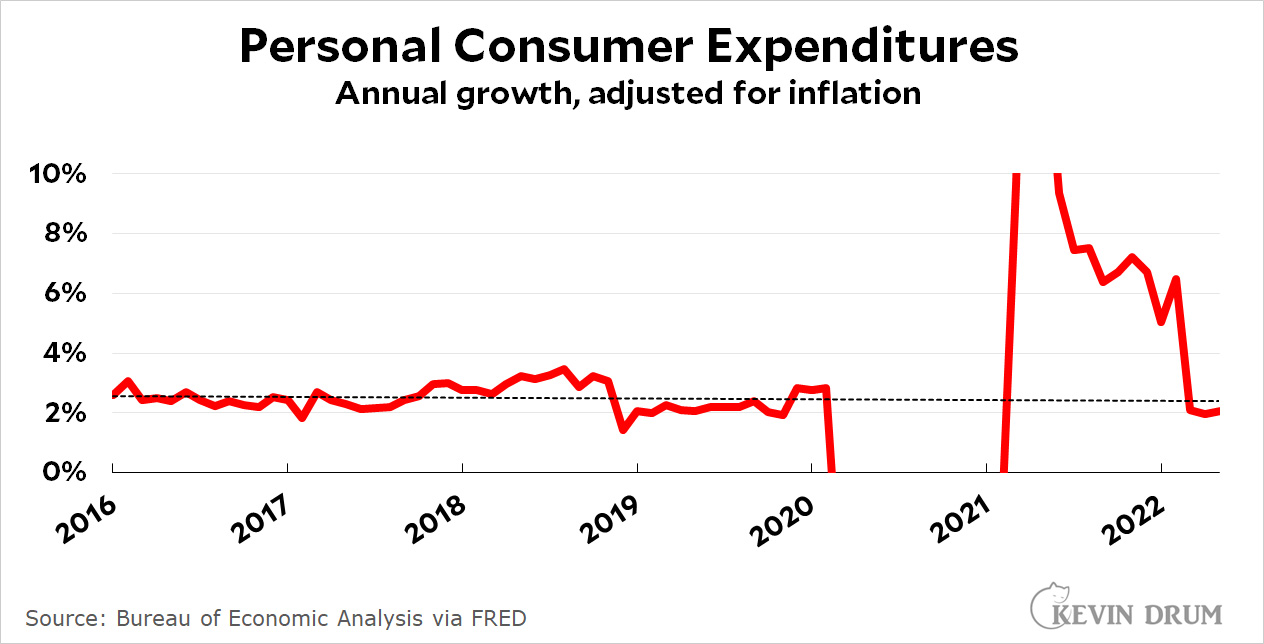

Consumer spending growth was flat in May:

After huge spikes due to the pandemic and its rescue packages, consumer spending growth now appears to have settled down to its normal, pre-pandemic rate of about 2%.

After huge spikes due to the pandemic and its rescue packages, consumer spending growth now appears to have settled down to its normal, pre-pandemic rate of about 2%.

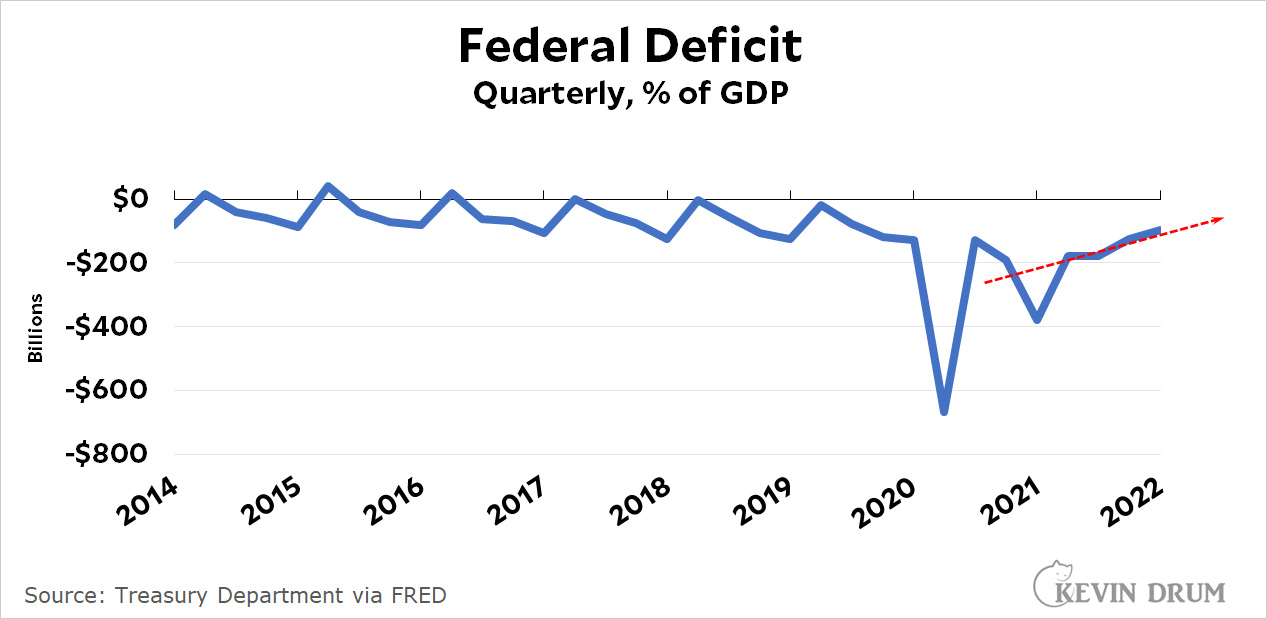

This means that spending isn't driving inflation higher. Wages aren't driving inflation higher. Home prices are no longer driving inflation higher. Rescue packages aren't driving inflation higher. And federal deficits aren't driving inflation higher:

'Uncertainty', and Republicans.

