Here is Hilbert on the front lawn eating grass while Charlie looks on. The purpose of this, of course, is to make himself throw up a few hours later when he's inside the house. He will make sure to do this on one of our area rugs instead of the wood flooring where it would be easy to clean up. Of course.

Month: December 2022

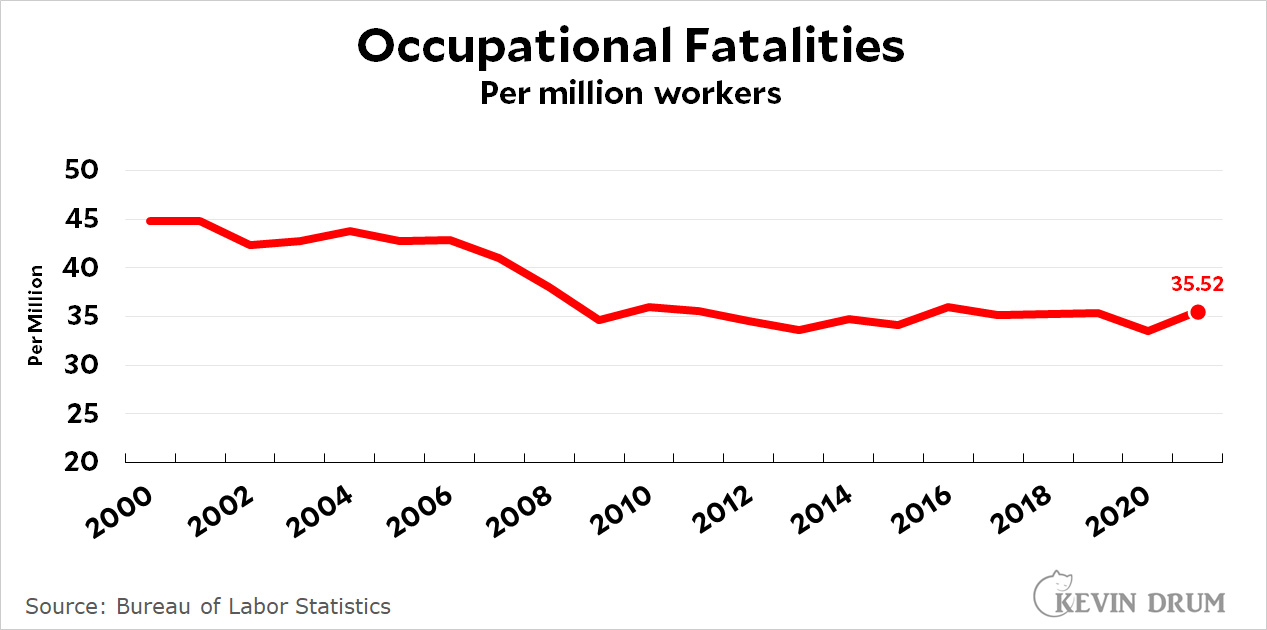

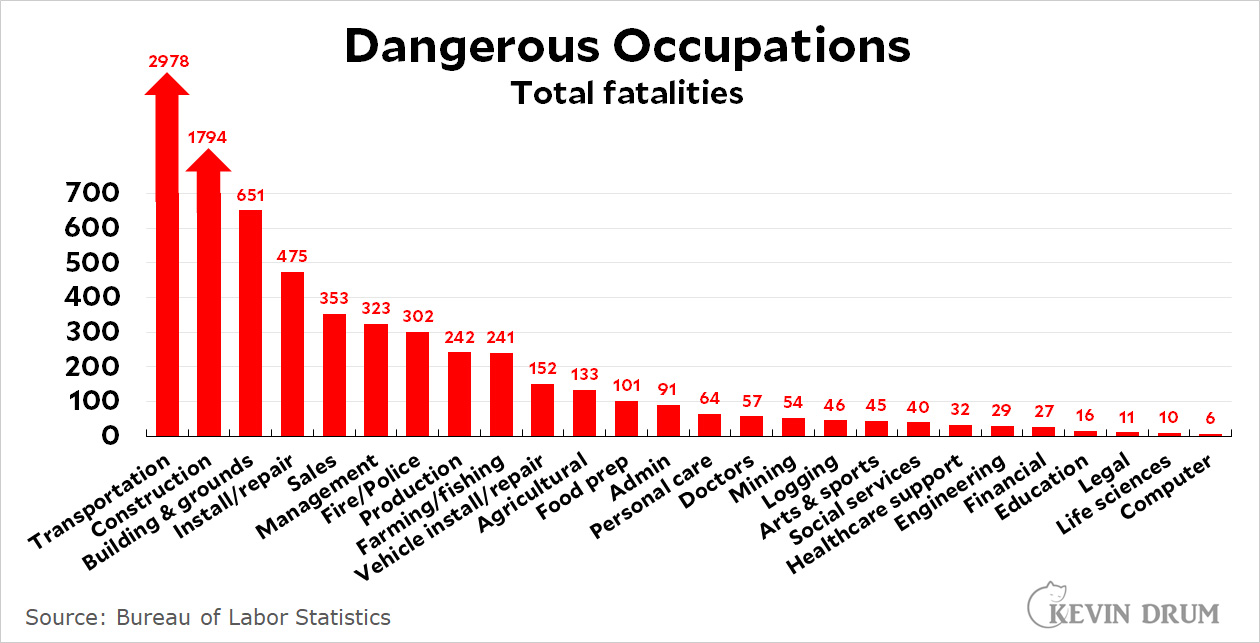

Raw data: Occupational fatalities in 2021

In a desperate effort to avoid writing about Elon Musk on a day that's light on news, I present you instead with results of the annual BLS count of occupational deaths. Here's the total:

That's a 6% increase between 2020 and 2021, but 2020 was an outlier. Aside from that, occupational fatalities have been flat for the past five years.

That's a 6% increase between 2020 and 2021, but 2020 was an outlier. Aside from that, occupational fatalities have been flat for the past five years.

