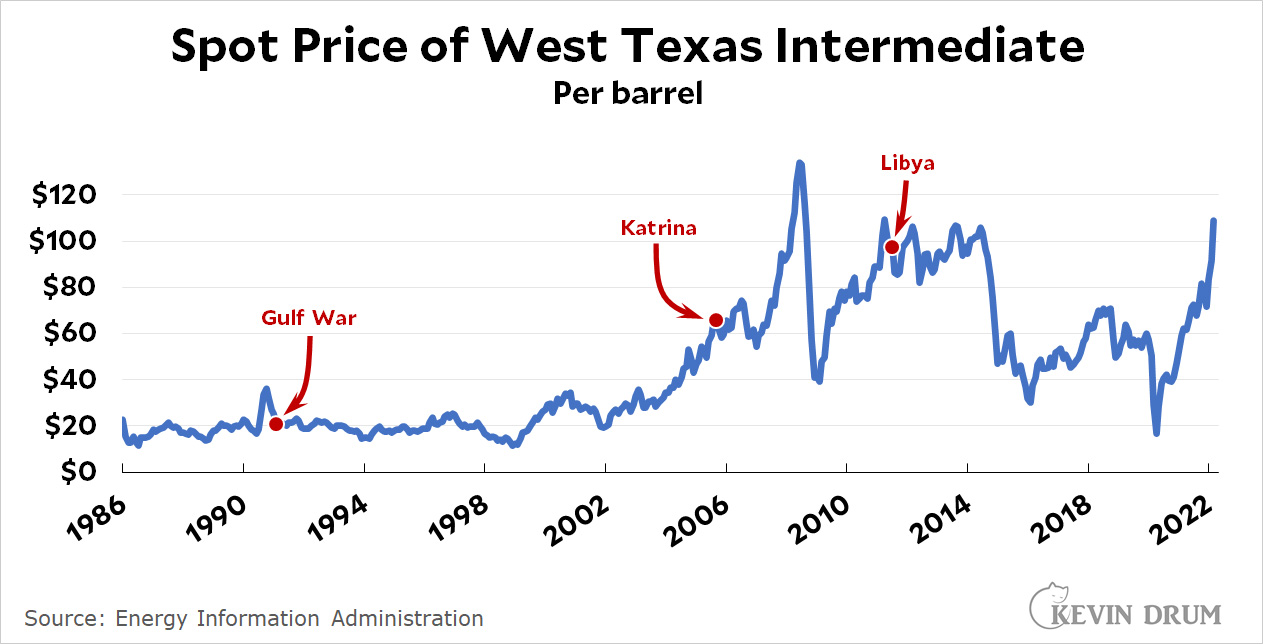

President Biden plans to release a million barrels of oil daily from the Strategic Oil Reserve in order to bring down the price of crude oil and, eventually, gasoline. Regardless of whether this is a good use of the SPR, the first question to ask is whether it's even likely to work. Here's the price of oil following the three previous times the SPR was tapped in an emergency:

In 1991, the price of oil had already come down by the time President Bush 41 opened the SPR. Nothing much seemed to happen subsequently.

In 1991, the price of oil had already come down by the time President Bush 41 opened the SPR. Nothing much seemed to happen subsequently.

In 2005, when President Bush 43 opened the SPR following Hurricane Katrina, the price of oil declined by a few dollars for a month or two and then started rising again. At most, opening the SPR produced a tiny blip in a four-year trend of rising prices.

President Obama opened the SPR during the Libya war, and once again prices went down a few dollars for a short while and then began to rise.

In all three of these cases, the amount released was in the ballpark of a million barrels per day, although that's hard to judge precisely since the oil was typically auctioned off at a single time and then delivered over an indeterminate time period.

Bottom line: It's impossible to say for sure what effect the SPR has. Maybe prices would have skyrocketed if the SPR hadn't been tapped. Maybe the SPR "calmed markets," as they like to say. But the far more likely conclusion from previous experience is that opening the SPR during an emergency has, at most, a tiny impact on the price of crude oil. I expect that if we do this again it will act more as a way of soothing the public than as a way of actually affecting the price of gasoline very much.

Wouldn't it be better to take a series of closer snapshots of the price of oil in the weeks preceding each release of the SPR and overlay the price of Brent and/or Ural?

By now, Trump would've diverted money from the Pentagon to directly subsidize the price at the pump.

All this time I thought Saudi Arabia was our strategic oil reserve. It turns out they are pretty darn useless. Can we cut them loose now?

Paul Krugman, Nobel laureate, made much the same argument, also throwing in the bellicose and hostile rule of Prince Mohammed bin Salman and its reflection on American "values."

Great minds think alike? Probably not in this case. But still… KSA and MBS are the worst client state ever.

The US reserve is not large enough to materially move the market price of oil. I suspect the real impact of this move is marketing. This is Biden signaling he feels the public's around gas prices.

