The Wall Street Journal continues to write endlessly about inflation being right around the corner, and other news outlets are starting to join in. I suppose that's only natural since the headline inflation rate has been rising over the past few months.

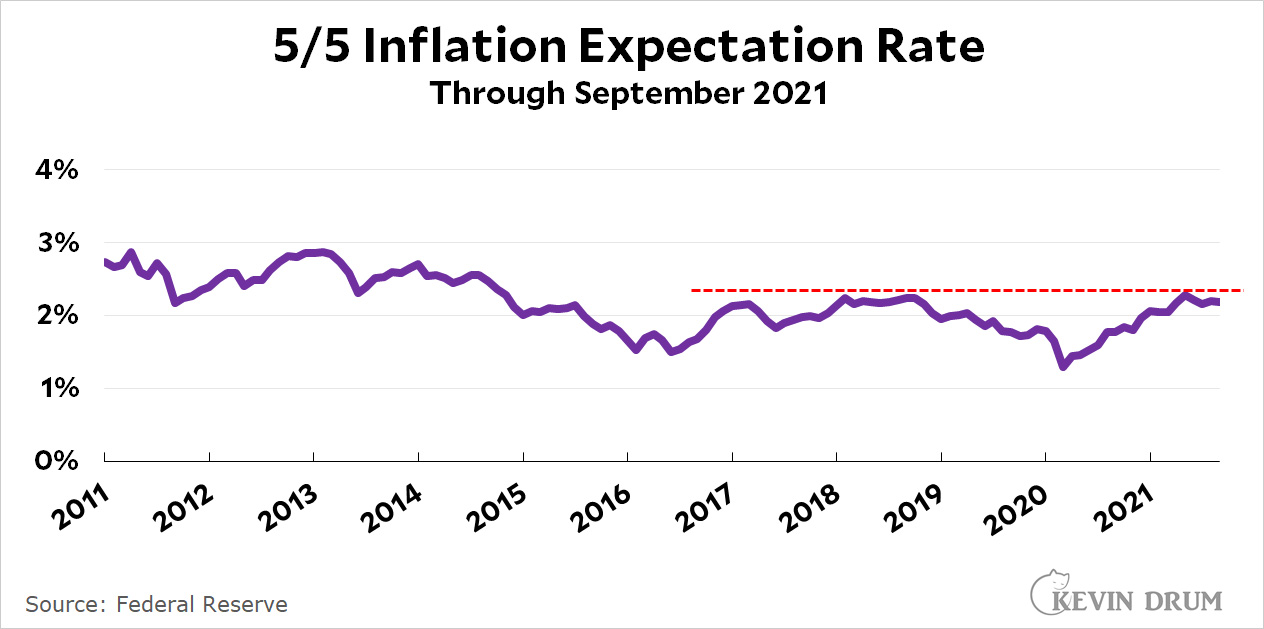

That said, inflationary expectations are . . . amazingly non-panicked. It's true that consumer expectations of inflation are up, but who cares? Consumer expectations are completely useless, as everyone who follows this stuff knows. On the other hand, here's our old friend the 5-year, 5-year forward inflation expectation rate:

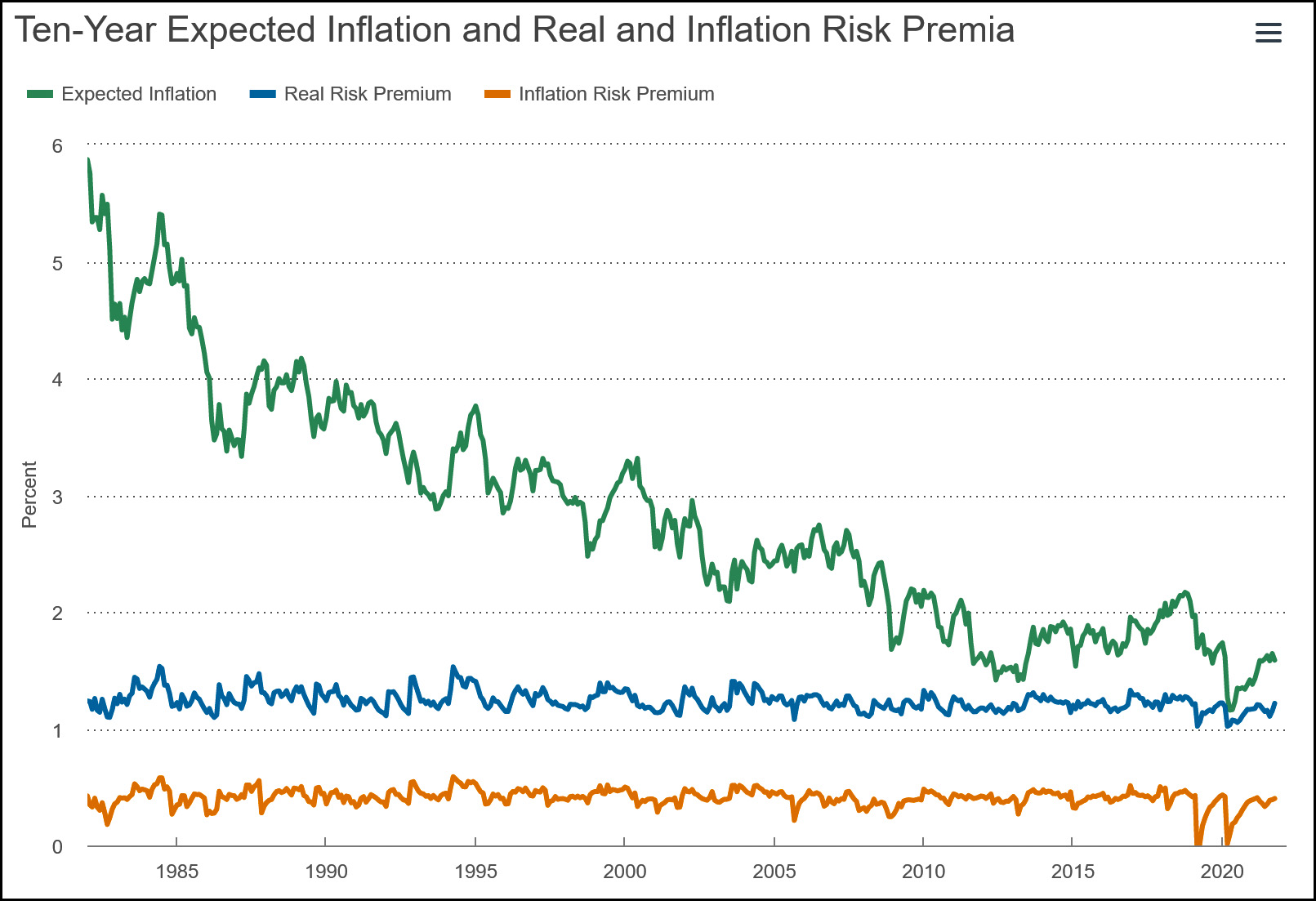

The 5/5 rate peaked in April, and despite rising headline inflation it's gone down since then. It currently sits at 2.20%, which is perfectly fine. And here's the Cleveland Fed's measure of 10-year inflation expectations:

The 10-year rate is currently sitting at 1.59% and hasn't changed since May. Meanwhile, TIPS securities maturing a year from now are selling for about 2% more than ordinary 1-year treasuries. TIPS are protected against inflation, which suggests that investors expect inflation to clock in around 2% or so over the next year.

I'm relatively agnostic about inflation right now. It's certainly true that we've pumped a tremendous amount of money into the economy over the past 18 months, and it's hardly ridiculous to think that might affect inflation. On the other hand, most of that money was simply replacing lost income from the pandemic. As I've mentioned before, I consider the stimulus spending of 2020-21 to be a fascinating test of Keynesian policy writ large, and I'll be as interested as anyone to see how it turns out.

Having said that, one thing I'm not agnostic about is good reporting. That means not just reporting headline inflation correctly, but showing inflationary expectations clearly if you write something claiming that everyone is freaking out about prices going up. The truth is that, at most, there's some mild fear of rising short-term inflation and absolutely none in the longer term. That may or may not turn out to be correct, but it's what the data tells us.

Do consumer expectations not influence consumer behavior?

Nope.

This isn't rocket science. You don't have to theorize about this and that. You just look at consumer expectations for inflation, and then you look at what actually happens, and this lets you determine whether consumers are any good at predicting future inflation.

