Yesterday I casually dismissed some common complaints of Millennials about their lot in life. You will be unsurprised that I got some pushback. So here's a rundown of the complaints I listed along with evidence that they're untrue.

I expect approximately zero Millennials to be convinced by this. But it's all true! Young people always have less money and crummier jobs than older folks, but compared to Boomers of the same age Millennials are doing just fine.

Here's the list.

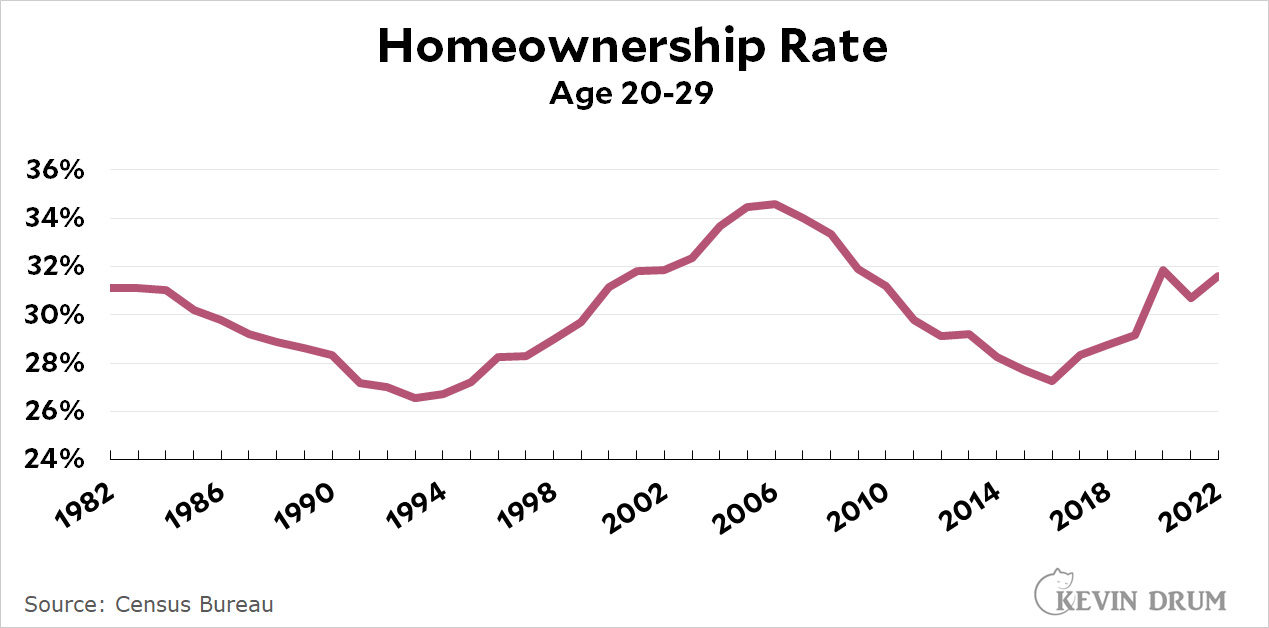

They can't buy a house. Oh sure they can:

