This is nuts. Truth Social stock plummeted 20% today:

Why the big decline? The Washington Post explains:

Why the big decline? The Washington Post explains:

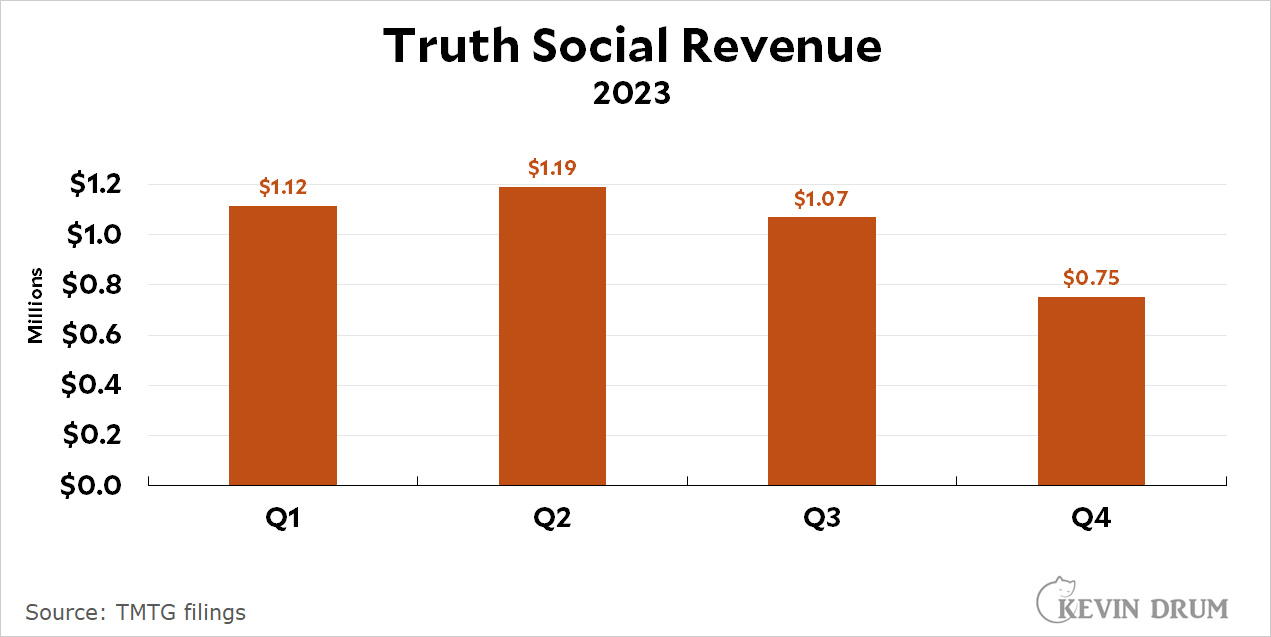

Trump Media and Technology Group, which owns Truth Social, said in a Securities and Exchange Commission filing that the company generated just over $4 million in revenue last year, including less than $1 million in the last quarter.

....The company has declined to share performance indicators like those common across the tech industry, such as its number of active users, and said it may continue to withhold such figures. Focusing on those numbers, the company said, “might not align with the best interests” of Trump Media or its shareholders.

Oh come on. It's true that revenue in Q4 declined to $750 thousand (yes, thousand):

But Truth Social revenue has always been minuscule and that didn't really change in any significant way. Either you believe that Trump will become president and cause Truth Social to skyrocket or you don't. Financial results hardly enter the picture.

But Truth Social revenue has always been minuscule and that didn't really change in any significant way. Either you believe that Trump will become president and cause Truth Social to skyrocket or you don't. Financial results hardly enter the picture.

Of course, maybe investors were reacting to the statement that Truth Social won't release user numbers because it "might not align with the best interests" of the shareholders. I'll just bet it wouldn't. This is basically an admission that even the crazy people who are buying into this scam would be taken aback if they learned just how few active users Truth Social has.

POSTSCRIPT: All the folks behind Truth Social's public offering knew weeks ago that their latest results were lousy. But they carefully chose to complete the offering a few days before they had to tell anyone. Whether that's clever or illegal is something for the SEC to decide, I suppose.

