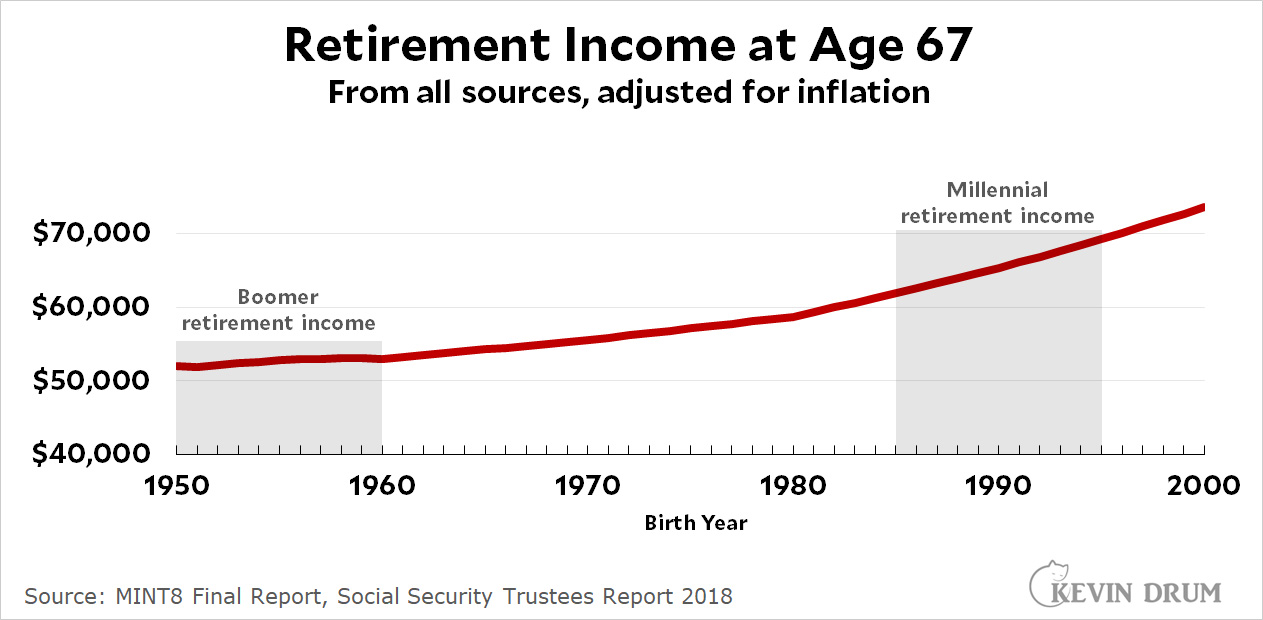

I posted a GAO chart yesterday showing that Millennials had pretty good retirement prospects compared to Boomers, and then mentioned in passing that this "gibes with projections from the Social Security Administration." However, that was based on my memory of an old Social Security report, and I had just warned everyone not to assume that things stayed the same forever. So I looked up the latest report to get their most recent projection:

This projection comes from MINT8, the current version of Social Security's MINT simulation tool. It was published in 2018 and relies partly on economic projections from the 2018 Social Security Trustees report.

This projection comes from MINT8, the current version of Social Security's MINT simulation tool. It was published in 2018 and relies partly on economic projections from the 2018 Social Security Trustees report.

MINT is considered one of the best retirement projections available because it tries to account for all types of retirement income, including Social Security, current earnings from work, pensions (including 401(k) accounts), financial assets, and a few other things. It also has no special ax to grind and merely tries to project income as accurately as possible.

Aside from the basic numbers, there are several things to consider here. First, and most important, Millennials have perfectly good retirement prospects in terms of raw dollars: about $65,000 compared to $52,000 for Boomers.¹ On the other hand, this represents only 75% of average worker income for Millennials compared to 94% of average worker income for Boomers.

As you'd expect, retirement prospects vary greatly for different demographic groups. You can read the report for details. Also, it's worth noting that the reduction in retirement income as a percentage of worker income is largely due to the steady drop in old-style pensions. However, those have long since disappeared for nearly everyone except government workers, which means that retirement as a percentage of current worker income also flattened out long ago. The projection for every birth cohort since 1980 is that their total retirement income will be about 75% of current average worker income.

¹Yes, this is adjusted for projected inflation. It's genuinely more income than current retirees have on average.

I wonder about this, and the wealth post, from the perspective of housing costs.

Yes, I've seen the charts of rent or mortgage payment as a percentage of income, or whatever, that KD is fond of posting. But I'm not sure that really translates - things are just differently structurally now than they were.

I still can't help but wonder about whether, when we look at national scope and population level measures like this, we're missing the actual story. Because it sure seems like there are two different nations and populations: those that live in populous areas where it's more expensive than the income premium earned for living there, and those that live in not-populous areas where it's less expensive but where incomes are also lower (but higher relative to the cost of living than in the more populous areas). You can look at incomes and costs in metro areas that add up to a substantial portion of the US population (NYC, Chicago, LA, and DC alone are about 1/6 of the US population) and see that housing costs in particular have far outstripped income growth.