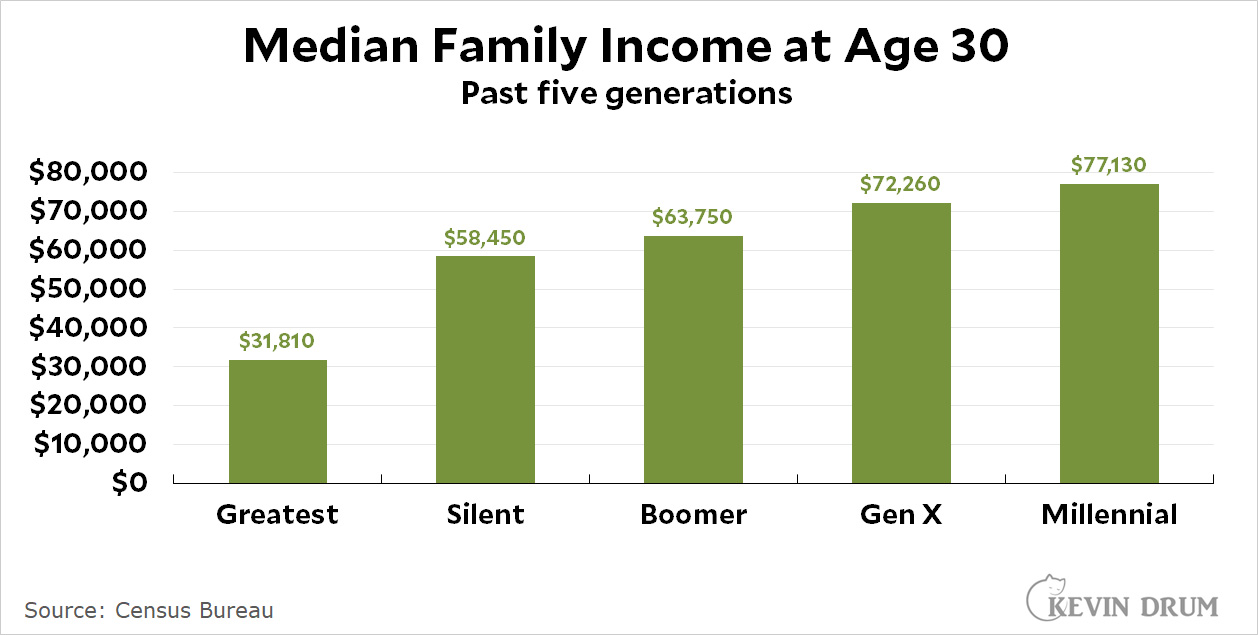

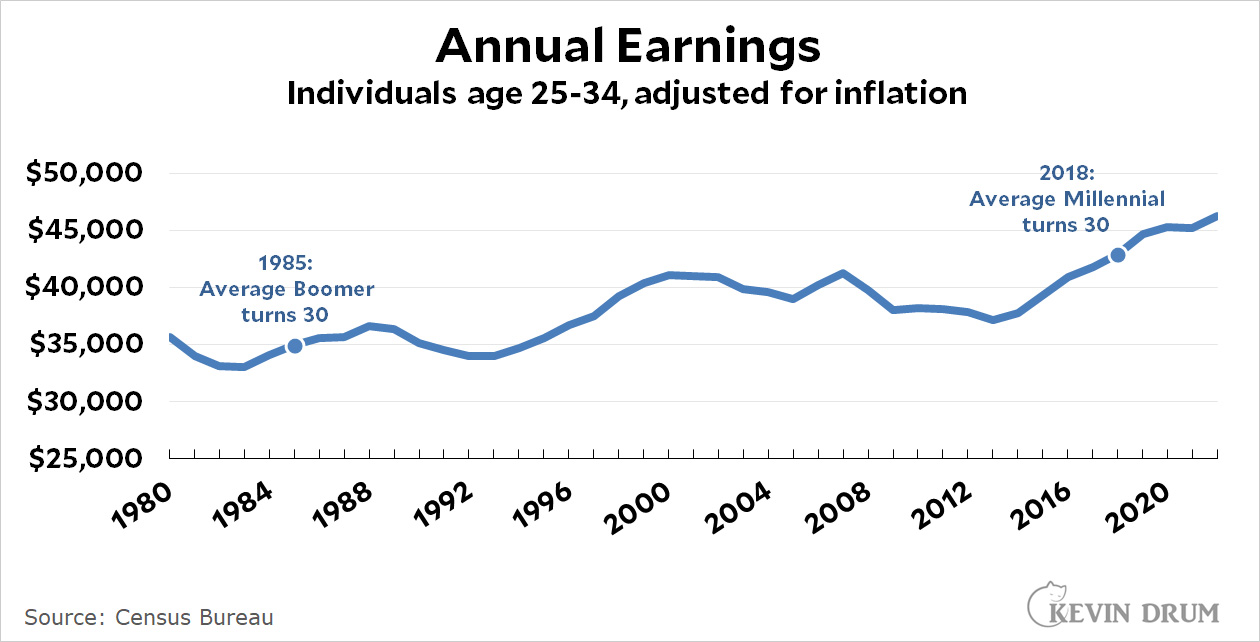

They don't make any money. We'd all like more money, but Millennials make more than any other generation at the same age.

They don't make any money. We'd all like more money, but Millennials make more than any other generation at the same age.

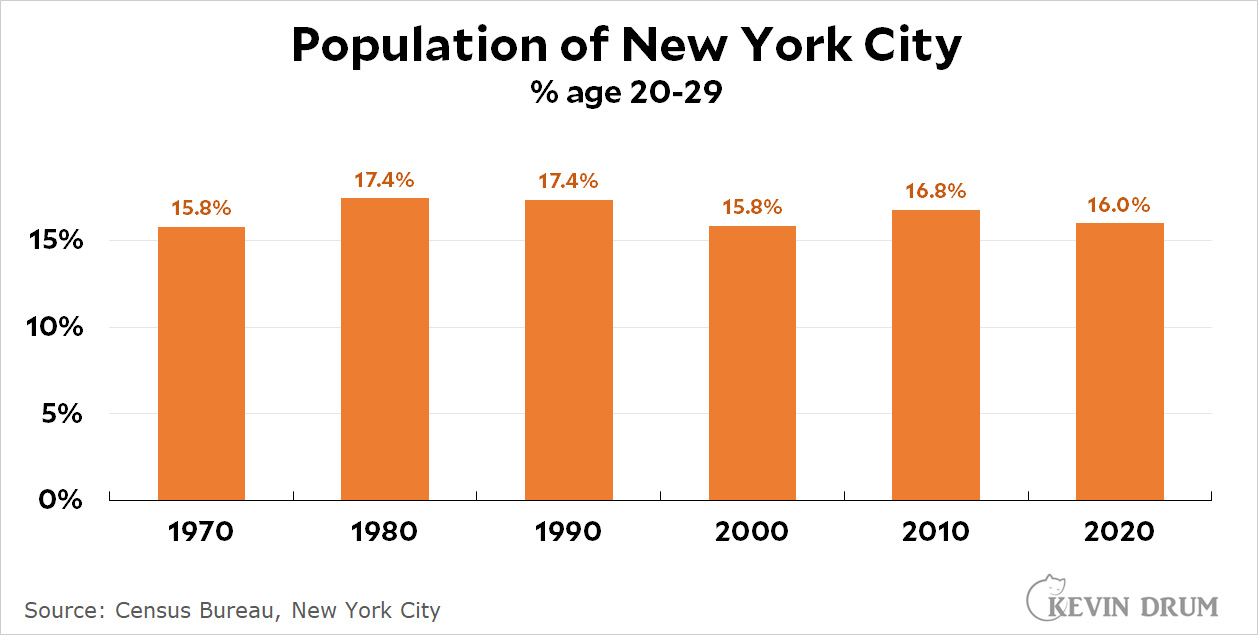

They can't afford to live in New York City. Young people make up the same share of the population in New York as they ever have.

