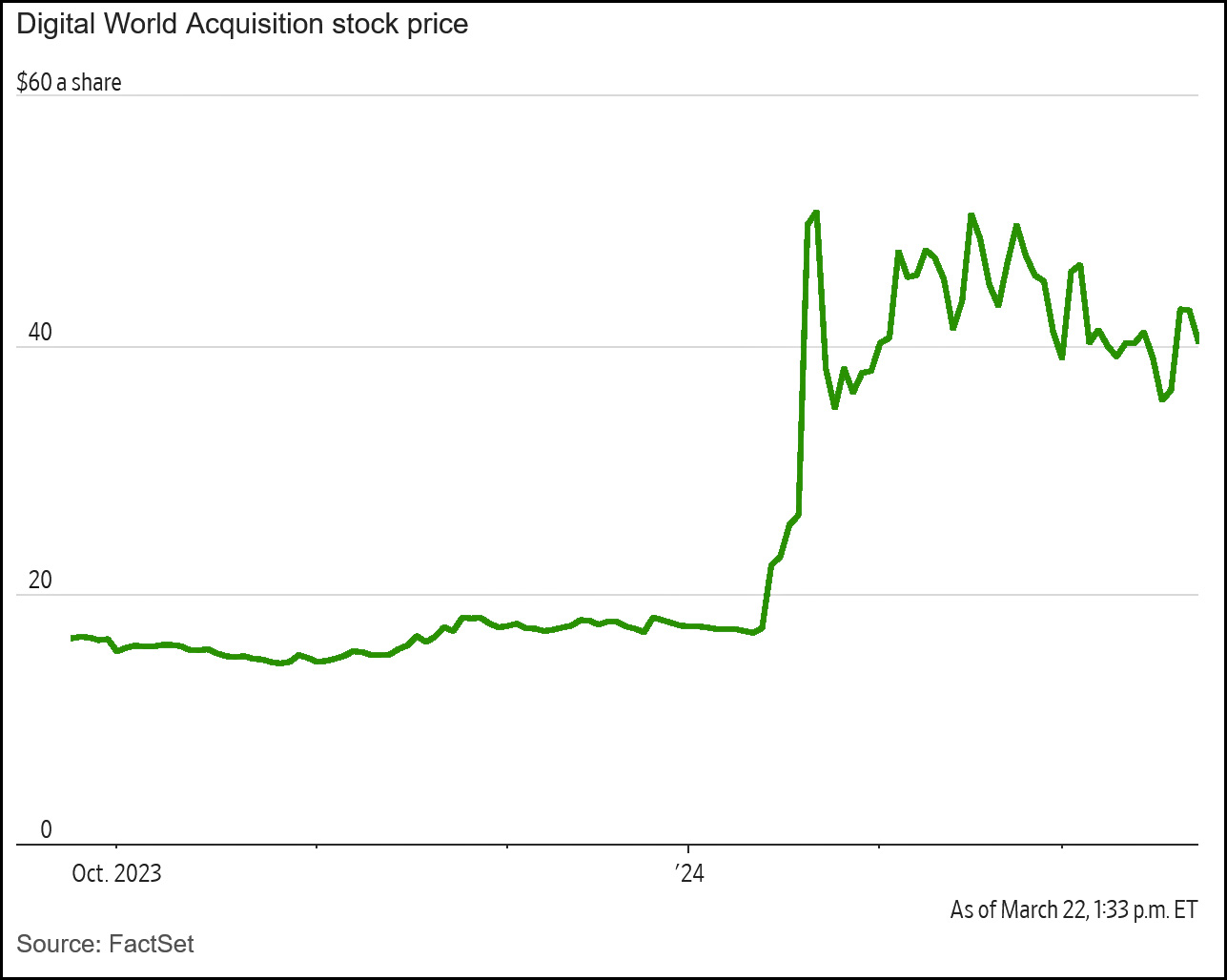

Donald Trump's plan to take his worthless social media company public has been approved by investors. At the current valuation of the acquiring vehicle, his 80 million shares (give or take) will be worth north of $3 billion:

But what's really going to happen when the newly merged company starts trading? It currently has 37 million shares outstanding, which will balloon to (approximately) 188 million shares after the merger—with no increase in underlying value since Truth Social is worthless. Under normal circumstances, a 5x share increase would mechanically produce a 5x drop in share price, which leaves Trump with a stake worth about $600 million. And since even that overvalues the stock, his stake could easily drop to $200 million or less.

But what's really going to happen when the newly merged company starts trading? It currently has 37 million shares outstanding, which will balloon to (approximately) 188 million shares after the merger—with no increase in underlying value since Truth Social is worthless. Under normal circumstances, a 5x share increase would mechanically produce a 5x drop in share price, which leaves Trump with a stake worth about $600 million. And since even that overvalues the stock, his stake could easily drop to $200 million or less.

