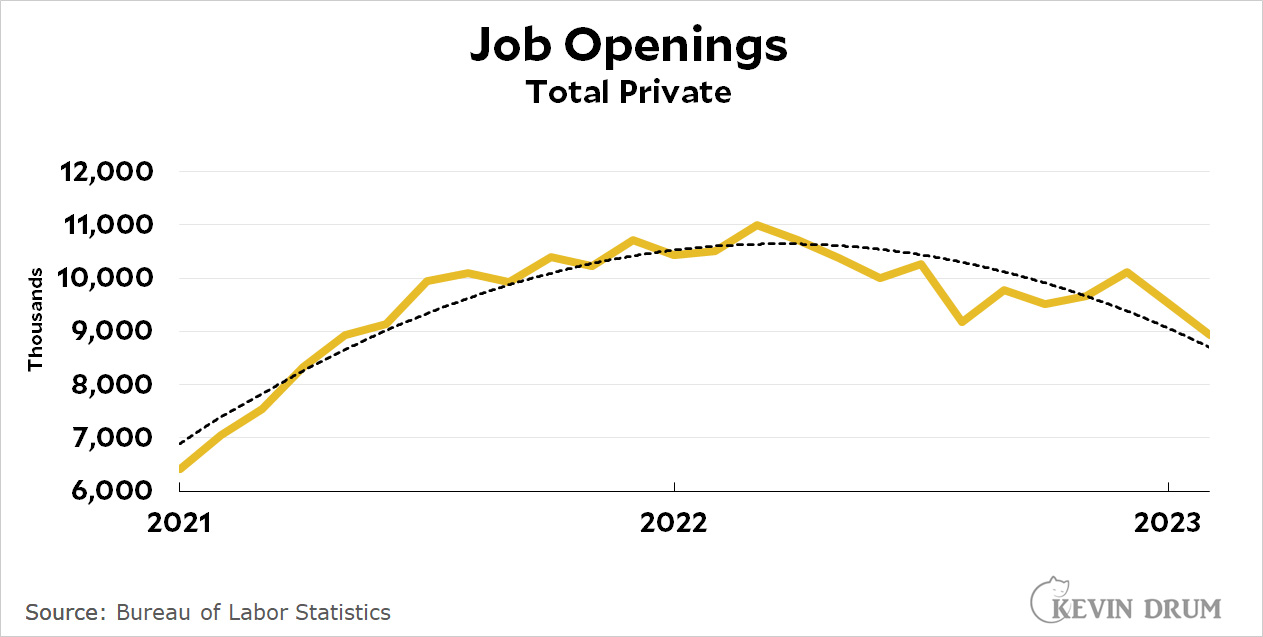

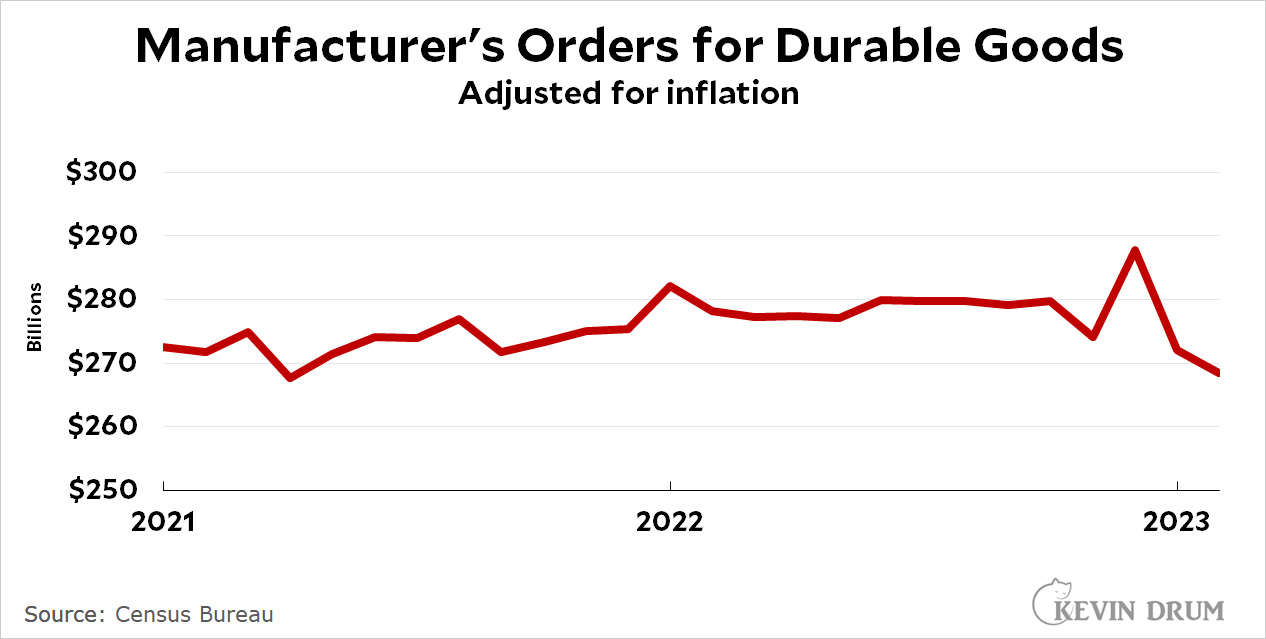

In today's release of economic news for February, job openings continued their yearlong fall and orders for durable goods continued their decline of the past few months (with a brief timeout for Christmas). It was against this backdrop that the Fed continued to raise rates a couple of weeks ago. Good job, Fed.

8 thoughts on “US economy continues to fade”

Comments are closed.

I'm still scratching my head over the "it takes a while for interest rate hikes to affect inflation" thing. Tech companies have been laying off employees and behaving like they expect a big downturn very soon, but it seems like the economics chattering class is acting like the it's not a thing at all. A very strange radio silence.

Dont the tech companies still have more employees than they did in 2019, 2020 and 2021?

The tech sector is a relatively small slice of the economy and im not aware of any evidence that this particular small sector is a good leading indicator of the overall economy. But maybe thats true?

Tech companies do receive outsize press coverage compared to their overall size of the economy. Ive seen quite a bit of coverage of the tech layoffs considering the relatively small size of the sector.

Ok, mentioning tech companies apparently distracted from what I was actually asking.

It's basically an economic truism that fed rate hikes take a long time to actually affect inflation. Yet for the last 6 months I haven't heard this discussed at all... even Krugman has acted as if rate hikes impacted things in real time and that's that.

So should we expect a rate induced downturn this summer or not?

Do you think it might be helpful context for your readers to understand that you started the job opening chart at a up-until-then series high, and that the level of job openings we have seen in the last two years is vastly different than anything else we've seen in the 20 year JOLTS time series?

