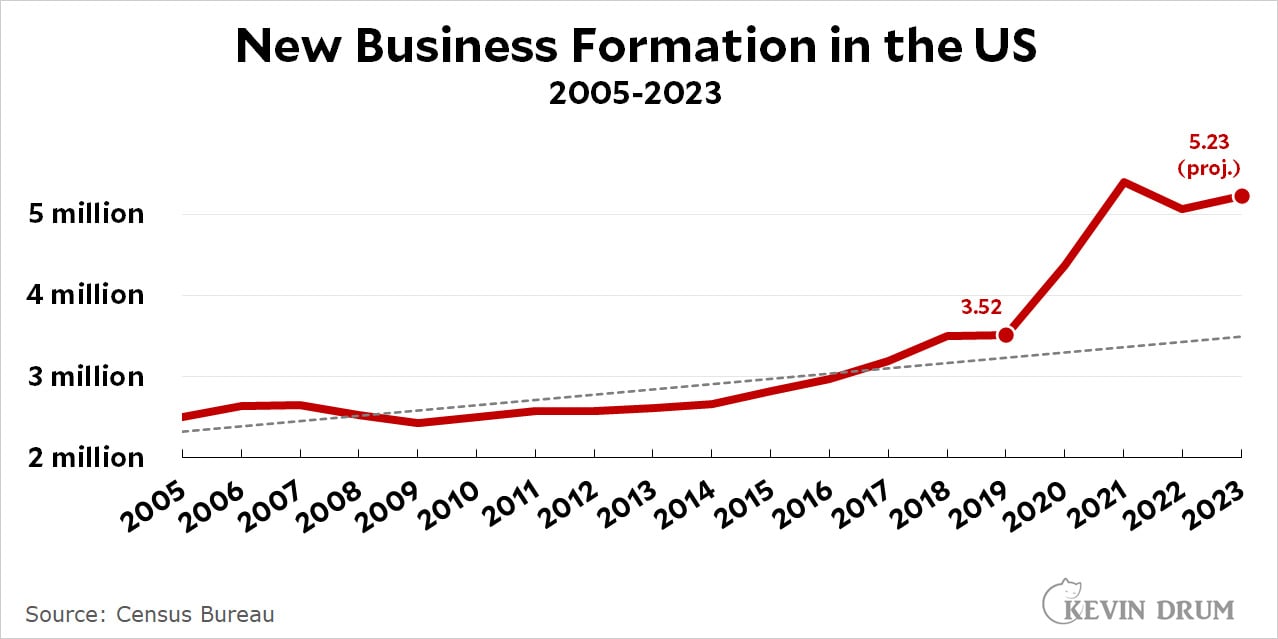

New business formation was up 0.4% in May compared to April. It was up a respectable 3.5% since last year.

But that's not super interesting. A longer term look is:

Note that this is not net business formation. It doesn't account for businesses that were shut down during the pandemic. Nonetheless, new businesses were obviously opening up even while others were closing, and they opened in huge numbers.

Note that this is not net business formation. It doesn't account for businesses that were shut down during the pandemic. Nonetheless, new businesses were obviously opening up even while others were closing, and they opened in huge numbers.

Even more interesting is that this continued through 2021 and then flattened out at the new higher number. Four years after the Great Bankruptcy, we're still opening new businesses at the rate of nearly two million per year more than we did pre-pandemic. That's what the trendline suggests, anyway.

Is this because net business formation has stayed about the same, but the new business formation number is high because existing businesses are still closing down at high rates? Or are business closures down to normal and new businesses really are booming? Employment levels suggest the former: The number of workers today is nearly the same as the number of workers just before the pandemic. If employment is about the same, then total business formation is probably about the same too.

But this means that existing businesses are still closing down at a high rate even though COVID-19 has largely lost its bite. Why?

UPDATE: A regular reader emailed today with a Fed report that summarizes BLS data on business closures. I had forgotten this existed. It only goes through the end of 2021, but if it's accurate it suggests that there was one quarter of high business closures (Q2 of 2020) and everything has been steady since then at the usual rate of about 1 million closures per year:

If this is right, it means just the opposite of what I concluded above. Closures have stayed about the same, which means that the boom in business formation is real.

