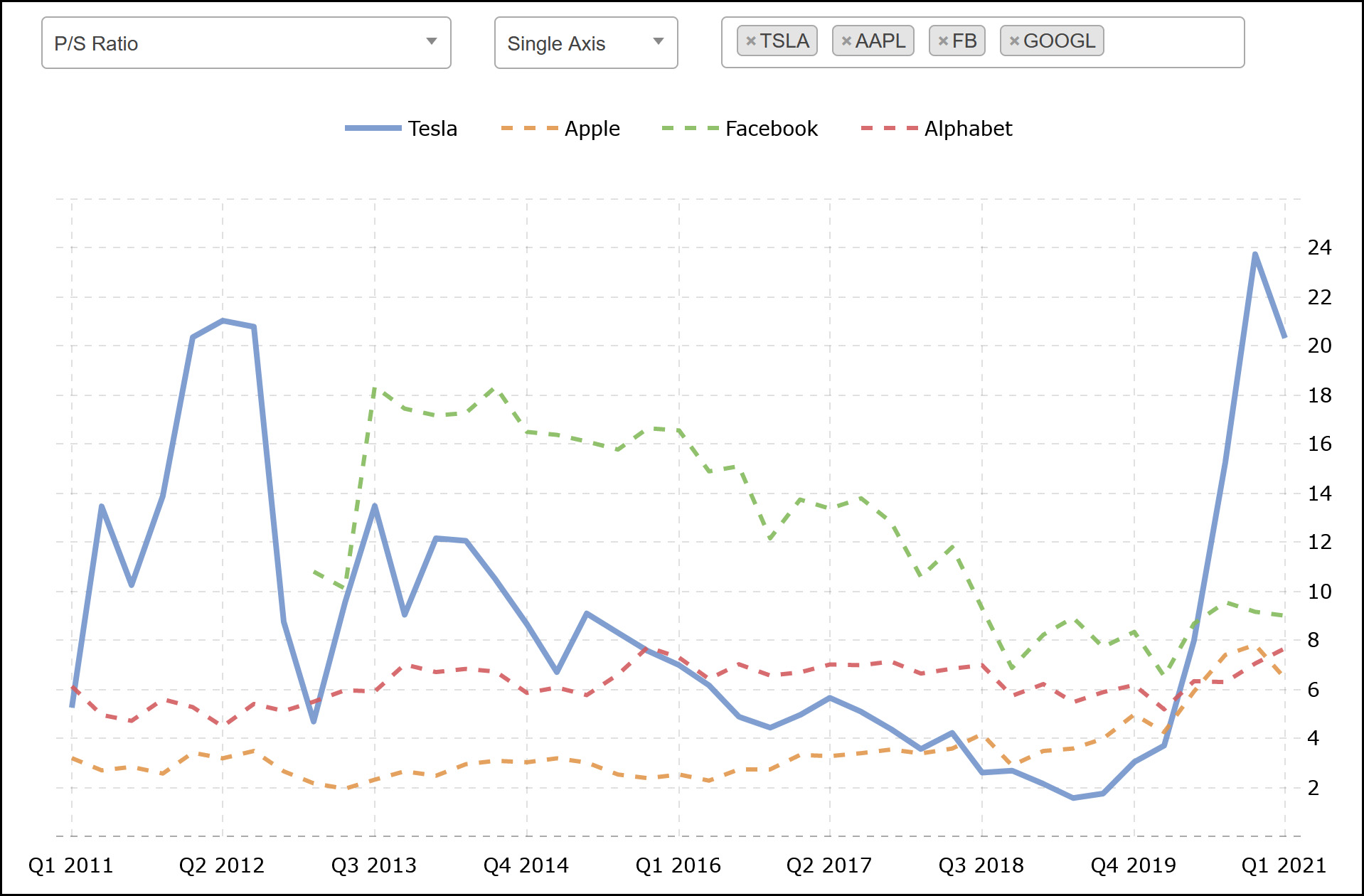

Oh come on. Maybe it has something to do with this:

For established companies you'd normally look at PE ratios, but in the case of Tesla it's better to look at the Price-Sales ratio. In the past year it's skyrocketed up to 20, which is 2-3x the level of even the hottest tech stocks and something like 20-30x that of other car companies. This is obviously nuts and isn't driven by fundamentals in any reasonable sense of the word.

