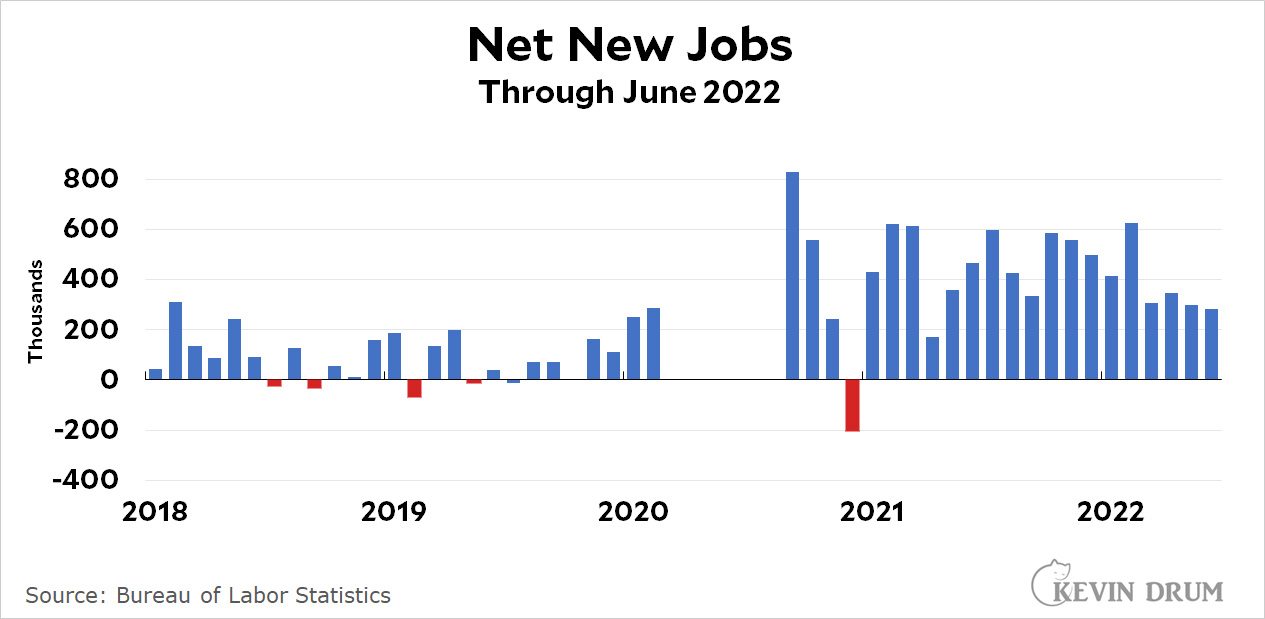

The American economy gained 372,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at 282,000 jobs. The headline unemployment rate remained flat at 3.6%.

This month's report is something of a statistical mirage. The size of the civilian labor force declined by 353,000 and the number of employed people declined by 315,000. Not so good! However, the number of unemployed workers declined by 38,000 while the number of underemployed workers (those who had to settle for part-time jobs) declined by 707,000. Not so bad! Meanwhile, more than half a million people dropped out of the labor force, which is . . . something. I'm not sure.

This month's report is something of a statistical mirage. The size of the civilian labor force declined by 353,000 and the number of employed people declined by 315,000. Not so good! However, the number of unemployed workers declined by 38,000 while the number of underemployed workers (those who had to settle for part-time jobs) declined by 707,000. Not so bad! Meanwhile, more than half a million people dropped out of the labor force, which is . . . something. I'm not sure.

This somehow gets mathified into 372,000 new jobs, but I'm not feeling super happy about it. Both the Labor Force Participation Rate and the Employment-Population Ratio were weaker than last month.

Earnings of blue-collar workers were up at an annualized rate of 5.9% over May, which comes to -5.7% adjusted for inflation. That's a volatile number and probably doesn't mean much. However, the yearly number is more reliable, and for the past year wages were up only 5.4%, which comes to -3.2% adjusted for inflation.

(Note that the New York Times says wages "continued to climb rapidly" last month, which is only true—both for June and for the past year—if you don't account for inflation. Why don't they?)

So . . . the number of employed people was down and blue-collar wages were down. On the bright side, a lot of part-time workers apparently got more work thanks to strong business conditions. I'm not quite sure what to make of all this, but for now I'd call it a fairly so-so jobs report.

Bill McBride has a more positive take.

https://www.calculatedriskblog.com/2022/07/comments-on-june-employment-report.html?m=1

thanks for the link.

The prime age metrics says a lot--25 to 54 years old are just shy of pre-pandemic levels of employment and participation. Still off from past highs that preceded major recessions.

Right if you're looking for we-are-already-in-a-recession signs, I don't see one here.

STOMP ON IT!!!

stomp on it now!!!

In other words, boomers are bailing?

Hopefully, into various plots & urns.

Nah, not yet

But Drum falls into the same trap from time to time

There's NO WAY to accurately gauge the % of people 62+ who were working before the pandemic as opposed to NOW. Why? There was no census question regarding it so we have to rely on surveys and extrapolation of numbers to even make an UNinformed guess

Take this sentence from the Drum article:

"Meanwhile, more than half a million people dropped out of the labor force, which is . . . something. I'm not sure."

