Believe it or not, I came home from Virginia with a homework assignment. The assignment was to answer this question: Is it really true that the share of wealth owned by Millennials is much lower than the share of wealth owned by Baby Boomers at the same age?

The simple answer is: Yes. The better answer is: Where did this meme come from in the first place? Who cares about population shares, anyway? Wouldn't it make more sense to look at per-capita wealth instead?

Yes it would. In fact, it's so obvious that I truly do wonder where this share-of-wealth meme started. But let's put that aside and move on.

Unsurprisingly, what follows is a bunch of charts. But don't get impatient with them! I'll eventually get to student loan debt, housing costs, and other Millennial issues.

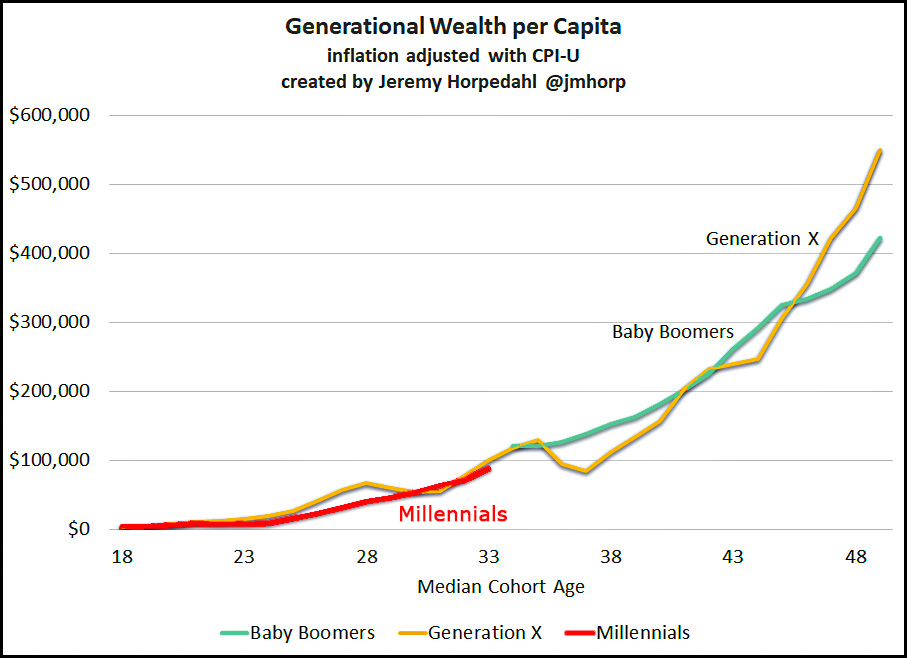

First off, here is wealth per capita for both Boomers and Millennials:

This comes courtesy of Jeremy Horpedahl, who pulled his data from the Federal Reserve’s Distributional Financial Accounts. This is more or less where everyone gets their data on wealth, and for now I'm going to assume that the Fed's data is reasonable and that Prof. Horpedahl has done his sums correctly.

This comes courtesy of Jeremy Horpedahl, who pulled his data from the Federal Reserve’s Distributional Financial Accounts. This is more or less where everyone gets their data on wealth, and for now I'm going to assume that the Fed's data is reasonable and that Prof. Horpedahl has done his sums correctly.

