Inflation is usually blamed on higher prices for commodities, which in turn raise the prices for finished consumer goods. Add in higher labor costs and you get the dreaded spiraling inflation.

But Reuters reports that European central bankers are finally waking up to something else:

Huddled in a retreat in a remote Arctic village, European Central Bank policymakers faced up last week to some cold hard facts: companies are profiting from high inflation while workers and consumers foot the bill.

....Data articulated in more than two dozen slides presented to the 26 policymakers showed that company profit margins have been increasing rather than shrinking, as might be expected when input costs rise so sharply, the sources told Reuters.

...."It's clear that profit expansion has played a larger role in the European inflation story in the last six months or so," said Paul Donovan, chief economist at UBS Global Wealth Management. "The ECB has failed to justify what it's doing in the context of a more profit-focused inflation story."

And it's not just Europe. This is also happening right here in the US:

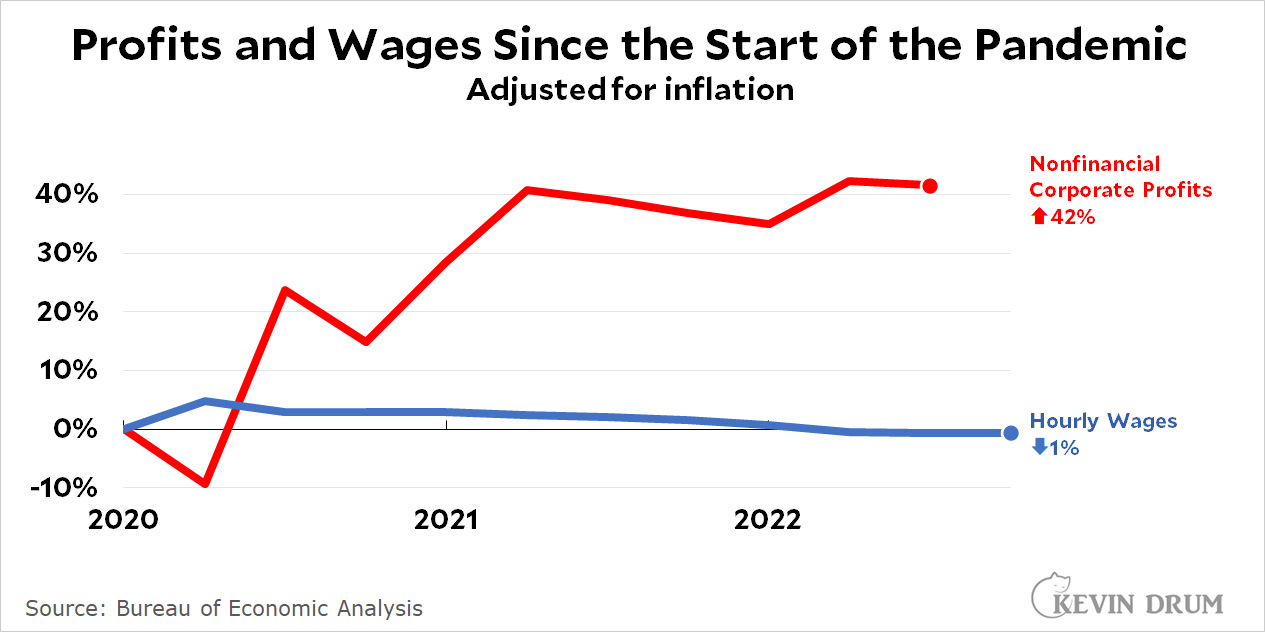

Since the start of the pandemic in the first quarter of 2020, corporate profits have gone up 42%. During the same period, hourly wages have gone down 1%.

Since the start of the pandemic in the first quarter of 2020, corporate profits have gone up 42%. During the same period, hourly wages have gone down 1%.

Who gets all this extra money? Mainly corporate executives whose bonuses are tied to share prices, and large shareholders who benefit from higher stock prices, higher dividends, and stock buybacks.¹

On earnings calls, where the only thing that's judged is how much money you make, not how you make it, CEOs are pretty open about the fact that they used the pandemic and our recent bout of inflation as an excuse to raise prices (and profits) as much as they could get away with. The cost of their inputs was part of the reason for higher prices, but the rest was the result of them testing the waters to see how much the market would bear as long as customers thought it was COVID related. All this scheming was taking place at the same time that they were furloughing workers and cutting off their health care during the worst pandemic of the past century.

