The Wall Street Journal reprises yet again Jerome Powell's great dilemma:

Inflation has fallen faster this year than many Fed officials anticipated after a hair-raising series of rate increases that none of them envisioned two years ago.

The big questions now are about when the Fed can start cutting rates and by how much. The answers will matter greatly to households, markets and possibly the 2024 presidential election.

One danger is that Powell and his colleagues—blamed for reacting too slowly to address surging inflation two years ago—will wait too long to lower rates as they ensure inflation is fully extinguished. That mistake could curb economic growth too much, causing a recession.

The hubris here is remarkable. Powell and his buddies on the Fed just can't bring themselves to admit that they aren't the ones responsible for inflation coming down. Their model of the economy is implicitly this:

Rate hikes → a miracle occurs → inflation comes down

Rate hikes don't directly affect inflation. How could they? There's an intermediate step, and everyone knows what it is:

Rate hikes → demand slows → inflation comes down

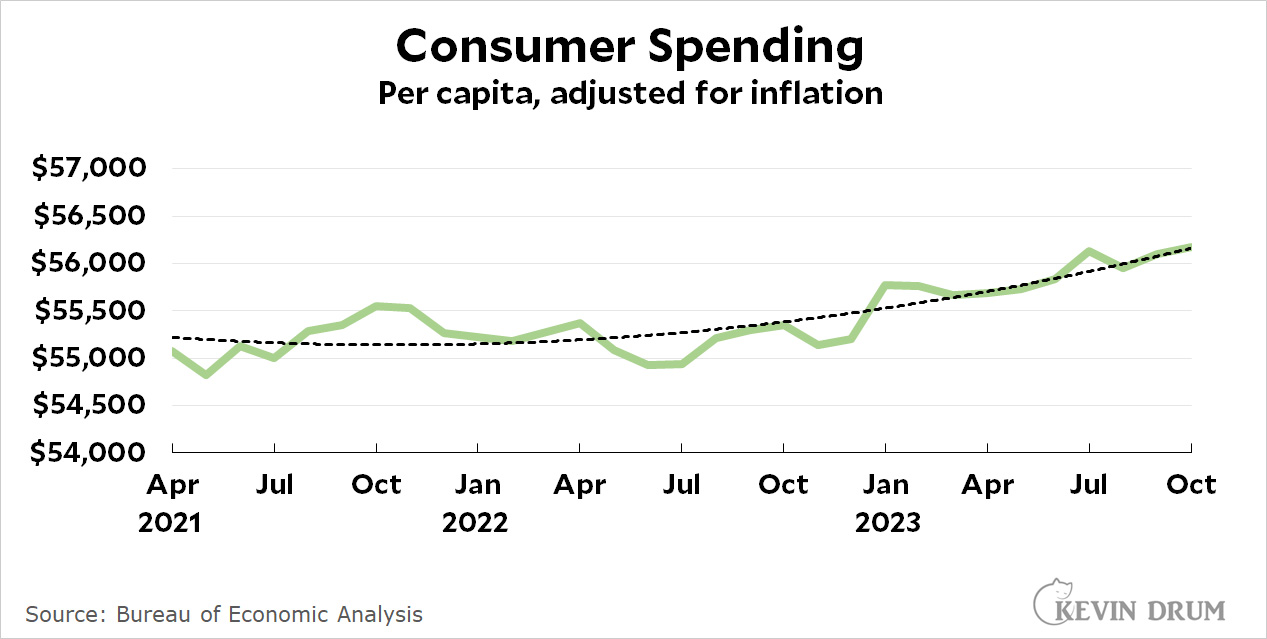

Until we see a slowdown in demand, the Fed's rate hikes haven't yet had an effect. So far, though, we haven't seen even a hint of a demand slowdown:

In addition, GDP was up 5.2% last quarter. Unemployment is running at 3.7%. Nonresidential investment is up. Wages are up.

In addition, GDP was up 5.2% last quarter. Unemployment is running at 3.7%. Nonresidential investment is up. Wages are up.

This isn't a "soft landing." Just look at the numbers. The jet is still in the air cruising at 600 knots. We haven't even started our descent.

