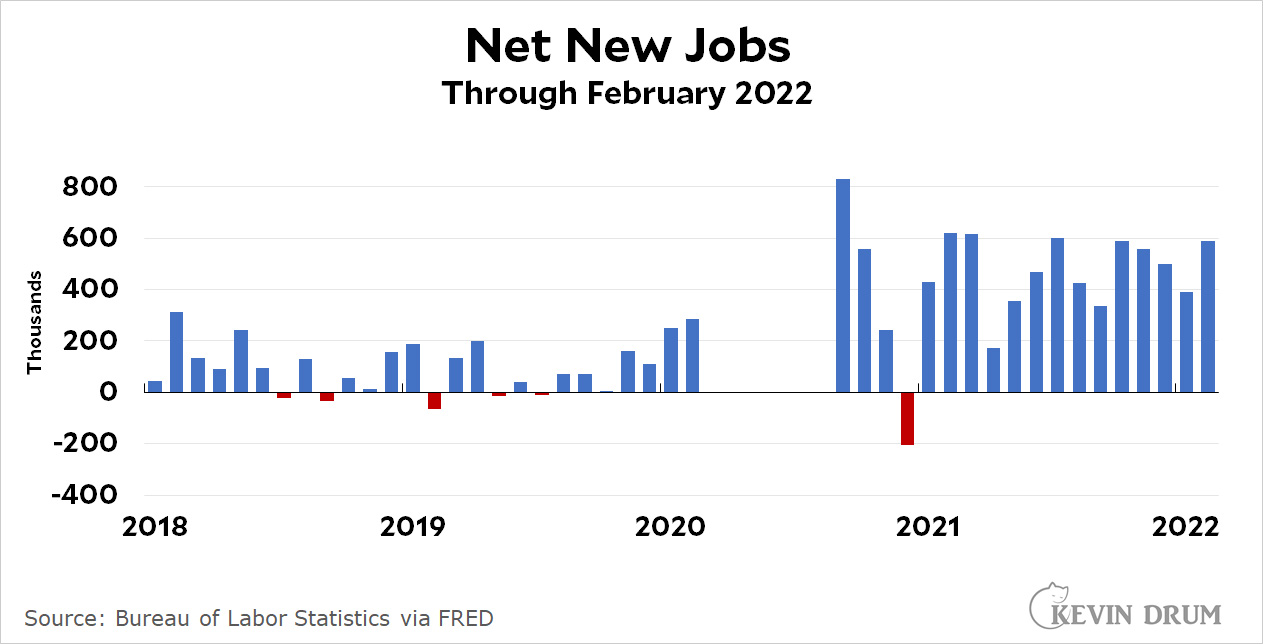

The American economy gained a stellar 678,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at 588,000 jobs. The headline unemployment rate fell yet again to 3.8%.

There's no bad news in this report. Employment increased by more than 500,000 jobs, unemployment went down by 243,000, the labor force grew, and the participation rate went up.

There's no bad news in this report. Employment increased by more than 500,000 jobs, unemployment went down by 243,000, the labor force grew, and the participation rate went up.