Is there any way to look at what Boomers paid, as a percentage of income, for their homes and apartments in 10 most populous metro areas when they were 30 (for example) vs. what Millennials pay now in the current 10 most populous (or the same 10, whichever)?

The whole point of this being: if the cost of housing is much, much higher relative to the inflationary adjustment, then it may not really matter if retirement incomes are also going to be higher.

But on the other side of the ledger, retirement is the stage of life when you're typically NOT tied to one particular (expensive) metro area. It's also the stage of life where people - granted a minority - are most likely to own homes outright and have no direct housing costs at all.

Medical costs seem to me to the big difference between retirees and workers. But boomers started retiring INTO high medical inflation (higher than we have now) so I'm not sure that factor changes the scales.

I disagree about not being tied to one particular area. Yes, people move elsewhere when they retire, but aging in place (maybe not THE house you're in, but the area) is important. Not just for health/mobility, but the social components of health are also very important.

I agree 100 percent! My parents aged in place into their 90s, at age 92 and 93 we finally had to move them to a nearby assisted living apartment. Being able to interact with their friends, go to water aerobics, visit their fave pastry shop and whatnot kept them younger than their age for a very long time.

My cousin could truly receive money in their spare time on their laptop. their best friend had been doing this 4 only about 12 months and by now cleared the debt. in their mini mansion and bought a great Car.

That is what we do.. https://earningblue.blogspot.com/

But crime is down! Oops. Walmart mass shooting in Virginia. Oh well.

Hunter Biden! Hunter Biden! HUNTER BIDEN!!!!

The incoming Congress is on it. Uh, no. Not that "violent crime" thing.

Thanks for concern trolling. In a country of 300+M people and 400+M guns, a mass shooting will happen somewhere pretty much every week (if not every day). Nothing can be done about it because Second Amendment and because contrarian cynics like yourself number in the millions and sabotage any effort to improve our country. Fuck off.

These days, all it takes for a guy to become a viable Republican candidate is to be an internets troll.

Nothing can be done about it because Second Amendment

Nothing can be done about it because of the deliberately erroneous interpretation of the Second Amendment.

Fixed!

Hey Kevin, any good charts looking at the population trends moving forward? If population growth slows or reverses that will change a lot of things. Less people paying into Social Security, but also maybe less pressure on housing, therefore reducing prices. There are rural areas and old cities that have lost population to the point schools are being closed and it is hard for remaining businesses, but housing can be found for cheap.

The problem is that most jobs still need to be done in specific places, and most people still need income from jobs to live. So it doesn’t matter for a good 75+% of the population if nice big cheap homes exist in 40 states, if 75+% of the good-paying long-term jobs exist in the other 10 states.

And if population growth ends or reversed, those rural areas will be even worse off. Countries that already have experienced population stagnation or shrinkage are littered with lots of villages, towns and cities that survive solely due to government spending, because they have no economic reason for existing.

I was thinking of the cost of housing for retirees, but with WFH others could take advantage of lower cost housing outside of major cities.

His data is from the Social Security trustees report, so the population trends are already factored into that side of the equation.

My cousin could truly receive money in their spare time on their laptop. their best friend had been doing this 4 only about 12 months and by now cleared the debt. in their mini mansion and bought a great Car.

That is what we do.. https://earningblue.blogspot.com/

Ugh. Not only do we have the nihilistic concern trolls, but now the get rich quick trolls have discovered Kevin’s site and its lack of blocking tools.

Since MINT includes Home Equity, how much of the increase is just housing costs?

There is a HUGE difference between boomer retirement and everyone younger.

We got the fantastic stock market. I believe the best market in history was from 1982 to 2022.

Those 40 years were AMAZING.

Now, we no longer have the significant increase in population that will never happen again.

Does anyone really think the Dow will be far noth of one million in 2062?

Those poor suckers who are coming into the work force now will be LUCKY to get half of the returns that we got.

I remember that I had a net worth of $100k when I turned 30 in 1989.

Kids of today are smarter and probably work harder but don't have the advantages we do.

I hadn't even though of this. Definitely also a factor, especially in the predictions going forward.

But if you consider boomers being born as late as 1964, the younger boomers and Gen X haven't reached retirement yet - how big will the losses be in the 2020s?

re: "government pensions". Don't know about state and local, but the feds retirement system was changed in the 80's, reduced the defined benefit portion and added a defined contribution portion (i.e., TSP). Some of us are still on the old CSR system, but we're dying away.

Correct the switchover happened in the mid 1980s, it's a small annuity, 6% contributions if you contribute enough and there's also a Roth style TSP.

I wonder what affect globalization had on boomer retirement. My understanding is that the ones adversely impacted (ie. lost their jobs) never really recovered and have reduced retirement savings as a result - reduced social security payments and lower contributions to to retirement accounts due to lower wages. I know that for a fact as that is what happened to me.

Turns out in my case I was in the right profession - IT, just in the wrong industry - Insurance. I was able to keep working somewhat throughout the last 20 years but at the expense of my retirement not to mention the impact on my family.

This has been going on for almost as long as I have been working. If someone came up with a number of 20 - 30% of baby boomers losing ground because of globalization I wouldn't be surprised.

Pingback: Millennial wealth is suddenly looking very normal – Kevin Drum