Yesterday Dean Baker asked a good question: why do media outlets keep telling us that it's all but impossible for young Millennials to own a home?

It seems that cost-cutting or other measures prevent reporters at CNN and the New York Times from getting the data that the Census Bureau publishes quarterly on homeownership rates among young people. They keep telling their audiences that young people will never be able to own a home. This is in spite of the fact that homeownership rates among young people are higher today than in 2019 when they did not constantly run stories about young people not being able to own a home.

Dean included a chart that goes back to 2018 for age 35 and under, but I wanted to go back further and zoom in on 20-somethings. Here it is:

As Dean points out, it's hard for young people to afford a home. But it always has been. Even with high mortgage rates right now, there's really nothing new going on. The homeownership rate is higher now than it was in 1982.

As Dean points out, it's hard for young people to afford a home. But it always has been. Even with high mortgage rates right now, there's really nothing new going on. The homeownership rate is higher now than it was in 1982.

As for why we hear the opposite so often, I think that's easy: it's just a part of the endless narrative about poor, downtrodden Millennials. They don't make any money. They can't afford to live in New York City. Boomers are hoarding all the wealth. They can't get good jobs. They're drowning in student debt. They'll never be able to retire. They're the first generation that's worse off than their parents.

Literally none of this is true. Millennials have problems, just like any generation. Some things are better for them and some things are worse. In the case of homeownership, Millennials suffered a bit during the housing bust, but Boomers suffered a good deal more during the Volcker recession:

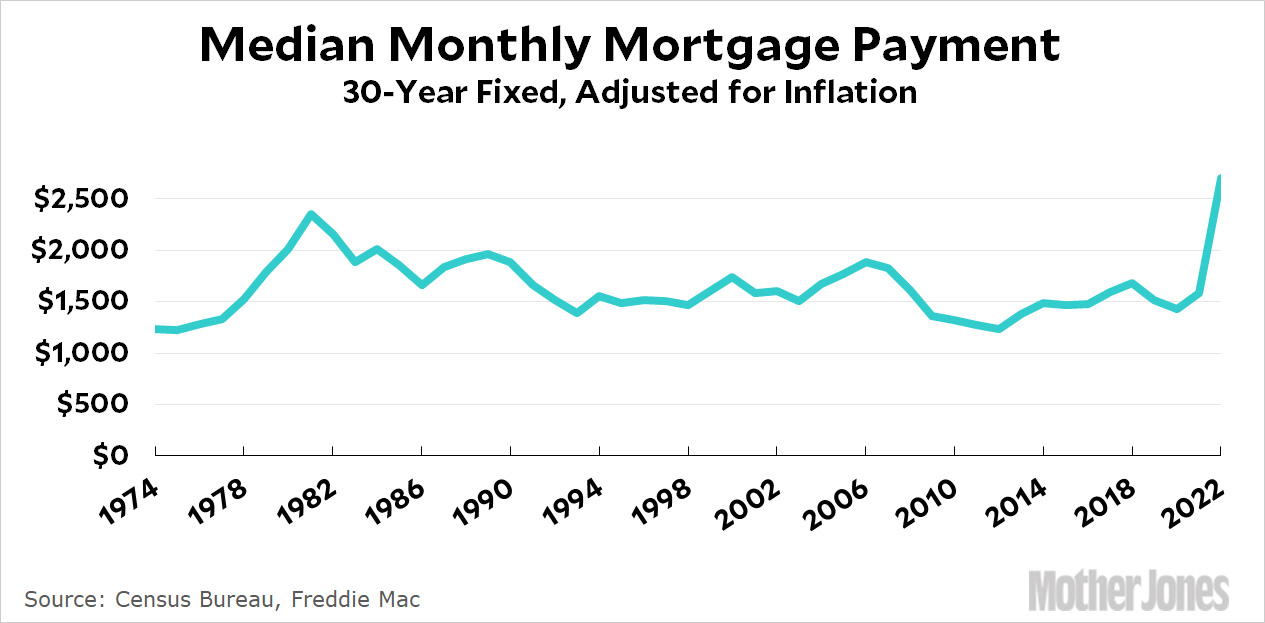

Endless whining aside, it wasn't until 2022 that housing costs actually increased from their level in 1980. And this is temporary. When rates finally go back down, so will mortgage payments.

Endless whining aside, it wasn't until 2022 that housing costs actually increased from their level in 1980. And this is temporary. When rates finally go back down, so will mortgage payments.

Oh I'm sorry, am I on your lawn? Did I interrupt you yelling at a cloud? My apologies, Boomer.

🙂

Silly Kevin, trying to go against The Narrative.

If you are single and 22 and don't have the same lifestyle as your parents do right now, you are Oppressed!

(I say this as the parent of a 20-something.)

Also: "smart" Republicans are really pushing this narrative, trying to keep young in the doom loop so they don't vote. Not that liberals need any help with Doomism.

I've been told that Case-Schiller somehow adjusts for the price of the house (probably as compared to inflation) and the type of house (size, amenities, location).

I find it hard to believe that location from the 1990s to now is in any way comparable. I mean, its possible, but from my view in SoCal very unlikely. Sooner or later you run out of room for lots and people run out of patience for commuting.

Its a version of the "what job can a doofus with a high school education get?" in 2024 vs. the same doofus in Michigan in the 1960s.

My man, you're blind on this.

I wonder if this is an "urban millennial" cohort issue that the "intelligentsia" views as a universal issue. Because the charts and data sure as heck do not match my expectations!