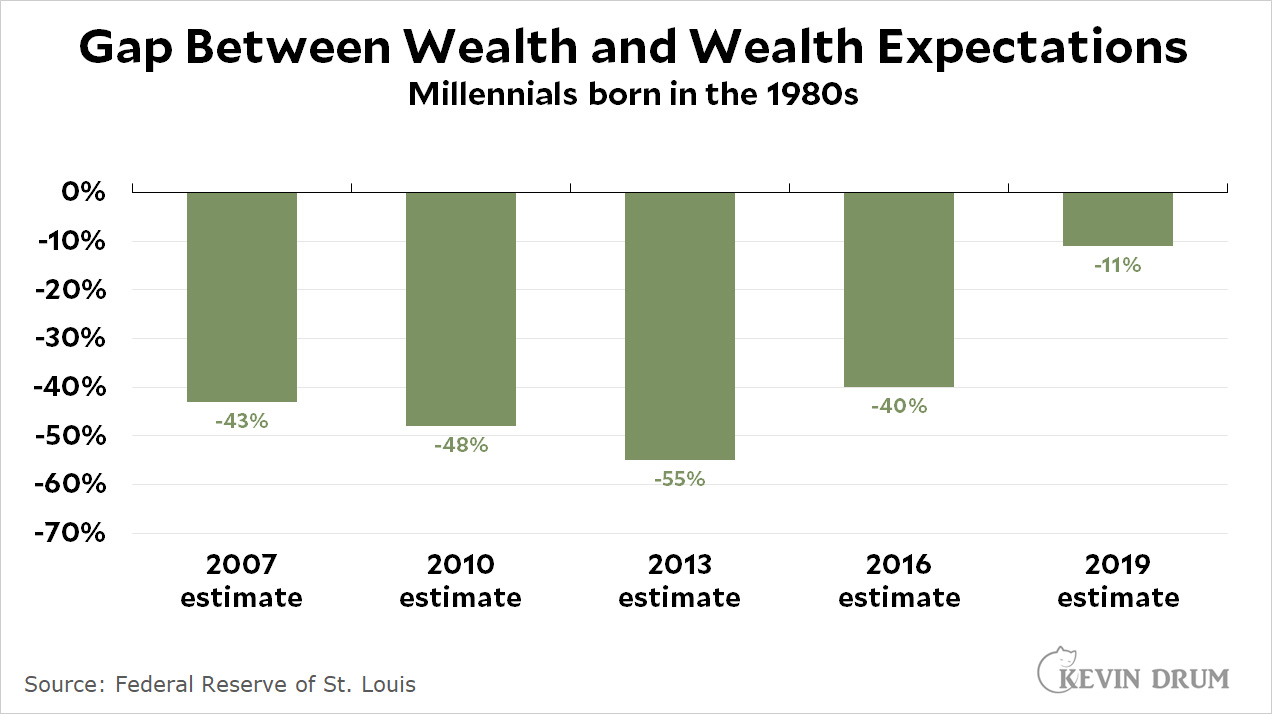

Here's another chart courtesy of the Fed:

The raw data for this chart comes from the Fed's Survey of Consumer Finances. The authors modeled expected wealth from the five most recent editions of the SCF and then compared it to actual wealth by generation.

The raw data for this chart comes from the Fed's Survey of Consumer Finances. The authors modeled expected wealth from the five most recent editions of the SCF and then compared it to actual wealth by generation.

As you can see, in 2007 Millennials were 43% below where they should have been. This continued through 2016, but in 2019 suddenly Millennials caught up. They are now only 11% below expectations and seem likely to make that up fairly soon.

There are two lessons to learn here. First, you have to keep up with the data. Things that we believe because we've seen them over and over don't necessarily stay true forever. Second, when you're dealing with small numbers, small changes can be a big deal.

For example, one of the reasons for the big jump in 2019 is probably student loans. When Millennials were in their 20s, they had lots of students loans and small incomes. Those loans had a huge impact on their ability to accumulate wealth. Today, many of those loans are paid off and Millennial incomes are higher. Put together, a big jump in wealth accumulation is what you'd expect.

