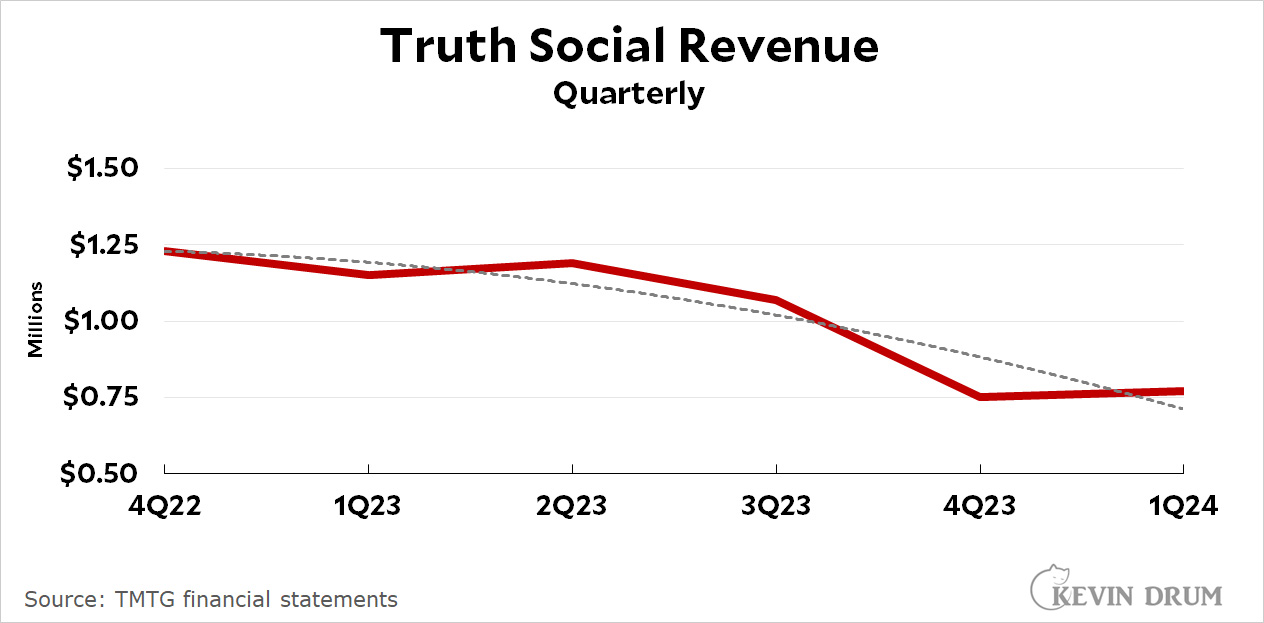

I see that Donald Trump's Truth Social reported financial results today for the first quarter of the year. Total revenue clocked in at $770,000 (yes, thousand):

Results were announced after the market closed, and in after-hours trading no one seems to care. The stock price is still hovering around $49, about where it ended the day.

Results were announced after the market closed, and in after-hours trading no one seems to care. The stock price is still hovering around $49, about where it ended the day.

TMTG (the official name of Trump's company) also announced operating losses of $12.1 million, up from $9.2 million last quarter.

Naturally the company said it was focused on long-term development, not pesky quarterly results because—well, what choice do they have? Their quarterly results are terrible.

They also announced that soon they'll start streaming live TV to the Truth Social app. Sounds like a blast.

I am surprised they did that well. You can only sell so much over priced, made in China "survivalist" gear and snake oil to loons and the expected return gets factored into how much advertisers are willing to spend. Granted just by being on Truth Social you have painted a target on yourself as being an easy mark, but that's free. Even loons get more selective when actual money out of their pocket is involved.

"Even loons get more selective when actual money out of their pocket is involved.: Not really as can be seen by the success of Trump University and the gold coin ads that supported Glen Becks fox news show for two years.

"Total revenue clocked in at $770,000"

Amusing -- my daughter owns a mid-sized nail salon in Colorado that has higher annual revenue than that. Trump is really killing it with his nationwide Truth Social business. And think of all the marketing Truth Social has had, like from Trump promoting it, to free publicity due to press coverage.

Assuming her business is valued like Trump's, it's worth at least $1.75 billion.

Congrats!

Yes, but Donnie‘s operation did that in a mere quarter! LoL. I was going to chime in to note that his internet platform is still not quite as large as a typical McDonald’s franchise.

They also announced that soon they'll start streaming live TV to the Truth Social app.

Reruns of Death Valley Days and The Many Loves of Dobie Gillis?

"The Many Loves of Dobie Gillis" appeared to be a really good show on Nick at Night.

Have to confess I've never actually seen it.

I just think he'd have to show reruns that are probably all but in public domain.

I watched the show when I was young. Mostly for the character Maynard G. Krebs who was a stereotype of a beatnik. Bob (Gilligan) Denver played the part. It was a fun show that probably hasn’t aged all that well.

Maybe OAN? Maybe some of the right-wing trolly networks that can't even make it as public access?

'post your own videos'.

You know, it could work.

Just to give you a taste, during every show at some time Zelda, who had a forever-crush on Dobie while being an uber-geek, would wrinkle her nose briefly and confidently say "Propinquity, Dobie Gillis....Propinquity!"

Any show which had such a self-confident woman -- raging hormones or not -- in the 1950's was fun to watch.

The alternative was Doris Day.....

there's also this:

SARASOTA, Fla. (AP) — Trump Media and Technology Group, the owner of former President Donald Trump’s social networking site Truth Social, lost more than $300 million last quarter, according to its first earnings report as a publicly traded company.