They can't afford to live in New York City. Young people make up the same share of the population in New York as they ever have.

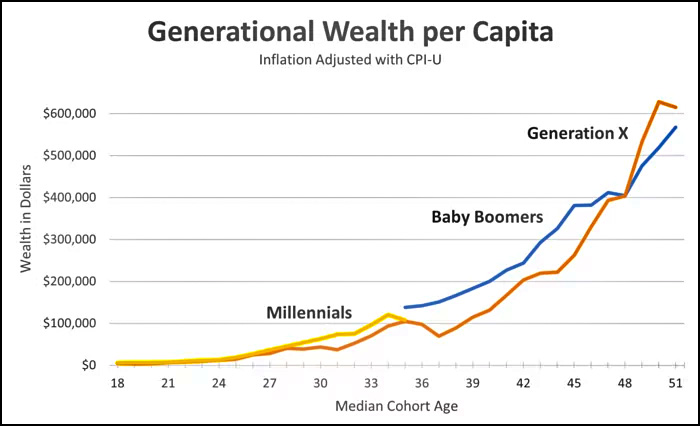

Boomers are hoarding all the wealth. This is a popular meme that's due solely to a viral chart that popularized some misleading figures by looking at total wealth per generation. But Boomers were a much bigger generation than Millennials, so you need to look at wealth on a per-capita basis. When you do, Millennials are right on trend.

Boomers are hoarding all the wealth. This is a popular meme that's due solely to a viral chart that popularized some misleading figures by looking at total wealth per generation. But Boomers were a much bigger generation than Millennials, so you need to look at wealth on a per-capita basis. When you do, Millennials are right on trend.

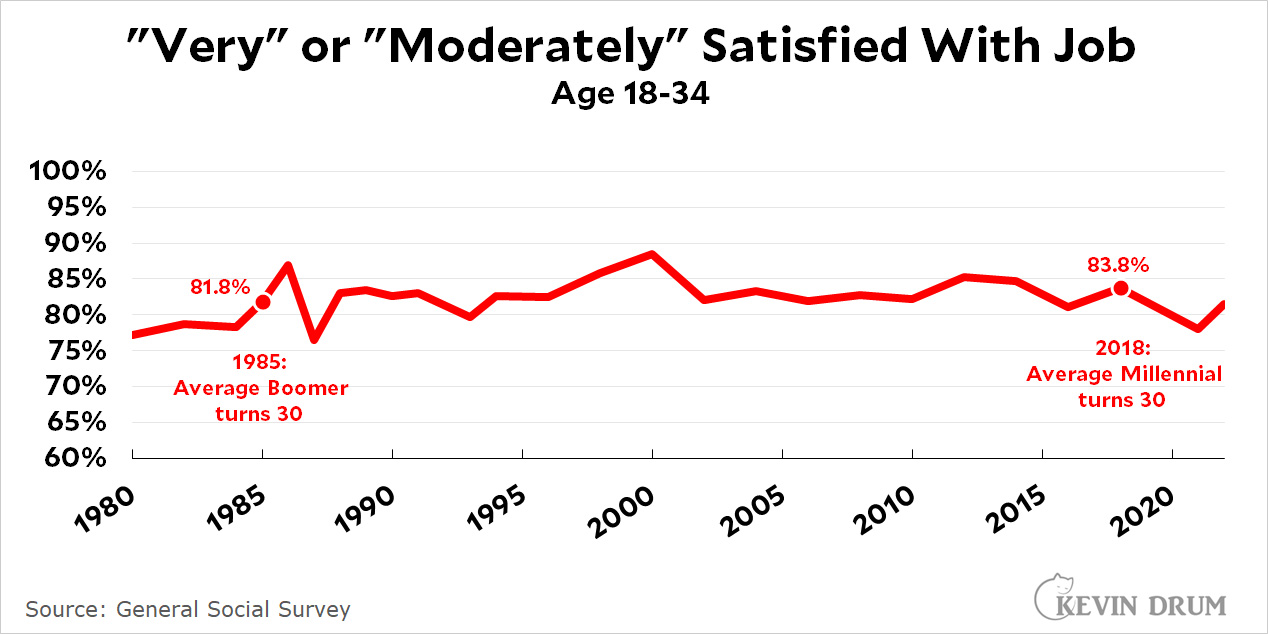

They can't get good jobs. This is obviously a judgment call, but there's no evidence that the job satisfaction for Millennials is any different than it was for young Boomers.