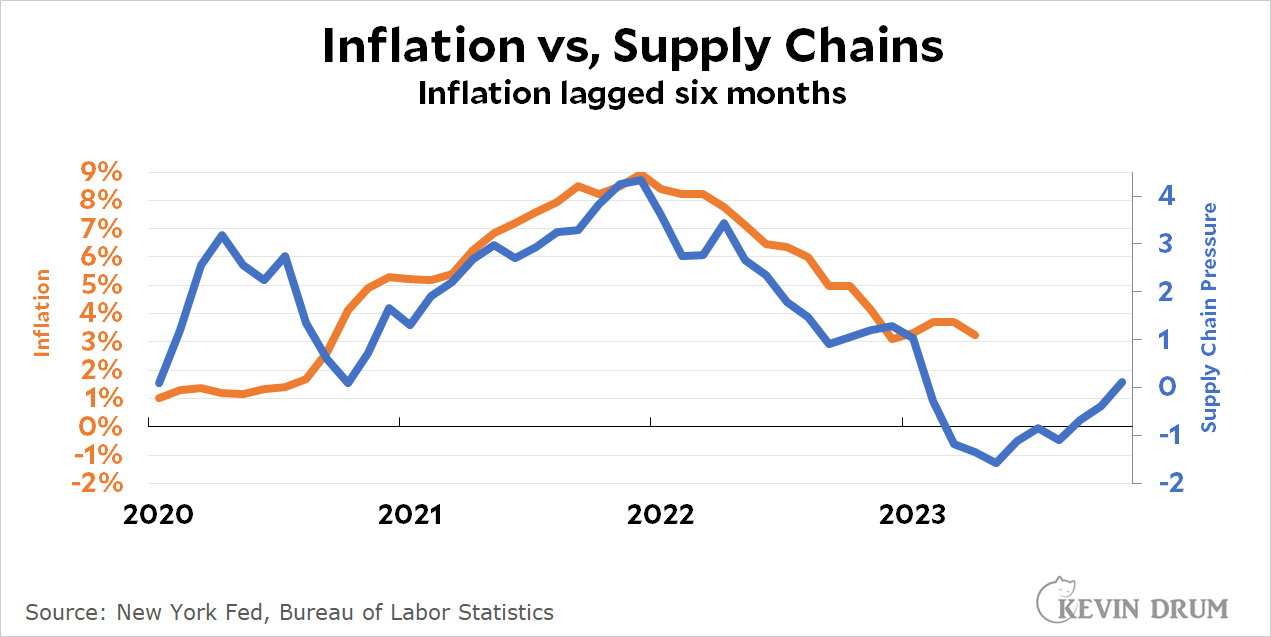

So one of two things is true. Either the Fed has reduced inflation through pure magic, or the Fed hasn't had any effect yet and inflation is down because supply chains have returned to normal.

The evidence is overwhelmingly in favor of the latter.

Kevin is, as usual, right. But this shows not only the hubris of the Fed but the credulous way the press queries market prognosticators for their predictions, never noticing how regularly their forecasts are wrong. Then the reporting shifts to how "no one predicted" what ends up happening.

"Inflation has fallen faster this year than many Fed officials anticipated" -- while economic non-elites like Kevin (and me) just consulted our common sense, which told us that a sudden world-wide pandemic would, of course, create disruptions to our finely balanced system of supply and demand.

My gripe with the media is that they continue to ignore the fact that their reporting affects public behavior, and so they should find some way to go beyond "quote harvesting" to help people understand what's going on. I know it takes more effort and resources that they may not have. But what are we supposed to do?

But then, reporters would need some economic literacy! Know the difference between an individual household's finances and a national economy!

In short, they'd have to be nerds and wonks. And even a greater stretch, believe that it's possible to report in such a way that the public at large has a better understanding beyond "my pocketbook."

Yes, the United States needs better reporting by better reporters. In this and many other ways. But paying for all that would cut into the bottom line and executive pay, not to mention the sacred needs of "the shareholders."

Big money ruins everything.

Reporting, like everything else today, is now a commodity. News is all about getting through the attention wall and economics is a dreary subject next to Kardashians and whatever Taylor Swift is doing this afternoon.

I just got paid 7268 Dollars Working off my Laptop this month. And if you think that’s cool, My Divorced friend has twin toddlers and made 0ver $ 13892 her first m0nth. It feels so good making so much money when other sb02 people have to work for so much less.

This is what I do………> > > https://dailyincome95.blogspot.com/

Excellent piece, and the point that supply chain opening up helped with inflation falling is another data point that Biden's policies -- in this case regarding unsnarling shipping and transportation -- made a difference. But he'll get no credit in the media while the Fed is treated like psychic magicians.