So sure, of course you should short Tesla, as long as you have lots of spare cash and nerves of steel, since Tesla stock jumps around a lot depending on Elon Musk's latest tweets. This is hardly a mystery.

You can often identify stocks that are overpriced, but to come out ahead on shorting you have to predict the crash to come fairly soon. When big and supposedly knowledgeable investors short heavily there must be suspicion of inside information of some sort.

For the small investor the old John Maynard Keynes saying applies: "the markets can remain irrational longer than you can remain solvent."

That's why firms like Hindenberg do planned infodump releases. And other shorts employ botnets and memes.

Very publicly doing a large short on Tesla seems like a bad idea. If Musk notices it, he'll tweet out something like "The shorts are at it again!" and a whole ton of Tesla and Musk fans will suddenly buy a bunch of Tesla stock to see if they can bankrupt the short-seller.

Better to quietly take a short position and wait, if you've got the money to survive.

There's also other EVs coming out this year that are actually really good and Tesla won't be the only car in town.

According to the article, (i) he isn't trumpeting his position, it's a required SEC disclosure and (ii) he's basically doing a hedged transaction: long the other stocks on Kevin's charts, short Tesla. So it's not exactly a bet that Tesla will go down, just a bet that its metrics will converge to those of other high-flying tech stocks, one way or another.

Yes, and the value of his short isn't that large; we don't know what his target date or price is, which is the actual value of the position.

In other Tesla-related news: https://abcnews.go.com/Business/tesla-autopilot-mode-crashes-parked-police-car/story?id=77753735

Most times some officer says 'Tesla in Autopilot hits X' in a story, it's retracted later.

That's not to say it doesn't happen, it does, but the few that happen are hyped way out of scale from the normal 'driver drives into a stopped car' rate.

Thing is, does Tesla have a business that looks anything like FB or Google? I don't think so...neither of the latter do a lot of selling physical things, which is a very different business.

Apple, at least, sells things, though it outsources all the physical parts of its operation. Tesla does not. It's kind of a weird comparison.

That said, the P/S ratio is really, really high.

Tesla built a real car company out of nothing. Maybe Tesla is overvalued but it does a lot of things right.

This isn't a long-term short, either.

Once Berlin and Austin come online at the end of the year and start pumping out cars, Tesla will double its capacity and those sales will catch up with its price.

I'm still fixated on the issue of insurance, Insurance that I believe must be purchased by all makers/sellers of any kind of "autonomous" or 'Self-driving" vehicle towards the benefit of the general public that may be injured by their devices.

Surely there must be some personal injury lawyers reading Kevin's blog, why aren't your associations screaming loudly for this in all your state legislatures?

Windows 10 hasn't given me a blue screen in several months, knock on wood, but there have been at least six in five years, and plenty of glitches with internet software every day. I'm supposed to trust computer companies to operate well enough to protect the public when they're guiding multi-ton vehicles ? They can't even manage handling social media well enough to protect the public.

Puts are a great way to bet against an erratic company. The maximum one can lose is premium on the stock. The buyer of an option always has the option to allow it to expire worthless. If TSLA tanks some time during the time period of the options Scion can buy the 800,000 shares for the market price and then ram them down the throat of whoever sold 8,000 TSLA contracts.

Given the volatility of the stock I expect that Scion paid a mountain of cash for those contracts. For instance, for an October 21 long put $30 out of the money someone would pay $5700 per contract, or $45 million. That's a lot of money, so Scion must be pretty confident that TSLA is going to be under $500 on October 15.