They can't get good jobs. This is obviously a judgment call, but there's no evidence that the job satisfaction for Millennials is any different than it was for young Boomers.

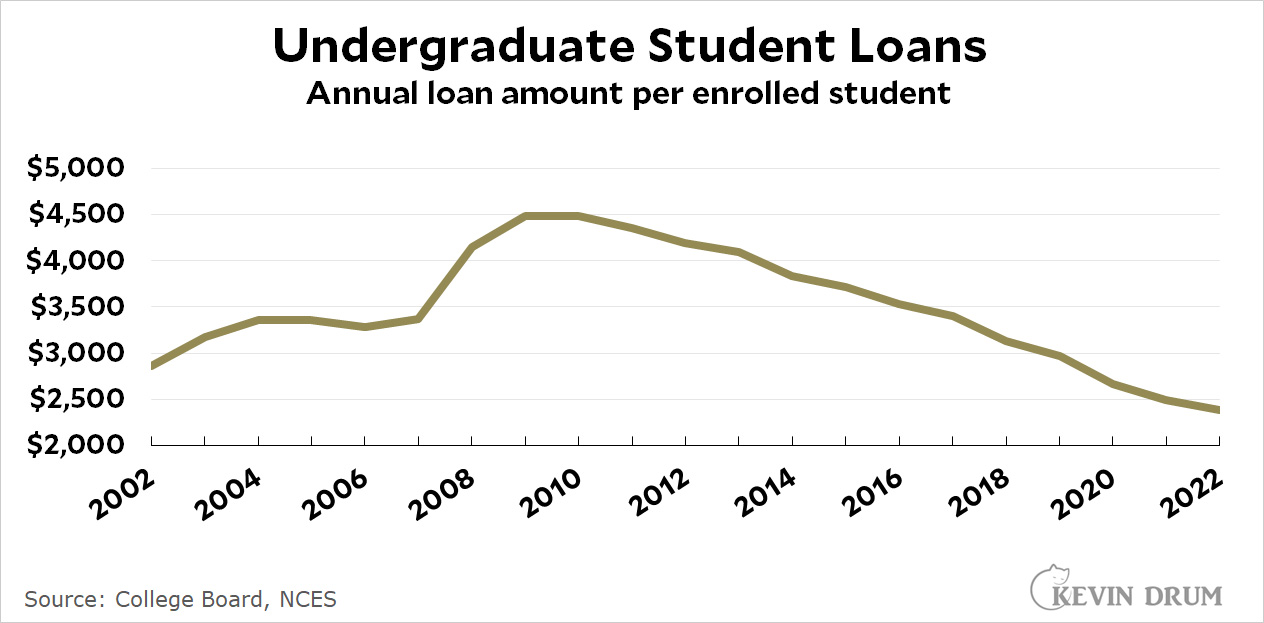

They're drowning in student debt. There's some truth to this one, but it's routinely exaggerated by including loans for postgraduate education (business, law, doctorates). Undergrad student loan amounts have been steadily decreasing for over a decade. Only about a third of young people have student debt at all, and before the pandemic halted repayments the Fed estimated that the median loan repayment was about $2,600 per year.

They're drowning in student debt. There's some truth to this one, but it's routinely exaggerated by including loans for postgraduate education (business, law, doctorates). Undergrad student loan amounts have been steadily decreasing for over a decade. Only about a third of young people have student debt at all, and before the pandemic halted repayments the Fed estimated that the median loan repayment was about $2,600 per year.