Don’t care how, lower rates now! - Veruca Drum (it would seem that using a synonym for gratis in conjunction with a synonym for currency triggers a filter.. so I’m going with lower rates. )

Meanwhile, there are two bumps in the supply chain pressure line and just one in the inflation line. How does that compute?

The start of the pandemic was a black swan event (ok, the real cause was not a bat but a black swan--but it's being covered up by their corporate lobbying!!!) anyway...

Supply chains were being disrupted, but so were consumers--sheltering in place as it were.

"Meanwhile, there are two bumps in the supply chain pressure line and just one in the inflation line. How does that compute?"

You doubt the science behind the "tweak the scales, find a lag time that fits nicely, ignore the intervals where the fit isn't good" methodology? So do I.

I've seen some people predicting high interest rates extending for a long time, primarily a function of what they consider to be high debt levels. People are going to see what they want to see, by excluding evidence to the contrary of their biases.

Let's appreciate the long-term demographic trend of an aging post-industrial society. By 2050, about one-fifth of the US population will be 65+ years old. The other G7 countries and generally all of the post-industrial world is further along than the US.

When we reach that age, our incomes will drop following retirement. Most of us will consume/spend less not more. We will shift our capital away from higher risk investments to lowest risk ones, particularly bonds, CDs, etc., creating more demand for debt instruments, not less.

I'm reiterating my point that, once we get past all of the exogenous effects of the last 3 years, we're going to be playing once again at the (Z)ero (L)ower (B)ound, precisely because of these inescapable demographic shifts.

Those who blame Biden for inflation - and there are many, perhaps including some of the same media writers who praise the Fed - claim that the covid stimulus payments and other expenditures were the cause. But how could the Fed have put an end to inflation caused in this way? It may be that the payments did contribute to inflation, but obviously most such influence has passed, since inflation is actually down now, and the Fed had nothing to do with that.

MAGAs seem to think that Trump has superhuman powers to control the economy, but economic writers and yes, many "liberal" economists have long attributed similar powers to the Maestros of the Fed. It has always been a fantasy.

It's the same refrain here in Canada where the media and the opposition Conservatives are blaming "Justin inflation" on the Liberal government's COVID spending, not even looking at how Canada and the US did compared to the G7.

Explain to me how it isn't possible that without the rate increases demand would be still higher, and hence inflation is lower than it would have been without rate increases.

It seems Drum's logic is too binary.

He does explain it. The mechanism for interest rate hikes to decrease inflation is supposed to be a decrease in demand. Consumer spending has increased, not decreased, but inflation still went down. Thus fed rate hikes did not cause the lowered inflation.

thanks.

Another consequence of higher interests rates is that it benefits people with savings and damages borrowers and potential borrowers.

Whether you believe this to be a good thing or a bad thing is a matter of perspective. I'm pretty thrilled with the returns on my savings and slowing down people borrowing for crap they don't need is not necessarily a bad thing. It also helps put a bit of a chill on house prices and auto prices, also not a bad thing.

This common sense about savers is only true for a very small groupert with certain types of savings.

If you had most of your savings in a house, stocks, bonds and social security, you arent really better off. You might be receiving a higher rate on certain savings today, but the value of your savings took likely a big drop over the last 2 years.

It just isnt true that savers benefit from slower growth, a smaller economy and a less prosperous nation.

I'm not sure I understand you. If most of your investments were in your house or houses, how could you not be better off in most parts of the country? Real estate values have skyrocketed in most places. Stock values are volatile in the short term but in aggregate the trends favor investors.

I meant to say thay they arent better off because of the actions of the Fed.

Raising interest rates has not increased the market value of homes.

Not true at all. With CD rates going to heights unseen since 2006 or so, over $1 trillion of funds have been pulled out of traditional banks and put into CD's over the past year.

But the amount of savings in stocks, bonds and housing is significantly more. Not just a little significantly more...A LOT significantly more.

Stocks have been doing pretty well. Bonds have taken a beating but that should only a a small portion of a portfolio and they'll go back up over time. As for housing market value, a house is not a savings account - it's a liability. Slowing price increases is the best interest of nearly everybody except those foolish enough to be using a house as an investment (which I know plenty of folks have been brainwashed into doing).

Im not sure what point you are making.

Whether you like it or not, housing is a significant part of most people's savings/assets. Cash in a CD or money market account is not a big part of overall savings/assets.

The higher interest payments on a small part of your savings doesnt make up for big losses in the majority of your savings.

