Why is core inflation (i.e., underlying inflation not affected by food and energy) so high? Most analysts cite three reasons:

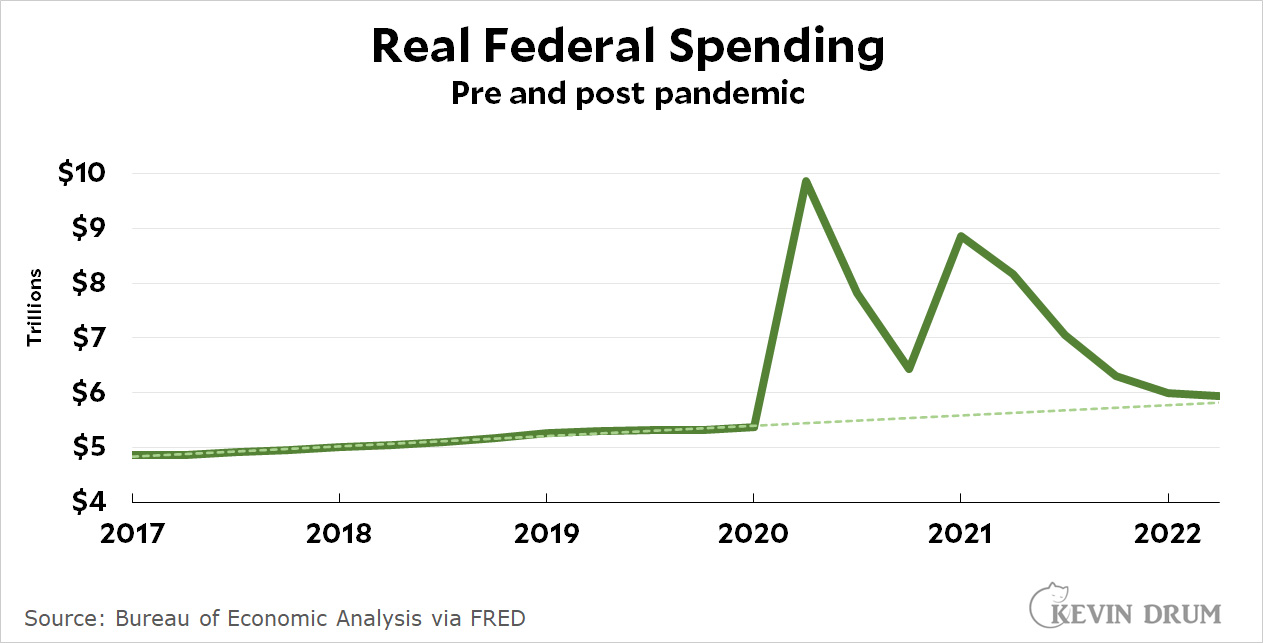

First, there's high government spending, especially from the January 2021 stimulus bill. But that's back to normal:

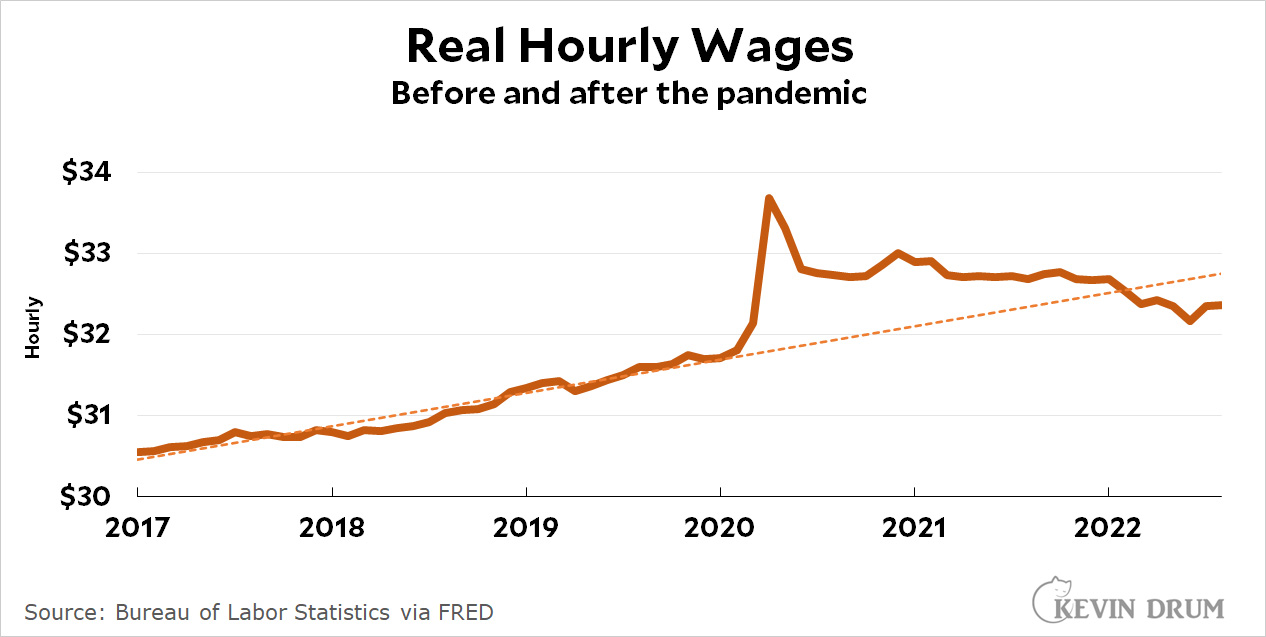

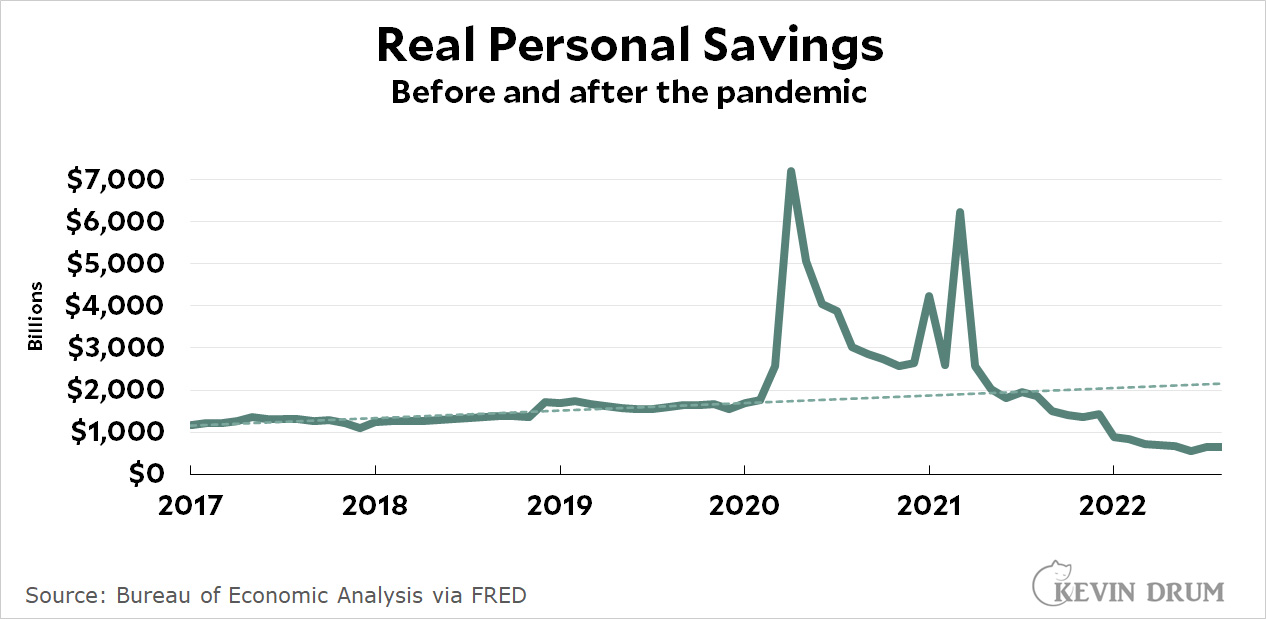

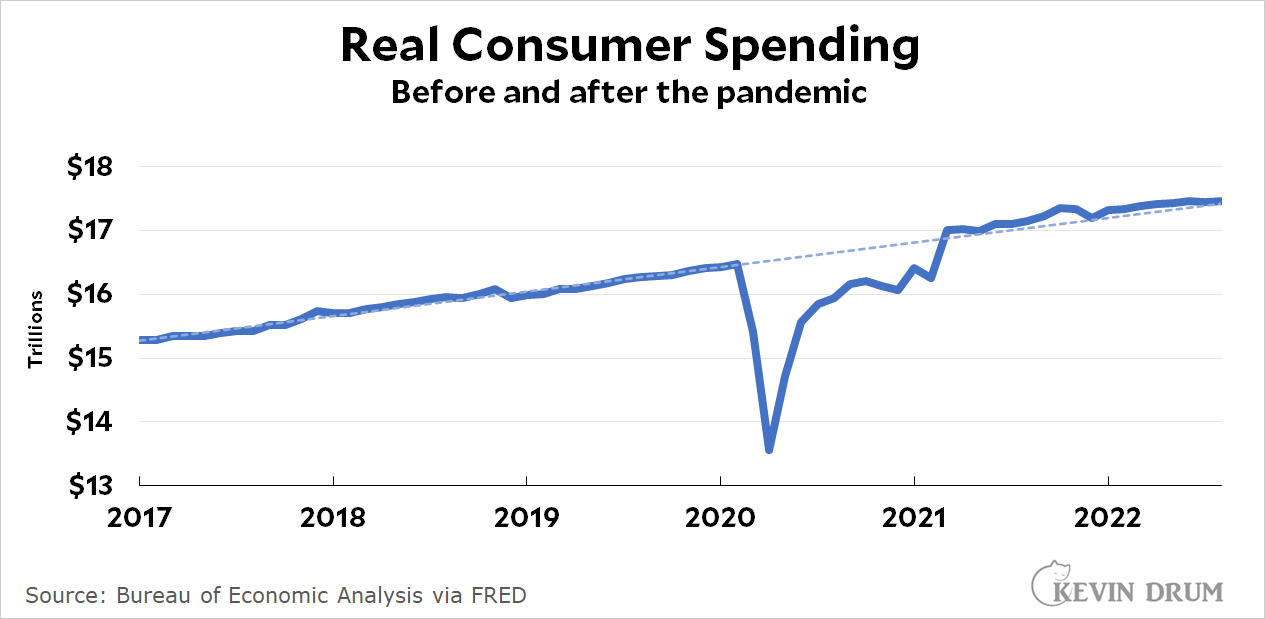

Second, there was increased consumer demand after the COVID-19 pandemic settled down. That was a problem in 2021, but this year wages are down, savings are down, and therefore (unsurprisingly) spending is flat:

Second, there was increased consumer demand after the COVID-19 pandemic settled down. That was a problem in 2021, but this year wages are down, savings are down, and therefore (unsurprisingly) spending is flat:

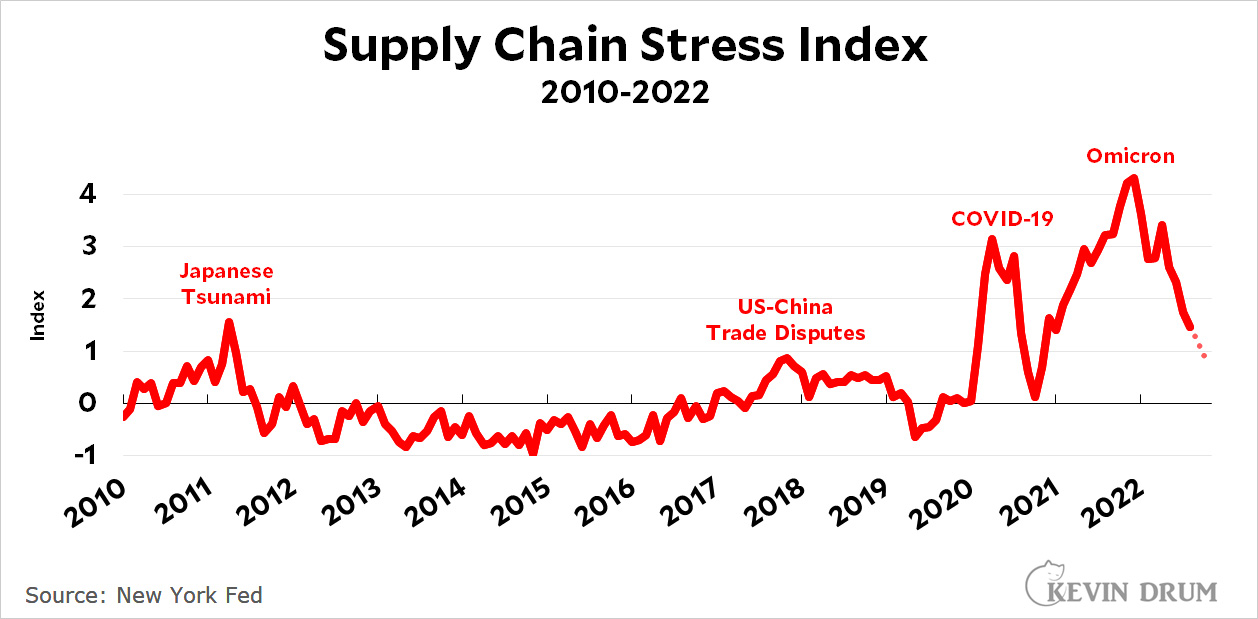

Third, there are ongoing supply chain problems. But according to the New York Fed's supply chain stress index, that's mostly gone away:

Third, there are ongoing supply chain problems. But according to the New York Fed's supply chain stress index, that's mostly gone away:

So what's left? We already know the housing market peaked earlier in the year and is now declining. The money supply has been flat since the start of the year. How about greedy multinational corporations?

So what's left? We already know the housing market peaked earlier in the year and is now declining. The money supply has been flat since the start of the year. How about greedy multinational corporations?

