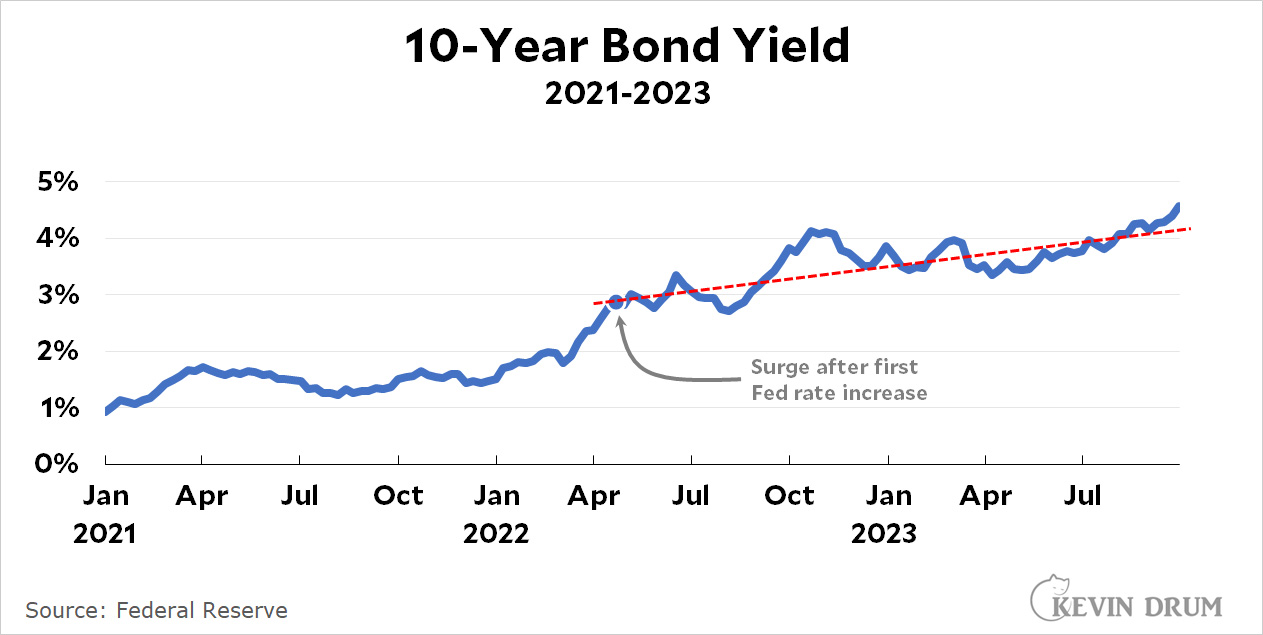

For some reason, this question has suddenly become the new hotness among economists. But why? Paul Krugman notes that bond yields were pretty steady for a while in late 2022 and early 2023:

Over the past few months, however, the bond market has, in effect, capitulated, sending the signal that investors expect rates to stay high for a long time. Long-term interest rates are now higher than they have been since the 2008 financial crisis.

Well sure, but this is hardly surprising since Fed rates are now at 5.33% compared to zero during most of the Great Recession. Plus there's this:

Long-term yields spiked right after the first Fed hike in March 2022. Since then they've increased at a pretty steady rate as the Fed has continued to hike short-term rates. 10-year yields are now above their trendline, but only barely and only for the past couple of weeks. This doesn't strike me as something to panic about. And there's this:

Long-term yields spiked right after the first Fed hike in March 2022. Since then they've increased at a pretty steady rate as the Fed has continued to hike short-term rates. 10-year yields are now above their trendline, but only barely and only for the past couple of weeks. This doesn't strike me as something to panic about. And there's this:

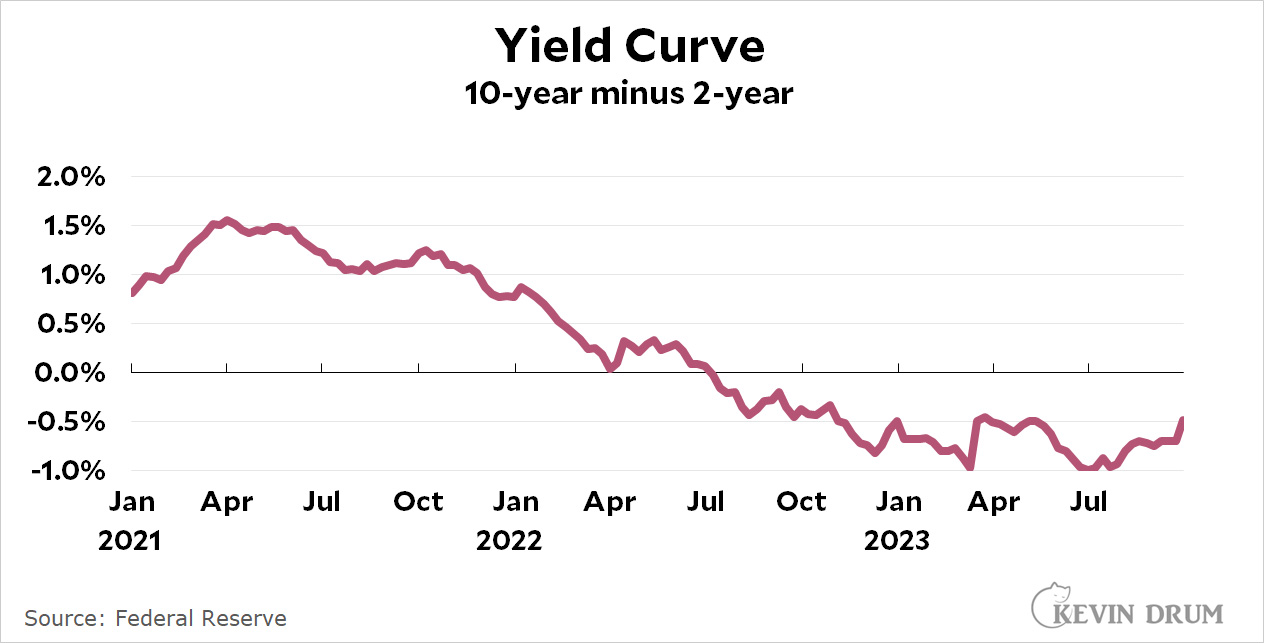

The yield curve remains inverted, a sign that bond markets still expect a recession that will lower interest rates. It's true that the yield curve isn't quite as inverted as it used to be, but that doesn't mean much.

The yield curve remains inverted, a sign that bond markets still expect a recession that will lower interest rates. It's true that the yield curve isn't quite as inverted as it used to be, but that doesn't mean much.

Krugman says: "My instinct is to say that the bond market is overreacting to recent data and that high interest rates, like high inflation, will be transitory." I'd go further: I'm not sure the bond market is really telling us very much in the first place. But yes, to the extent that it is, it's overreacting.

Unlike Krugman, I don't have an economic argument to make for believing this—aside from the fact that I suspect a recession is on the horizon. Mainly, my argument is that everyone, everywhere, at all times overreacts to everything that's new, and this goes double for financial markets. Fed rates have been above 4% for—hold onto your hats!—ten whole months. That exhausts our patience and must mean it's time to give up and assume that rates will be high forever.

Spare me.

I think that rates will stay high and maybe even go a little higher until Powell gets the recession he wants to help put his party in power. So I don’t think the market is overreacting.

Powell doesn't want a recession, per se. He wants a labor surplus. He probably thinks these are two ways of saying the same thing. Time was, they may have been. Today, not so much. Anything he tries to do is like as not to have opposite effects from what he intends. My takeaway from Kevin's charts is that (at least right now) the inversion of the yield curve is not predictive.

But he also wants Republicans in the White House and congress and that’s far more likely if he can sends the economy into the crapper.

The problem with that thinking is that no matter what Powell wants he wont get his labor surplus because we have too many people who are retired and needing/wanting goods and services and too few people who provide those same goods and services.

Here's a very republican thought for you. We need a tax cut

Not for the 1%

Make all earnings - Social Security, pension, 401k and all job earnings tax free for anyone 65 years of age of older. So if someone is collecting SS and is able to return to work they should be able to without getting their SS taxed. Add to that the benefit of earning a paycheck that is also not taxed.

I would think there'd be a lot of recent retirees would gladly return to the work force. It would be the greatest economic revival we've ever seen.

Which makes it also a non-starter

But think about it this way. NO need to increase immigration

Its a tax cut

And it INCREASES the labor pool

All the things republicans want

Are interest rates high? When they hung out at near zero for all those years, that certainly felt low. But it wasn't meant to be a baseline. 5% is a little high. Should be like 4% or so, then let it ride. Interest rates a little higher than most young-folk can remember is a good thing. Keeps everyone more honest.

CD rates are way up, all through the terms. If you have money you want to earn a decent rate that's completely safe and liquid, buy CD's. I just bought up a bunch of 5 year CD's at 5.7% rates.

Just curious as to where there was a 5 year CD at 5.7%

Sorry, my bad, it's a one year CD.

