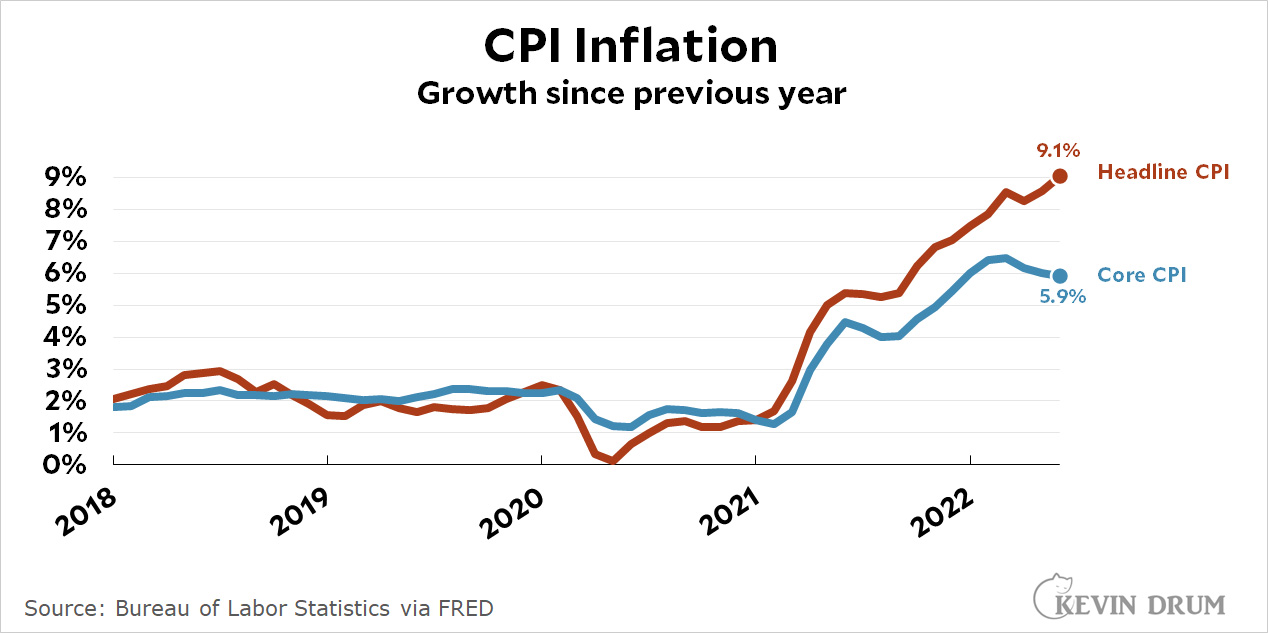

Without further ado, ladies and gentlemen, your inflation rate for June:

As usual, I'm less interested in the headline number and more interested in core CPI, which dropped another tenth of a point last month, ending at 5.9%. It has now declined 0.6% since February.

As usual, I'm less interested in the headline number and more interested in core CPI, which dropped another tenth of a point last month, ending at 5.9%. It has now declined 0.6% since February.

