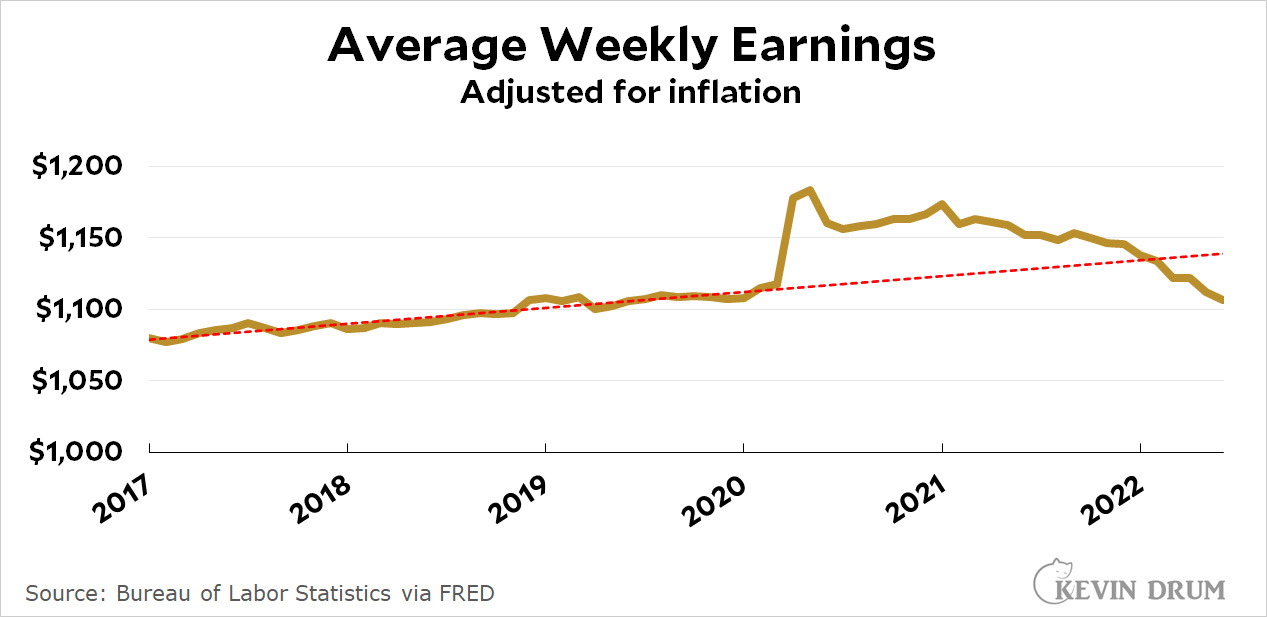

A bunch of people have put up complicated charts today showing that wage growth is cooling down. Here's my simple chart:

Well, maybe mine isn't really any simpler. But as you can see, wages have been running behind inflation for the past 18 months, and even nominal wage growth (shown quarterly by the cute blue arrows) has been slowing down recently.

Well, maybe mine isn't really any simpler. But as you can see, wages have been running behind inflation for the past 18 months, and even nominal wage growth (shown quarterly by the cute blue arrows) has been slowing down recently.

Now, this is mostly making up for the big wage spike during the pandemic. But not all of it:

Maybe it's natural that wages should revert to their trendline after a big spike, but we've obviously overshot. On average, workers are now making less than they did before the pandemic. Anybody who's worried about a wage-price spiral—or who thinks employers are serious about a worker shortage—is crazy.

Eh, then inflation collapses while wages grow 5%. Beware flawed data.

Workers making less on real terms is frankly irrelevant to potential wage price spirals - although a decelleration in nominal wage increases is relevant.

Specialists worried about the potential of wage price feedback loop are not crazy, rather they understand the issues better than you do. Of course there are signs that some global inflation pressures are fading, but others are not, of which natural gas most notably. Repeated supply shocks in energy and food, not usual variations, as one should have learned from the 1970s have a nasty habit of passing structurally through multiple transmission paths. Of course some of the mechanics of the 1970s are no longer there but that does not mean one can hand waive away as you have been doing well-past the sell-date. Mistaking concern about inflation now for the foolish inflation scare-mongering from the right over the past two decades is merely to mirror their error.