I bought a 5 year CD at 5.55%.Bank of America.

https://digital.fidelity.com/ftgw/digital/bondrsch/?securityId=DSN9P1702&ordersystem=AORD

Well, hell, i got that wrong too. NO more financial advice from me.

It's instructive to ask why we are paying interest on risk-free Government bonds and reserves (as opposed to risk-based interest on bank loans).

Historically, the Treasury issued bonds to protect its gold supply. The currency used to purchase the bonds was temporarily taken out of circulation and couldn't be presented to the Treasury for conversion to gold. (Conversion to gold is not risk free. The Treasury could run out.) The interest paid on the bonds was motivation and reward for forgoing convertibility.

With fiat currency there is no convertibility risk because convertibility is not offered. There is no public purpose in paying interest on risk-free Government bonds or reserves. It's just giving money to people because they already have money.

Government bonds may once have been free of the risk of default but, obviously, that’s no longer the case. It’s practically a plank in the Republican Party’s platform to default and Trump’s threatened to stop paying on bonds many times.

Also, even if you discount the risk of default, there’s other risks involved in buying government bonds just as with other bonds. So it’s hardly money for nothing.

If the government defaults on its bonds, you are going to have bigger problems than trying to get your money out of them, at any interest rate.

Bonds are a gift to the rich.

Donald Trump says an unending number of ignorant things because he's massively ignorant, and most of what he says is bloviation, but defaulting on bonds is the domestic equivalent of Saddam Hussein saying that he's no longer going to sell oil denominated in dollars. It would get the full attention of the ruling class.

Personally, I believe, as Creigh Gordan does, that the government act of paying interest on bonds is an undeserved and counterproductive gift to the rich, and bond sales should be eliminated. The government doesn't need to sell bonds. They can print money, so the reason they sell bonds is......what?

Stock market down, Binky? You've impoverished your workers to the point where they can't afford to buy what they, themselves, produce, so your factory is shutting down for lack of sales? No problem. You can still earn money on your wealth by buying government bonds.

There is no public purpose in paying interest on risk-free Government bonds or reserves.

I think you'll find the government won't be able to raise the funds it needs without paying interest on the IOUs it issues. So the public purpose is "being able to pay its bills."

Maybe what you're angling at is: the government could just print money to pay its bill and forego borrowing its own currency? I guess that's true. But the votes don't exist for shifting to such a system.

The Federal Government "prints" the funds it needs to finance its spending. It "prints" bonds using the same machinery that the Fed used to "print" notes and reserves. The bonds are simply future money, not particularly convenient as a medium of exchange but an effective store of value, that the Government chooses to create but doesn't need to. Rich people benefit, so I imagine the practice will continue.

If I have money to lend, there are very secure, essentially risk-free, borrowers who are willing to pay me interest on it. If the government wants to borrow my money, they have to compete with those other borrowers that are willing to pay interest.

If the government wants to borrow my money, they have to compete with those other borrowers that are willing to pay interest.

MMT cannot fail. It can only be failed.

The idea that a government that prints money needs to borrow is, frankly, absurd. But the idea that our government needs to borrow serves the interests of rich people who are paid to buy bonds or now to park money at the Fed (5% interest on reserves) and also people who don't like government. So the fiction is promoted by those people and the people who make a good living promoting the interests of those people

If there is an academic paper on how US Treasury could stop borrowing money to fund the deficit, and start "printing" the money, I would certainly be interested in seeing it. The amount of greenbacks in circulation is just a fraction of the total money supply, and when $2+ trillion of extra funds each year is required (the deficit), we are not going to actually print a $2 trillion mountain of greenbacks. So how would this actually work?

Treasury bills / notes / bonds are not currently issued in paper form or printed.

I'm not aware of any paper on that exact topic I can point you to. Logic might have to do that work. We do things the way we do because the law (Federal Reserve Act) was written that way. It could be written many other ways, even so as to say that the Treasury can simply write checks to cover government spending and the Fed cashes them or accepts them for deposit. I believe that the reason we don't just do that is because the current system serves the interest of a coalition of rich people and anti-government ideologues, and is promoted by them and their well-rewarded hangers-on, who prefer that you think alternatives don't exist.

I'd be happy just to stop using the unnecessarily negative term "borrowing" to refer to bond sales. It isn't borrowing in any sense we normally understand. It's just a swap of one kind of financial asset (bonds) issued by the Government for another kind of financial asset (currency) issued by the Government. One is a liability of the Treasury and the other is a liability of the Federal Reserve Bank, but that is not a significant difference. Both are public debt and at the same time private assets.

