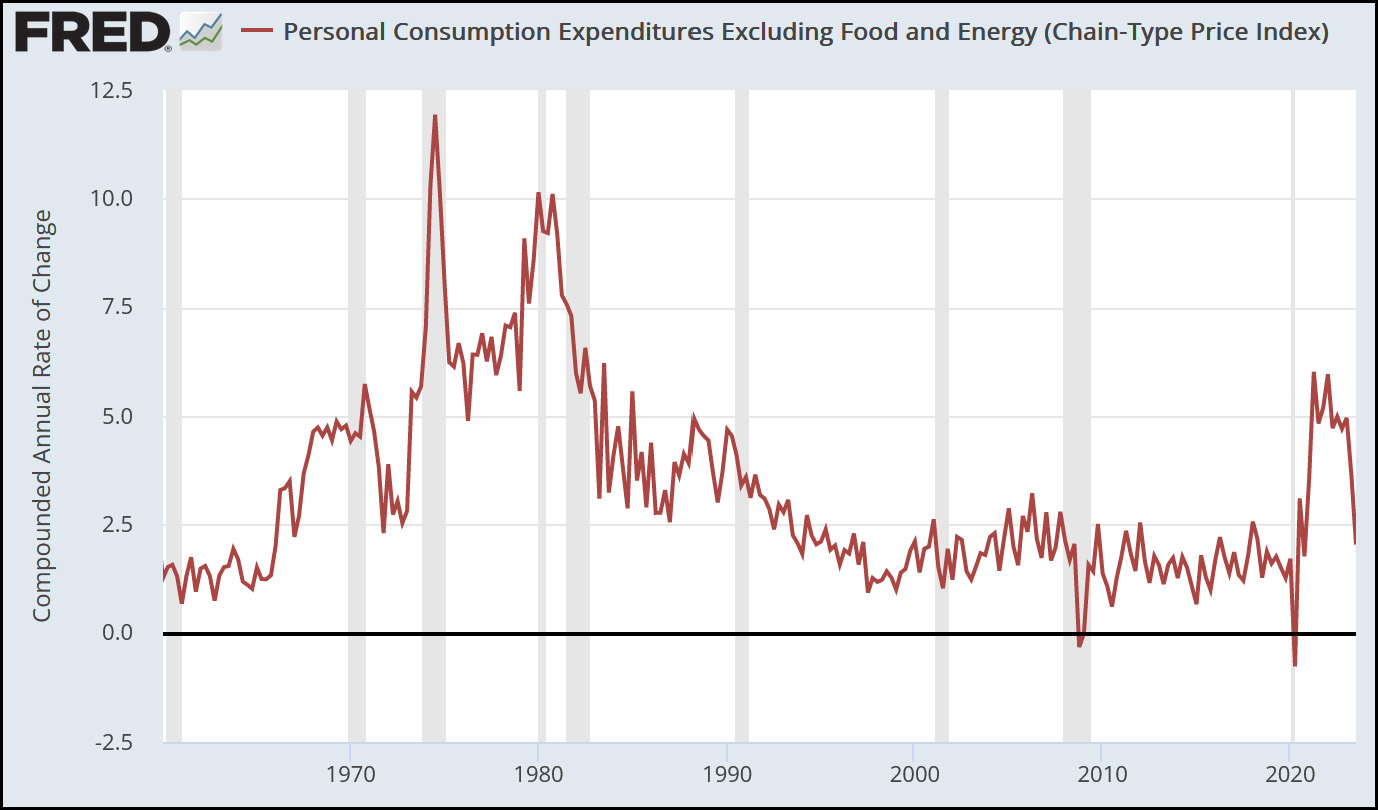

Was our recent bout of inflation "transitory"? That depends on how you define it. But since a picture is worth a thousand words, let's look at a picture of core PCE, the Fed's favored measure of inflation:

The inflationary surge we typically associate with 1980 actually started in the late '60s and didn't fully recede until the early '90s. Call it 25 years.

The inflationary surge we typically associate with 1980 actually started in the late '60s and didn't fully recede until the early '90s. Call it 25 years.

Our current surge began in early 2021 and receded by late 2023. That's about 2½ years.

So yeah, I'd call it transitory.

if it stays down, and it's not just a transitory dip.

