The Washington Post summarizes the results of a new Gallup poll today:

As prices creep higher for food, gasoline and other necessities, nearly half of U.S. households say they are feeling the financial strain, according to a Gallup survey released Thursday.

Roughly 45 percent of households are being hurt by price increases, according to a survey of nearly 1,600 people conducted Nov. 3 to Nov. 16. About 1 in 10 said that hardship was severe enough to affect their standard of living, while 35 percent described the hardship as “moderate.”

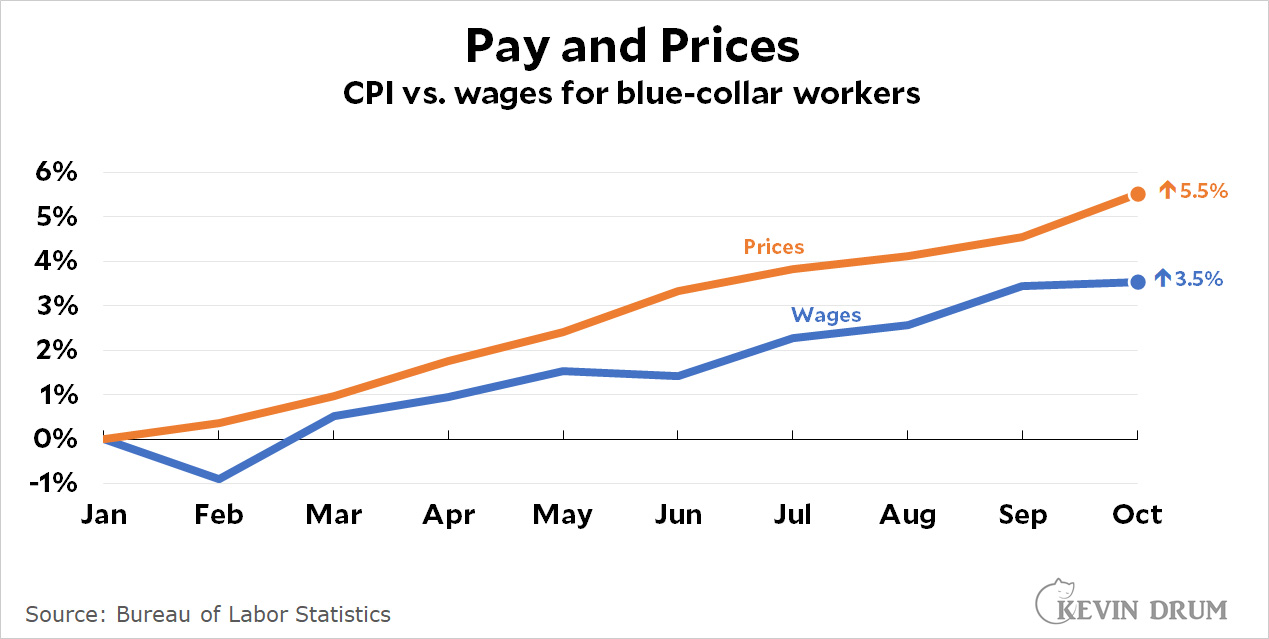

I don't want to be in the business of telling other people how to feel, but this is crazy. Here are pay and prices since the beginning of the year:

As a God-fearing liberal, I am always unhappy when pay falls behind inflation. I want to see working and middle-class folks making more money, not less. That said, a net decline in spending power of 2% just isn't enough to cause very much hardship for anyone who wasn't feeling it already. These poll results make no sense.

As a God-fearing liberal, I am always unhappy when pay falls behind inflation. I want to see working and middle-class folks making more money, not less. That said, a net decline in spending power of 2% just isn't enough to cause very much hardship for anyone who wasn't feeling it already. These poll results make no sense.

Now, obviously this is a bell curve, and some people are feeling inflation worse than others. It all depends on what you buy a lot of. But the number of families facing any noticeable hardship has still got to be tiny.

This is the kind of thing that should make us question the role of the media in all this. Please note: I'm not saying that no one would notice higher prices if the media didn't report it. The price of both a pound of hamburger and a gallon of gasoline have gone up 50 cents since May, and that's something people are going to notice. Nevertheless, the media's job should be to put highly visible price increases like this into context—and in this case the context is that there are some outliers, but on average prices have gone up only slightly more than wages.