Well, there is real concern about inflation now, as it has obviously occurred and there have been real factors causing it - money from stimulus, supply-chain problems and oil price. Wages are not a major contributory factor.

But there is also foolish inflation scare-mongering (it never goes away) and tendency to call on the Fed to do things which it failed do in the 70's - it did not prevent inflation despite raising federal funds to astronomical levels.

Yes, there are the permanent "hyper inflation" scaremongers who also saw inflation all the past two decades. That does not make concerns about wage price feedback spirals crazy in general. Drum has been and is overstating.

(leaving aside your non factual final statement)

"Inflation" is hard to add up. If you didn't buy a car in 2021, inflation was 2.9%. I dislike cpi for this very reason.

Wrong, mathematically, since real and nominal wages are related by simple multiplication.

Interesting that you mention natural gas, which has a very small labor-cost content:

Distribution -

https://fred.stlouisfed.org/series/IPUCN2212U100000000/?utm_source=rss&utm_medium=rss&utm_campaign=fred-updates

Production -

https://fred.stlouisfed.org/series/IPUBN211U101000000

Trend has been down …

Wages have nothing to do with the soaring price of gas; buyers are bidding up the price and producers are pocketing windfall revenues.

And here are unit labor costs for food retailers:

https://fred.stlouisfed.org/series/IPUHN445110U101000000

Damned if they aren’t low (absolute values 10 - 15%) and have trended down, too.

You really are quite dim aren't you?

Simple maths is quite irrelevant to the observation (and not wrong mathmatically mate as you simply have not understood in the least the observation which is not about the maths between real and nominal but about wages, nominal being perfectly potential contributors to inflation even if on real terms workers are losing ground (there is nothing new about this - in fact that's generally why wage earners hate inflation) so citing losing ground on real terms is neither here nor there in and of itself)

And wages and soaring gas, you natter on.... having not in the least understood. There is no statement about labour prices effecting gas you dim sod, there is a statement about nat gas supply effecting inflation as an inflation driver. Of course wages have f-all to do with gas prices now, you dim sod, you need to go back to school to learn joined up reading.

Please cease name-calling; we have too much of that here already. You have been here often enough to know that most of us take it as an indicator that the name-caller is losing an argument. Abuse is no substitute for facts, evidence, and sound reasoning.

Here’s a further fact to ponder: it is possible for nominal wages to rise faster than nominal prices without driving a wage-price spiral. How? It has to do with the relationship between unit labor costs and hourly wages; it has happened quite often since the Industrial Revolution, and Bridgeman’s ‘dimensional analysis’ will tell you how

The price of eggs, which recently shot up due to bird flu, seems to be starting to drop, albeit slowly.

The shipping bottle necks are clearing up a bit--shorter times and big drop in costs, though still a lot more than before the pandemic.

Sales are coming back.

The price increases will remain sticky, but inflation moderating. I'd guess companies are getting in the last of their major increases while they can still blame somebody else. Start ups no longer so flush with cash that they can continue to subsidize prices to get growth, so delivery and "taxi" prices will be high from here on out. Don't see established companies trying to win market share via pricing--most close to capacity anyway, so no real profit (short term) in going after more market share--though it should be fun watching the EV market now that the old guard is finally ramping up production.

Some proportion of the increases will remain, but animal diseases, human-pandemic-idled-production, weather, war, shipping bottlenecks - none of these include feedback mechanisms that could cause an inflationary spiral. They will sooner or later succumb to Stein’s Law. Exogenous factors causing prices to rise are just a fact of life.

Remember that the jump in average wages in the pandemic was mostly compositional, that is the lowest-wage people were disproportionately fired or laid off (although there were some bonuses) so the wages of the individuals who were actually still working did necessarily not go up. The loss of earnings of those who were unemployed would have been disinflationary, but this must have been counterbalanced to some extent by the supplements to unemployment compensation and the checks for everyone. How all this worked out in terms of inflation is not given by the pandemic spike in Kevin's average wage graph.

Yes.