The New York Times reports today on tax season:

Decades of Neglect Leave I.R.S. in Tax Season ‘Chaos’

"Neglect" is the opposite of what's happened, as the body of the story makes clear:

Tax-averse Republicans, who have spent years cutting the agency’s budget, have seized on the I.R.S.’s problems as proof it should not be given more money or responsibility, with at least one lawmaker calling for the tax collector to be abolished.

Much of the agency’s current woes can be traced to those budget cuts, which have eroded the agency’s ability to function at a critical moment. Staffing shortages and antiquated technology have collided with a pandemic that kept much of the agency’s work force at home while the I.R.S. was turned into an economic relief spigot responsible for churning out checks and other stimulus payments to millions of Americans.

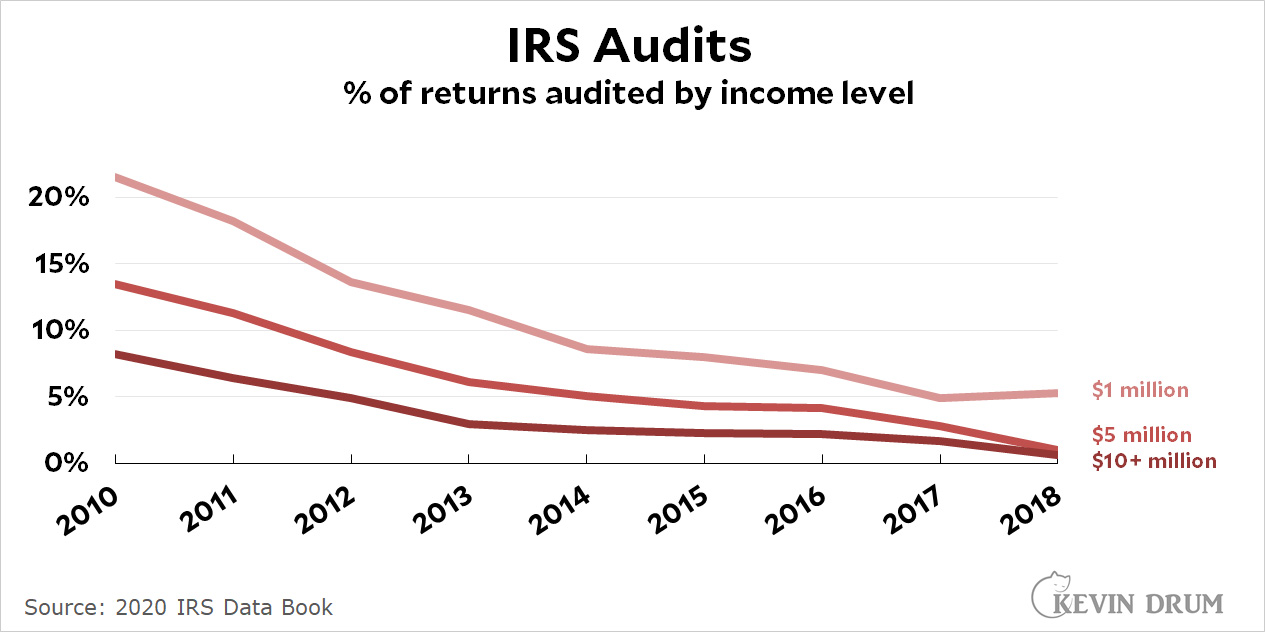

"Tax averse" is a little better, but still doesn't capture what's really happened to the IRS. "Deliberate destruction" is more like it. Republicans have long had a goal of hollowing out the IRS so that it can't afford to audit the rich taxpayers who are the base of the party.¹ As a bonus, this also guarantees that ordinary taxpayers get lousy service, which makes them generally pissed off about taxes.

This is first-degree murder with malice aforethought. It's a carefully crafted strategy and so far it's worked great.

¹What, you thought that nutcase MAGAnauts were the base of the party? Ha ha ha. No. Take a look at what Republicans do, not what they say. Rich people are still the real base of the party.

¹What, you thought that nutcase MAGAnauts were the base of the party? Ha ha ha. No. Take a look at what Republicans do, not what they say. Rich people are still the real base of the party.

This is very well-stated, Kevin. NYT needs to re-train their headline writers. Maybe outlaw gop-friendly euphemism formation too.

Weapons of mass destruction? Partnering with Breitbart to cover the Clinton foundation non-expose? Buttery males? The old grey lady is just not too sharp. One senses the reporters have spent too much time sitting in Iowan cafes trying to learn how the world works.