But it's been just the opposite. If anything, reporting has made inflation look worse than even the outliers suggest. This is why you get people vaguely guessing that prices in the supermarket have gone up 100% or so. And it's why people report serious hardship from inflation even though the vast majority of us are feeling only a tiny effect.

This kind of context setting is, in theory, one of the most important things the media does. And obviously it's a matter of judgment. Is inflation better or worse than it seems? Is the COVID-19 pandemic better or worse than it seems? How about global warming? The demise of democracy? The answers aren't always simple, and this kind of judgment is often one of the hardest parts of journalism.

Then again, sometimes the evidence is clear and these judgments are pretty easy. This is one of the easy ones.

It's the latest in the interminable series of poorly-designed surveys and focus groups with meaningless "findings" that have done so much to bring the American public opinion industry into disrepute. "Hardship" means "a situation in which your life is difficult or unpleasant, often because you do not have enough money" (Collins), or "severe suffering or privation" (Oxford). Hardship that doesn't affect your standard of living is a contradiction in terms.

Coming tomorrow: A majority of members of a Buttcrack University focus group of 12 randomly-selected Americans believes the Supreme Court is under the control of the Vatican. Listen to the podcast discussing the profound implications for moves to increase the size of the court.

Families with children are now getting more money by way of the increased child tax credits--which are being sent out monthly.

People might be complaining about inflation--but maybe is the fact that stimulus checks have stopped.

If it bleeds, it leads....

The March-June period will be telling next year. Declining deficits and spending. But a tightened pre-crisis labor market with rising inventory driven by a boom in auto production. Sounds disinflation like as I don't think the pre-crisis labor market was in a boom. That is 2-3% unemployment.

I am astonished at Kevin's continued minimizing of inflation, which has significantly affected those lower down the economic scale.

He looks at wages and completely ignores savings and people on fixed income.

The post is Card Stacking Propaganda:

Excluding important elements to present a rosy scenario, or minimizing the omitted elements "But the number of families facing any noticeable hardship has still got to be tiny." Tiny! I don't have that value on my calculator. What is it?

The problem is it can't last without excessive spending. Producers are already ordering well above replacement level goods.

The largest group of “people on fixed incomes” - aka Social Security recipients - are getting a massive raise in January.

Social Security is not a fixed income. It rises with inflation. It's going up 5.9% in January, if I remember the number right. Traditional pensions generally are fixed income, and never rise post retirement.

Lots of websites disagree with you.

https://www.newretirement.com/retirement/retirement-101-what-is-fixed-income/#:~:text=Your%20Social%20Security%20payments%20may,considered%20to%20be%20fixed%20income.&text=There%20are%20many%20types%20of,may%20be%20used%20for%20retirement.

Google "fixed income" and "social security" and thousands of websites cite social security as a form of fixed income (as opposed to wage income, I suppose, which you can influence by working more hours, getting promoted, etc.).

Also, people getting traditional pensions are almost always also getting social security... so their *overall* income (pension + social security) will also be going up in January... and thus by your definition, those people aren't on fixed incomes either. Their social security portion of their total income will always "rise with inflation" too.

What were the response frequencies when the CPI was rising at 1 - 2%? Without a baseline, these numbers are pretty much meaningless.

I'm feeling it a little bit, for a couple of reasons:

1) My rent went up by $100/mo two months ago. Property values have increased by about 25% here over the last year because of all the people moving to the new Rocky Mountain "it" town. At the same time the city imposed a 20% surtax on water bills because of the drought. The combination of increased taxes and increased water costs made my rent go up. I blame Joe Biden.

2) In March my employer went from a once a month pay schedule to a bi-weekly pay schedule. This resulted in a decrease in my income by about $400/mo, except in the two months of the year that I get three paychecks. Those months are great, but on balance it sucks. Once again, I blame Joe Biden.

If I was still getting paid once a month I would notice inflation, but it wouldn't bother me. With the change to the pay schedule and the increase in rent I've decided to withdraw money from my investment account to pay off my car two years early.

I have noticed some price increases at my local bar and grill but they aren't bad except for the cost of steaks. The place buys only local beef from small producers and here in Montana the drought has taken a toll on beef producers. Lots of them have had to sell off parts of their herds early because of the cost of hay (the local hay crops here sucked this year because of the drought). This has driven up the cost of finished beef. Burger may be up a little, but a high quality steak is now stratospheric. Once again, I blame Joe Biden.