I just got paid 7268 Dollars Working off my Laptop this month. And if you think that’s cool, My Divorced bc03 friend has twin toddlers and made 0ver $ 13892 her first m0nth. It feels so good making so much money when other people have to as20 work for so much less.

This is what I do................> > > https://dailyincome41.blogspot.com/

I planted a flag last year about a return to ZLB. Just wanted to reiterate it.

I don't think it's out of the question, but I think that the Fed rate returning to bounce around 2% (+/- 0.5%) in the medium term is my expectation. Or maybe that's their stated, but things end up more around 1.5 or 1.75 +/- the 0.5.

If you were in 1971, you might be saying the same thing. Lots of things could happen; China invades Taiwan, supply chains go to hell. War in the Persian Gulf spikes oil prices, then everything else.

In 1971 we would be thinking that the recent recession and large increase in unemployment played a role in the current disinflation. That would not have been a good argument for inflation being transitory.

That graph may be true but it is still more important to remember Her Emails!!! and Joe Biden is old!!!

"Yep, Team Transitory was right all along"

I thought team transitory believed that no action was required by the Federal Reserve: Covid related challenges would end and inflation would return to a normal level.

In fact, we had rapid rate increases by the Fed and it has taken two and half years, to get close to normal inflation levels. Hard for me to imagine, absent Fed action, inflation would have declined so rapidly.

Yes, of course one would have to assemble the posts since the commencement of usage (including the deliberately fuzzy but evidently motivated predictions of recession notably), but of coursel in a scenario where "transitory" is stretched to mean several years of elevated inflation in the face of ECB, Fed, etc central bank action...

The problem of course with an undefined term is post-facto one sees exactly this, the redefinition to claim rightness.

More rigourous and honest is Krugman.

Ending quantitative easing and bringing rates up from zero was expected. Cranking rates above 3% was extreme, especially without pauses, and the fear was, and still is to a degree, that this would squeeze the economy enough to force a recession. The full effect of rate increases is expected to take years to be felt--though the stimulus packages, from left over Covid money to spending on weapons for Ukraine, has counteracted some of the Fed's rate increases.

It is not expected to "take years" - that's an absurbd exaggeration.

Rate rising to 5% is hardly extreme, it is well within long-term average before the post-2008 bizzaro world of zero bound efforts to avoid deflation.

8% from zero bound might be extreme.

Well you obviously haven't been reading Kevin. His point has consistently been that Fed rate increases take time to have an impact and the rate of inflation was already falling. Beyond that, for rate increases to actually affect inflation one would have to observe a decline in demand but we haven't had a decline in demand. The far better explanation is that the inflation was supply chain driven and once those problems were solved inflation started to decline. This had nothing to do with whatever the Fed did. The Fed is going to take bows for being successful in bringing about a soft landing but the evidence suggests they had nothing to do with it.

Drum is simply wrong in his understanding of Central Bank rate rises - just wrong, based on fundamental misunderstanding of some high level statements and no understanding of interest rate transmission mechanisms.

And this is utterly wrong: "Beyond that, for rate increases to actually affect inflation one would have to observe a decline in demand but we haven't had a decline in demand."

This is fundamentally incorrect analysis arising from the same kind of innumeracy that leads Popular understanding to thinking inflation has not declined beause prices have not declined, innumerate understandings. Reduction in increases is the reduction aimed at, not absolute reductions (deflation).

Rate rises aim at reduction in demand including demand increases. In the face of economic growth from whatever forcing factors including market liquidy, fiscal stimulus, the slowing of demand is in fact demand reduction.

Innumerate states based impoverished understanding of the economics (and econometric measuring).

There has been a decline in rate of demand (without being an absolute decline in demand ) - a decline in all markets as investment intentions are delayed, as demand is deffered.

Such comments are a fine illustration of why Populist understandings - either Left or Right are not a good basis of monetary policy.

An unnecessarily angry and unconvincing response. My point was simply that the rate of inflation was already declining before the Fed actions had any chance to have an impact. As far as demand I also never said demand had to fall in absolute terms. After the pandemic demand surged--tha surge couldn't continue at that rate but again the decline had nothing really to do with the Fed. Krugman and Drum are both right about this no matter what fog of rhetoric you try to create.

unnecessarily angry and unconvincing chracterized all his comments.