Even with the decline we're seeing now, the job openings rate is at 6%. From 2001 - 2021 we had never seen anything above 5%.

Relevant context, no? Maybe makes it seem like the recent decline isn't actually all that bad?

Kevin is deeply committed to his "there's going to be a recession and we're all going to die!" story, and has blinded himself to evidence that lessons or contradicts that narrative.

I know. And I'm deeply committing to commenting on every post on the topic, pointing out how and why he's wrong.

I should really stop. But I just can't quit him.

Maybe it's performance art?

The labor force participation rate dropped during the pandemic and is just getting back to pre-pandemic levels:

https://www.dol.gov/agencies/wb/data/lfp/lfp-sex-race-hispanic

https://fred.stlouisfed.org/series/CLF16OV

We can expect job openings to be high during the recovery then drop back to normal as employment approaches pre-pandemic levels (or trend lines). We've had a pretty rapid economic recovery from the pandemic, so high job openings followed by lower job openings now does not concern me that much. The drop in durable goods is a bit disconcerting.

The Fed raising rates has caused some of this slow down. If this in mainly due to raises made 6 months to a year ago, then we could be in deep trouble, and the Fed raising rates now is a folly of their own creation that will hurt us even more later. IF the Fed rate has not had a huge effect, or only the rates set in thee paste few months are really doing the heavy lifting, then it can work out ok.

Pushing the Fed rate up to 2% or so shouldn't really hurt the current economy that much, 3% will put a damper on things, and much above that could do damage. My conjecture. Of course the Fed does more things than raise rates.

Being too loose with money causes bubbles, so getting the rate back up a bit and ending quantitative easing was needed. If getting rates above 2% was needed to have an effect on the economy, then that started in Aug 2022 and is starting to hit now.