The home ownership rate was built up during a long period of low mortgage rates culminating in record lows during the pandemic. Things are very different now. Home prices are far above long-term averages and except for the 2000-2006 bubble, highest in history.

https://en.wikipedia.org/wiki/Case%E2%80%93Shiller_index#/media/File:Case%E2%80%93Shiller_Index.svg

In that bubble lenders were handing out mortgages to any live bodies regardless of price, but of course the result was the worst recession since the 30's. Mortgage rates are now somewhat above long-term average, but the probability that they would return to the record low rates before and during the pandemic, when home ownership among low-income people was being built up, is extremely small. The outlook for home ownership among low income people is in fact poorer than at any time since the astronomical mortgage rates of the 80's. Why does Dean Baker keep denying this? The media currently seem to like to run negative stories about the economy, but there is nevertheless a real shortage of housing.

Aside from the Fed continually fooling around with interest rates and deregulation, the problem appears to be local government restrictions. It is certainly not anything that either Biden or Trump has done. Anyway housing is a major problem in an economy which is otherwise doing very well. Something needs to be done about it and there are actually initiatives to get more housing started. Claiming that there is no problem is not constructive. I generally agree with Dean Baker but his obsession with denying that houses are now hard to buy is weird.

Remember also that real wages have not grown substantially since about 1970, although GDP has continued to grow, as have higher incomes. So wage-earners have no increased income to buy the more-expensive houses. It's not surprising that builders prefer to build more expensive houses - that's where the money is.

The house price link I gave above only goes to 2020, but prices have only gone up since then:

https://fred.stlouisfed.org/graph/?g=1fIzX

and now may be the highest in modern history.

I would drop the "may" - they absolutely are the highest in modern history, and given that we treat housing as an investment asset they are only going to increase at greater than the rate inflation unless we break that link.

I don't have any faith that we'll break that link. The interest of money (both big and small) is too great. Ergo, I think we're just fucked until we reach the point where demand (buyers that are actually capable of buying) is in equilibrium with the extremely limited supply (our housing stock). At what price point that occurs - I don't know. It certainly hasn't happened yet in any of our biggest cities.

What data do you believe we should look at in order to get a clear picture on this stuff?

In addition to the price indexes, one of which I linked, and mortgage rates (see FRED for rates), there are many combined indexes. Google "home affordability index" or the like.

There is really no ambiguity about this - houses are currently very expensive. This will probably improve, but don't count on going back to the 2021 mortgage rates.

The CNN article that Dean (and Kevin) are complaining about doesnt appear to make the argument that Kevin and Dean try to refute.

Good job taking down that strawman....but the near vertical jump at the end of graph 2 certainly seems to provide evidence that the CNN article was accurate and sensibly written.

The data in graph 1 is perfectly interesting, but it isnt particularly meaningful to the actual topic of the article.

The cost of buying a home and the cost of buying a car are both at record highs.

Granted, the houses and cars of today are much better than yesteryear--but that's impart due to the lack of entry level housing or actual small cars (everything today is a crossover or SUV).

People feel this. Even those buying a house are spending a greater share of their income on the mortgage. And the 2/3's of the young ones who have not bought a house do not see a way that they will ever save enough for a down payment. In many ways, the same as after the great recession.

A lot of this is about the great differences in housing costs across the US. The young people working for media companies tend to live in really expensive housing areas: New York, LA. etc. Young people want go live in placed that are popular: Portland, Denver, Austin, etc. Those placed are crazy expensive.

Younger Xers were all in a tizzy about not being able to afford homes in the early 2000s. Homes were often sold in a single day for tens of thousands over asking, even in less popular cities. They complained that they'd never buy homes. And then the crash changed everything. After a decade of not being able to buy, everyone I knew was buying homes. A lot changes in a decade.

The home ownership rate for younger people today is only a few points below what it was for Xers. So, yes, it's a bit worse, but not that huge a difference.

The stats I have found for home ownership by age:

At age 25:

Zers: 30%

Millennials: 28%

Xers: 27%

Boomers: 32%

At age 30:

Millennials: 42%

Xers: 48%

Boomers: 51%

At age 40:

Millennials: 62%

Xers: 64%

Boomers: 69%

It looks to me like Millennials made up a lot of ground during the extreme low rate years, after being held back during the final years of the bubble build-up. It's also likely that small city/rural ownership is driving high rates for Gen Z. I would bet that changes to the housing market are coming soon. The oldest Boomers are closing in on 80.

A central problem here that is sometimes spoken of but not often enough ... the boomer retirement bubble.

It has meant that there are almost no areas of the country that are judged attractive by more than a handful of people where the influx of cash purchases driven by real-estate gain-enhanced retiring or near retiring boomers has not caused a price explosion.

When I moved to Seattle in 89, it was neither the lodestone it became some years later, nor the "last one to leave, turn out the lights" place that it was during the late 70s. My wife and I were young, we had jobs (one of us a PhD) student, and after a few years there, we could afford to buy a (modest) house.

Where is the equivalent of this now? I suppose some of the supposedly renewing upper-midwest cities like Detroit. Maybe there are places in the south - I don't know the market down there well. There certainly are not places like that in the west, nor most of the NE Corridor (Phila and Baltimore may be exceptions).

Consequently, while rates of home ownership may indeed not be that different, the sense of freedom to move has, I suspect, been sharply curtailed.

Pingback: Are Millennials really as well off as Baby Boomers? – Kevin Drum