I don't believe that Trump will become president again, and I don't expect the stock of Truth Social to skyrocket, barring some rich Republican throwing money away to temporarily support the stock price.

I think that even the faithful are seeing that everything that Trump touches, dies. And most of those rich, conservative donors didn't get rich by throwing good money after bad. They got rich by stealing, fair and square.

From what I read, it was suggested that the stock price drop had more to do with the risk factors indicated in its SEC filing today, specifically these three:

I mean c'mon, of course a Trump company would be issuing misstatements and inaccurate forecasts. That's the whole game.

As someone on LGM noted, a good size grocery store generates as much revenue as Truth Social. Just one store.

I want to know who bought the shares in the IPO. I'll bet a nickel there are some names that are difficult to pronounce.

I don't quite know what this is supposed to mean.

i assume something involving cyrillic

It's a conspiracy theory promoted by people who (hilariously) say that other people promote conspiracy theories. It's what should be called disinformation.

I think it's supposed to mean buying shares in Truth Social might be a way for foreigners antagonistic to Biden, democracy and/or America to funnel money to Trump (since generally foreigners are banned from donating money to political campaigns)... as well as a way for all the sketchy people in Trump's orbit to launder money gained through illicit or questionable means.

I knew this was a stock to short, but I didn't figure the early run on the fools to be over so quickly.

The real opportunity for shorting will come when Trump and Jeff Yass, a major "investor", start unloading their shares. DJT will be a penny stock in no time. On the other hand, it is possible that Vlad Putin, Trump's BFF or the Saudi public investment fund will step in to buy a few billion dollars worth. For Russia in particular, that's small potatoes if it helps keep a good friend in the Whitehouse.

Just wondering who you think is Putin's broker and how that would work?

I have no idea if Putin et al. would actually want to do this, but are you seriously suggesting they could not do so?

putin could just give trump a few riverfront acres in volgograd; no need to waste money on trading commissions

I'm assuming one of Putin's oligarch pals can help him set up a shell company if he can't buy shares directly. Heck, Digital World *was* already a shell company. Leaving Putin aside, you really don't see the potential problem with the president owning, nominally, billions of dollars of stock in a public company whose valuation otherwise would be in the 2 or 3 million (if that)? How about if that president is also a career criminal?

i figure there's a few more cycles of boom and crash before this thing plays out

Would I buy shares in Truth Social? No. Definitely, no. But I wouldn't buy GameStop or Dogecoin either-- and they are still around somehow. There are lots of extremely speculative investments available. Matt Levine writes very well about these things at Bloomberg.

Over at Talking Points Memo, Josh Marshall observed that "Truth" "Social" had about the same revenue as TPM. But you can count the TPM reporters on your fingers, and probably wouldn't need many toes to add in the rest of the staff.

The Defendant's "big" platform is a joke -- very appropriate for today!

Trump Casinos redux?

I still think they should sell framed paper shares signed by Trump! for what, $100/ea (limit 5 per household so buy now with special offer to get 10 today only!). Turn that "meme" stock into a memento!

From TMTG's 8-K filing:

TMTG believes that adhering to traditional key performance indicators, such as signups, average revenue per user, ad impressions and pricing, or active user accounts including monthly and daily active users, could potentially divert its focus from strategic evaluation with respect to the progress and growth of its business.

TMTG does not currently, and may never, collect, monitor or report certain key operating metrics used by companies in similar industries

TMTG’s management and board has not relied on any particular key performance metric to make business or operating decisions.

TMTG believes that adhering to traditional key performance indicators, such as signups, average revenue per user, ad impressions and pricing, or active user accounts including monthly and daily active users, could potentially divert its focus from strategic evaluation with respect to the progress and growth of its business. TMTG believes that focusing on these KPIs might not align with the best interests of TMTG or its shareholders, as it could lead to short-term decision-making at the expense of long-term innovation and value creation.

=-=-=-=-=-=-=-=-=

Looks good to me! A business that shuns performance indicators and metrics is one that already knows what it's going to do. Genius. Buy TMTG now before its price soars.

So don't be surprised when Il Duce hypes the hell out of Truth using the biggest megaphone in the world, his presidential champagne, and then dumps all his stock, letting the MAGA suckers holding this bull shit company.