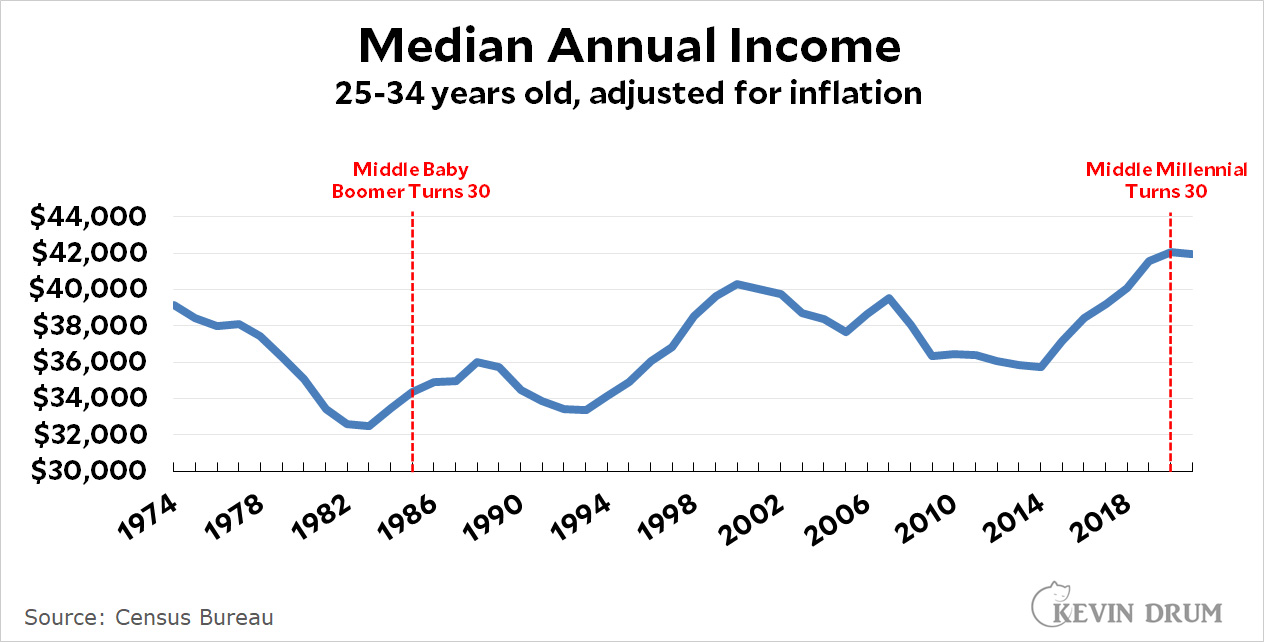

Now let's take a look at some other stuff. First up is plain old income:

Incomes haven't gone up much over the past few decades, but it's nonetheless the case that Millennials make more money than Boomers did at the same age.

Incomes haven't gone up much over the past few decades, but it's nonetheless the case that Millennials make more money than Boomers did at the same age.

Here's a GAO look at retirement assets:

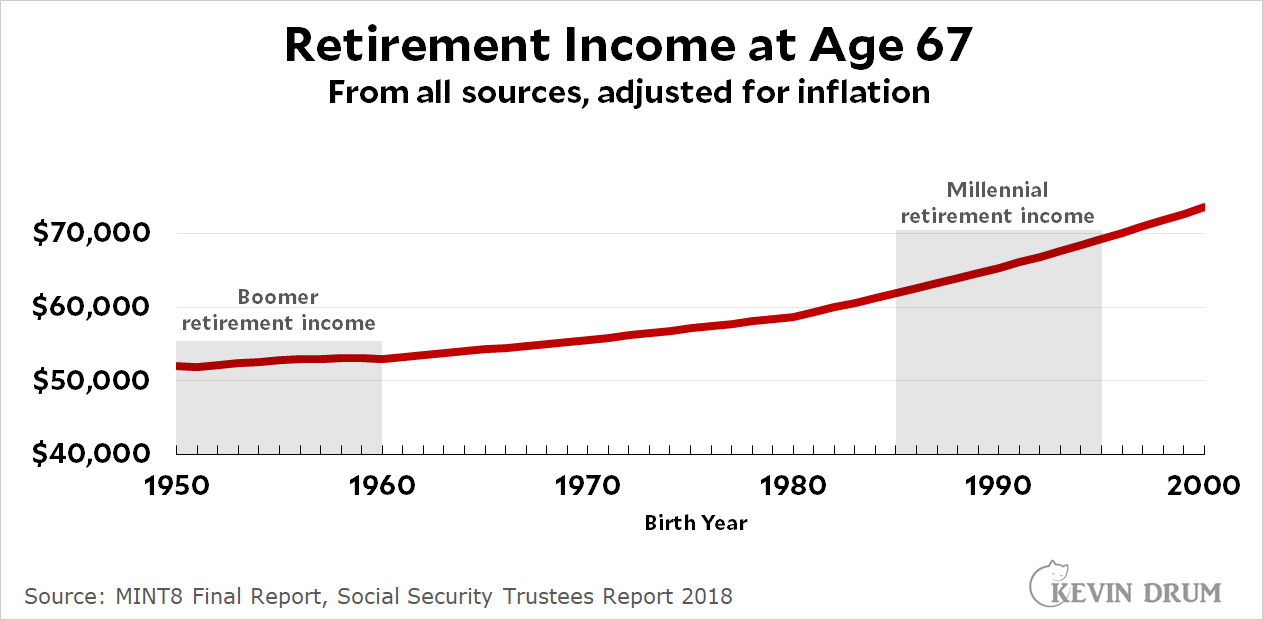

Millennials are doing well, and this data gibes with projections from the Social Security Administration:

Millennials are doing well, and this data gibes with projections from the Social Security Administration:

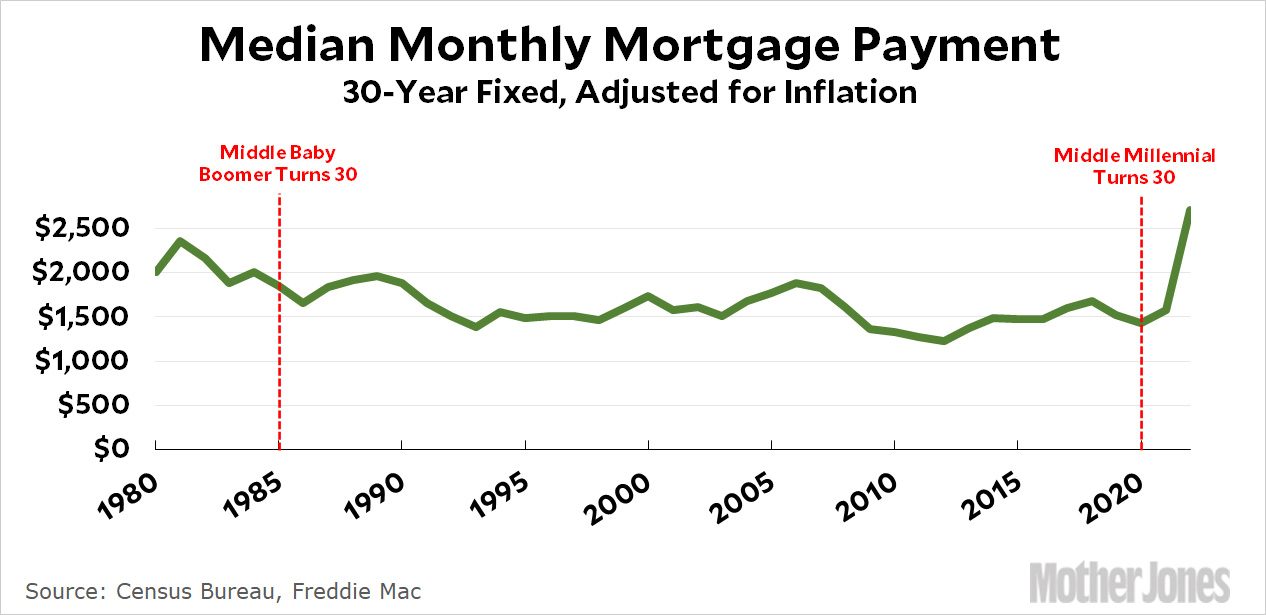

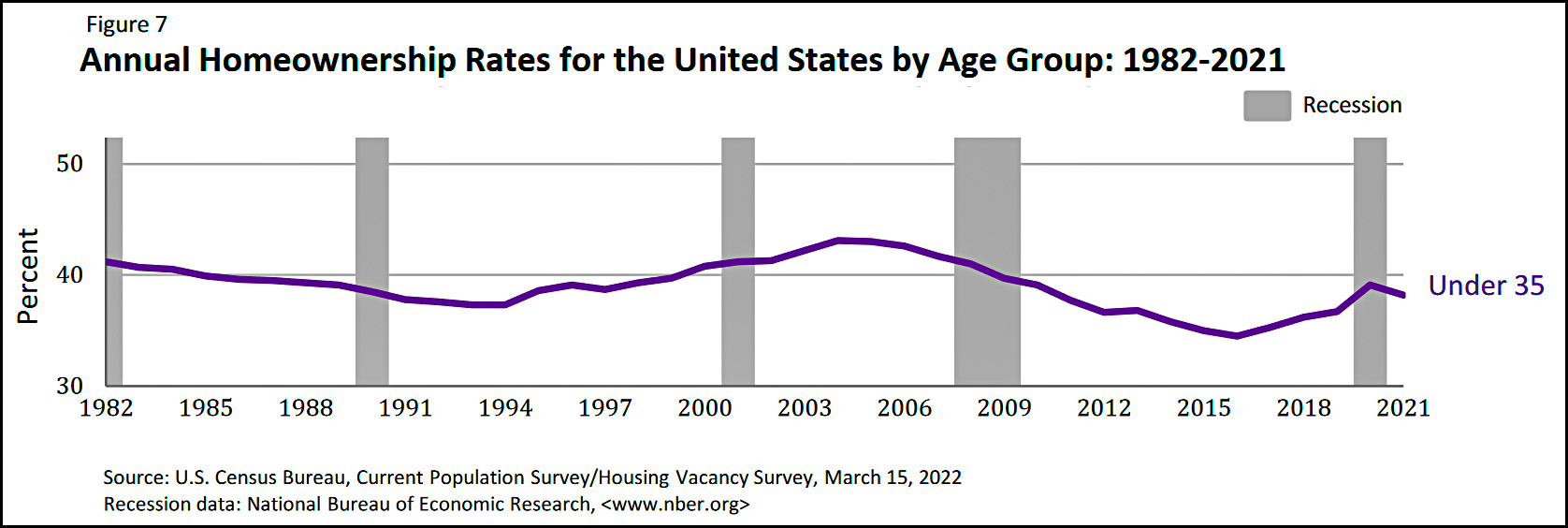

Up until this year, actual mortgage payments had been dropping. The middle Boomer had a monthly payment of about $1,900 at age 30 compared to the middle Millennial with a payment of $1,500. However, homeownership is still down among Millennials:

Up until this year, actual mortgage payments had been dropping. The middle Boomer had a monthly payment of about $1,900 at age 30 compared to the middle Millennial with a payment of $1,500. However, homeownership is still down among Millennials:

Homeownership dropped for a decade and then recovered, but today's Millennials still have a homeownership rate that's less than the rate of Boomers in the mid-80s. The difference is slight, but it shows that the Great Recession really did take a toll.

Homeownership dropped for a decade and then recovered, but today's Millennials still have a homeownership rate that's less than the rate of Boomers in the mid-80s. The difference is slight, but it shows that the Great Recession really did take a toll.

The big lesson I take away from all this is that student loans have probably been skewing these numbers for the past decade. Millennials really have borne the brunt of the student loan explosion, which means that college-educated Millennials have been forced to lead a more austere life in their twenties than Boomers did. However, the amount of wealth accumulation for any generation during their twenties has always been trivial, so once their loans are paid off Millennials catch up pretty quickly in the wealth department.