I don't know what the Fed or the ECB can do about this. Probably nothing. It's a done deal at this point. But if there were any justice, this is the kind of thing that would produce mobs in the street with torches and pitchforks.

¹That is, rich people.

Excessive market concentration, monopoly, and monopsony. That's the problem. Firms are always "greedy" in that they'll charge as high as the market can bear. The mom and pop store down the street is probably no different. But the latter can't get away with it because you've got other options.But when only three firms produce 90% of our beef or flour or orange juice, that's a problem! So, when a lot of extra money got sloshed into the economy, it's no surprise who ended up getting the bulk of it in the long run.

Yes. Governments, not central banks, are the ones to deal with corporate concentration, by enforcing antitrust laws, and strengthening those laws as needed.

I’m currently generating over $35,100 a month thanks to one small internet job, therefore I really like your work! I am aware that with a beginning cdx05 capital of $28,800, you are cdx02 presently making a sizeable quantity of money online....

.

.

Just open the link————->>> http://Www.Coins71.Com

"...But when only three firms produce 90% of our beef or flour or orange juice, that's a problem! .."

Don't know about flour but it is easy to stop buying beef or orange juice if the price is too high.

That's one doozy of a comment. The whole point of excessive market concentration is to deny consumers a choice, so that their options are: pay more or go without.

In other words, in an economy characterized by vigorous promotion of a competitive landscape and antitrust enforcement, it shouldn't be necessary to "stop buying" this or that product. It should be possible to shop for a more competitive price!

Of course the CEO's are trying to screw us. Nothing has changed from the Gilded Age. Except for the bombing of Wall Street or the CEO's houses.

If they keep this up, that will come.

Oh golly gee, it's basically mostly straight up profit-seeking from monopoly/oligopoly corporations using "inflation" as cover, who'd'a thunk it?!

If only somebody had been doing a story on that last year. Wait...

https://www.axios.com/2022/05/26/new-paper-finds-monopolies-contribute-to-inflation (May 2022, doesn't even look at data after 2018! The authors say because "concentration increased sharply after 2018"!!)

https://ilsr.org/inflation-true-monopoly-story/ (August 2022)

https://mattstoller.substack.com/p/on-inflation-its-the-monopoly-profits (links back to that Fed paper in May 2022; "Back in December [2021], as this debate was first raging, I did a rough calculation, and showed that 60% of the increase in inflation was going to corporate profits. I was, along with others in this debate, trying to show that there’s a profits-inflation spiral.")

Literally from 1982 on food prices: https://repository.law.umich.edu/cgi/viewcontent.cgi?article=2095&context=mjlr

No worries, executive compensation is awarded in a tax avoidance manner, and the changes in the tax code our Republican friends help that. So, and the money gets funneled up to the top, less of it gets taxed.

"...to raise prices (and profits) as much as they could get away with. .."

That is actually their job. They can get away with it because demand is up due to the Biden administration overdoing stimulus.

Bullshit. Milton Friedman should have been lynched.

We live in a society* the CEOs no less than the rest of us. They have obligations not to rape and pillage their own civilization. Stop acting like they don't.

*yes thats on purpose

Same as it ever was?

It's not a bug, it's a feature?

Help, help, I'm being repressed, witness the inherent violence of the system?

Profit margins? Or simply absolute profits?

Shouldn’t these charts go back to before the pandemic?

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article... https://createmaxwealth.blogspot.com

Yeah, but like, the unemployment rate is the lowest it's been in 40 years, so everything is pretty much alright.

Nothing to see here.

There is no reason that containing inflation has to be, or should be, left up to the Fed. The Fed does not have a record of success against inflation - inflation went over 14% in 1980 despite years of raising interest rates, and came down only when oil price quit rising.

Inflation was held down during WW II, reaching zero in 1944, when there were excess profits taxes. Of course there was also rationing, which wouldn't be popular either now. The Fed had nothing to do with it.

But the idea that wage increases were responsible for inflation in the 70's was wrong, and it is wrong now. This idea obviously appeals to the bankers who run the Fed, but shouldn't be held by economists and politicians who consider themselves liberals.

eat the rich

This isn't that hard. During the pandemic production fell because businesses were shut down, the disease disrupted production, and businesses intentional drew down production. At the same time, Government passed out tons of cash to try to keep demand up. With a reduction in supply and demand being (roughly) maintained, prices were naturally going to rise to press down demand to the available supply. This is the reward side of investment -- when your product or demand is in greater demand than the supply you make more money -- which can be profits or re-invested back into more production to match demand. Price increases are a necessary part of demand mitigation to minimize shortages.