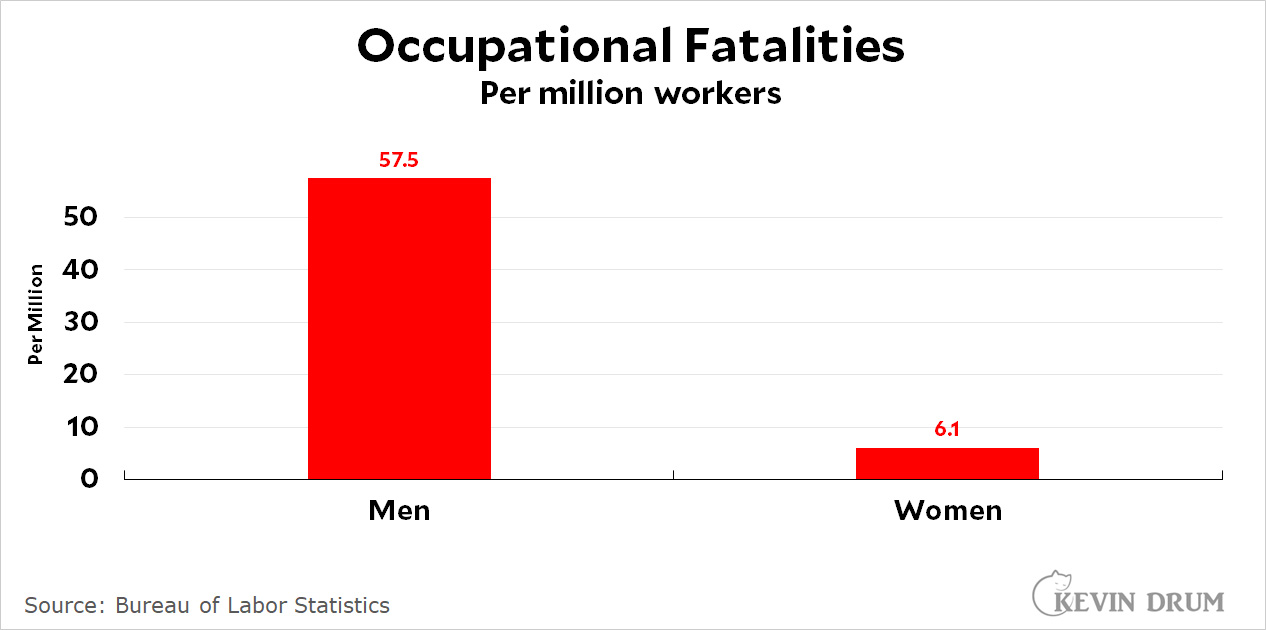

As you'd expect, the fatality rate is far higher among men than women:

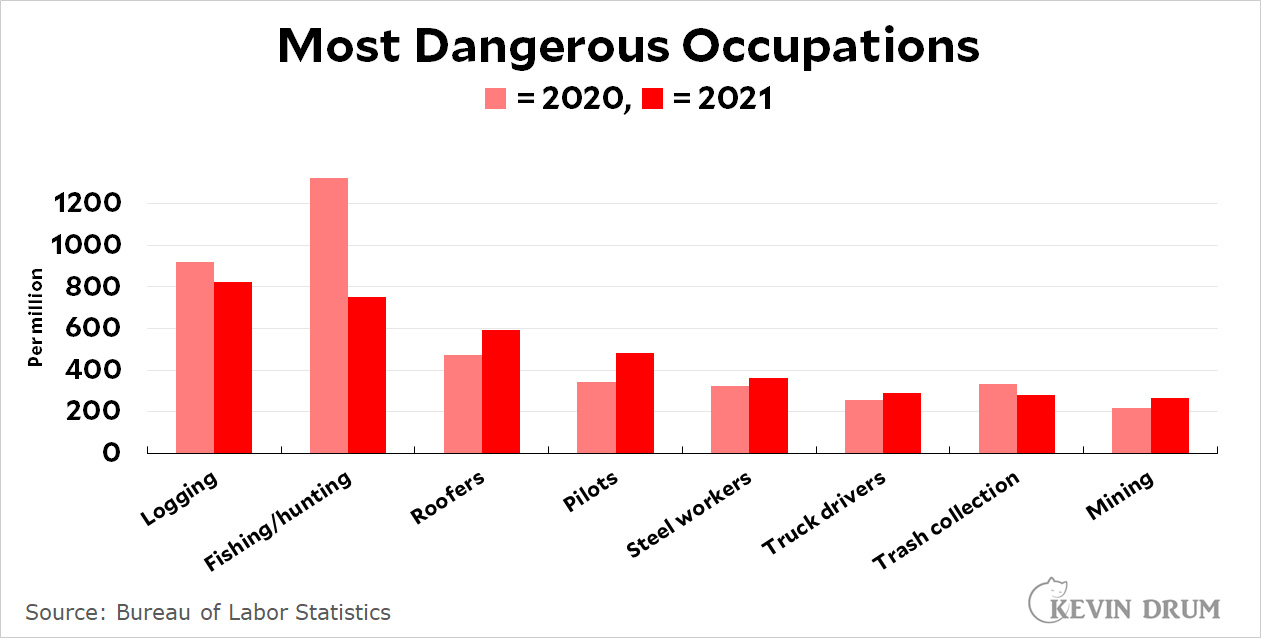

Here are the eight most dangerous occupations:

Here are the eight most dangerous occupations:

Hunting and fishing lost its #1 spot to logging. Note that both of these occupations have fatality rates around 800 per million, which makes them 20+ times more dangerous than the average occupation. I was a little surprised to see trash collection on this chart. It's a more dangerous occupation than I realized.

Hunting and fishing lost its #1 spot to logging. Note that both of these occupations have fatality rates around 800 per million, which makes them 20+ times more dangerous than the average occupation. I was a little surprised to see trash collection on this chart. It's a more dangerous occupation than I realized.

Finally, here are raw numbers for a bigger list of occupations. This is not per million,¹ so the biggest numbers tend to represent occupations with lots of workers.

On the other hand, there are some big occupations at the bottom of the list that are super safe. If you work with computers, you're about as safe as you can get as long as nobody is counting heart attacks from sitting and eating Doritos too much.

¹This is because, for whatever reason, BLS doesn't report it that way. I'm too lazy to look up employment numbers for each category, and I'm not sure I could match the categories perfectly anyway. This is the best we can do.