Ignoring losses in savings/assets because maybe they will go back up later isn't a good way to think about how someone's assets have been impacted and their overall return.

My point remains, interest rate increases are not good for savings if you take into consideration what most people's savings actually look like.

Now, has there been enough investment in manufacturing? And what about market concentration?

Supply chain pressure is going back up. The question is, are companies investing more to meet demand--or will it just be more profit taking, i.e. inflation?

Powell wants a recession before the election. And he may be able to get one.

So Biden was a fool to re-up Powell for the position of Fed Chairman, and enough of the four Democrats on the board will be traitorous and vote with Powell and the other two Republicans?

Some might consider it hubris to claim that one can explain how the entire US economy works by posting one chart about supply chains.

Some might consider it hubris to continue to claim to know more about monetary policy than all the PhD economists at the Fed, even after consistently being wrong about when a recession is coming.

Some may consider it hubris to claim that higher interest rates have had no effect yet on the economy, even when it is quite demonstrable that they’ve had quite some effect already for months.

So where is that evidence?

Argument to authority is nonsense when those authorities have so often been wrong. How accurate have economists been in predicting recessions? (You've heard the joke that they have predicted nine out of four recessions, haven't you?) The entire rational of interest-rate increases is to induce a recessionary trend (one hopes without crossing the line into an actual recession). Yet they can't even get that one right.

And now we've had an unusual event -- a pandemic. Our system is now globally interdependent, with a heavy reliance on just-in-time logistics that weren't even a pipe dream the last time such a thing happened. Yet when I see justification for anti-inflationary measures there there is chart after chart presented as "evidence" -- charts from when such a system didn't exist or existed to a much smaller extent.

People seem to have an inane desire to pretend COVID never happened, except as an event for them to project their cultural preconceptions upon. But it happened, and the effects on the world were severe. Inflation due to supply chain disruption was one of those effects.

"So where is that evidence?"

See my comment below responding to jdubs.

"Argument to authority is nonsense when those authorities have so often been wrong. How accurate have economists been in predicting recessions? (You've heard the joke that they have predicted nine out of four recessions, haven't you?) The entire rational of interest-rate increases is to induce a recessionary trend (one hopes without crossing the line into an actual recession). Yet they can't even get that one right."

Fair point about argument to authority, though I reject the statement that the Fed hasn't been successful so far - their stated goal was to bring inflation down, not to cause a recession. The labor market is getting back into better balance (measured by job openings versus job-seekers). They still might screw it up, but so far things are going basically as well as a Fed Governor could want.

But since you bring up how often economists are wrong, it's important to point out that Kevin has also been wrong quite often these last ~20 months or so. He said inflation would be back under control by the end of 2022. He said we were barreling towards two recessions by the first half of 2023. He has not, as far as I've seen, even acknowledged this significant errors - he just keeps moving the goal posts.

"And now we've had an unusual event -- a pandemic. Our system is now globally interdependent, with a heavy reliance on just-in-time logistics that weren't even a pipe dream the last time such a thing happened. Yet when I see justification for anti-inflationary measures there there is chart after chart presented as "evidence" -- charts from when such a system didn't exist or existed to a much smaller extent."

I agree with you completely on this point, which is why I find Kevin's binary thinking and apparent high levels of certainty to be so off-putting.

"People seem to have an inane desire to pretend COVID never happened, except as an event for them to project their cultural preconceptions upon. But it happened, and the effects on the world were severe. Inflation due to supply chain disruption was one of those effects."

Of COURSE inflation due to supply chain disruptions was one of those effects. Did I say it wasn't? My point is that the economy is incredibly complex, and that supply chain disruptions are not the ONLY thing that caused inflation. Just to name a few others: stimulus checks, which were also caused by the pandemic (at least indirectly). Labor shortages in certain sectors, which were also caused by the pandemic. COVID is at the source of almost all the inflationary pressures in the economy - the only big one that can't be directly tied to COVID is the war in Ukraine, but that hasn't had as much impact in the US as it has in Europe. Far from pretending that COVID didn't happen, my point is that COVID upended a large number of aspects of society - not just supply chains!

Once inflation starts, it can be self-perpetuating based on expectations, based on labor costs, based on any number of factors. It is entirely possible that supply chain disruptions kicked off inflation but that healing supply chains would not have ended inflation - these things are complex!