There is little that Biden can do in the near term to change the price of gas that is also politically possible. Steps, such as WWII style price controls are not tenable politically. Actions to increase supply only have impact in the 1 - 4 time frame: plus, increasing oil supply is politically challenging for Biden.

Thus, Biden (similar to Bush and Obama) turns to symbolism.

A million barrels a day sounds like a lot, but in terms of total consumption it is roughly 5% of daily consumption… https://www.eia.gov/tools/faqs/faq.php?id=33&t=6

Of course it seems unlikely the oil will be put out there for free, and the oil present in the reserve was likely purchased at lower prices, so it seeks the government will make a profit on this otherwise symbolic gesture.

5% increased supply in a good with short term inelastic demand can actually have a pretty big impact on price.

But either way, the symbolism is good politics, and anything that potentially moderates volatility in oil prices is probably good. What we need are predictably high oil prices, to provide a strong market signal to switch to alternatives.

And yeah, to the extent that this means that the government bought low and is selling high, good on 'em.

Upon reflection it occurs to me the proper comparison is with world oil consumption.

Correct me if my memory is faulty, but didn't Bush's administration suggest that it would be a good idea to buy oil for the reserve when prices were near the $150/bbl peak? And also, didn't congressional Republicans consider selling oil when the price was low to help pay for the Trump tax cut for the rich?

Buy high/sell low?

What caused the run-up of oil price in 2008? If it was due to speculation, the amount of oil that was being "cornered" was not not large. There is some excess storage, and to the extent that future contracts involve actual deliveries they shift demand in time, but these things would not have caused a huge shortfall in supply. But there was a huge drop in price when the financial crash hit in mid-2008. How much could real demand have dropped off in the time it took for oil price to drop to a third of its peak?

What happened during that time shows that relatively small changes in supply or demand can cause large price movements. Demand for oil is not very elastic on the scale of months.

The way that oil price briefly went negative in 2020 also shows the strong response of oil price to demand changes.

I see two possible, and very marginal, effects here. One, the got-your-back signalling for domestic consumption (sorry, couldn't resist).

The other is that even taking one barrel in 20 of US consumption off the world market could have a supply effect for other consuming countries. Given OPEC production limits, they wouldn't be competing with us for it and it's one less barrel they'd have to pay the Russians for if they're still buying from them. Potentially a small effect, but isn't the action determined mostly at the margins?

Right now, oil companies are making record-breaking profits and doing massive stock buybacks and huge special dividends. Tapping the SPR to lower gas prices only makes sense if the price of oil has a 1:1 relationship to the pump price of gasoline. It does not because prices tend to be sticky downwards.

IF it disrupts speculators driving up the price to insane levels, then it works. Is it enough to cause a significant drop in prices on its own--not really, unless global demand drops a lot too.

The talk was that they'll do this until US production ramps up in a few months. There needs to be a ramp up of renewable energy production too--and more pluggable vehicles being sold (currently ca. 5-10% of sales if I Googled it right) and more recharge stations running.

Speculation has driven prices since the avent of financial liberalization in the late 20th century. Hedge Funds driving the ponzi bus. They could care less about storage or demand as 2008 showed.

Of course it is something that the Administration is doing to be seen to be doing something more than something that will make much of a difference.

What I like though is that we bought this oil when the price was low and are selling it while it is high. There is some good money there (I know, maybe enough to buy one F-35, but still it's better than nothing).

It is 5% of our total daily usage and 10% of our imports. How big of an impact can that have?

Can *all* the oil pumped into the SPR be pumped out?

News reports to not tell the reader.

Hard to believe all oil can be pumped out unless caverns are lined & shaped appropriately. They aren't. The SPR consists of four sites with deep underground storage caverns created in salt domes by dissolving the salt w/ water".

How much oil is lost to permeation is variable. Rock salt is overall, quite good as a liner.

https://www.mdpi.com/1996-1073/13/7/1565/htm

But the shape of the cavern matters a lot. I haven't found any information about that.

All this time I thought Saudi Arabia was our strategic oil reserve. It turns out they are pretty darn useless. Can we cut them loose now?

We should. Hell I would shake up world geopolitics by alighning the U.S. with Iran and not the Saudis.

What caused the run-up of oil price in 2008?

The bigger user of fossil fuels on the planet, the U.S. military, had sucked up enough fuels in its wars with Iraq and Afghanistan that global supplies shrunk and thus increased prices, only to fall during not just the Great Recession (caused by the run up of those prices in 07-08) but also the fracking revolution in oil production which allowed the U.S for the first time since 1970 to be able to export surplus oil

The point to the SPR, of course, is to soothe the public. But one does wonder what sort of cash cow it provides.

Pingback: How’s the latest release of oil from the SPR doing so far? – Kevin Drum