News reports based on leaks from the Fed have said that Silicon Valley Bank was called out in 2021 for some poor governance practices but that warnings about financial risk didn't come until late 2022. However, testimony yesterday by Michael Barr, the Fed's vice chair for supervision, paints a slightly different picture:

Near the end of 2021, supervisors found deficiencies in the bank's liquidity risk management, resulting in six supervisory findings related to the bank's liquidity stress testing, contingency funding, and liquidity risk management. In May 2022, supervisors issued three findings related to ineffective board oversight, risk management weaknesses, and the bank's internal audit function.

In the summer of 2022, supervisors lowered the bank's management rating to "fair" and rated the bank's enterprise-wide governance and controls as "deficient-1." These ratings mean that the bank was not "well managed" and was subject to growth restrictions under section 4(m) of the Bank Holding Company Act.

In October 2022, supervisors met with the bank's senior management to express concern with the bank's interest rate risk profile and in November 2022, supervisors delivered a supervisory finding on interest rate risk management to the bank.

In this account, we still have the governance issues raised in May 2022 and the warnings about interest rate risk in October and November.

However, the very first warning, at the end of 2021, is now said to be about SVB's liquidity risk management. This raises a few big questions:

- How serious were the warnings? Barr goes to the trouble of including a footnote explaining the difference between an MRA (matters requiring attention) and an MIRA (matters requiring immediate attention) but doesn't say which ones were issued at this time.

- There were apparently no further warnings about liquidity. Does this mean that SVB resolved its problems?

- To deal with warnings from the Fed and a downgrade threat from Moody's, SVB bulked up its cash reserves and announced a capital raise. Was this what the Fed had recommended? Did they know about it?

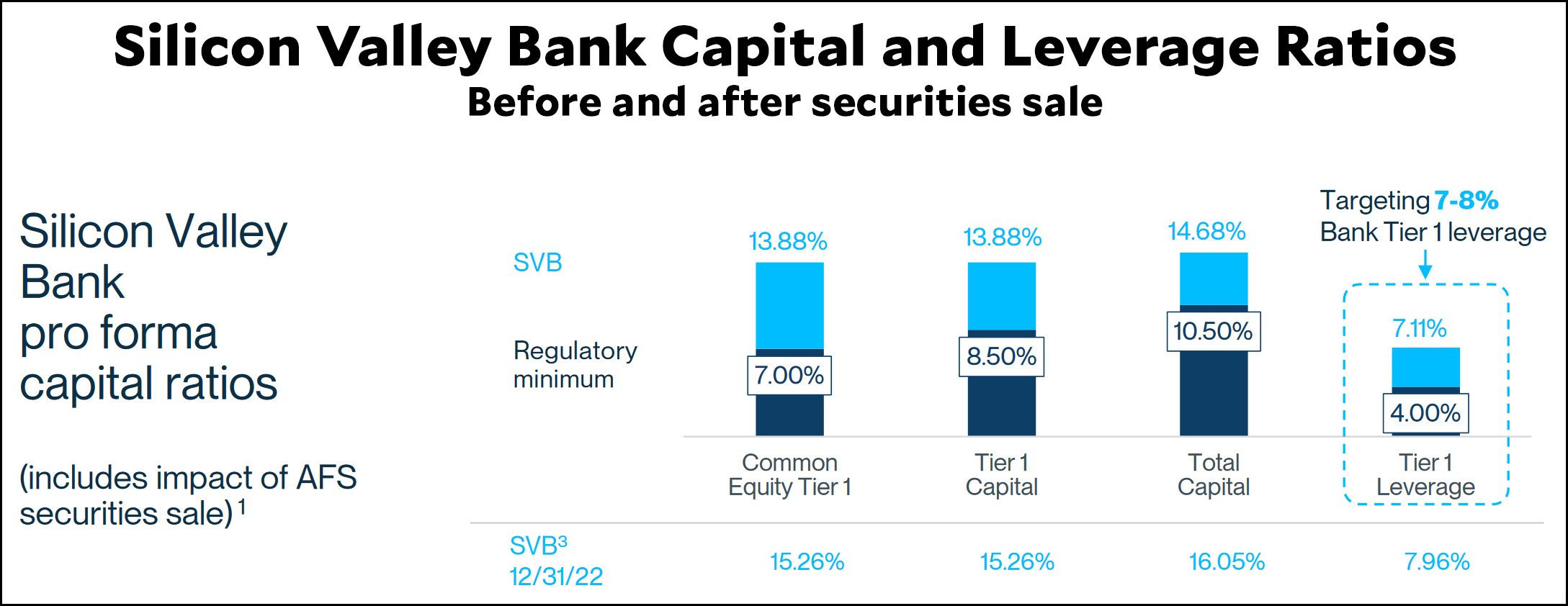

When SVB sold securities to generate cash, this still left it well above the minimum required capital and leverage ratios:

Ironically, it was SVB's announcement of this action, which was precisely the right thing to do, that sparked the run the next day. After that, it had only a few hours left to live.

Ironically, it was SVB's announcement of this action, which was precisely the right thing to do, that sparked the run the next day. After that, it had only a few hours left to live.

Their t-bills were the cause of their problems, yet aren't they still a highly rated component of their capital reserves?

From an AP article this morning on yesterday's hearings and related political B.S.:

>>Republican members of the committee focused their fire on the Fed and other regulators for failing to prevent SVB’s failure. The Fed has been criticized by advocacy groups for not adequately responding to red flags about the bank’s management. "I hope to learn how the Federal Reserve could know about such risky practices for more than a year and failed to take definitive, corrective action," said Sen. Tim Scott, Republican from South Carolina. "By all accounts, our regulators appear to have been asleep at the wheel." >>

Hmmm...Asleep at the switch doesn't sound like what we heard, does it? More like "hamstrung by the recent relaxation of regulations, leaving the Fed with only advisory power."