Hillary Clinton's imminent indictment in January 1997, per William Safire.

Nonsense. We can't engage in overly aggressive truth-telling. That would be partisan. And mean to conservatives.

More proof it is the GOP that is pro crime and supports "Defunding the Police".

"...Rich people are still the real base of the party."

No. They never were the base. They used to be the ones at the controls. But now we have reached the stage of human devolution where material rewards no longer have any salience, only infantile emotional rewards, i.e. any form of destruction for its own sake. The plutocrats can still get their way in some areas, but not all, and fewer with time.

Correct. See Mitchie now engaging in trying to put out regular brushfires fro the magats while Trump's Kevin licks their... boots.

This is not quite true. Rich people are not MAGAnauts in general. But so long as they get their tax cuts they don't care if the country goes to the dogs. They are willing to go along with MAGA. They know better but they don't care. This is how Orban, Erdogan, Putin etc. become powerful.

These people are much more despicable than some MAGA true believer hillbillies.

+1

It is true, and bad, that IRS funding has been materially reduced. However, the number of audits may not be the perfect measure. Let me make my point:

1) an option for more IRS employees would be to materially increase audits related to the earned income tax credit. IRS estimates that between 21 percent to 26 percent of EITC claims are paid in error. This strategy would raise the number of audits and clearly increase the win ratio. Not a lot of new revenue would be generated.

2) you could audit a relatively small number of very rich folks. To be successful the IRS would need a small number of VERY sophisticated accountants and attorneys. The number of new audits would not change that much and the win rate would not be great. However, this would raise a lot of new revenue.

My point, a graph that shows a lot more audits (or even audit wins) is not the crucial measure for me. Auditing EITC folks might help the charts but not likely a win for this country.

With option 2 a lot of revenue would be raised just by the increased threat of an audit.

The GQP already overaudits EITC recipients.

Try again, Joe Liebermann-Zell Miller-KKKlay Travis Democrat.

He still thinks people don't know what he really is. Kind of like a puppy hiding behind the couch with his hindquarters hanging thinks you can't see him.

The last time Kevin was riding this particular horse I went ahead and pulled out staffing levels vs US population going back to 1950-ish: https://docs.google.com/spreadsheets/d/1QCDTT2M0-xb2KeLdmdVyj4nsAfnrRiPWV1B2-ZLH9qw/edit

thanks!

We also have the rise of commercial tax preparation services...which is why we can not have the IRS just do your taxes for you...

But how can you trust the government not to cheat!?

Speaking of auditing rich people, has there been any news in the last year or two on that massive tax dispute Trump was having with the IRS? It was sent to some Congressional arbitration comittee that has apparently been sitting on it for years. If they rule against him, he could be on the hook for tens of millions in back taxes.

And now the Manhattan DA is apparently getting cold feet about charging him in his ongoing tax scheme to undervalue his properties when paying taxes while wildly overvaluing them to get loans.

The rich truly do live differently than you or I.

I thought the base of the GQP was bread n' butter suburban voters turned off by Democrat wokeness.

Its infuriating to see this happen, but on the other hand it’s also hilarious. Americans are so messed up.

Anecdotes aren't data, but here's anecdote that argues the IRS has been deconstructed to the point it can no longer perform its core functions. At the end of January I received a CP80 form letter from the IRS stating that I had a "credit" with the IRS, but that I had not paid my taxes for the year 2020. I was instructed immediately to file a 1040 for 2020. Instead, I went to my files and pulled a copy of the 1040 I HAD filed that year. What I found particularly curious was the fact that the sum of my four estimated tax checks from 2020, along with the check I sent in April, 2021 for taxes owed, came to the exact amount as the supposed "credit" I had with the IRS. Apparently, the IRS recorded the money I had sent in (all checks had been cashed), but somehow lost track of my 1040. So I copied my 1040 along with all attendant schedules and forms, and sent it to the IRS asking that they respond ASAP to let me know they had received this material and had resolved the issue. It's been well over a month and I have not heard from them. Since then, the IRS, realizing there is something wrong with its algorithm, has stopped sending out automated CP80 form letters. Grrr.

I know of two people who had the same thing happen--have a tax credit but IRS can't find their tax forms.

What, you thought that nutcase MAGAnauts were the base of the party? Ha ha ha. No. Take a look at what Republicans do, not what they say. Rich people are still the real base of the party.

No, I think MAGA is indeed the base of the party.

Rich people are the boss of the party.

Maybe EITC is not such a hot idea after all. If 25% of claims are "in error" there must be a similar percentage that--in error--were not even filed.