And gas? Gas is a bit high around here for this time of year but is generally in line with typical summer prices in the tourist trap of a town. Of course last year at this time of year prices were silly low, not as low as they were in the spring (I seem to remember paying something like $1.79/gal in May before people started driving to Yellowstone and crowding the damn place).

So, yeah, I notice it a bit, but not really enough to dent my budget. I am middle middle class as far as income is concerned, but I'm a SINK (single income, no kids). I don't make enough to be a SINKHOL (add holy outrageous lifestyle). I blame Joe Biden.

+1

If I were you, I’d be careful not to get on Joe Biden’s wrong side. He can send another drought, y’know. Just sayin’.

My rent went up by $100/mo two months ago.

My rent has gone up every year since I started renting 20 years ago. That's not anything Joe Biden, Donald Trump, Barack Obama or George W Bush did. That's just life as a renter... the landlord almost always has more power in the negotiating relationship than you do.

Also in the WaPo article:

"Prices jumped more than 6 percent in October, according to the Bureau of Labor Statistics (BLS), the largest annual increase in about 30 years."

That would be alarming news, if prices jumped more than 6 percent in October. But of course, that's not the case. Prices jumped 0.9 percent in October.

A $100.00 grocery bill in September would have cost $100.90 in October.

There is virtually nobody who would even notice the difference. If anyone was feeling financial strain in October, it was because they were feeling financial strain already -- not because their grocery bill went up 90 cents.

October's annualized inflation rate of 6.2 percent reflects a rise in prices during an entire year, not during a single month. Likewise, a hike of $6.20 in the grocery bill after one year would not likely cause financial strain. But anyone already under financial strain would continue to feel financial strain, all other things being equal.

For perspective, how does an annualized inflation rate of 6.2 percent compare with high inflation of the past?

Rather favorably. In the 1970s and '80s, the US experienced periods of both 65 consecutive months and 31 consecutive months when annualized inflation was never below 6.2 percent. If inflation for the single month of October persists every month for another 2 1/2 to 5 1/2 years, then we would have an inflation problem comparable to the past.

Having taken my first vehicle loan during that time (18%) and looking at mortgage rates (11% or so) during that period I realized I would never own a home.

Double-digit inflation and double-digit rates for loans! The good old days only look good to people who don't remember them.

My first mortgage rate was about 9% in the '90s. The average 30-year fixed mortgage rate today is 3.11%.

Either banks suddenly like to give loans at negative real interest rates -- or they understand the current spike is prices is temporary.

yeah when I got my first mortgage 30 years ago it was like 9.4% or something in that range and people were celebrating that they had finally gotten below 10%

My mortgage now is 2.9% The payment is about the same even though the house is nearly double the price of what that first one was.

My wife and I bought our first house in 1984 - 14% mortgage interest rate. Fortunately the deduction helped absorb a lot of the shock - and it dropped to 9% the next year (we refinanced - that was an absolute no-brainer - saved the costs of the refi within 2 months. Things kept dropping and we refinanced any time the costs paid off within 6-9 months. We did 4 refis over about 7 years.

Right now we're at 2.75% after a refi in April. The monthly payment is under $1200 and that includes a pretty good chunk going to principal. That's quite a bit less than the rent on a 3 bedroom plus large bonus room house in Bellingham.

So-called "criminal" convictions undertaken by CCP-dominated deep-state socialists are a badge of honor to the victims of such persecution. The lack of such convictions associated with Democrat administrations is a measure of just how corruptly un-American the Democrat party has become.

Wrong thread. But that doesn't make it any less true!

Ask my inlaws.

"The dollar store is now $1.25!!!" They talk about this every time I see them.

"Gas!!!" "How much do you drive?" I ask. "Oh a couple thousand miles a year!" In a kia.

I would like to agree with Mr. Harbin who brings important perspective to this question.

However, I'd like to take this in a different direction...Inflation such as it is, doesn't bother me at all...except for maybe high CA gas prices and this doesn't really both me much, (and I don't blame Mr. Biden for any of this).