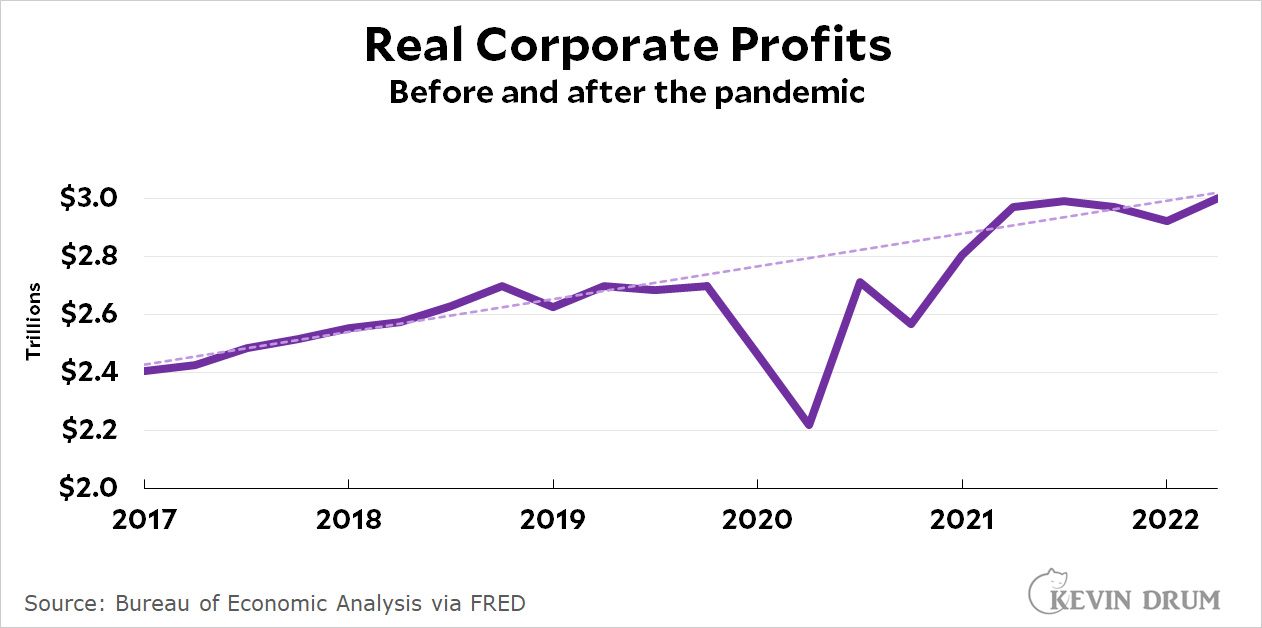

I'd love to blame inflation on corporations, but it's hard to do. Pretax profits are right on the pre-pandemic trendline and they've been dead flat over the past 12 months. But maybe there's an asset bubble in stocks?

I'd love to blame inflation on corporations, but it's hard to do. Pretax profits are right on the pre-pandemic trendline and they've been dead flat over the past 12 months. But maybe there's an asset bubble in stocks?

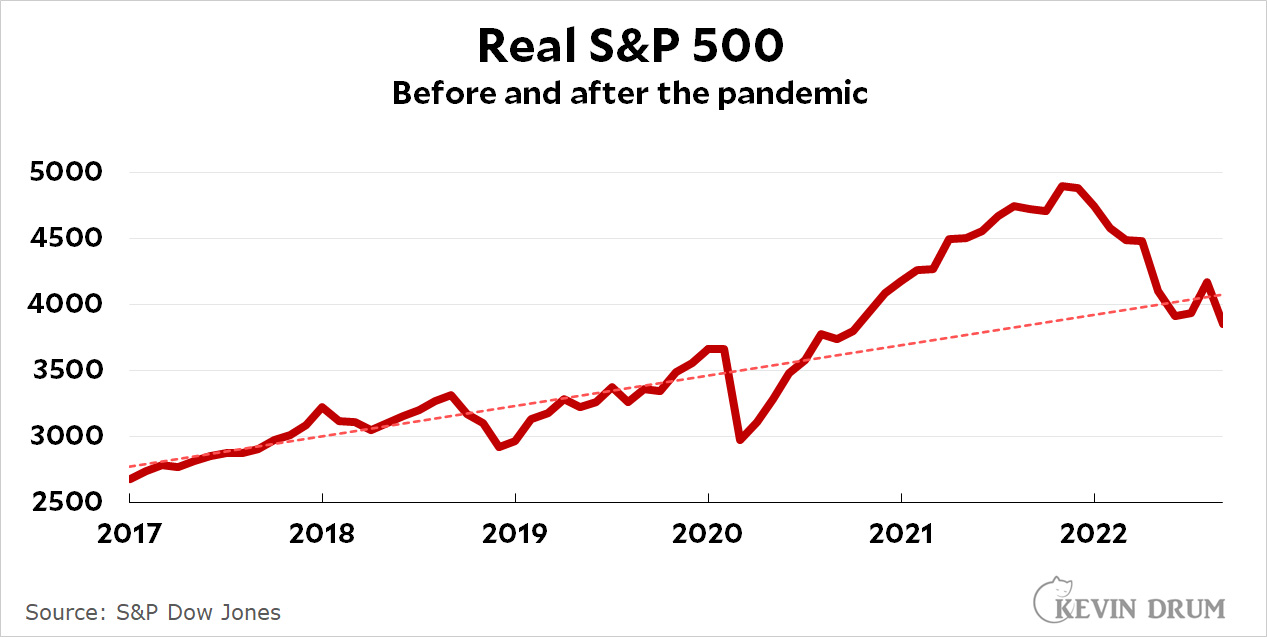

Even the stock market is back on trend, and it's down a whopping 24% since the start of the year.