¹This is because, for whatever reason, BLS doesn't report it that way. I'm too lazy to look up employment numbers for each category, and I'm not sure I could match the categories perfectly anyway. This is the best we can do.

The price of gasoline keeps going down

Lunchtime Photo

I have good news and bad news for local readers. The good news is that the Queen Mary reopens today after a two-year shutdown. And the city of Long Beach is conducting free one-hour tours!

The bad news is that the tours are already all filled up. Easy come, easy go.

Anyway, it turns out the Queen Mary is only reopening because it's cheaper to make the repairs needed to keep it from capsizing than it is to spend $190 million to scuttle it. That seems like a lot, doesn't it? Towing it out to sea and blowing it up can't cost all that much, so I suppose there must be a ton of prep work or something.

You don’t have to know anything to know that crypto is a scam

Is crypto just a stupid scam, sort of like the Tulip Bubble? I'd say the answer is obvious based on one single thing:

Crypto enthusiasts actually tout the fact that anyone can create a cryptocurrency, which is almost the only true thing they say. But it should be pretty easy to see that if something can be created literally out of thin air and an algorithm by anyone who wants to, it's definitionally not something that can have any value except as a bubble-ish collectible.

So yes, crypto is plainly valueless as money. It's value is solely that of a collectible, which can crash anytime the marks finally figure out what's going on. Or when they just get bored and move on to a new scam.

In terms of usefulness, crypto also fails in pretty obvious ways. There are many ways of transferring money (cash in an envelope, Western Union, money orders, wire transfers, hawalas, checks, Venmo, banks, etc.), nearly all of which are quick, efficient, and safe. Blockchains, aside from burning up absurd amounts of electricity, are generally limited in speed and capacity by their very design (though the blockchain folks are working on this). Even in third-world countries there's really nothing crypto can do that traditional money networks can't do better.

Except for one thing: criminal transactions that benefit by being hidden from the prying eyes of public police forces. And even then you have to be motivated: Most cryptocurrency is kept by crypto exchanges, which need to have an address and need to pay employees. This means that prying government eyes can see everything they do. You can do crypto on your own, but it takes some effort.

And of course, ordinary non-criminal types will do almost all their crypto investing through an exchange, because it's as easy as investing in stocks through Charles Schwab. Easy but nonregulated, that is. Criminals might like this, but all those depositors who put $10 billion into their FTX brokerage accounts aren't going to get bailed out by the FDIC anytime soon.

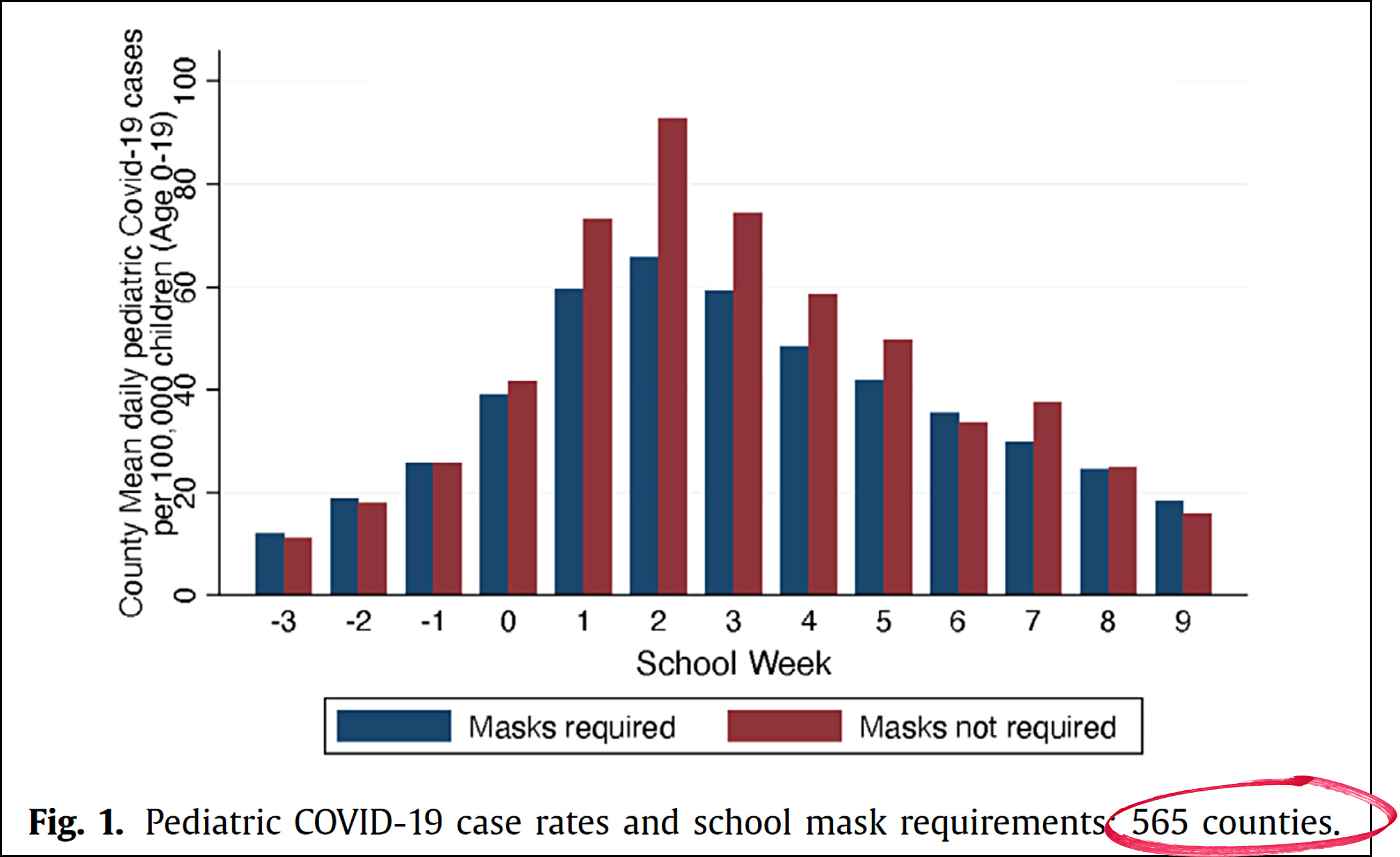

Should we be masking students in K12 schools?

