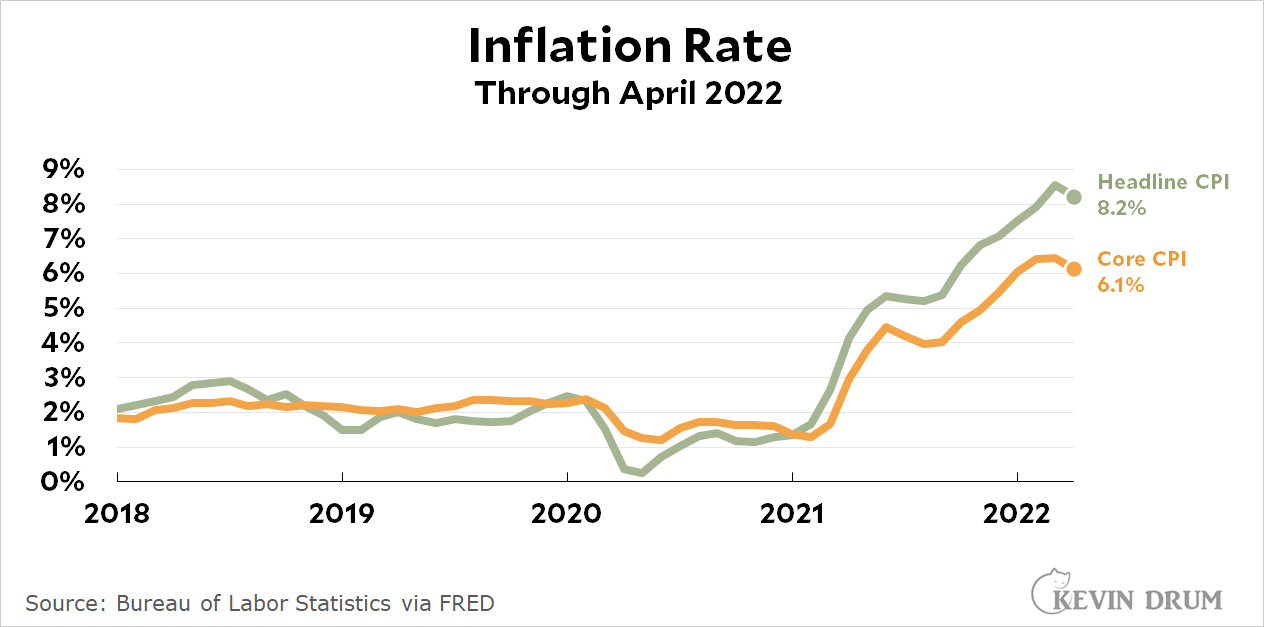

Today is inflation day, and the BLS reports that the US inflation rate has finally begun to decline. The headline inflation rate fell from 8.5% in March to 8.2% in April. The core inflation rate, which excludes food and energy, fell from 6.4% to 6.1%.

This means that our collective optimism about a drop in the inflation rate was justified. Good forecasting, folks! But if want to really see optimistic, check out inflation measured since last month, not last year:

This means that our collective optimism about a drop in the inflation rate was justified. Good forecasting, folks! But if want to really see optimistic, check out inflation measured since last month, not last year:

Headline inflation rose 0.3% since March, which is an annualized rate of only 4.1% compared to 15.9% last month. Oddly, core inflation did just the opposite: it rose to annualized rate of 7.0% compared to 4.0% last month. This is largely because there was a large drop in energy prices, which shows up in CPI but not in core CPI.

Headline inflation rose 0.3% since March, which is an annualized rate of only 4.1% compared to 15.9% last month. Oddly, core inflation did just the opposite: it rose to annualized rate of 7.0% compared to 4.0% last month. This is largely because there was a large drop in energy prices, which shows up in CPI but not in core CPI.

Anyway, the news is largely good on the inflation front, but not so great on the wages front. Weekly blue-collar wages were up 5.5% since last year, which translates to -3.1% after you adjust for inflation. On a monthly basis, wages were up 0.2% from March to April, which translates to a real yearly change of +2.4%. That's not bad, but only if it keeps up for a full year.

Generally speaking, we saw a welcome easing in inflation, but it was about what was expected. Nobody is going to go crazy over this.

On the other hand, the massive drop in the monthly rate of inflation from March to April was, as far as I know, completely unexpected. However, it will probably be treated as a meaningless outlier due to a one-time drop in energy prices that's not likely to be repeated.

However, it will probably be treated as a meaningless outlier due to a one-time drop in energy prices that's not likely to be repeated.

I don't buy gasoline, but I'm reading it's gone back up again over the last couple of weeks.

Nope, it's down again

Diesel and gas are hitting record highs here in New England. The price of diesel eventually impacts just about everything else.

A strong confirmation that inflation is, indeed, appearing to ease is that the media is now hawking gasoline prices as The Day's Big Thing.

Gotta stick it to them Democrats, doncha know? There's always something bad going on that they can be blamed for.

Gasoline is down as well. Lags kill media.

Higher gas prices are a good thing; it should encourage the more rapid adoption of low carbon transportation solutions.

Higher gas prices are a good thing; it should encourage the more rapid adoption of low carbon transportation solutions.

It also encourages people to vote Republican, which will do anything but "encourage low carbon transportation solutions."

Obviously, the Democrats need to give people something more significant than gas prices to base their vote choice on.

While its been a constant them that people are falling behind because inflation statistics outpace wage statistics, this is hard to reconcile with the stats showing that bank account balances are still higher and credit card balances lower than pre-pandemic.

Anecdotally its been relatively painless to avoid the major inflation items, but the higher earnings are still there.

I'm always a bit bemused that rapidly rising home prices and/or stock portfolios are not considered a bad thing for millions of folks...

Inflation of assets, if you have them, is a good thing of course.

"The consumer price index (CPI), the most widely used gauge to track inflation, dropped to 8.3% in April from a year earlier, down from 8.5% in March, a four-decade high, according to the report published Wednesday. Economists had estimated an 8.1% rate for April."

I'd say 8.3% CPI is a forecasting victory for folks who responded to the poll saying they expected inflation to remain about the same.

Let's go, Brandon.