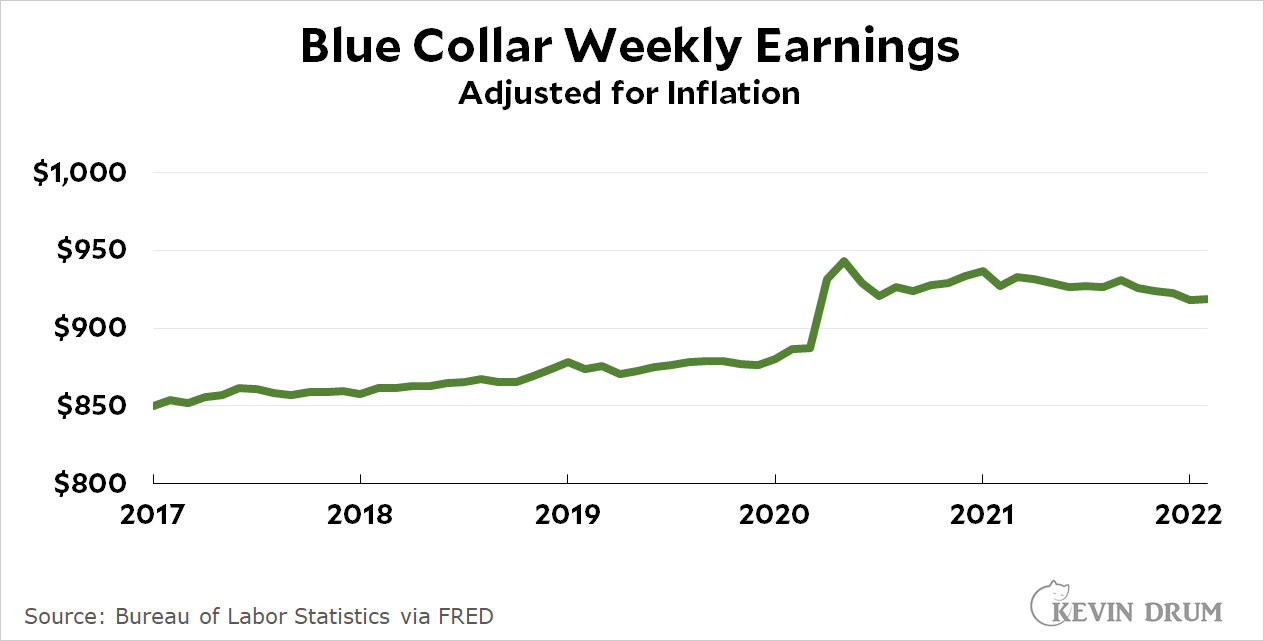

Even wage growth picked up a little bit. Accounting for inflation, blue-collar earnings were about flat, which is nothing to write home about but still better than the declines we've seen over the past few months.

Wages have been slowly trending downward since the start of 2021, but the good news is that they're still about 4% higher than pre-pandemic wages.

Wages have been slowly trending downward since the start of 2021, but the good news is that they're still about 4% higher than pre-pandemic wages.

Great news! One hopes that inflation will recede and we will be left with a robust economy.

Of course, if inflation continues to rise then employment gains will fall to secondary information, where the lead 'story' is how expensive everything is....

Let's go Brandon, indeed.

Paul Krugman muses on "America's Very Peculiar Economic Funk"

https://www.nytimes.com/2022/03/03/opinion/biden-economy-inflation-jobs.html

WordPress hesitated for a full minute on what to make of a four-letter word that begins with f-u and ends with a k.

And yet right-wing family members and social acquaintances bemoan the destruction of the economy and the country's dire situation. The sky is always falling.

It has to be, else they'll have to admit a Democrat got something right...

Meanwhile, the Putin plunge:

https://www.cnbc.com/2022/03/04/russia-stock-etfs-trading-in-us-plunge-this-week-with-some-halted-for-trading.html

Reportedly the US and Europeans spent weeks planning the sanctions regime, well in advance of the invasion. Never get into a financial war with capitalists; if we know anything, it's how to crash markets.

This comment is dangerously close to ( ( ( SOROS ) ) ).

I firmly believe we are in for a long period of extended but mild inflation that will last at least 5 years, maybe longer

There's pent up demand after the pandemic

People are believing they can retire earlier than anticipated

Wage have risen along with prices

Population growth is now stagnant if not falling

Just for these reason alone we will have labor shortages that will result in a competitive labor market. Wages will continue to go up and inflation will subside a bit but still be here

The war in Ukraine is a temporary influence

The economy has been overall good for a lONG while (Outside of the pandemic shut down). A return to normal means a return to solid growth in jobs

The question is gonna be housing. IT should begin to cool off soon and the FEDS will probably help it along but eventually the end of the boomer generation will end the long term boom in housing. There will be more units on the market then the population can absorb and that will bring prices down.

It is a great economy, no doubt about that