A year ago the CDC published a study of mask-wearing in elementary and secondary schools. They collected data from 565 counties and produced the following results:

With a couple of small exceptions at either end of the chart, schools that required masks were correlated with lower rates of COVID-19 cases in children.

With a couple of small exceptions at either end of the chart, schools that required masks were correlated with lower rates of COVID-19 cases in children.

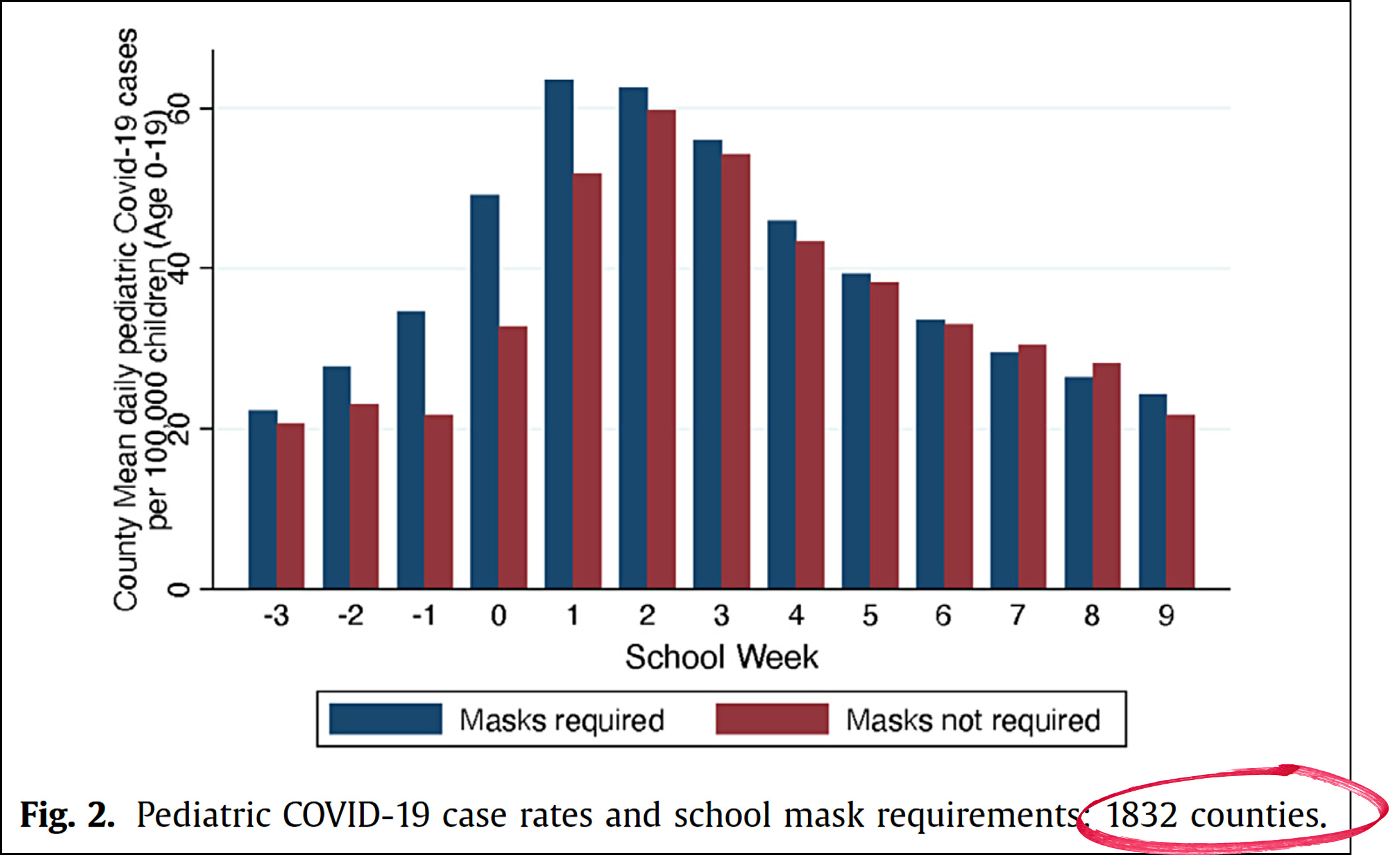

A pair of researchers recently went back to duplicate the CDC study—which they did—and then to extend it to 1832 counties using newer data. Here's what they found:

With a broader set of cases, they mostly found just the opposite of the CDC study: schools that required masks were correlated with higher rates of COVID-19 cases in children.

With a broader set of cases, they mostly found just the opposite of the CDC study: schools that required masks were correlated with higher rates of COVID-19 cases in children.

There are all sorts of methodological issues with these studies, primarily the fact that it's a correlation between schools and counties, which might or might not mean anything. It's likely, for example, that schools which require masking differ in other non-random ways that might produce the differences seen here. It's also important to keep in mind that these studies are solely about masking in school, not masking in general.

That said, what conclusions can we draw? There are probably two:

- When you get beyond week 0 (the start of school) the differences between masking and non-masking schools are pretty trivial in the bigger study.

- Expanding the study changed the results fairly dramatically.

This makes it likely—though not proven—that school masking produces a very small difference that could easily be modestly negative or modestly positive. If I were a school board member using these studies to help my decision making, I'd probably vote to make masking optional. The benefit, if any, is probably not worth the likely degradation in the teaching environment.

But I would require vaccination.

It’s time to change our minds about the cause of our current bout of inflation

E.J. Dionne writes today about inflation. But I would like to dissent in part and concur in part. Here's what he says:

I was among those who did underestimate the immediate threat of inflation in early 2021, so I salute those (notably former treasury secretary Lawrence H. Summers) who warned us about what was coming....[But] at the risk of oversimplifying, inflation hawks examine our situation and see something approaching the situation of the 1970s: inflation roaring out of control and in danger of becoming embedded in the economy.

....But it’s not the 1970s anymore. Jared Bernstein, a longtime adviser to President Biden and a member of the White House Council of Economic Advisers, points to three big differences. First, the inflation of the ’70s was driven by big oil price shocks....Second, unlike now, unions were still strong in the 1970s.