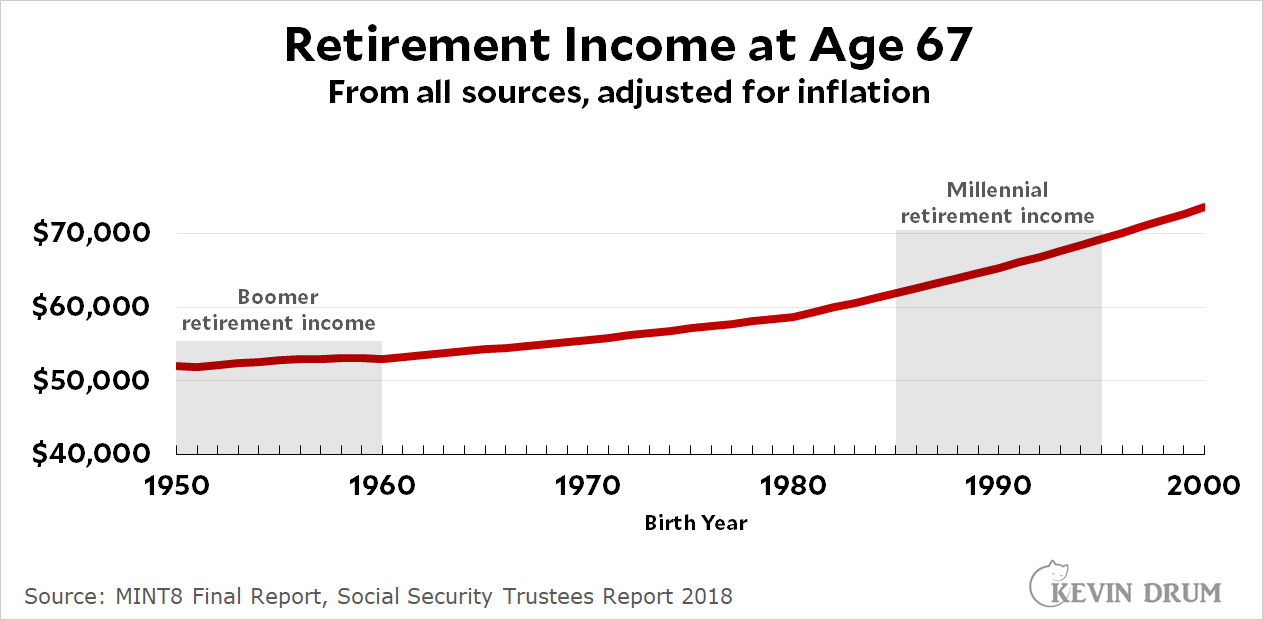

They'll never be able to retire. The best projection tool we have says this isn't so. Compared to Boomers, Millennial income upon retirement will be a smaller percentage of the median wage but a larger amount in absolute terms.

They'll never be able to retire. The best projection tool we have says this isn't so. Compared to Boomers, Millennial income upon retirement will be a smaller percentage of the median wage but a larger amount in absolute terms.

They're the first generation that's worse off than their parents. Millennials have incomes 23% higher than boomers at the same age.

They're the first generation that's worse off than their parents. Millennials have incomes 23% higher than boomers at the same age.

Kevin is totally wrong about the prospects for home ownership - they are very bad at present, for all low-income people. The fact that ownership is high is because of exceptionally low mortgage rates in prior years does not mean that prospects are good now, when prices are higher than ever and mortgage rates are above average. Ownership was high in the bubble peaking in 2006 when mortgages were handed out to anyone, but of course a lot of people really couldn't afford the payments and they lost their homes.

Kevin has more justification for arguing against the idea of overall poor prospects for younger people. Part of the media's obsession with this is probably due to those who want to cut Social Security - they have been trying to foment a generational war or the idea that boomers with their SS benefits are stealing money from younger generations. The real problem with SS is the lack of increase of the wages which are taxed - or the failure to tax non-wage income.

It also reflects continued income/wealth stratification and perpetuation of privilege between generations.

I also agree that there's more of an argument for overall income and quality of life measures. But the homeownership and home price data do not agree with Kevin's argument.

The fact that he keeps doubling down on this without addressing the data criticisms is pretty telling.

I also think that, given the explosion in housing prices, the inflation calculation is now *way* off.

At what point in history has it ever been essy for low income people to buy a home? Even Goober on Andy Griffith didn’t have a home.

I ask again: what data should we be looking at to see this in the way you've described it?

But long term rates are dropping. The 10 year T bill rate was 4.83 in October, and now it's 4.17. The blowup in long term rates start back in March 2022, so home ownership prospects became tougher only recently and are already well on their way back to normal.

And the increase was in an attempt to fight inflation that was apparently mostly due to supply chain issues and once-only cash grants.

Rates aren't the only piece to homeownership prospects - it's also prices. The blow up of rates only temporarily slowed the explosion in prices. As rates come down, price increases are going to accelerate again.

Here in the DC area, the rate hikes barely impacted the market at all.

" Millennials make more than any other generation at the same age."

Are those nominal or real (inflation-corrected) dollars.

Kevin is always harping about inflation adjustments, so I'd be shocked if these weren't adjusted.

Inflation adjusted.

Thanks. He usually puts that qualification in the header.

I wonder if millennials' perception that they are financially worse off is because they are less willing to live within their means than prior generations were.

KiDs ThEsE dAyS

C'mon.

I was born in 1952. I absolutely thought I was worse off than my parents. My mom didn’t work. My dad was able to support our family of 4 owning a house and 2 cars (one newer, one older). He had a very middle class job. There was, I thought, no way I’d ever be able to match that. I was right in a way. Everything he had I got, but it took a wife working in a job making the same salary as me.

Yep - it's just part of a long slide back towards oligarchic capitalism. There was a brief window where it wasn't dystopian out there - and the boomers got that window. The rest of us didn't.

I often see the comparisons to a household in the 50s, and tho it’s useful there’s also an apples to oranges quality to it. That 50s family lived in a tiny house, had a shitty car (that dad had to repair himself), ate food not cooked at home maybe once a month, and their yearly vacation was camping or a stay in a cheap motel on the drive to see relatives.

The house had a single tv that was expected to last a decade at least. (I remember as a kid seeing the machine in our local hardware store where you’d test the tubes from the tv to see which one needed to be replaced.) Yes it’s more expensive today for every family member to have their own personal hi res screen to watch their streaming media. Does that mean they are worse off or better? I can see the argument both ways.

It would be interesting to see what it would cost for someone today to live the 50s lifestyle. Not that it’s possible in a lot of ways. No one’s building houses as small as the ones families lived in back then, and a similarly basic car probably isn’t even allowed on the road anymore.

What gets lost in the "but life is better these days, and that's optional" assertions is that so much of the improvement is NOT optional.