For the three-month period that ended March 31, the company posted a loss of $327.6 million, which it said included $311 million in non-cash expenses related to its merger with a company called Digital World Acquisition Corp., which was essentially a pile of cash looking for a target to merge with. It’s an example of what’s called a special purpose acquisition company, or SPAC, which can give young companies quicker and easier routes to getting their shares trading publicly.

https://apnews.com/article/trump-media-earnings-0ee9a4598f7da6c217720445605dfbdd

Fraud alert. Paging the SEC...

I just think it's WONDERFUL that President Trump is devoting so much time and money to making sure people hear the TRUTH, even when it's costing him dearly! Really, he is JUST like Jesus in that way! This is why I buy a share of his stock EVERY DAY, just to show my support, and also to have a real heritage that I'll be PROUD to pass on to my children!

i'd love to see the gratitude on their faces when they find out their entire inheritance was so wisely invested

please don't tell anyone your plan; the surprise will make their joy all the sweeter

Wait a sec. That post is... real?

Dang! I thought about heart emojis but the edit timer expired.

This "company" has got to be one of the weirder ones, in a long, long line of very strange endeavors people have attempted. Consider its possible fates:

- Massive rug-pull of his most loyal supporters,

- quiet bankruptcy and a few lawsuits picking the bones,

- Unfiltered comms channel to subjects (you won't be a citizen at that point), direct C&C from the White house to the brownshirts.

Can anyone else think of a company that could have been a 9-digit con, a miserable failure or Goebbel's wet dream with roughly equal probability?

sell to Elmo for $20 billion. then Elmo gets exclusive NASA contract worth 1.5 trillion over 19 years

He tried to sell to Elmo already. I'm sure it, or something like it, is the plan. The Saudi's have a lot of blood money to spend...

forgot to tickle Elmo.

You're giving them ideas.

Orwell really blew it, two minutes - HAH! Streaming is where it's at, baby!

Anyone who already bought into this is waiting to see whether Trump gets reelected. Being leveraged in any Trump venture helps you get in on the ground floor of the next round of corruption, so why bail now? If Trump loses, then you'll see the price plunge.

You will see the price plunge in 5 months when Trump and Jeff Yass start dumping their shares.

Breaking News:

Dow Hits 40,000!

OK, that may not be news to you. But consider this an update to the "good news is no news" policy at the NY Times.

The Dow hit 40K on Thursday and closed above that level for the first time in history on Friday last week. For anyone relying on the NYT for their news, it might as well not have happened. Except for a single Dealbook "In Case You Missed It" link to a CNN article, it remained a story no one (at the Times) dared to mention.

Finally (at the Times), the story can be told. The Dow 40,000 news has been released from its apparent embargo. Breaking the news is Paul Krugman in his Tuesday column. You can read it here:

https://www.nytimes.com/2024/05/20/opinion/trump-biden-stock-market-dow-jones.html?unlocked_article_code=1.tk0.5p8d.UGUxkelDqo9B&smid=url-share

Why the (relative) silence?

For what it's worth, "reconciled" is what a number of Krugman's colleagues and higher-ups have done ever since they realized Joe Biden is a) getting shit done, and b) boring and not selling newspapers.

+1

I keep trying to explain (to myself) why seemingly all news related to Biden reported in the NY Times (and other supposedly responsible outlets) is so negative.

Are they trying THAT hard to seem "balanced" to conservsatives and MAGAnauts ? Or does the success of Biden's programs, which really are much more progressive than anyone wants to admit, threaten the old conventional centrist wisdom, all those Larry Summers types warning of 70's stagflation just around the corner ? Or is it just that it upsets these folks:

https://www.nytimes.com/2024/05/15/business/wall-street-donors-trump.html?unlocked_article_code=1.sU0.7PVA.Z6vEd6NULBsZ&smid=url-share

Or is it that they desperately want a horse race to November, because they either don’t know how to cover issues anymore, or they found issues don’t draw clicks? TFG has lost the popular vote twice, the second time by a bigger margin than the first, even though he was the incumbent. The fundamentals are mostly in Biden’s favor: he’s the incumbent, unemployment is low, crime is down, financial markets are up, we’re not losing a war. Democrats have been sweeping special elections and did historically well in the midterm. Striking down Roe v. Wade was a Republican own-goal. So, got to level the old playing field, eh?

OT: more breaking news

For all the folks who think (erroneously) that inflation doesn’t end until prices actually go down*. Well, they are going down. That’s actually disinflation, or deflation.

*Inflation is the first derivative, i.e. the rate of change, of a price index. When prices stop changing, inflation is ZERO. 0.

What Target is also implicitly admitting is that it's current retail markup was way more than it needed to be to attract and keep customers. As Krugman and others have pointed out for the past year or more, there were some real reasons -- namely pandemic induced labor shortages and supply chain disruptions -- why prices briefly spiked in 2021-22. The reason they *stayed* up is because wholesalers and retailers discovered that people were still grudgingly paying those prices, so they just kept them high rather than bringing them back down in line with their actual costs. Hence the record corporate profits and record stock market returns.

Maybe that's hit its limit now and we'll start seeing some pullback as manufacturers and retailers compete to see who can lower prices faster. Consumers would certainly welcome that.

I think a good portion of the subscribers are journalists who want to know what trump writes so they can repost in their "news" articles.

And then dropped 4.5% to 5.5% shortly after the open the next day…

And today it’s down another 9%. But the price is still crazy. If we assign the company a price/sales ratio of 10 (which is high), the stock is worth 2.25 cents per share. If we subtract liabilities from assets, we get $1.54 per share, which is better, but that’s as of March 31. Assuming that the company has continued to spend money, it has less cash now than it did then.

Down another 4% or so shortly after the open the second day after…

Perhaps after hours isn’t the cherry of an indicator Kevin thought it was when he picked it.