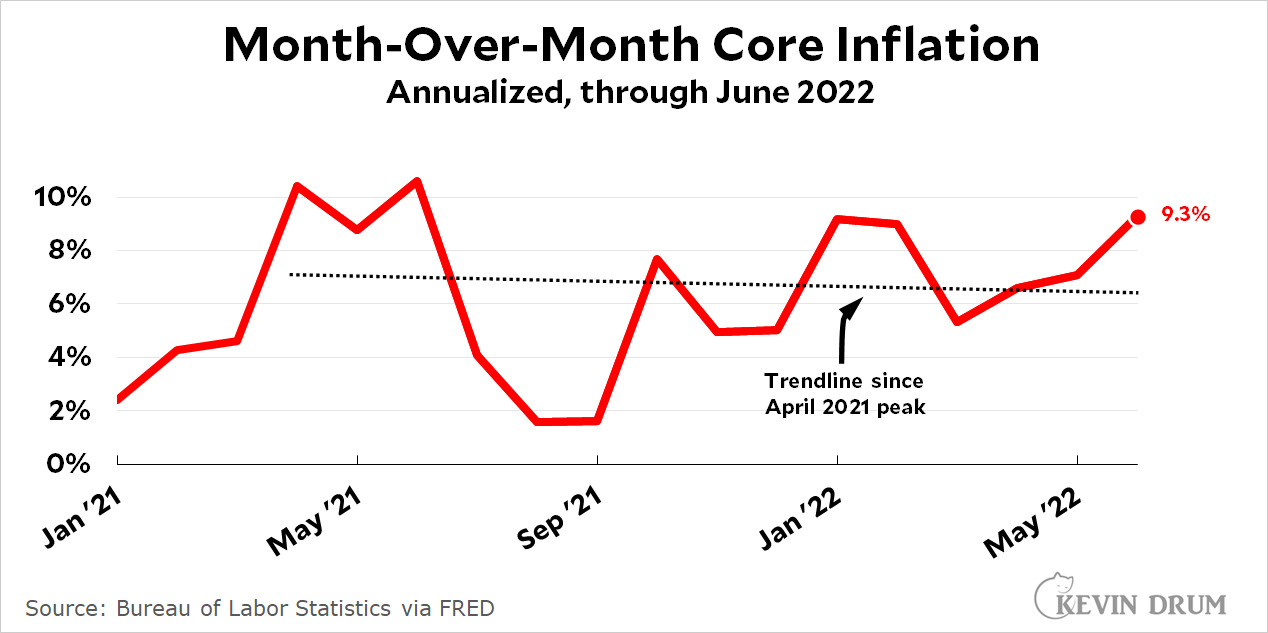

If you want a sense of how inflation is running this month, your best bet is to extract month-over-month figures and then look at the trend. Here's an updated version of my chart from last month, which does exactly that:

Not so good! The trendline is still down, but the current figure is 9.3%, which marks three consecutive months of strong growth. However, note that this is CPI core inflation, not PCE core, because that's all we have available today.

Not so good! The trendline is still down, but the current figure is 9.3%, which marks three consecutive months of strong growth. However, note that this is CPI core inflation, not PCE core, because that's all we have available today.

Overall, my conclusion is that inflation is under control, which I base on the fact that core year-over-year CPI is continuing to trend down. However, I expect to see a general freakout when I'm finished here and start looking at media coverage. The headline number is all they care about, and it was pretty scary this month.

"Overall, my conclusion is that inflation is under control, which I base on the fact that core year-over-year CPI is continuing to trend down. "

uhh ok, but if you run the trendline from July '21 instead of June '21, it's going up. So, next month will you consider inflation to be out of control if that upward trendline from July holds true?

Kevin picked a nice looking cherry. Don't spoil it by citing data!

Remain calm! All is well! https://youtu.be/zDAmPIq29ro

I see the previous section of the chart, example in https://jabberwocking.com/inflation-has-been-declining-for-the-past-year/ is now no longer included. The different variety of starting point and duration cherry combining this month with a trend line covering the entire period starting May 2020 looks, to the MkI eyeball, like a continuing increase.

It seems Kevin has shifted horses/metrics? https://jabberwocking.com/inflation-has-been-declining-for-the-past-year/

That other inflation post was about PCE (core). Today's report is about CPI (headline and core).

I think trimmed mean PCE is the true measure of how most households (on a budget) actually act, however.

The shape was similar enough to the eye I thought it was the same metric there for a bit. Still somewhat ... interesting he didn't take this one as far back as he has taken the others.

Also, the headline number and core both were above expectations, whatever that means (analysts, economists?)

Under control? Perhaps, just barely… People were surprised it was a bit higher than expected.