....The third difference: The Federal Reserve has a much better understanding than in earlier years of the “underlying mechanisms of inflation.”

I concur with Dionne's basic thesis: Inflation hawks have spent the past 40 years warning over and over that liberal policies would send inflation spiraling, just like the 1970s, and for 40 years they've been wrong. But eventually we were bound to get a bout of inflation. Even if they were right this time, they're more like a stopped clock than a Swiss watch.

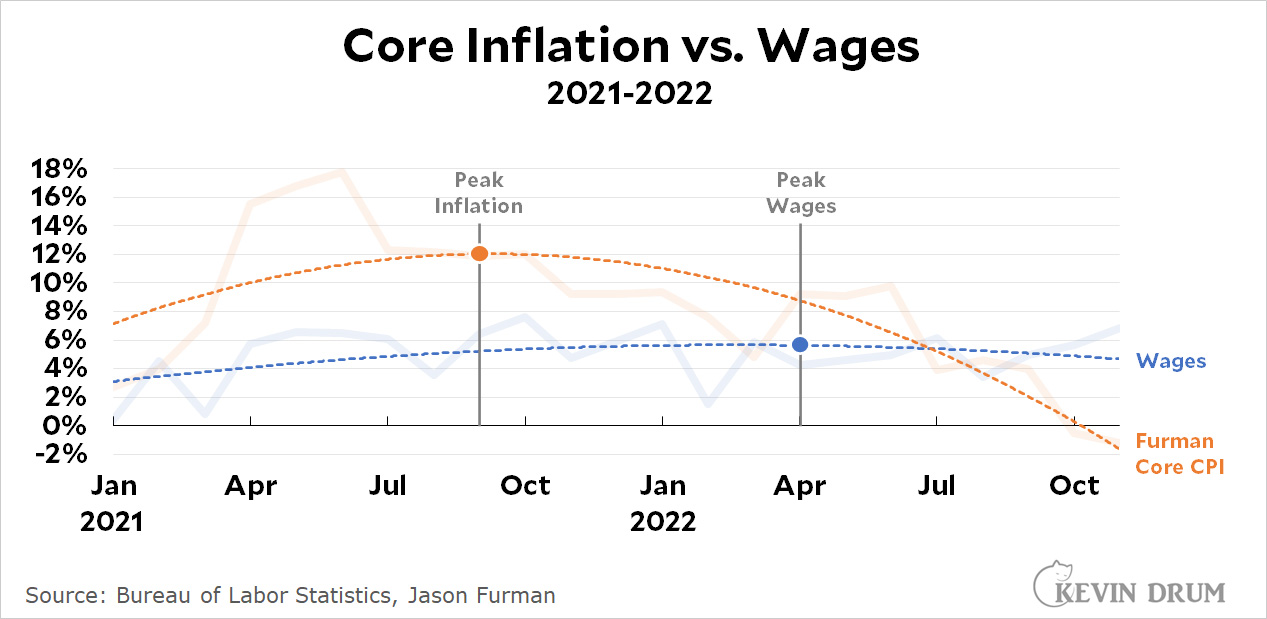

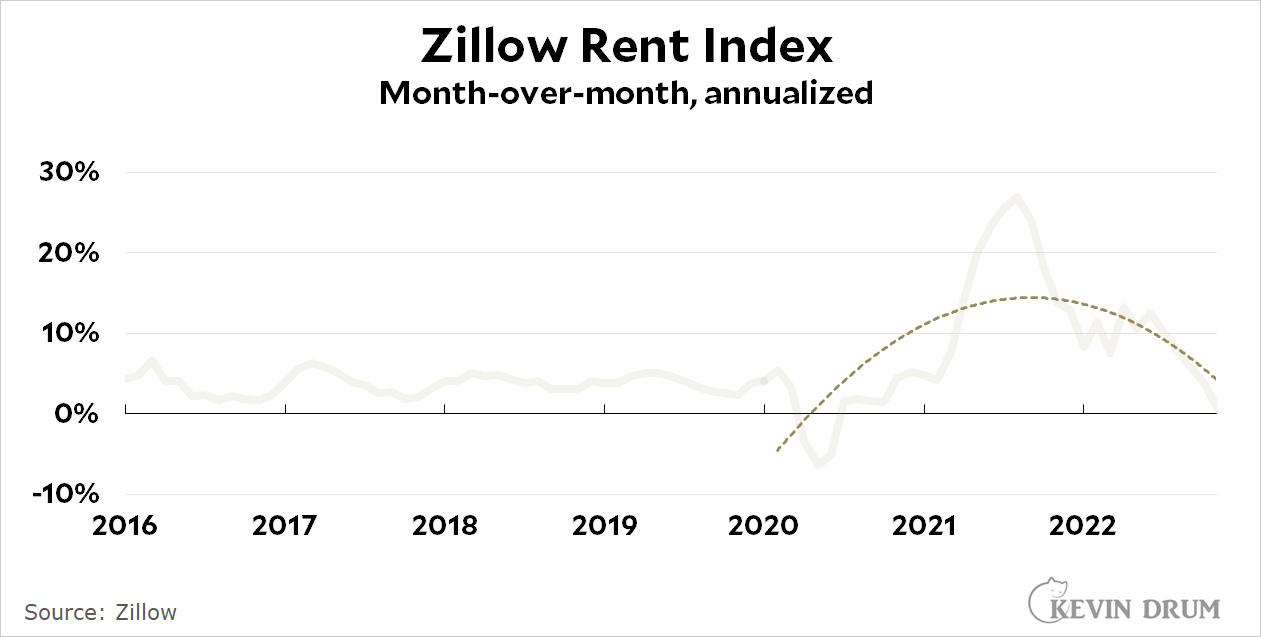

But I dissent from the rest. They weren't right. As time goes by and we get more data and a better sense of what that data means, inflation has started to look very different than we thought. Take a look at this chart:

It's a little complicated. Sorry about that. But the orange line shows Jason Furman's revised measurement of core inflation using actual rents instead of official BLS rent measurements that are six months out of date. What we now know is that rents skyrocketed in mid-2021 and core inflation was even higher than we thought. It hit 18% month-over-month in June of 2021!