You are encouraging a nuanced, complex view of the world - and so am I! My problem with Kevin is (a) his insistence on this single factor as being entirely explanatory in a world that is much more complicated than that, (b) his insistence that interest rate hikes have not yet impacted the economy, simply because they usually take 12-18 months (a timeline that we have now passed, by the way), and (c) his refusal to acknowledge his many predictions that have been proven false since interest rates have started rising.

Some may consider it hubris to claim that higher interest rates have had a 'quite demonstrable effect' on the economy, even when they cant demonstrate it.

Others may consider it an argument in bad faith.

Probably both.

I have done nothing but argue in good faith over the past many many months, jdubs, and each time you respond, you act like I’m some sort of troll. I don’t understand where this comes from. You and I feel differently about the economy and Kevin‘s take on it, but I’ve never argued in bad faith.

“Can’t demonstrate it” and “didn’t demonstrate it” are two different things. I agree that I didn’t demonstrate it, but it simply not true that I can’t demonstrate it.

I was commenting while waiting for the subway yesterday, and I am doing so again now, so I don’t have the ability to pull up charts, but I think it is well known and understood that interest rates have led to a collapse in home sales. Try telling mortgage bankers and real estate agents that interest rates have had no effect on the economy

I am now writing this while on the subway and it’s not really sustainable. But I know you know interest rates have impacted the economy. You may feel that they are not primarily responsible for bringing down inflation, and that more damage is to come in the future, and while you and I disagree about that, that’s a defensible position. But Kevin keeps insisting that higher interest rates haven’t had *any* effect yet, and it just doesn’t make any sense.

Its these kind of 'the subway is why i cant demonstrate anything that i claim to be easily demonstratable' posts along with the original posts ad hominem theme that led me to consider your posts in bad faith.

This is a continuing pattern.

If you are able to pull up charts and paste them into the comments all from your iPhone while navigating the NYC subway system, I am impressed! I am not able to.

However, I'm at a computer right now, and can point you to this data series:

https://www.statista.com/statistics/226144/us-existing-home-sales/

Existing home sales were at 5.34M in 2019, 5.64M in 2020, 6.12M in 2021, then dropped to 5.03M in 2022. For the 12 months ending May 2023, the number stood at 4.3M. This is an extreme drop off - the number hasn't been that low since 2011 - and higher interest rates are the number one cause. It is not true that higher interest rates have had no effect on the economy.

I do not agree that my original post had an "ad hominem" theme. Kevin was talking about hubris at the Fed, and I asked him to look in the mirror.

To be clear, I'm a huge Kevin Drum fan. I've been reading Kevin continuously since 2008. He has influenced my thinking significantly. But I think Kevin is very wrong about this topic.

Further, I think he has made predictions based on his (very wrong, IMO) beliefs - predictions that have been proven false. I am disappointed that he has made no public acknowledgement of this. On the contrary, he continues to post posts like this one, that are strong attacks on the Fed, making it seem obvious what the "correct" way to conduct monetary policy is, when actually I think it's an incredibly difficult job to get right - as is proven by Kevin's many wrong predictions. It's beneath him! He's better than this! That's why I'm frustrated - because I'm such a big fan!

My frustration may get the better of me at times. If you've seen some other posts of mine that make it seem like I'm attacking Kevin personally, and view my other comments in that light, I understand where you're coming from. But I promise I'm not intending to attack the man, and if it seemed like I was at other times, that was my error. I love Kevin's work - except on this topic.

Another data point in the “interest rate hikes have impacted the economy” theme:

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff9a7a84a-912e-4eda-9db8-8bf53ef4e980_2886x1843.png

If you can’t see the image: it’s a chart of non-mortgage debt service as a share of personal income. It was trending up towards 2% pre-pandemic, dropped below 1.5% at the beginning of COVID, and has shot up to 2.5% recently, coinciding with rate hikes.

“ Since the beginning of the Fed’s hiking cycle in 2022, the annual pace of interest payments on nonmortgage consumer debt has increased by $300B, less than $38B of which comes from the recent ending of student loan forbearance. As a share of aggregate personal income, interest costs haven’t been this high in more than 15 years.”

From this larger post mostly about student debt:

https://www.apricitas.io/p/the-economic-fallout-of-student-loan

Maybe demand did slow down, in that it hasn't increased as much as it otherwise would have?