If this is right, it means just the opposite of what I concluded above. Closures have stayed about the same, which means that the boom in business formation is real.

Echos of the supply chain constraints working their way through system + higher wages.

"But this means that existing businesses are still closing down at a high rate even though COVID-19 has largely lost its bite."

Some businesses haven't closed but have done rounds of layoffs. That may explain how we can have so many new businesses without employment going up. Just a theory.

Probably a bit of this. Also a bit of other things that I can't identify.

Mrs. Rau's Restaurant, a family-friendly local place in Staunton, VA, shut down and sold their building to a new owner, who then opened a new restaurant there. I assume, since the owner bought the physical facility but not the business, that counts as one closing and one opening.

Bed Bath and Beyond, with about 1,500 stores in 2019, has gone from a Chapter 11 bankruptcy to a liquidation this year. All remaining stores will close by sometime next month. Does that count as one closing, because it's one business? If so, then the side effect of that closing may be hundreds of openings, as local entrepreneurs buy or lease the physical properties to go into some business (retail or other) for themselves.

Counting closings and openings is a complex task. Making sense of the data is even more complex--much more so.

A lot of companies use the franchise model. You might see another chain move in, but locally that is probably done by a new business set up to be a franchisee.

Is each Uber driver set up as a new "business"?

How about resellers on Amazon--buy on TEMU, re-sell on Amazon--are new "businesses"?

What about all the delivery companies set up to deliver exclusively for Amazon? Talk about outsourcing.

Something something market consolidation - it's harder than it's ever been to break in as a successful new business, while simultaneously being more necessary than ever because our oligopolies fuck over everybody else in the name of sky-high returns for executives and shareholders?

Just another symptom of the ongoing class war. Which we lost decades ago, so I'm not sure it's a war so much as a series of massacres.

Even small businesses these days need to have their digital act together. They need to have the details correct on Apple and Google Maps. They need to have a story of Uber Eats and DoorDash. They need to accept Apple Pay and have online menus. They need to be aware of what's happening on Yelp.

etc etc etc

I've stated this in terms of food, but it's as applicable, in its way, to plumbing, or running a midsize retailer or whatever.

We are seeing a turnover of old-school businesses that have refused to adapt to this new reality vs newer owners who, if not exactly savvier, at least understand this reality. Covid simply accelerated this a little as people were compelled to increase their internet interaction with businesses faster than would otherwise have been the case.

Two thumbs up for using longer series of data to reveal the effects of the pandemic.

You've surmised that but you really need to find a data source to show the rate of business closures.

"Closures have stayed about the same, which means that the boom in business formation is real."

The boom in business formation may be real, but the significance is not so obvious. I can't find the source for the number of business formations, but the Business Dynamics Series Explorer (https://bds.explorer.ces.census.gov/?xaxis-id=year&xaxis-selected=2016,2017,2018,2019,2020&group-id=fage&group-selected=010,065,070,075,150&group-group=2&measure-id=job_creation&chart-type=bar) gives data on the number of jobs created.

The 3 million-ish new businesses in 2016 created 2.3 million jobs. In other words, many of these new businesses had no employees by the end of the year (not clear whether they were "closed"), and the vast majority had exactly one employee. Similar figures for other years:

2017: 3.2 million new businesses, 2.3 million jobs

2018: 3.5 million new businesses, 2.4 million jobs

2019: 3.5 million new businesses, 2.4 million jobs

2020: 4.2 million new businesses, 2.4 million jobs (last year with figures available)

My interpretation: the vast majority of new businesses are self-employed individuals, who may or may not make any actual money. If a boomer "retires" from a job and is willing to do some consulting or freelance work, and files the proper paperwork, he creates a new business. If a housecleaner leaves an agency and begins cleaning for herself, and files the proper paperwork, she creates a new business.

The number of new business formations is a meaningless statistic.

Additional information based on further reading:

The reported Actual New Business Formations is based on the first time the business pays payroll taxes, so it should indicate some level of business. But this data is available only through 4th quarter 2020, so I'm not sure what the numbers for 2021 and 2022 are based on.