It's a little complicated. Sorry about that. But the orange line shows Jason Furman's revised measurement of core inflation using actual rents instead of official BLS rent measurements that are six months out of date. What we now know is that rents skyrocketed in mid-2021 and core inflation was even higher than we thought. It hit 18% month-over-month in June of 2021!

But don't look at that. Look at the trendline. It's just a simple least-squares regression, so it's not rocket science. But it does a good job of smoothing the monthly data, and we now have figures for nearly two years to look at. Here's what it shows us: the trendline for modified core inflation peaked in September 2021 and then started declining.

Team Transitory was right all along. When you look at a better measure of core inflation, it peaked higher than we thought and sooner than we thought. It's been declining pretty steadily for the past 15 months.

As for wages, the blue line shows nominal hourly wage growth over the past two years. As you'd expect, it took a while for inflation to sink in and motivate people to demand higher wages. Its peak is seven months after the inflation peak. Wages are also more stable than inflation, so they're probably going to stay a little high for several more months, especially as workers want to make up for their losses of the past couple of years. But the trendline is still downward, and before very long it will follow the inflation numbers and drop even more.

So I dissent from the view that the inflation hawks were right. Thanks to the pandemic and its artificial rent controls, rents were a way bigger deal in our current bout of inflation than they were in the past.

By deliberately ignoring this—Larry Summers knew the rent data was wrong but pretended it meant the opposite of what it did¹—and by focusing on dumb metrics like year-over-year inflation that are practically designed to mislead in situations like this, we've spent the past year panicking over a delusive view of what's going on.

By deliberately ignoring this—Larry Summers knew the rent data was wrong but pretended it meant the opposite of what it did¹—and by focusing on dumb metrics like year-over-year inflation that are practically designed to mislead in situations like this, we've spent the past year panicking over a delusive view of what's going on.

And in case you think I forgot, there's a second phrase I highlighted from Dionne's column: namely that the modern Fed has a better understanding of "the underlying mechanisms of inflation." Am I permitted a small guffaw? As near as I can tell, literally nobody seems to understand the underlying mechanisms of inflation right now. Oh, there's lots of vague talk about supply chains and government spending and so forth, but nobody can supply a firm explanation of what really happened. So I will:

- Yes, the pandemic artificially reduced supply.

- Rents dropped at the start of the pandemic and eviction moratoriums were put in place. Rental markets overreacted to this, and in 2021 rents spiked enormously for six months before subsiding.

- Artificial fiscal stimulus kept consumers solvent and able to buy at normal levels. However, this was a minor part of core inflation (the best estimates range around two percentage points) and its influence ended quickly when the stimulus ran out.

- Savings also accumulated thanks to the stimulus. Inflation was always bound to decline as those savings were used up.

- Outside of core inflation, the Ukraine war caused energy prices to spike.

- Also outside of core inflation, food prices went up for entirely prosaic reasons: bad harvests, higher fertilizer prices, the Ukraine war, droughts overseas, and pandemic driven labor shortages. It was mostly just an unfortunate coincidence that this happened at the same time as everything else.

The bottom line is that practically everything about this inflationary episode was caused by an unprecedented pandemic that we reacted to quickly. And good for us! It's what we should have done even if we couldn't quite tune it perfectly and we ended up with perhaps a year of heightened inflation.

But it also means that it was all artificial. It wasn't due to underlying monetary policy or out-of-control spending or unions demanding higher wages. It has no analogs in the past and no lessons for the future—unless we encounter another huge pandemic. In that case it does provide a lesson: we mostly did everything right. We'll do a bit better in the future if we respond faster and more competently to the pandemic itself; adopt the same enormous fiscal response we did this time with possibly some tweaks; and maybe go easier on the eviction moratoriums, which aren't really necessary as long as we get the stimulus stuff right. That's probably about it, though I'm open to other suggestions.

MORAL OF THE STORY: We have been fooled all along because we surrendered to fears of the past and didn't look at the inflation data properly. Perhaps that was inevitable early on when data was thin, but today we have plenty of data and we know how to look at it. So now we need to do what John Maynard Keynes allegedly recommended, and change our minds when the facts change. Or, in this case, when the facts become clearer.

Our current bout of inflation was (a) completely artificial, (b) fairly short, and (c) will be completely gone within half a year. Unfortunately, monetary policy has lags, and we're still likely to pay a price next year for the higher interest rates of this year. We can only hope the damage isn't too great.

MY BIG CAVEAT: I don't know what's going to happen in China now that they've eased their COVID rules. In the worst case, they will have massive outbreaks and business shutdowns, which will either raise inflation by causing supply shortages or spur a massive recession that might reduce inflation. Or maybe neither. I have no idea.

¹Earlier this year Summers warned that the BLS rent figures were out of date, which meant official inflation figures for rent and housing were likely to go up this year because they were measuring year-old rents that had already gone up.

Think about this. He was explicitly telling us that inflation figures were going to rise because they were based partly on defective data. This should be a reason to tell us that we should calm down a bit because the official BLS figures were artificially and wrongly too high. Instead he simply said that because of the defect the official figures were going to rise and left it at that.

Chart of the day: Retail and food service sales for November

Retail and food service sales were down 7.9% from October to November:

This is a sizeable decline, though it's not wildly out of the ordinary. Generally speaking, retail sales have been pretty flat during 2022 with the trendline showing a steady but small decrease.

This is a sizeable decline, though it's not wildly out of the ordinary. Generally speaking, retail sales have been pretty flat during 2022 with the trendline showing a steady but small decrease.

That said, down is worse than up. November's decline is probably a result of depleted savings and a harbinger that the economy is already slowing a bit.

Note that these figures are seasonally adjusted, so holiday spending is already accounted for.