You can't opt out of internet service and work a decent job. You can't opt out of cell phone service for the same reason. You can't opt out of transportation costs, and you can't opt for worse housing (i.e., SROs or group housing). These not-optional things are not well accounted for in inflation-adjusted measurements (if they're captured at all), making these 40-year-long comparisons of X as a % of Y (such as household income) golf balls to grape fruit comparisons.

Well ... you can opt out of landline service, which given the cost of typical service plans in the 80s and 90s will save you a bunch, and opt in for an MVNO like Mint. I paid $180 for a year of entirely adequate cell phone service. Done.

Also, network TV was crap. I Dream of Genie? Hogan's Heroes?? Betwitched (save Endora)?? I didn't own a TV from 1974 - 1994, and if I missed anything, it's news to me.

Boomers didn't have some of the bills that Millennials have to pay. A land line was much cheaper than a cell phone plan. Network TV was free - no cable bills. No Internet supplier to pay, no computer repair bills. Music streaming? Microwaves? Instapots? Didn't exist.

All those things look almost like necessities to a a young person today, yet Boomers didn't have them. I'm a little young to be a Boomer, but some of the things my adult offspring pay for do surprise me. Delivery of prepared meals seems to be a frequent expense. And for some reason, all the young couples seem to require one of those impossibly complicated coffee makers that costs over $120 now. I was glad when one of our kids finally realized that they were living under three miles from work in a city with public transportation, so they didn't need a second car.

Younger people may choose to pay for grubhub, that doesn’t mean they need to or are worse off because they have the option. Cell phone bills don’t need to be expensive. When my company stopped reimbursing my Verizon bill I switched to US Mobile and pay $36 for two lines and 10GB data.

Instapots? Come on. Boomers had crockpots and pressure cookers and fondue pots. Boomers are the last bastion of cable subscribers, young people are cord cutters. And almost every consumer product is much cheaper with globalized supply chains and offshore manufacturing.

I was born in 1949. Expectations, tied to peer pressure, are everything. Millennials and younger feel deprived if they have less than their peer group. My family was middle class, dad was a meat cutter, mom a seamstress. We lived in apartments, had one car which dad used to go to work, and everything else was either walk or take the bus. One phone, one black-and-white TV.

Got married at 20, lived in an apartment, then when I was 23 got a lead on an old run-down house for $21K. My mortgage was $16K, rate was 10.5%. House was barely a shack, no garage, dirt driveway. Wife and I both had jobs, supplemented my income by playing guitar in bars. I built a garage with my own hands, fixed up the house, eventually was able to buy a 2nd car.

I thought I had died and gone to heaven!

You've all heard this Boomer song-and-dance, but it's true! It's all in what you expect.

Yeah, the housing market expects you to pay more than 50% of your take-home on rent or a mortgage these days as a baseline. Expectations sure are different!

It's a lot more subtle than you make it sound.

The housing market expects that ** in areas seen as desirable to live in **

Lots of places where that's not true, but most people don't want to live in those places.

I think this has changed far more than is recognized, and I think it is partially driven by Boomer retirement migration. Places that used to be somewhat affordable (especially out west) no longer are, mostly because empty-nest/retiring Boomers take the cash gains from their family homes and relocate.

Of course it's more nuanced than that, but I'm not here to write essays.

I'd push back on "areas seen as desirable to live in" - it's just "areas where people want to live" full stop. Not simply "seen as." The perception of the perception of desirability doesn't cause bidding wars and waived inspection clauses for homes. Actual demand does so.

You've also highlighted (perhaps unintentionally?) why looking at housing market indicators on a national level is foolish. Housing is regional. You can aggregate those markets and it's useful for things like a national population's total debt service, total value of all housing markets, etc., but it's very much not useful for arguing points like Kevin tries to argue.

> A land line was much cheaper than a cell phone plan.

My cell phone plan (Mint Mobile, 5GB/month) is $15/month. Massively cheaper than any landline service I ever had, not to mention that this provides unlimited calls whereas my old landline service (Bell Atlantic, Qwest) were always based on call volume and duration.

Ha ha ha. I wouldn't focus on telephone call prices if I were looking for sympathy. When we called outside of our unlimited area in 1970, we paid something like 25 cents a call. That's about $2 in today's currency. For a single call to Manhattan from the suburb we lived in. God knows what the monthly rate was.

Call internationally? We'd call our relatives in Turkey once a year. We'd put in a call with the international operator in the morning and sometimes in the PM we'd get a callback. It was about $50 ($400 today), and the quality was so crappy that most of the time I couldn't tell if the "hello" I heard was my own echo, or someone on the other side.

Now of course you get crystal clear calls to anywhere on the planet, pretty much for nothing.

The loss of defined pension plans for recent hires, which is almost universal among non government employees, will require much larger 401K contributions and performance of such investments, in order to make up for that loss. So a larger portion of current employee income will need to be utilized for that, and not available for current consumption.

In addition, continuing increases in employee medical contributions should be expected, reducing money available for current consumption. Back in the good old days, such amounts were limited to relatively small deductibles and co-insurance payments.

Kevin is generally right in minimizing the idea of generational warfare. But what we have been having instead has been class warfare, and the rich classes have been winning. Kevin seems to want to minimize this as well. He clearly thinks that if somebody's earnings keep up with prices that person is doing OK. But everybody should be doing much better, since the economy expands, and wage earners have kept up with the economy in the past.