And I'm aware that most of the money issued by the Government is just ledger entries on some computer. I use the term 'printing' because money works the same way if it's physical or electronic, (one is just usually safer and more convenient--and more sanitary--than the other) but I feel that the term 'printing' resonates with my intended audience.

I think what would resonate with this audience is an academic treatise on how your goals could actually be accomplished and what would be the potential impacts.

Current money supply is about $20.9T, and as far as I know, there is no right to take your money to the US Federal Reserve and demand anything for it. You have the right to exchange it for goods and services. With Treasury debt, you have the right to payments of principal and interest as scheduled.

If you want to end US borrowing, you also need to extinguish the $33T in government debt with cash as they mature.

Wow, two years and 500 basis points later, and Krugman is still waving the "transitory" flag.

Basis points have nothing to do with whether inflation is transitory or not.

There was nothing structural about the inflation we had. Meaning it was transitory.

Well, I just wished Krugman and Drum had said more clearly, "Inflation is transitory. By that we mean, that if the Fed raises interests by 500 bps, the most in history, inflation will possibly abate in two years." Instead they made these Delphic pronouncements that might have led less knowledgeable people to believe that transitory meant something like, "Even without any policy response, inflation will abate within six months or a year," which would be a more intuitive interpretation of "transitory."

The evidence mounts by the day both Krugmand and Kevin were correct. If not, we wouldn't have seen the large decline in inflation without an increase in unemployment.

"Inflation is transitory. By that we mean, that if the Fed raises interests by 500 bps, the most in history, inflation will possibly abate in two years."

That's a category error. Transitory inflation (which ours was, especially given that it was driven by shocks and profiteering) is by definition not structural.

Fed rate increases are meant to counteract structural inflation.

For over a year, now. Eventually you'll be right. In 2024 or later.

“The stock market has predicted nine out of the last five recessions”

-Paul Samuelson

Maybe my brain has melted with age, but I see a very bright future for the US as a whole, for at least the next fifty years.

The biggest problem that I see the US facing right now is that countries are trying to grow their markets by undercutting other countries prices (by reducing their own domestic wages), instead of by increasing production efficiencies (and thereby lowering prices) through innovation.

Right now, the US is bearing the brunt of this practice through reduced domestic employment and increasing debt levels, but I have a feeling that the US will find a way to turn this situation around. Without a major war, that is.

I see a very bright future for countries in direct proportion to how enthusiastically they pursue decarbonisation. Massive investment and much R & D are called for and the countries, and businesses, that get in early are going to have enormous economic booms, while those that try to cling to fossil fuels become slowly deteriorating economic backwaters.

No, the inverted yield curve means that bond investors expect a lowering of rates in the future.

It does NOT mean they expect a recession that leads to the lowering of rates.

Basically, bond investors are saying the same thing (with their money) that I (and others) have been saying this whole time: the Fed went too far too fast with their aggressive rate hikes, and they're going to be forced to come down at some point in the medium term. That doesn't have to be because of a recession.

Sarah Huckabee Sanders, style icon,

https://twitter.com/BettyBowers/status/1708257611433341049

The bond market is, frankly, stupid.

There may be reasons the actors in the market do things they know don't really make sense -- laws about what they have to invest in; asymmetric risk and reward profiles; etc. -- but long term bond rates have only fairly recently gone above 4%, which, given the Fed's commitment to 2% inflation, should just about be their lower limit.

Interest rates can be considered as being composed of different parts reflecting different financial forces. The first piece is inflation: no market participant should accept losing money to inflation in investments. The second piece is lost opportunity: if you lock up an investment over any amount of time, it's value is not generally available to you as cash for some other investment or a purchase. A third piece for longer term debt is the option adjustment: the effect of interest rate changes is usually asymmetric, which means that for an extended period of time -- usually around 20 years -- the interest curve should be going up. And a last piece is just to address market imbalances, because usually there is more pressure to acquire cash than there is to invest it ... although that can go the other way.

Anyway, in combination, if we have stable 2% inflation, that should mean an immediate interest rate of at least 3%, and going up from immediate to longer term rates. That's how I get a 4% floor for longer term interest rates.

But right now inflation is running around 3%. If the Fed intends to tamp it down, that means immediate interest rates have to be at least 4% and probably higher, which they are.

OK, if the Fed is successful, then they can lower immediate interest rates to 3%, and maybe that can be the point of stability for immediate interest rates for a long time.

But that still puts a floor on longer term interest rates at around 4%, and there's no guaranty that the Fed will be successful any time soon, which means higher interest rates for longer.

So locking your money up for 10 years at 4.5% or for 30 years at 4.75% is just about certain to lose you money as compared with keeping cash and waiting for better investment opportunities. And it was even more out of whack a month or so ago.