Even the stock market is back on trend, and it's down a whopping 24% since the start of the year.

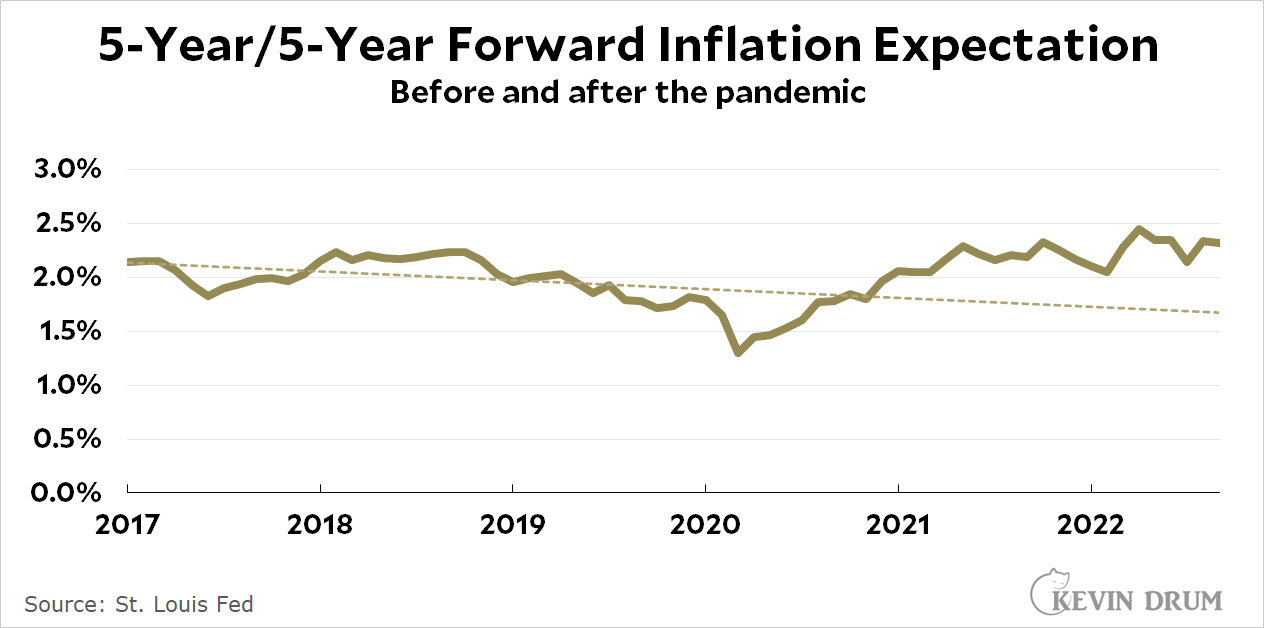

Maybe it's now at the point where it's purely about inflationary expectations? That's possible, but even the one-year estimate from the Cleveland Fed is only up to 4%, which suggests that investors think headline inflation will be cut in half within a year. And the ever-reliable 5/5 breakeven rate is only slightly above its pre-pandemic trend and has been flat at about 2.4% for more than a year:

I'm stumped. If inflation is really a long-term problem that's so entrenched it can only be fought by putting a million people out of work, surely there must be some deep and profound cause. But what is it?

I'm stumped. If inflation is really a long-term problem that's so entrenched it can only be fought by putting a million people out of work, surely there must be some deep and profound cause. But what is it?