Since 1980 GDP per capita has more than doubled. Median or even average earners (his graph Annual Earnings, for example) have gotten only a fraction of this increase. Over US history until the 70's wage earners did keep up with GDP/cap, as shown by the wage index from the Economic History Project:

https://www.skeptometrics.org/WageIndex.png

There is no reason for the majority of people in the US to be satisfied with this.

Yeah, this is true. A lot of the growth in income has gone to high earners, and of course a bunch has gone into dividends too.

First of all, great post Kevin. This is incredibly good food for thought for examining this narrative that feels quite real to me (as a Gen Xer).

To make my priors clear, the thing I really can't quite reconcile is that when I was in college in the 90's, it felt like there was housing as cheap near the center of whatever town as I wanted as long as I was willing lower my standards sufficiently. That no longer feels true, but I have yet to see data that proves it.

But looking at this post, a few things spring to mind:

1. KJK's comment really makes me wonder if there is a collective improvement that masks a person to person instability that makes the losers feel the loss but the winners feel the as perfectly justified and not much of a "win".

2. The Boomers made 2x of what the Greatest gen made. So, statistically (I can't do the actual math), most people could really did make a noticably larger income than their parents. Millenials are making 23% more than boomers on average, so for every 10 people doing better than their parents, there might be 4-6 doing worse and a bunch doing basically the same. (again, I can't begin to do the actual math here.

3. Household vs individuals might really be doing a lot of work here, and I don't know enough to even guess. But the psychology of "household income" might feel very different when a pair of folk are living as a household, but might still be considering their finances from an individual level.

4. Maybe it's not about money. The greatest generation went from a world where movies, cars, air conditioning, and airplanes didn't or barely existed to one where they were commonplace and affordable. Boomers roughly went from a world in which telephones existed as neighborhood party lines, televisions & computers didn't, to one where all were commonplace. Maybe it's about how the experience of the material world is or is not obviously improving?

First viable search engine: AltaVista, in 1995, followed by Google in 1997. No social media till the 2000s. No YouTube (a proxy for widely available video-on-demand) till 2005.

They might not be "the material world" but these changes have utterly transformed the lives of most people in the technologically-accessible world.

The term this discussion is missing is "Elite Overproduction"...

The stats are the same as before; the difference is an ever larger fraction of the population that has a (basically worthless) degree assumed to be a golden ticket to the good life.

ie the problem is not so much the actual statistics, or even the lives, of these kids so much as the promises made to them implicitly (and not so implicitly, especially the claims for a university degree given to the mediocre).

I won't rehash the inevitable terrible consequences of this; Peter Turchin has already written multiple books on Elite Overproduction, and things are playing out pretty much as you would expect from his model.

Instead I will point out something that has been less noticed: China, always enthusiastic about importing the worst ideas from the West has engaged in substantially *more* elite overproduction than the US, though not for as long. The consequences of this are just *starting* to play out, but already we are seeing widespread complaints about the "uselessness" of most degrees (in the sense that, just like the US, mediocre kids acquired [and were encouraged to acquire] degrees on the promise if a golden ticket). The Chinese consequences of this are likely (as far as I can tell) to be directed against the Party, since there is no other obvious villain, no matter what the Party may attempt. The Party may try to blame the US, but that sees dumb and desperate; and there aren't any obvious internal groups to demonize large enough to move the needle [demonization was of course part of how this is playing out in the US].

Those who refuse to learn from history, blah blah. And if there's nothing else we've learned from 60 years of PC, it's that people, even in China, are UTTERLY uninterested in learning anything from history except a few politically convenient slogans...

The named generations paints too broad a brush, methinks. One particular that personally touched me is that the Boomers born from '45 to '54 made out like bandits. The cohort from '55 to '64, eh, not so much. Those Carter years were brutal for recent college grads.

Here is a Millenial take. I am a mid-millennial (born '87). High school teacher (for rough salary reference), wife is also a teacher. White, middle class. These comments mostly relate to this group. As mentioned in another post, age range of the group/experiences vary greatly.

My age group and friends entered the workforce (following college) immediately following the financial crisis, jobs were not ideal, but you took what you could get.

What I noticed from other Millennials was that they were never saving any money. There are always people across all generations who are not savers, but the Millennial group grew up in the world of the internet and there were so many possibilities. Spend money on travel, friends, food, etc. The concept of saving was not there.

I lived with roommates, worked at a grocery store through college, paid off debt, etc. Saved up a nice chunk of change and was ready with a downpayment by 2018 for a sizable house in an upper-middle class neighborhood. Houses were dirt cheap (with low rates), but no one had any money for a down payment.

$Dollar after dollar wasted on experiences. You can't whine, you had some great experiences on the boat, or traveling Europe, or the fancy wedding party, or the new iPhone, etc.

I will say that most of my friends and family in my Millennial group are doing great. They are all college educated with degrees/advanced degrees that have a purpose. They all have houses, families, reasonable wealth. Exactly as Kevin describes.

There just happens to be a lot of idiots out there.

*I cannot comment on millennials without a college degree

The generational war of the finances isn't going to let up anytime soon, in large part because what is expensive and what people spend money on has changed significantly.