On the other hand, the continuing Covid crisis, just got my Moderna booster shot yesterday at Costco and it really knocked me for a loop, higher temperature, aches and pains and inability to sleep, (though I am fine now...it was just a surprisingly difficult 24 hours....

Inexplicably, I semi blame Mr. Biden for the massive, for the truly massive life changes imposed on me by Covid.

I know this makes no sense...but Inflation? Pift...doesn't matter to me at all, it is something I can steer my way through...no problem, no real life changes. However, Covid, that bastard has materially changed my life and even my consciousness.

Covid is what I am angry about, not Inflation.

Just sayin`

Best Wishes, Traveller

What should Biden do that he hasn't done already? He's already rolled out a vaccine mandate for large businesses, the military, and government workers and had the federal government do everything it can to get shots in people's arms. He can't control how individual people react to the booster (fwiw, my Moderna booster knocked me on my ass for day as well). He isn't recommending bleach injections or deworming paste as a cure.

So what's he to blame for?

This is almost all the fault of the media. They are lazy lazy lazy, and they yearn to have Trump back.

I mean probably not far from half are going to say they are having some amount of financial hardship at any one time. This survey seems pretty reasonable to me.

Given how many people live paycheck to paycheck...yes, a lot of people are going to notice. They dont have much wiggle room, so an increase in one expense requires a decrease somewhere else. No one likes to retrench, even if it is just less money for luxuries. Fewer dinners out can easily feel like hardship.

It doesn't help that energy prices are up. Those tend to result in bills that are obviously higher by a noticeable amount, such as filling up a whole gas tank. My home heating bill is also higher, although that has much more to do with Texas' disaster last year. Even though I dont live anywhere near Texas, their stupidity resulted in higher costs elsewhere. And those higher costs are going to be paid over the next 2 years, according to my utility (which used the words "unprecedented cold" as a euphemism for Texas, because it sure wasn't that cold here last winter). Regardless, an extra $1.50 a day is going to be very noticeable on a monthly bill.

People and their individual families are the micro level, Kevin. You are too focused on the macro picture. Perhaps the "average" pay raise has been 3.5%, but I'm betting that a lot of existing workers (maybe even half) have gotten zero pay raise since the pandemic started. I know that's my case. My wage is the exact same as it was in 2019. This inflation is really starting to hurt my family's monthly budget.

I believe those of the media lack critical thinking skills. They want a head line or something that might make folks notice. Usually not the truth. We have come a long way "baby" but not in the right direction of truth.

Half of all Americans are hurting. That's what they know and that's what they respond to when asked. They are hurting because of many years of Republicans redistributing wealth to the top 1% and many years of Democrats unwilling or unable to prevent that redistribution.

I am sure that price increase do not help and exacerbate the problem. But until Demcrats stop ignorning the fact that middle and working class Americans have been screwed over for decades, they will get their share of the blame.

Ever since Biden refused to cave to the media’s massive temper tantrum over withdrawing from Afghanistan, they’ve made it their mission to destroy him.

Since then they’ve disregarded the obvious narratives every single time, and instead focused on the most damaging possible takes. It’s been pretty gross to watch.

First , always look at the poll question itself. The 45% includes those with " moderate hardship " which is defined as affecting you but not to the extent that it jeopardizes your standard of living .

That to me is a poorly worded question. The term itself, including the word " hardship " would seem to require some significant harm i.e. that it does jeopardize to some extent your standard of living. But it is defined as only having to affect you.

Based strictly on the literal definition used, and only considering prices, something like 99% should have answered yes, not 45%. But then not fair to call it a hardship. I assume most responders did implicitly include the term hardship in their answer and that is where the other 55% came from.

But using a vague term like " hardship " is not great - is not being able to afford to eat out a hardship if you used to do so a lot, but you can still afford enough food for eating in ? And then defining it so broadly ( which most ignored) makes it worse.

And this sort of poll question encourages partisan responses. Anyone anti biden can justify saying yes, as technically the answer should be . While anyone pro biden who is not starving can justify a no answer. Honestly surprised the partisan difference is not larger.

And I alluded to only considering prices . I think Kevin is wanting the term inflation here to be inclusive of increases in both prices and wages . So someone who has wage increases marching inflation which are due to that inflation ( i.e. subtracting out any deserved raise if zero inflation) are not harmed at all. But not everyone perceives the question that way and many focus just on how prices increases alone affect them ..