Under normal circumstances. Which these aren't. The share price is being held up by Trump's MAGA fans, who don't care about fundamentals. They just want to support their hero. The question is whether they can keep this up when there are 188 million shares out there. Are there enough of them to withstand even a modest short seller willing to bet that the balloon has to burst before long?

Beats me. Meme stocks can keep their value for a surprisingly long time if the fan base is big enough and committed enough—and God knows the MAGA base is committed.

Still, the scam here is so obvious that it's hard to believe even the MAGA crowd is going to keep the faith for very long. We'll see.

Why hasn't Trump come up with his own cryptocurrency?

Every idiot in Russia would buy into it, the Saudis would buy a hunk of it, wingnuts would insist on trying to buy beer and ammo and pay their taxes with it.

Exactly what I was thinking. MAGAcoin would have been far easier than doing this weird stock offering.

Oh, there is one!

https://www.coindesk.com/markets/2024/03/02/trump-maga-meme-coins-are-the-first-experiment-in-polifi/

If the MAGA folks are smart, they'll invest all of their pensions and savings into Trump's social media company.

/S

They don't know what S/ means. He's their orange Jesus. He would never lie to them.

Trump just needs them to keep the value up long enough for him to extract a sizable portion of his value before it collapses. His followers will eat the losses, as always.

I'm very skeptical that he'll manage to extract much value before the price collapses. A key part of how the stock has remained so high is that it is very thinly traded. The average is about 1.6 million shares trading each day. That may sound like a lot, but it isn't.

If we say that Trump would like to cash out $600 million, roughly what all of the judgments will be soon, he'd have to sell 15 million shares are the current price. There's a short dialogue that those in the business (which I was once) use:

Q: Why does a stock price go up?

A: Because there are more buyers than sellers.

Q:Why does a stock price go down?

A: Because there are more sellers than buyers.

The instant, and I mean less than a second after, Trump enters a sell order for even a small fraction of those 15 million shares, there will be a lot more sellers than buyers. The price is going down.

That's aside from the short sellers. For regulatory reasons, it's difficult to short a SPAC before its merger. Once the merger does happen, short sellers are going to pile in.

So, there are going to have to be a very large increase in the number of buyers to come close to offsetting that.

The caveat is whether someone who wants to curry favor with Trump buys a whole lot of shares to keep the price up. The Saudi Public Investment Fund could do it.

I read elsewhere that apparently the short sellers have managed to overcome the difficulties you mention, and 11% of the company's stock has been shorted.

That's actually an indication of how hard it is to short. Given Trump Social's financials, I would expect the short interest to be a lot higher than that.

Trump is a deplorable human. With that said, if idiots want to buy shares in a worthless company, or for that matter buy bad Hunter Biden paintings, why should I want to stop them?

Hey, mega's believe that pigs fly.

It looks like somebody is pumping up the price of the stock in the expectation that they'll be able to dump it at a much higher value than the company is worth. Presumably the SEC has rules against that, but if they approved the merger I guess they're OK with it.

No one needs to be pumping up the stock. DWAC is so thinly traded that the price can stay far above what it is worth just through Trump fans buying shares.

Once the merger goes through, trading volume will spike, and that won't be so easy.

There is an expression to describe what is happening to Trump enthusiasts that got on board early. They are getting crammed by their own hero. Couldn’t happen to nicer people!

Over the last couple of days reports have surfaced that indicate:

1 - Trump would not be able to sell for about 6 months

2 - When the Truth Social DWAC merger was announced TS stock plummeted as much as 12% before recovering to a loss of 3%.

I think the over valuation will crash down around DJT before he can sell

Also, the RNC has announced (officially) that they will be re-directing some contributions to DJT's legal fees. This has caused a DROP in donations to the RNC.

It's also not helping that MTG has thrown the GOP into chaos (again) with her move to oust Johnson. This is causing a huge back lash within the party making MAGA to have a new meaning

Majorie's

Ass

Gets

Attacked

Bankrupting MAGAts sounds like a win to me.

A couple points. I checked the borrow cost on DWAC today and it was a 195% annualized fee. Trump is locked up for six months so a long time for the bubble to deflate. I’m worried that he does an offering at some point and the Saudis, Chinese etc… use the offering as a way to bribe him legally.

Others than MAGA folks might buy stock. Trump can't sell for six months. That's brings him to just one month from the election. If he polls well, I can think of any number of rich and/or powerful people who will want to be in his good graces and everyone knows how to get there. And if he becomes prez, US policy and especially foreign policy will be up for sale.

A worthless company in which the President or potential President of the United States owns most shares sounds like a very fine corruption vehicle to me, worth much more than 3 billion. Heck, one single oil state might fork over more than that.

Some of the investors are true dupes, but I suspect some know that the real purpose here is to circumvent campaign finance laws.

IV on options ranges from ~125 to over 800 depending on the strike.

Back when I was a market maker in stock options, I fucking hated stocks like this.