Old people will keep shouting, "you have no idea how expensive a stove was in 1980, why don't you brown-bag your lunch, no one needs Uber Eats, mortgage rates are actually still piddly today, and we had no air conditioning and we liked it!" And young people will shout, "your first house was a lot less expensive, grandma didnt have a job, and my mental health has real value!"

Things will get really nasty once the Millennials start to inherit all that money the Boomers leave behind. After decades of feeling put-upon, the even younger generations will be calling THEM the lucky ducks!

I've been thinking about this, but I don't think it will change much.

The Millennials who are likely to inherit money from Boomers are likely already doing well. Privilege/affluence begets privilege/affluence. Those Boomers with an estate worth mentioning (say, high-6-figures) and Millennial kids who are in their 30s are more likely to have paid for their kids to go to school, more likely to have helped them out with major life hurdles early on (paying for their rent for a little while when they were getting established in their careers, helping with a down payment for a house even if it was an interpersonal loan, etc.).

Boomers who don't have an estate worth mentioning probably have Millennial kids who had to take on college debt and delay household formation, delay purchasing a home (if they even have yet), and so on.

So I see the "greatest generational transfer of wealth in history" narrative and spit back that the people who are going to inherit that wealth are probably doing pretty fucking well already, so don't use that population-level data to try to say that it isn't hard (and getting hader) out there for the ever-increasing portion of the population that's in the Have Not bucket.

And it makes people angry. It's not hard to figure out.

People seem to want it both ways: Boomers had it so easy with their pensions and houses they bought at age 20, but also those very same blue collar workers won't have a penny for their kids to inherit.

It may not be millions, but I have already seen the inheritances trickle down from blue collar Boomers to their kids (lower education levels and lower life expectancy go together in the US). The sale of a 55+ condo and a used car can net heirs tens of thousands of dollars, if not more.

Tens of thousands doesn't go all that far, though... Compare to the hundreds of thousands just from home value appreciation alone for the more affluent Boomers...

Not going to happen like you think. 50% of the elderly aka the Boomers will need long term care, vulture capitalism has got their greedy mitts into the elder care biz and are hoovering up all the estates of the Boomers so there's nothing left to leave to the millennials.

2 big changes are not covered in these wonderful charts:

1) Large increase in the amount of 2 earner households across the different generations.

2) Large increase in income and wealth inequality across the different generations.

Both of these may play a big role in how people feel vs how they might appear on a spreadsheet.

I find Kevin's refusal to engage with this very obvious criticism of his population-level data curious.

Or I would find it curious if it weren't part of the typical pattern of doubling down on being wrong that we're all guilty of at some point or another. Some of us more so than others, and some of us being more willing than others to pause and examine our preconceived storylines when confronted with protestations for the 10th time.

My counterargument: count the kids.

I’m a millennial. I was able to buy a condo (alone) at 36 and a house (with my spouse) at 40. We have good salaries, we’re stable. But kids are out of the question- we have a ton of school debt, and we’d need a bigger house in a good school district, bigger cars, etc. It’s just not doable. All my friends are in the same position- either no kids or fewer than they’d like, and they waited way longer than they wanted to.

The year I was born the birth rate was 15.9 per 1000. now it’s 11. that is not sustainable, and it isn’t making us happy.

So are millennials hitting some of the markers of adulthood? Sure. But we’re doing it later, and by sacrificing reproduction.

You dont actually have to have a big house in a "good" school district. I live in an urban neighborhood where 5 person families in 1200 Sq ft houses with just 1 bathroom are pretty normal. Lots of people go to the urban public schools (my kids do). You don't really need a big car for 2 kids, although having 4 doors on the vehicle is really nice. I have a family member who is so keen on living in San Francisco that they put up with all living in a one bedroom apartment - his daughter gets a walk-in closet as her room. She is just fine.

If Millennials want to put off kids until they can buy a new Pacifica and a 4 bedroom house in the suburbs, that is definitely a choice they have the right to make. But the families I know who live in small urban houses with rotting garages and send their kids to urban schools without air conditioning are also happy.

Omnibus collection for the series "That thing (those several things) you're worried about? They don't bother me, Kevin Drum".

This rosy comment is based on bad data. Kevin shows us a graph that purports to show that about 30% of 20-29 year olds own their own home. Is that correct? No, of course it is not. And that should have been obvious.

The "homeownership rate" that he is graphing is computed by dividing the number of homes owned by 20-29 year olds by the number of homes where a 20-29 year old is the head of the household, which would be homes either owned and lived in by a 20-29 yo, or homes where the 20-29 year old is the tenant with their name on the lease. It doesn't answer "How many 20-29 year olds own homes?" It answers the question, "Of all the homes owned or rented by 20-29 year olds, how many are owned?" It's by house, not by person.

Notice who that leaves out: People who live with their parents, people who are in dorms, people who rent a room from homeowners or other tenants. In other words, young people who live with their parents don't count. About a third of 20-29s live with their parents; they do not count, in Kevin's chart.

The intuitive way to calculate homeownership rate is by people, not by houses. Of all 20-29 year olds, how many live in a home owned by them or their spouses? That number is nowhere close to 30%, and is going down over the last few years. And that's the number we care about. We want to know how people are doing, not how houses are doing.