Man, the CEOs really hated losing their nonfriend in the White House who they would not want to join their country club.

How soon til we find out the pricefixing was cooked up at Bedminster or Maralago during secret meetings with the Kushners, a la Reagan's dispatch of "nonaffiliated" persons to Madrid to tamp down Iranian willingness to free the hostages before election day, 1980?

Nah, it was in the basement of a pizza joint…

Papa "John" Schnatter was surprisingly removed from the discussions of reinstalling Trump on January 6, 2021, but I knew he would come thru for the party, eventually.

Didnt he play keys for Jefferson Starship?

Might have.

I am still kind of surprised no one like Grace Slick was at the January 6, 2021, March on Washington. MO Tucker would have been, but she died.

The housing component is likely going to present a very misleading picture of current month CPI for the next several months.

My understanding is that for the CPI figure -

1) Current month housing increases actually represent the pro-rated average increase over the last 6 months.

2) Homeowners are assumed to be paying the market rate to rent their house. That most people either own their home or have a fixed mortgage is not factored in.

Unless rental rates are stable for years, this seems to make for a highly misleading current month CPI value. It doesn't seem to give us useful, actionable information when rental rates are changing quickly or when rental costs diverge from the cost of owning.

But it's the statistic we are stuck with.

From https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.htm

To say the least, I can think of better ways to get at imputed rent for homeowners. When I was a homeowner, I naturally had little interest in rent trends in my town. But as you say, and as with so much economic data, we are stuck with crappy measures because better ones would be incommensurate and would obscure trends.

Three straight months of core-CPI dropping. That's a good sign that high inflation expectations haven't settled in.

But by virtue of the high rate of inflation (both CPI and core), we can assume that Q2 real GDP will be negative, even if nominal GDP is positive. Two straight quarters of negative real GDP will cause a lot of people to declare a recession, even though employment is expanding and without a contraction ib employment, the current business cycle hasn't ended. Nonetheless, there will be people in the media running their mouths about stagflation already here.

The Fed is going to boost their rate by 75 basis points again. They have no choice. They raised it 75 basis points when the headline inflation rate was lower, after all.

And I'll still be bitching about how we could give out free public transit passes to the first 50M people and have a positive effect on those most affected by headline inflation that will trickle up to everyone else who has to drive to work.

The Fed is going to boost their rate by 75 basis points again. They have no choice.

Drudge is suggesting 100 points.

Well, I should have said, "at least 75 basis points." But yeah, I'm sure there's pressure to go for 100. Feds can do more, however, by accelerating the reduction of their balance sheet -- https://bityl.co/DDtE

Does it even matter????

Maybe not.

An anecdote: yesterday when I filled up the auto, gasoline was down to $4.059! This morning, I passed a station advertising $4.049.

Not that any of this is good news for the Democrats. There is never good news for the Democrats.

I haven't heard anything about the baby formula shortage lately. Funny how these crises come and go.

I heard Gary Condit solved it while riding a shark across Chesapeake Bay.

Also, with the recent Supremes revocation of Roe, will there be a lot more Garyconditian murders of Capitol Hill interns & staff since pregnancies will be more difficult to undo? Smart money has to at least be on Scott des Jarlais going full Pedro the Lion -- Winners Never Quit on his next ho.

https://youtu.be/MtI0HRBmAMU

For point of reference: track 5, "Never Leave a Job Half-done". The song that encapsulates Scotty D's moral rot & abortionist impositions on his mistresses. Abortion may not be murder, but it should be a choice -- & Dr. des Jarlais's slampieces never had a choice. Scott is just Jason Miller with the AMA seal of approval.

The Fed's primary inflation index is the PCE, and the PCE excluding food and energy has been much more easy-going than the CPI over the past four months, at an anuualized clip of 4%.

"Overall, my conclusion is that inflation is under control, which I base on the fact that core year-over-year CPI is continuing to trend down."