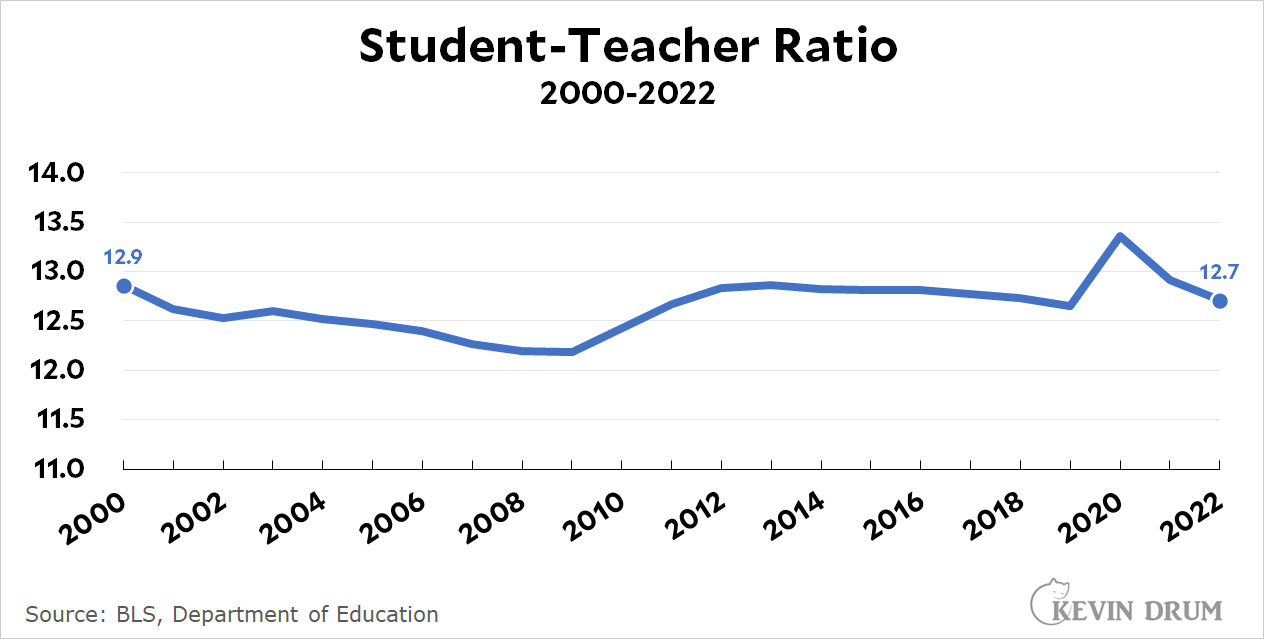

There is (still) no reason to panic about our schools

Today brings yet another story about the catastrophic state of our public schools, this time from Tom Edsall. And I just don't know. These stories keep coming and coming even though the simplest, most straightforward data says there's nothing to it. Here is the K-12 student-teacher ratio for the past two decades:

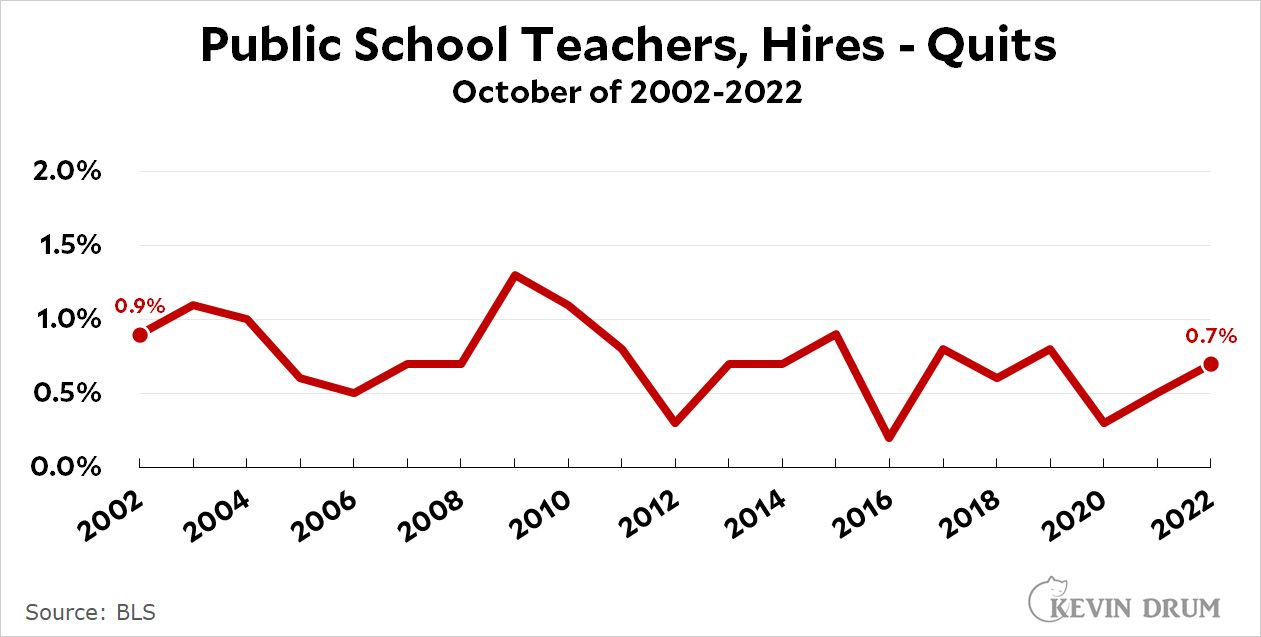

And here is the hiring rate vs. the quit rate for K-12 teachers:

And here is the hiring rate vs. the quit rate for K-12 teachers:

Nothing much has changed. New hires outnumber quits in public school districts by about 0.7%, and this number has been pretty steady for the past decade.

Nothing much has changed. New hires outnumber quits in public school districts by about 0.7%, and this number has been pretty steady for the past decade.