And the answer turns out to be: Consumers know f**k-all about future inflation.

For that matter, do the experts? What Kevin’s charts here don’t show is their expectations versus reality. Which would be useful to have.

Inflation must be put in context.

Is inflation much higher this year? Social Security cost of living is up 5.9% (versus normal of about 1.6%)

Is job growth matching current inflation levels? I defer to liberal economist Justin Wolfers

https://twitter.com/JustinWolfers/status/1446457505341747201

Therefore, the problem is inflation combined with slower than expected job growth....

If you look at Wolfers' full thread, however, he makes it clear that the underlying issue is still Covid and our lackluster vaccination rates in many states. The job market won't return to normal until everyone gets vaccinated.

jte21 - your point is spot on. Rather, to clarify, I was trying to make the following points:

1) Given Covid, high inflation and strong job growth is probably okay

2) Disappointing job growth and high inflation is far from ideal

The problem is, it is not slow. Does the man see household employment surge of not???

Core inflation right now is being driven primarily by global supply chain bottlenecks and shortages that are forcing both producers and retailers to raise prices on a lot of stuff, particularly consumer goods, that people were used to getting cheaply because they were made in China. Customers *do* notice that, but few seem to be paying attention to the bigger picture. All we hear is how Christmas is all but cancelled now and it's all Biden's fault.

The news focuses on the angle that will scare the shite out of the most people so that they will click and view. Inflation is scary and writing about it takes almost no effort---just find something in the economy that has increased in price by a lot, drop in some quotes from frustrated consumers, talk to the same tired economists (Summers, Lawrence), rinse-repeat. Our news media is an embarrassment.

A person of lesser means (not poor, but lower tier hourly) who managed, over ten years, to put $50k in their savings account lost $3,000 this year.

'A person of lesser means (not poor, but lower tier hourly) who managed, over ten years, to put $50k in their savings account ...'

So did wood elves, selkies, Elder Gods, and other fantastical creatures.

Right. Meanwhile the person who put $50k into their IRA is still accumulating wealth. This is, what, the 21st century now?

A lot of people don't have brokerage accounts. A lot of people are not prepared to lock away money for decades (as with an IRA).

In 2018, 62 percent of, US households had some type of formal, tax-advantaged retirement savings.

The remaining 38% don't, many because of the circumstances they find themselves in,

Undocumented are particularly vulnerable to having their savings lose value dur to inflation.

And maybe the circumstances they are in that don't let them open an IRA also don't let them save 50 grand over ten years. What are the statistics on that?

Who's afraid of a little inflation?

NOBODY, except for the right-wing base, who are terrified of everything outside of their half-inch comfort zone, and so easily roused into panic by the likes of geniuses like Sean Hannity and Rush Limbaugh.

Inflation panic is a GOP tactic, nothing more.

Krugman has a good column on this subject today: https://www.nytimes.com/2021/10/15/opinion/us-economy-inflation.html?referringSource=articleShare

The basic point is that (a) economists don’t agree on the forecast, (b) the actions they might take based on the forecast are asymmetric, and (c) in that circumstance, irrespective of your opinion about which forecast is more likely right, the best action to take is the one that’s easiest to undo if it turns out something else would have been better.

In today’s inflation uncertainty, Krugman says (and I believe), allowing it to continue for a little while longer will still allow for clamping down soon, when the picture is clearer, but clamping down too soon could have a REALLY BAD effect—if it screws up the ongoing recovery, that could take a LONG time to fix, and the fiscal stimulus it might take is a political non-starter.

So his bottom line is:

Don’t just do something…stand there and wait!

Krugman is full of it. The recovery from a money pov is over. Because it was so fast, you are seeing apparent lags in data.. Clamp down is needed now to help supply chain issues.

I have a feeling that sustained high inflation is no longer very probable. When unions were strong enough wages went up to (at least) cover inflation. This is no longer normal, indeed people don't expect it. Which on one hand makes them more afraid of inflation than in earlier eras, on the other hand provides a break on growth whenever real wages decline because there is no compensation for inflation any more.

Inflation and strong corporate go hand in hand?

https://www.nytimes.com/2021/10/14/business/bofa-wells-fargo-earnings.html

Pingback: The economy doesn’t appear to be on the verge of overheating – Kevin Drum