>>Last September, before the banks’ collapse, Barr had said he was conducting a "holistic review" of the government’s capital requirements. He suggested that he might support toughening those requirements, which prompted criticism from the banking industry and Republican senators. ... At the hearing, some Senate Republicans questioned whether new rules were needed and noted that the Fed had had the authority to force Silicon Valley to address its shortcomings. "I can’t think of another rule, or law, or regulation, that you needed," said Sen. Cynthia Lummis, a Republican from Wyoming.>>

Gee, do you suppose the rules, laws, and/or regulations they needed were the ones that the banks and Republicans lobbied so strongly against, and eventually scuttled, five years ago? If you'd like to see more on THAT subject, check the AP story last week titled "Army of lobbyists helped water down banking regulations."

I still think the biggest problem with SVB wasn't their interest rate exposure, it was the fact that most of their deposits were uninsured (over the FDIC limit) by volatile startups. I don't know if this is something the Fed looks at, but it should be.

FDIC insurance wasn't just added so depositors wouldn't go broke when a bank failed. It was also added to prevent the panic that leads to a bank run. Sure, it sounds like their customers panicked, which started the run that turned a struggling bank into a failing one, but that panic is a type of risk our banking system is supposed to protect against. As we saw, even a bank meeting the Fed's liquidity requirements can't handle all of its depositors withdrawing their money. If they were insured (or if SVB wasn't allowed to hold that much in uninsured deposits) the panic wouldn't have happened, or would have been manageable.

>>FDIC insurance wasn't just added so depositors wouldn't go broke when a bank failed. It was also added to prevent the panic that leads to a bank run.>>

Historically, that statement was not true for at least the first 40 years of the FDIC. In fact, it was only in 2008, the 74th year of the FDIC, that the limit was raised high enough ($250K) to have any serious protection against bank runs.

The problem with trying to insure huge deposits, which has been a specialty of SVB, is that to calculate insurance premiums on the World Trade Center you have no experience data, so it's all conjecture. To avoid bankrupting the insurance company, the company reinsures their risk. But who could reinsure the FDIC? Unfortunately, the risk in SVB was several times greater than the loss in the World Trade Center, and that's compounded by the fact that when a domino that big falls over, it tends to knock down some others, too.

The answer to the problem is relatively simple--regulation. But that, we know, tends to encounter hysterical overreaction both in the banking industry and in the Republican Party. And if you think I'm exaggerating, I refer you to the article I cited above in my previous comment.

It started at $2500 in 1934, but was increased to $5000 that same year. Which sounds paltry but it's $109,000 in today's dollars. I'm not as handy with charts as Kevin, but every time it was raised, the limit was over $100k in current dollars. That seems like pretty good coverage, at least with most consumer depositors.

Personally, I'd prefer regulation to insuring all depositors. They're big enough that they can manage their own risks. But a bank shouldn't cater predominately to uninsured depositors, or those accounts should have withdrawal restrictions to prevent bank runs. No, the banks and businesses won't like that, but they never do until they collapse.

You're absolutely correct about the "present value" of the FDIC insurance through the years. Nevertheless, even the current limit of $250K is realistic for retail depositors, but wholly unrelated to venture capitalists who park millions in demand deposit accounts so they can access them on a moment's notice. FDIC was never intended for that type of risk.

Let's be real.

SVB had plenty of liquidity.

They ended Thursday with an OD of less than $1 billion after about $50+ billion was withdrawn over the previous two days.

Keep your eye on the ball.

The run started because SVB had to RECOGNIZE some significant losses on their investment portfolio. The losses were there the previous week but nobody cared. They SHOULD have cared. But they didn't.

Why does opening your eyes and saying we lost $2 billion in the value of our investments since we bought them? Let's sell them now because it will give us more cash than if we keep them.

Why? Because too much of the world is stupid and thinks you haven't really lost it until you sell it.

SVB had solid capital ratios according to Kevins last paragraph and image (image provided by SVB).

We know that this is completely false if you consider the market value of SVBs assets. Capital ratios that use historical or fair value costs instead of actual market values are basically worthless. We know that SVB had an actual market value capital ratio around or below 0. The bank was insolvent, we all know this. Why do we keep pretending that the bank had great financials if we just ignore the actual value of their assets.

What we know:

- On Feb 24 SVB published info showing they had roughly $2 Billion in market value losses for short term assets and roughly $15 B in mkt value losses for long term assets.

- In the same publication, SVB projected continuing deposit withdrawals through the year. This means that some of those market losses would have to be realized.

- On March 8, they sold 80% of their short term assets for a $2B loss. These sales would represent their best assets, future sales would bring larger losses even if interest rates did not increase.

At this point investors/ depositors had to see the large discrepancy in projected losses as of Dec 31st ( published Feb 24) and realized losses on March 8. At Dec 31st it was clear that the bank was insolvent, but the shortfall appeared to only wipe out the equity holders.

Suddenly on March 8, the losses appear much larger. If you have uninsured deposits and are among the depositors who knows they will need to withdraw large sums for operating purposes and the bank has told you that other depositors are likely withdrawing funds throughout the year..... what's the right move?

"When SVB sold securities to generate cash, this still left it well above the minimum required capital and leverage ratios:"

So obviously sometimes the minimum requirements aren't good enough. The bank was insolvent.

Isn’t it really both? They could have been better managed, but if there wasn’t a bank run they would have just muddled through?

https://www.bloomberg.com/opinion/articles/2023-03-29/svb-s-depositors-weren-t-very-loyal