I thought team transitory believed that no action was required by the Federal Reserve

That is what they believe. That's what Krugman appears to believe. I think he's probably right. People were really freaking out 9-12 months into the inflation surge screaming "Inflation's not ending! It can't be transitory!" My response was: what law of physics says transitory inflation can't last a couple of years or more? The classic example of transitory inflation—when wage/price controls were lifted at the end of WW2—did last about 24 months, IIRC.

Yes, and the federal funds rate was raised only slightly, IIRC, and was not intended as an inflation-fighting move.

Same. Transitory, to someone with an economist's mindset (where you're thinking about systems and longer terms), can mean a couple of years that are anomalous in the broader pattern of the data.

Inflation peaked and then began falling in spring/summer 2021, just a few months after the Ukraine.

This is well before the Fed increased rates and even well before the Fed began projecting that they would enact significant rate increases in 2022/2023.

This is an important part of the puzzle for those who believe Fed actions were both necessary and successful to be able to explain their argument. A less successful argument is to state that because the Fed took action, we know that Fed action was both necessary and responsible for the disinflation that followed.

The consensus among those of us who felt the evidence pointed more towards non-financial-policy (i.e., interest rate) reasons for inflation was not that no rate increases were needed.

It's that the Fed did not need to raise rates as high and as fast as they did.

You're skipping from causation to correlation pretty glibly.

The *mechanisms* by which rate increases were supposed to bring down inflation were by increasing unemployment and by slashing aggregate consumer demand. Neither thing happened. Neither thing even came close to happening

Fed action turns out to have been largely irrelevant.

BECAUSE it was supply chain transitory all along and not the traditional expectations-driven inflation we were familiar with.

Well, for some definition of transitory anyway. “At the start” I don’t recall you thinking it would be this long…

A series of extraordinary events....starting with Covid...

Droughts, wildfires, war in Ukraine, bird flu, Ever Given stuck...

Any one of these would have been a bit of a blip--but combined on top of recovery from Covid proved to be significant. And, of course, companies saw this as an excuse to raise prices and keep them up.

Do we ever have periods where nothing unexpected happens?

No, and usually more than one too....

But the Russia's invasion of Ukraine was a major shock--way beyond the "average" unexpected event.

The drought out west (US) has been building for some time, but really hit home. Climate change is having adverse effects on our economy. Only the recent (past year or two) atmospheric rivers have given everyone a reprieve--but damage due to climate change will continue to climb.

Of course populists Leftists love Greed as an economic explanation as much as populist on right love attacking govenrment spending, rather than proper data (or understanding that price rises transmit and that as well companies need to buy inputs in advance of production leading to asyncronous changes, if of course the company does not wish to run into cash flow crises).

Actual data analysis, European, show that ex-energy industry, sustained margin change did not happen: https://www.ft.com/content/917c053b-4ad3-4354-90e8-93121a9af2b5

It is unlikely the USA is any different.

can't really comment on a paywalled article

but here's one from fortune, which shows there are actually differences in the UK vs the US, so you may want to rethink your position wrt equivalence between the EU and US

###

Profits for companies in some of the world’s largest economies rose by 30% between 2019 and 2022, significantly outpacing inflation, according to the group’s research of 1,350 firms across the U.S., the U.K., Europe, Brazil, and South Africa.

In the U.K., the research found that 90% of profit increases occurred among just 11% of publicly listed firms. Profiteering was more broad in the U.S., where a third of publicly listed firms were responsible for most of the increase in profits.

The biggest perpetrators were energy companies like Shell, Exxon Mobil, and Chevron, which were able to enjoy massive profits last year as demand moved away from Russian oil and gas.

Food producers including Kraft Heinz realized their own profit surges. The war in Ukraine rocked global grain supplies and fertilizer prices, significantly increasing the cost of food, which remains sticky.

The findings add to a growing body of research seeking to highlight the role of major businesses in forcing up inflation last year.

A June study by the International Monetary Fund (IMF) found that 45% of eurozone inflation in 2022 could be attributed to domestic profits. Companies in a position to benefit most from higher commodity prices and supply-demand mismatches raised their profits by the most, the study found.