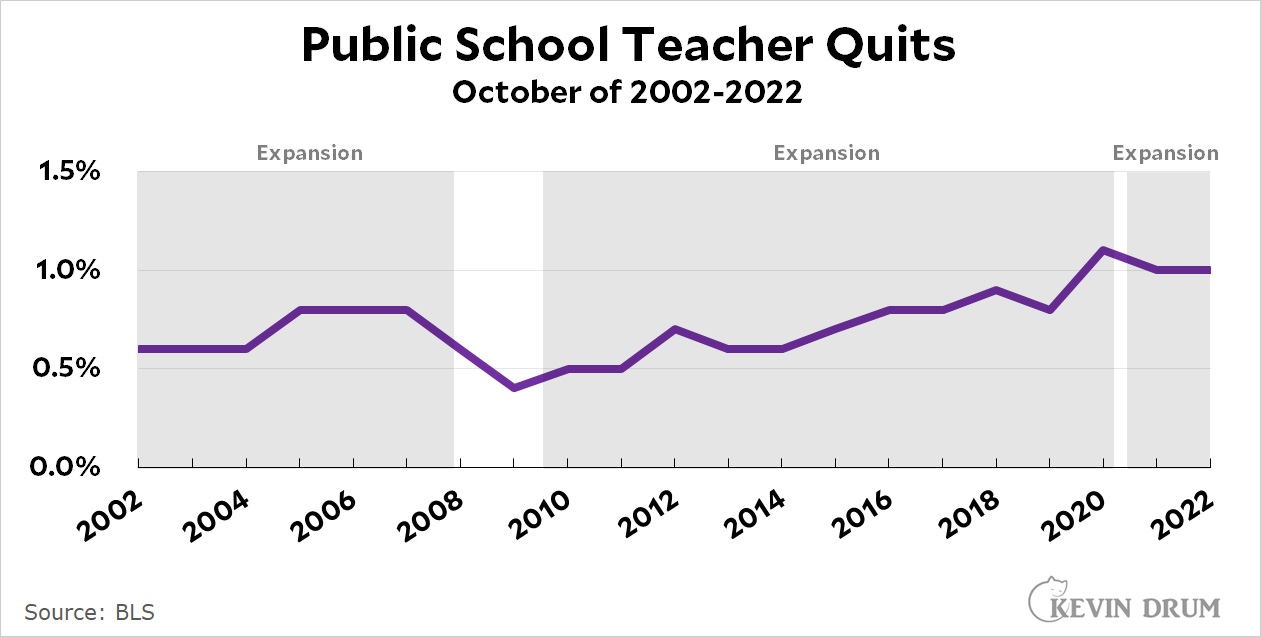

And what about the raw number of quits? As boomers continue to age I'd expect a higher quit rate just due to retirements. But we haven't even seen that. For the past two decades quits have followed their usual pattern: down during recessions, when people are worried about finding another job, and up during expansions, when better jobs seem more plentiful:

Maybe there are specific places that are having bigger troubles than before. Maybe there are specific areas, like bilingual or special ed, that are hurting. Maybe the quality of new hires is going down. All of these things are possible, and beyond that there's no question that the pandemic has had a short-term effect on classroom behavior and overall performance level.

Maybe there are specific places that are having bigger troubles than before. Maybe there are specific areas, like bilingual or special ed, that are hurting. Maybe the quality of new hires is going down. All of these things are possible, and beyond that there's no question that the pandemic has had a short-term effect on classroom behavior and overall performance level.

All that said, if you look at basic national statistics there's nothing very worrisome to see. The pandemic aside, test scores have been up or stable,¹ and the number of teachers has been stable. Unless I'm missing something big, there's really no cause for panic here.

¹Although scores among Black 12th graders fell in the most recent NAEP report.

SOURCES: K-12 enrollment, 2000-2021, here. K-12 enrollment estimate for 2022, here. Public school education employees (November), 2000-2022, here. About half of these are classroom teachers.

Hires and quits data from JOLTS series, here.

Elon’s jet: A drama in three or four acts

Jack Sweeney is a guy who operates a Twitter account called @elonjet. It uses public information to track the location of Elon Musk's private jet and post it in real time.

A few days ago there was a kerfuffle about the account being de-amplified: it still existed but a search for it brought up nothing. I was going to write about this, but Sweeney said the search ban had been in place for months, well before Musk took over. So I skipped it.

Today, though, a month after saying this . . .

My commitment to free speech extends even to not banning the account following my plane, even though that is a direct personal safety risk

— Elon Musk (@elonmusk) November 7, 2022

. . . Musk suddenly took down the @elonjet account entirely. No shadow banning, no search banning, no warning. It's just gone:

To mask the personal nature of this suspension, Musk took down a bunch of other accounts that followed the planes of various billionaires and celebrities. Then he added the following violation to Twitter's privacy policy:

To mask the personal nature of this suspension, Musk took down a bunch of other accounts that followed the planes of various billionaires and celebrities. Then he added the following violation to Twitter's privacy policy:

Twitter promptly went nuts. Regardless of how you feel about tracking private jets, this violation is so broad that it's nonsensical. Are reporters not allowed to tweet about events where some celebrity is about to show up? Or what the president's daily schedule is? Or a car chase on some Southern California freeway?

Twitter promptly went nuts. Regardless of how you feel about tracking private jets, this violation is so broad that it's nonsensical. Are reporters not allowed to tweet about events where some celebrity is about to show up? Or what the president's daily schedule is? Or a car chase on some Southern California freeway?

At the very least, this policy needs to include variants of "routinely" and "permission." That is, it needs to be aimed at people who could be described as stalkers, obsessively tweeting the locations of a particular person constantly. And it needs to include exceptions for explicitly permitted information, like where the president is throughout the day, or announcements obviously designed to publicize someone's location ("Kevin Drum will will be appearing live at Carnegie Hall Friday at 8:00!").

But no one thought of that, I guess. It's just whatever comes out of Elon Musk's brain, and he's shown many times that he's never thought through the nuts and bolts of how Twitter actually works. I imagine this policy will go through the usual Twitter sausage grinder now, getting redefined and reclarified until eventually it's relatively well worded.

And then we'll all go off to Discord or Instagram to see the location of Elon's jet.

POSTSCRIPT: Speaking of that, life must be sweet for Mark Zuckerberg right now. He could announce a new policy saying that a team of ninja assassins will kill anyone who posts insults about Nickelback and no one would even notice. Social media is all Elon all the time, at least for now.

POSTSCRIPT THE SECOND: I expect the political right will suddenly discover that they've always been at war with Eastasia opposed tracking people. Hell the Fourth Amendment forbids it, as anyone with half a brain can see! Stupid liberals.

UPDATE: The @elonjet account was reinstated briefly earlier today, but then suspended again after about an hour. ffs.