In any case, older Millennials (age 30+) are finally entering a phase of life where their loans are paid off and their jobs are paying well. As more and more Millennials exit student loan hell, the true state of their financial status becomes a lot easier to see. Roughly speaking, they're better off than Boomers in almost every respect.

POSTSCRIPT: All the usual caveats apply here. These are all averages, and lots of people are above or below them. Housing costs more in big cities. And most of the results I've presented here are for older Millennials. Younger Millennials are still affected by student loan debt and will not begin accumulating significant wealth for another 5-10 years.

Isn't this the old 'poor people these days are not actually poor because look!! they have _____ (toilets, applianes, TVs or phones)' argument?

Or....

You are doing fine because GDP is rising, stop worring about distributional matters, I'll post about this when I get back from the carribean!

I don't see Kevin engaging in either of those practices here. He's pretty clearly using wealth and income indicators—hard numbers.

+1

But it's the same argument. Society in total becomes a bit wealthier each year and over time it adds up.

Using money, wealth or the material items you can buy with that money/wealth still amounts to the same argument.

It can be true that society is both wealthier than it was 30-50 years ago, and the distribution of that income can have grown much worse.

Discounting the distribution because we all have TVs is always an odd argument.

That’s the “fun” part, isn’t it. Picking and achieving the point on the continuum between what you assert Kevin is suggesting and a philosophy tantamount to poverty being until either everyone eats caviar or no one.

One wonders where they might have been without ridiculous student debt, then.

That said, the housing thing may look reasonable in aggregate, but such things are very location-specific; many here in Denver haven't owned a house and never will except on the crawling edges of the sprawl.

Yeah, I think this one's a bit "what're you kids complaining about?" on Kevin's part.

My cousin could truly receive money in their spare time on their laptop. their best friend had been doing this 4 only about 12 months and by now cleared the debt. in their mini mansion and bought a great Car.

That is what we do.. https://earningblue.blogspot.com/

Well my cousin has balls swoll up the size o f coconuts. Wanna see?

You're mixing median and average all over the place.

Rather than squeeze the Millennials by running the per-capita chart out well beyond their age and wealth today, try stopping the chart at their age and show us greater detail down at that section. No idea what we’ll see but I suspect it would be interesting.

I see we now know what became of Jeffrey. From telling everyone on the plane he was four years old to telling everyone about his cousin. https://m.youtube.com/watch?v=Fs0cYJUqJys

😒😒 ༼ʘ̚ل͜ʘ̚༽

It's normal for people to not have money in their 20s. You get paid little and you have a lot of expenses.

By the time a generation reaches their 50s, they on average have a nice nest egg. It happens over and over. I think of my grandparents who worked as domestic servants in their 20s (thanks, Great Depression!), but were taking vacations in Hawaii by age 60.

Millennials will probably be extremely well off in their 50s. They had a particularly rough 20s, because it coincided with the Great Recession, but will likely see massive wealth accumulation hit during their 40s.

Can't wait for all the complaints 15 years from now from Gen Z, and whatever comes after them, about how cushy things are for the Millennials!

Or rather, University graduates will be perfectly fine, for that age cohort, while the non Uni grads will be significantly worse for same age cohort.

However this bifurctation will be ignored and obscured by bankrupt "generational" analysis as if one age cohort are having a single common experience when in fact what Left and Populists are referring to generally are in fact a sub-set of the age cohort.

So your grandparents made bank during the 40s and 50s, one the greatest economic periods in American history, so people in the future will be just as lucky? Hm...

It is interesting how the discourse collapses Millenial College Graduate (apparently approx 40% of overall national population) to Millenial, erasing the non-college graduates.

Not good news for me, a Gen-Xer who will possibly never stop paying off student debt.

Pingback: Good news for millennials | Later On

Pingback: Another looks at Millennial vs. Boomer retirement – Kevin Drum