CEOs of the world’s biggest companies consistently sounded the alarm on inflation as a significant barrier to growth. Many blamed rising input costs on their own price hikes. However, lots of those CEOs appear to have instead used the panic of rising costs to pump up their balance sheet.

https://fortune.com/europe/2023/12/08/greedflation-study/

I don’t recall you thinking it would be this long…

I don't recall Kevin spelling out one way or another how long he thought it would last.

Not clearly, artfully avoided, and of course when one has an undefined term and does not provide any numeric metrics, it's easy then to take pot-shots at the Central Banks that in fact do have published metrics, while remaining oneself in plausible deniability.

Krugman at least rather more rigourously admitted that Transitory of 2021 was wrong - simply wrong - which makes his criticism of those arguing for more hard action in 2023 and taking skeptical views of soft-landing more credible.

Of course equally one can look to comparatives to ECB and Fed - as like Turkey which did not take CB action and saw severe acceleration or UK Bank of England that was signficantly slower than ECB or Fed and has seen more prolonged elevated inflation - although of course Brexit Self-Harm is and was a confounding vector but the real observtaion here is that macro-economic data is

(1) lagging, is complex and noisy

(2) is subject to a confounding mix of forces and variables making simplistic single variable analysis sterile and generally wrong

Krugman at least rather more rigourously admitted that Transitory of 2021 was wrong

No. Krugman just last week reiterated his belief that America's recent bout of increased inflation has indeed been a classic transitory episode, and that Fed action has been both unneeded and possibly harmful:

https://www.nytimes.com/2023/12/18/opinion/inflation-economists.html

Krugman may be wrong for all I know: let's see what the consensus is ten years from now. But his opinion on this matter doesn't bear a passing resemblance to your description of it.

I'm celebrating Christmas with food, music, old movies, and this delayed take on Krugman:

Paul Krugman pointedly does not take aim at the Federal Reserve for raising interest rates in the past couple years. He explicitly says he doesn't blame them for doing it. What he does say is that people should not believe, like Larry Summers, maybe, that severe Fed rate hikes are the right solution for a case of inflation like what the world has seen. It isn't the Fed's actual recent behavior that Krugman is worried about, it's something much more hawkish.

The Fed's actual move on interest rates was not very severe. Number one, they didn't start raising rates until inflation had been elevated for more than a year. Two, their increases didn't get very high. With core inflation running at 5%, the Fed's target rate stayed below that level until slightly topping it in May 2023. With inflation now having finally dipped back under 3%, interest rate cuts have already been slated for 2024.

Here's a chart of Fed effective rate compared to core PCE inflation over the past forty years: https://fred.stlouisfed.org/graph/?g=1detP . Recent Fed rate targets have not been any higher than they were for much of the past few decades, and are remarkably tame in comparison with an inflation rate that had surged higher than at any time since the 1980s.

The measure most often cited as significant is the rate at which the fed-funds target was raised; see the steep rise on your FRED chart.

Thanks, I'm happy to address that point.

Who thinks the steepness of the rise is significant? I don't think it is. Look at the surrounding facts.

Between March and December 2022, the target rate went from zero (extraordinarily low) to 4.1% (not even exceeding the rate of inflation at the time). Not a big deal. And the increase wasn't all that fast, either, considering it was not begun until after five quarters of extraordinarily high inflation (during which many of the usual suspects cried out for the Fed to act), and three months after the plan for rate increases was made public. After all that, neither the size nor the speed of the increase could be considered shocking to the business world. And has the economy reeled in response? We're still waiting, but it's looking like a no.

since we're talking about teams, larry summers of team entrenched thought we'd need to push unemployment up to 7.5% to get inflation under control

so team transitory was definitely correct that we didn't need to kill the economy to get inflation down

so i'd score it 2 for krugman/transitory, 1 for summers/entrenched

To the headline I'll say, "No shit!"

But of course in the Official Narrative (TM) there will be no mention of this. There will be continued hagiographies of Jerome Powell and to a lesser extent the Biden administration. I don't have a problem with that given that the narrative (which lower information voters absorb) has been so baselessly anti-Biden at times.

I'd also add that an exploration of why price growth was transitory is necessary. Yes, pandemic-related shifts in demand (some of them permanent) were a major factor.

But so was pure rent-seeking on the part of the plutocratic classes.

This was not "true" inflation where there was a wage/price spiral. Inflation got as high as it did because corporations used the pandemic as an excuse to squeeze ever more juice from the rest of us. And it worked.