The TFG's Jobs and Tax Cuts bill putting extra billions into corporate and billionaire pockets?

And then too much money chasing to few (rich person goods.

P.S. Remember, the bill was going to "supercharge" the economy. Maybe it did. Just not in a way that benefited most people.

Whatever the cause(s) are - the one thing we know for sure, beyond any doubt, is that it's GLOBAL.

Dd not see that mentioned at all in the post....

If the Fed knows what is causing core inflation, or more to the point why inflation should continue, it's not talking:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220921a.htm

As discussed in previous posts, economists don't really understand inflation, and there is no reason to think that the bankers who are on the FOMC have any special knowledge or insight, except for what most benefits big banks. The Fed is sensitive to political and media pressure and does not want to be accused of not acting.

After being steady for a while, both Verizon and Spectrum Charter cable raised prices this month. Doesn't seem justified by their nice profitability from 2Q 2022.

And federal spending isn't real spending when it is tax cuts. Is it?

"And federal spending isn't real spending when it is tax cuts. Is it?"

Ha, ha.

Lead?

the old people running the country are still feeling the effects from earlier exposure...

😉

I wonder if a million people dying has anything to do with it, and the ancillary impact that has had on the labor force. Here in WA, everywhere is short staffed, and/or experiencing high turnover. Not enough bodies? Its hard to square that with official stats, so who knows man.

Might be all that extra inheritance cash from those millions dead. Inheritance money for the not so rich is easy to put out the door and into the flow of goods and services.

I hate to sound so impersonal about such a difficult and painful subject for many, but has anyone seen a "surplus" death count as of late? I know that many people that died from Covid would likely have passed away by now of something else if it weren't for Covid. Obviously, many others wouldn't have. I'm just wondering where the country and world stand in that regard. Curious if anyone has seen those stats or if anyone is still doing them?

The last analysis I saw showed a mean average of 11 years life lost per COVID death.

Oof. That's ROUGH! Thank you!

The vast majority of deaths were among the elderly, few of whom were in the labor force any longer. But a good chunk were also working class people and the restaurant industry was particularly hard hit. That probably did have some effect, especially in cities like NY.

The prices of all goods are dependent on food and energy. If 15% of your production costs went up 20% over the past year, that's an overall increase of 3%.

It has been my understanding that ‘core’ measures simply exclude food and energy purchases from the market basket, but do not attempt to net out the knock-on effects, the pass-throughs in other goods and services. That would require that the BLS have a model of weighted costs of production for every item in the market basket. I’ve read some of their methodology pages, and haven’t seen anything like that. So, I think you are correct, that core measures include costs of food and energy, ‘downstream’.

Probably global effects, which the Fed is worsening by raising rates so aggressively.

The effect of federal spending on the money supply has a built-in delay. A phase shift as we engineers would call it. Yes, the spending has stopped, but the effect of it hasn't stopped.

AND, (and I think Kevin is being cute about this) the oil shock that we got from the Ukraine invasion is having an effect and also has a phase shift.

We're on the downside of both those slopes, but the Fed doesn't think it's coming down quick enough. Because the Fed always takes the side of debt holders when matched up against debt owers.

I think you are 100% correct. You can't look at the current levels and see an overflow that's still settling throughout the system. Supply shocks and gas prices both would have a longer lasting impact on expectations. Somebody's Phd dissertation might take a closer look when this is all over, in the meantime the Fed is a hammer looking for a nail. Great post.

The word is "lag". Inflation was triggered by covid and by all the efforts, world wide and not just in the US, to deal with the economic fallout of that. It then takes time for the burst of inflation to work through the system. Consider the supply chain in manufacturing. A mine raises the price of ore concentrate delivered to the smelters. A few weeks later, the smelter raises the price of refined metal in consequence. A few weeks after that, primary fabricators raise their prices in response to the increase in the price of metal.