Cld, if anyone wants to extend the personal consumption expenditures line as it trended throughout 2021 to see how it was deflected downward in 2022 and 2023., they might think you're on the right track. You could also try drawing a trend line for real PCE in the period from 2014 through early 2020, and notice that we have now returned to that trend line after 2021's excursion above it. Kevin sometimes likes to do this kind of thing in his charts. Anyway, it looks a lot like 2021 was overheated, while 2022 and 2023 have been markedly cooler—without us tipping into recession. Imagine how a responsible Federal Reserve would try to influence these trends. I think they'd do exactly as this Federal Reserve has done. Was it entirely and easily within their control the whole time? No—who says it was?

It is strange to me that you find yourself almost completely alone out on this limb, because I agree this seems obvious

Maybe I'm slow but I don't understand why Kevin is reading this article as if it's an authoritative statement of Powell's and the Fed's view. (Maybe if I had paywall access I would?) Instead this snippet looks to me like the bog-standard trader's entreaty-- indistinguishable even to the trained eye from mere wish-casting-- for rates to go *down*, go *down* now, dammit! Of course the traders and players want to see rates drop back. They make their money on the change of direction and can get in on the expanding mortgage business, etc.

Also, consumer spending is what, 2/3 of the economy at most? It's gone up a little under 2% over more than 2-1/2 years. There's no downtrend for sure, but the uptrend isn't about to make anyone's nose bleed.

For what it's worth, I think supply-chain disruption due to covid and the re-shoring and other global re-jiggering going on probably accounts for the bigger proportion of inflation.

But mostly I just want to observe, based on the excerpt here, that the mystification seems to be coming not from the Fed's sacred precincts but from other extremely interested parties who know exactly what they want the Fed to do.

Also, consumer spending is what, 2/3 of the economy at most? It's gone up a little under 2% over more than 2-1/2 years.

Yep. I made a similar comment below. We need more context to assess where things stand with respect to demand. What kind of increase is typical over a thirty month span? Perhaps that number suggests consumers are spending freely.* Or perhaps it's a weak number characteristic of pre-recessionary, tepid demand.

*If it the case, mind you, that consumer demand has held up well, that would seem to argue against Kevin's "a recession is imminent" worries.

I'm inclined to think Kevin's more right than wrong, but the case he makes isn't quite as strong as he implies. Per his graph, it looks like real per capita consumer spending is up about 2.5% over the last 30 months. Is it possible this is a more subdued rate of increase than would have been the case absent Fed tightening? I'm not sufficiently familar with the topic of consumer demand to know, but this seems plausible. Also, "supply chain repair" is a bit simplistic for a descriptive of what's happened. I'd go with the less convenient but probably more accurate "bringing supply and demand back into balance" (or something like that). Supply chain improvement is one part of that, sure. But part of it is also the closely related but not identical phenemoneon of raw output increases, espeically of services (as workers went back to work in large numbers, post 2020). And finally there's the depletion of stimulus-fulled savings. I reckon all of these have plaid a role.

Anyway, housing's a big chunk of the economy, and Jerome Powell—whatever you think of his overall strategy—has surely cooled down this sector. I suspect more likely than not this has had a dampening effect on the economy, and hence on demand, and hence on inflation.

While the inflation *rate* has come down over the past year due to supply chains and labor markets righting themselves again, prices for many consumer goods have remained high thanks to good old fashioned corporate greedflation.

https://www.theguardian.com/business/2023/dec/07/greedflation-corporate-profiteering-boosted-global-prices-study

Yes, and if you've been living in America you have to be about 60 years old to have experienced the reality that prices won't come down even if inflation reduces to zero. Most people in prime working age don't have that awareness and it must be very upsetting for them to see prices ratchet up and stay there.

Most of us tend to have an intuitive idea of what things *should* cost and I'd bet it gets set when we're paying attention to specific kinds of goods, so most middle-class types probably set mental prices for household goods and groceries when they're maybe between 25 and 35. Of course those right-prices can change with experience but that's tricky-- I first paid 35 cents a gallon for gas, am intellectually okay with paying over 3.50 now, but the vague feeling is that 2.50 is closer to what it "should" be.

But gas is something I get very often. If I'm looking at stuff I haven't been paying attention to for 20 years or so my mental right-price is usually half or less of the current price. But other things are way cheaper than I expect to see. But not nearly as many, and not nearly enough to make it all come out even.

What's going to matter now, and especially over the next year, is how fast people get used to higher price levels on stuff they buy or check very often. I don't see a source of general countervailing pressure that would reduce prices, so these are the price levels we're going to be seeing and adapting to.

This seems to back Kevin up:

https://www.bbc.com/worklife/article/20231130-why-americans-yolo-spending-attitude-baffles-economists