Respectfully, the vast majority of the economics' profession disagree with your conclusion. While Kevin could be correct, and the economists wrong, its hard to imagine that the near term impacts are not 1) material increases in the Fed discount rate (rising broader interest rates) and 2) declining Biden popularity.

Can it get even worse? He's the most hated president ever.

Low approval rating =/= hate. I doubt any President was more hated than Lincoln. Says more about the haters than it does about the 16th President.

I THINK the reason that Biden's approval is lower than Trump has to do with the Democrats. The Republicans supported Trump and the Democrats hated Trump. In contrast, Democratic groups such as the under 35 crowd, are turning on Biden.

Basically, I don't think the Democrats hate Biden: rather, they are disappointed....

Citation needed. The only source I’m aware of that could bear on this is the University of Chicago Booth School poll of ~80 economists. Here’s the most recent one I found where they asked about inflation:

https://igmchicago.org/wp-content/uploads/2022/06/RESULTS-2022-06-06-Survey-05.pdf

FTxIGM Survey: Recession in 2023?

JUNE 13, 2022

Median expected core PCE for the year is a little below current level, which would require a decline of another point or two. The most important factors, by a solid majority, are the geopolitical situation and supply-chain problems.

My personal opinion is that expenditures on food and energy are less elastic (demand changes less with changes in prices) than most other categories, and the causes are global, so I don’t expect interest-rate hikes by the FOMC to have much effect on prices.

Thanks, we needed that!

I'm actually (finally! at long last!) optimistic about the inflation picture for the first time since it began spiking last year. The strong dollar is not only helping to keep fuel prices in check (and fuel is a major input throughout the economy), it's also helping to keep the lid on import prices. This is not only good in and of itself for consumers, but will also make it more difficult for domestic producers to raise prices. Imported inputs and parts will also be cheaper. US exporters will get creamed, of course, but that's a good thing for the inflation situation, too, in that export-oriented US firms are likelier to ease up on hiring, which will eventually provide a bit of relief to employers more generally.

Finally, we've got multiple rounds of Fed tightening in the rear view mirror, so the cavalry is on the way. Newspaper headlines right now are ugly, to be sure, but a big and sustained drop in inflation is only a matter of time at this juncture.

You realize 50%+ of that mythical cpi inflation from that report was the first week of June, right??? Maybe it's time to arrest the people who create these reports???? Double check the work.

The other 50% is from the last week of may. remember they start the new month in the old month.

.1% from the 2nd week on. So the last 50% of sampling was .1%%% . What a dumb index.

You mean a lying inflation report. No way prices went up that much with all the fire sales.. Abolishing cpi permanently should be looked at.

Seasonal adjustments?

Core CPI down (year over year) yet up (month over month)....hmmm....

Last report didn't really catch drop in gasoline prices, so headline number will look better.

As for core CPI--raises in Fed rates still working their way through the economy, so will affect numbers down the line. Perversely, the drop in gas prices will offset the increase in Fed rates and stimulate the rest of the economy, and cause gas prices to rise....

Of course the war in Ukraine is still playing havoc with commodity markets. Not sure what Putin will do when his troops are pushed all the way back.

The only thing that matters is whether it is harder to pay for food, shelter and energy. If yes things are worse, if no things are okay/better.

Basically, headline inflation = microeconomic inflation = Michigan inflation expectations = angry voters.

Waste of a post. Michigan Survey is made up trash. Like most indictors, we don't need it.

Lets also note, the way sampling occurs, it's mostly a midmonth to midmonth measure. I think all bls data is procured that way.

Nope.

Same as the last time this chart was posted (a few weeks ago?) - the overall trendline is up. Cherrypicking the start of the trendline as the spike (which was very clearly a spike above underlying trends) is lying with statistics.

This picture is actually worse than I expected, as I expected (hoped for) the trendline to continue flattening, but it didn't. But like Jasper, I'm still somewhat optimistic as I do think the worst of the inflation is already behind us.