Bingo.

Because they can...

Just price gouging. Capitalism is anti life.

It couldn’t be the war in a major grain supplier being invaded by a major gas producer? Could it?

Of, course, those events have driven up prices of those commodities. But sector price increases =/= inflation. Any non-repeating, exogenous disruption of supply cannot continuously drive inflation. And Russia is in no position to expand this war, or start another. One-time step increases in sector prices are just what markets are supposed to fix, by consumers, through substitution; by producers, given the incentive of higher prices, adding production capacity, or producing alternatives; and by new producers entering the market.

"by a major gas producer?"

Russia sanctions aren't really heavily impacting our gas market, though--LNG export capacity is very, very limited, meaning that the US gas market is not really exposed overmuch to global markets. US domestic production is ~90 billion cubic feet of gas per day, and our daily exports went from about 6 billion cubic feet per day before Russia's invasion to about 7 billion cubic feet per day.

Europe is getting slammed by gas price spikes due to the war, definitely, but not so much here--for the moment. The bigger implication is that, long term, US foreign policy is to increase LNG export capacity, so the US domestic market will be increasingly exposed to price pressures elsewhere.

I remember (vaguely at least) during one of the previous European energy worries wet Russia the Baltic states asked the US to up its ability to export LNG. Circa 2012. One pundit (not sure about Mr Drum) opined it wasn’t worthwhile because the then crisis would be over before the terminals could come online …

> So where is the threat of future inflation coming from?

You know as well as I do that the risk they're defending against is a 2022 Democratic congress.

+1!

From a sketchy University of Michigan survey result.

Something that, with no irony AT ALL, rhymes with “Lootin’” has at least contributed

+1

Gas and oil companies want Republicans in power.

The price of gasoline here in Santa Fe has dropped about 40 cents over the past few weeks. Haven't seen this reported on anywhere.

Gas prices in Baltimore are down about $.35 per gallon in the last couple of weeks.

Energy on supply constraint. Primary resources on supply constraint. Primary food on supply constraint.

(leaving aside the dubious nature of Drum's assertion none of the factors are

Of course price rises are themselves the market mechanism to reconcile supply and demand mismatch and inflation may cool unless further constraints, or demand is not allowed to cool.

Did you notice that FRED has removed the share button?

So where is the threat of future inflation coming from? From likely sustained high energy and food prices. The idea the world could move painlessly from reliance on fossil fuels to a new era of renewable energy was always a pipe dream. Price shocks are the only way to break the conviction of Americans (and Australians) that they have a God-given right to fill up their gas-guzzling trucks for peanuts and drive them as far as they like. Fortunately it's likely to be a transitory cause of inflation, but transitory in the sense of a few years, not a couple of months.

Food is a different story and very uncertain, partly because of the Ukraine war and partly because of the effects of climate change. Prices of fresh fruit and vegetables in Australia are astronomical at the moment thanks to unprecedented wet weather and floods in summer and autumn. The prolonged drought in SW USA is well-known. Typically, we expect these extreme weather events to be temporary. If they become the new norm, food production is going to endure a very long crisis.

Once again, inflation is a rate of change, not a level; it is the first derivative of a price index such as CPI. So ‘sustained high energy and food prices’ contribute nothing to inflation, they would have to continually increase. Europe isn’t going to lose another Russia-sized gas supplier next year, nor will the world lose a Ukraine-sized grain exporter next year.

That is erroneously limited and wrong headedly narrow: yes inflation is a rate of change but it is wrongly simplistic.

Sustained high energy and food prices absolutely can drive further inflation via sustained price pressure that is passed through particularly if 'mitigation' measures by goverments sustain a demand-supply mismatch (subsidies, etc), as well as pass through on inputs in intermediate goods that get passed through only on sustained pricing.

A continuous supply-demand mismatch and pricing feedthrough can certainly drive inflation cycle as a certain infamous decade shows. Thus the paranoia of the central banks globally re unanchoring of inflation expectations.

Pingback: This Chart Shows That Ending Pandemic Aid Created a Financial Disaster – Critical News Autoblog

Pingback: This Chart Shows That Ending Pandemic Aid Created a Financial Disaster | Nuke News

Pingback: This Chart Shows That Ending Pandemic Aid Created a Financial Disaster | Mandala

Pingback: 2:00PM Water Cooler 7/6/2022 | naked capitalism

Pingback: 2:00PM Water Cooler 7/6/2022 | naked capitalism - Investment Policy Wealth

Pingback: 2:00PM Water Cooler 7/6/2022 | bare capitalism - GIST BEAST