Is it something? Or is it a result of the huge increase in babies born 62+ years ago?? Thats a loaded question for sure

I look at the unemployment rate (again a number done by survey) at 3.6%. We at full employment, period. Probably a little beyond full employment IMHO

Sure half a million is a big number but keep it in perspective related to the birth numbers of 62 years ago.

This puts the job creation admins of Reagan, Clinton, Obama and now Biden in a whole new light as they created so many jobs to absorb the new workers, and at the same time allow for reluctant workers to come into the workforce - all at a time when the number of workers of age were increasing. Now that the numbers of workers of age is decreasing losing half a mill in one month isn't so bad.

The baby boom doesn't come near to explaining a 500,000 drop in the labor force in a single month. The number of babies born in 2000 was only about 250,000 less than the number born in 1957, and those are numbers for a full year.

Jerry

One year doesn't thats for sure but anyone OVER the age of 62 would be eligible for SSec so it's not just one year

Old people are very strange when it comes to work

They love doing a job but once they're done? They walk away without regrets for the most part

From Bloomberg this morning: An indicator of US supply-chain pressure fell to the lowest level in two years, as a sharp drop in transportation costs underscores the slowdown in the nation’s economy heading into the second half of year. The Logistics Managers’ Index declined to 65 in June, the third straight fall from a record of 76.2 reached in March and the lowest level since July 2020, the monthly report released Tuesday showed. It was the first time since mid-2020 that the reading came in below the all-time average, currently at 65.3. (Click here for more.)

The years of the former guy's maladministration, even the pre-pandemic numbers, look pretty awful when compared with those under President Biden. And yet, the media persistently paints the former admin's economy as "much better" than what we have now, whiich is "a total disaster."

Meanwhile, gasoline is down to $4.199 at the street corner I pass every day (there three stations; Chevron is still something like $4.599, but they're always way high.)

As an aside, it's this very corner where Saul Goodman's office was located, back in "Breaking Bad." SE Eubank & Montgomery.

Afghanistan. Baby formula. Car sauce.

Alphabetically, the next thing the Biden-Harris despocy repairs starts with d.

Better Call Saul's final chapter starts like, this week I think. Or next. Should be good...

And even purportedly liberal pundits continue to pick starting points for their charts which don't include the (full measure) of the Trump years...

Grr... crossed postings - the next one where wages are shown for just the last two years was the topic of that missive.

“Meanwhile, more than half a million people dropped out of the labor force, which is . . . something. I'm not sure.”

If Long Covid is as dramatic as many studies have suggested, it makes you wonder when it’s going to start impacting the economy. Is this that?

If I had been given the option, I would've retired at the begining of summer. Has anyone studied this? Maybe that explains the drop in labor participation.

If I had been given the option, I would've retired at the begining of summer. Has anyone studied this? Maybe that explains the drop in labor participation.

The large empty gap in the net new jobs chart being for keeping the chart "clean" or some such?

Well, evidently the NYT has a different opinion than Kevin

"The robust pace of U.S. hiring continued in June as employers added 372,000 jobs, a boost that may ease worries of an impending recession."

But then again, Kevin has recently predicted a recession.

That's OK Kevin. Just keep on grinding out the numbers in your efforts to understand and quantify "the dismal science".

Put it this way: JOLTS report from Wednesday showed May had 11.25M job openings, so there appears to be a very large demand for workers (11.25M openings - 5.92M unemployed = gap, 11.25M/5.92 = tightness).

BLS has been setting records for — the size of corrections to jobs reports.

https://www.washingtonpost.com/business/2021/11/16/government-underestimated-job-growth/

I look forward to that Friday in August when the corrections to this report are published, and we find out what actually happened in June. Or at least we get a better estimate.

"which is only true—both for June and for the past year—if you don't account for inflation. Why don't they?)"

In no small part because nominal wage growth reaction to inflation (as we saw in the 1970s) can and does drive wage-price self-reinforcing spirals.

While the Lefties have spent the past year denying inflation was anything more than transitory, it's abundantly clear it is not, and that the justifying tales of why it's going to moderate are basically rerunning the same mistakes the Left made in the 1970s.

Lefties? Nope. Like leftists care about capitalism. You need to prove it is not transitioning. June inflation looks flat.

I wonder how the new B.A.5 variant will affect these numbers

14% positive test rate in NY?

THE dominant strain in the United States? Many companies are requiring a 5 day lock down for a positive test

And of course the worst part is that anyone who got original Omicron is very likely to have NO PROTECTION against the latest variant so re-infection with Omicron is much higher than with earlier versions.

And now we're finding out that re-infections are causing multiple serious long term problems for some folks

Our employment situation will get tighter still

Irrelevant. You need a finger snapped for this post.

For economists, nominal wage growth of 5% is indeed high - too high to make a 2% inflation rate possible. Everything is measured against the holy 2% goal, not people's lived experience.