This can go on through dozens of steps by the time it ends with delivery to the consumer. If there are a dozen steps with a month response lag at each step, it takes a year for inflation to work its way through the production chain. When you consider that the real production chain has loops which can cause feedback, you can see that once a burst of inflation has been triggered, it can take years for the resulting reverberations to work their way through the system and die down.

Joe Biden is the correct answer.

But seriously, the real problem that the Fed is addressing is that the bottom 50% was getting ahead. They needed to be brought to heel.

If rapidly-rising labor costs were the main issue here, you may have a case. But wages are one of the few things that have notably *failed* to keep place with inflation elsewhere in the economy. Working class people are getting screwed by this as well.

Nope. The bottom 50% literally reached RECORD levels of household wealth this year....

When inflation has been so low for so long any major impact event will have an impact and we have had two or three of those. The truth of the matter is that there is no need to panic on core 5% inflation like the Fed has. The major events will work themselves through and inflation will come down without further Fed intervention. Now it is possible that the Feds are intentionally favoring the rentier class and every time Powell talks people about having to suffer who is he talking about? High interests rates protect the wealthy and actions speak louder than words.

Rentier class, as in people who are earning wages. funny.

Ah the bizarro lens of the ideological Lefties that want inflation to be about the Kulaks and the Fatcats, and not wage earners.

Rentier refers to people who make a living from property or investments.

Create chart.

Show return to trendline-du-jour.

Assert things are done.

But I have to wonder if return to trendline is the measure rather than total area under the curve… when /that/ is back to where trendline-du-jour would have it.

Hysteresis?

Area under the curve: I think that would depend on whether the underlying goods/services can accumulate. Earnings can be saved, in part; nonperishable goods can be stockpiled but most services can’t be, or even deferred (people didn’t go to theaters or concerts during the pandemic, but those visits will never be made up).

This is Drum's problem, he wants Inflation to be like the lead subject.

"surely there must be some deep and profound cause. But what is it?"

There are in fact multiple feeder 'causes' although a signficant cause for the entrenchment is expectations and reduction of stickiness of prices through the value / supply chains (not simply the prices Consumers see, the intermediate prices of inputs in either services or physical).

It is quite amusing how though Drum manages to extrapolate on his trends for his pre-set view (e.g. supply chain stress).

Vacuous. Identifying ‘reduced price-stickiness’ as the cause of inflation is purely circular; it merely describes the phenomenon in different words. As to expectations, the usual story is that expectations of high inflation motivate people to purchase sooner, ‘before the price goes up even more’. One should expect to see this especially for big-ticket durable goods, where the potential savings are most significant. Can you produce evidence that this is happening? Or can you state another mechanism by which expectations drive inflation?

No it is not purely circular you idiot, it is an effect feeding through a system. Psychological disanchoring is not circular, it is the process

Point based static analysis is why you have been and are still wrong. Produce evidence... good god.

Except you never produce evidence. Do you have evidence that

psychological disanchoring is occurring now - a repeat of the 70's

you keep jnsisting we're headed for ?

I don't see it here:

https://fred.stlouisfed.org/series/T5YIFR

Once again, Lounsbury, name-calling is no substitute for argument and evidence. If ‘reduced price-stickiness causes inflation’ isn’t circular, the terms must be defined and measurable independently. Please provide those definitions and measures.

That supply chain stress index is heading downward, but still pretty damn high.

People forget that there's a war on in eastern Europe that still has energy markets, especially in Europe, on edge and Russian can still fuck around a lot with oil and gas deliveries (it cut Italy off the other day, e.g.). Drought in the plains states has put pressure on grain and feed prices, which drives up the price of meat. On top of all that, a bird flu outbreak has led to the culling of millions of chickens across the country, driving up the price of poultry and eggs. Rebuilding in FL will draw further construction labor and raw materials away from the rest of the country, leading to shortages in a lot of places over the next six months. We're a ways still from being out of this mess.

Check out the Global price of Energy index

https://fred.stlouisfed.org/series/PNRGINDEXM