An awful lot of people still don't seem to get the fact that you have to adjust wages for inflation to see how people are doing. A 5% wage increase is good if the inflation rate is 2% but bad if the inflation rate is 8%.

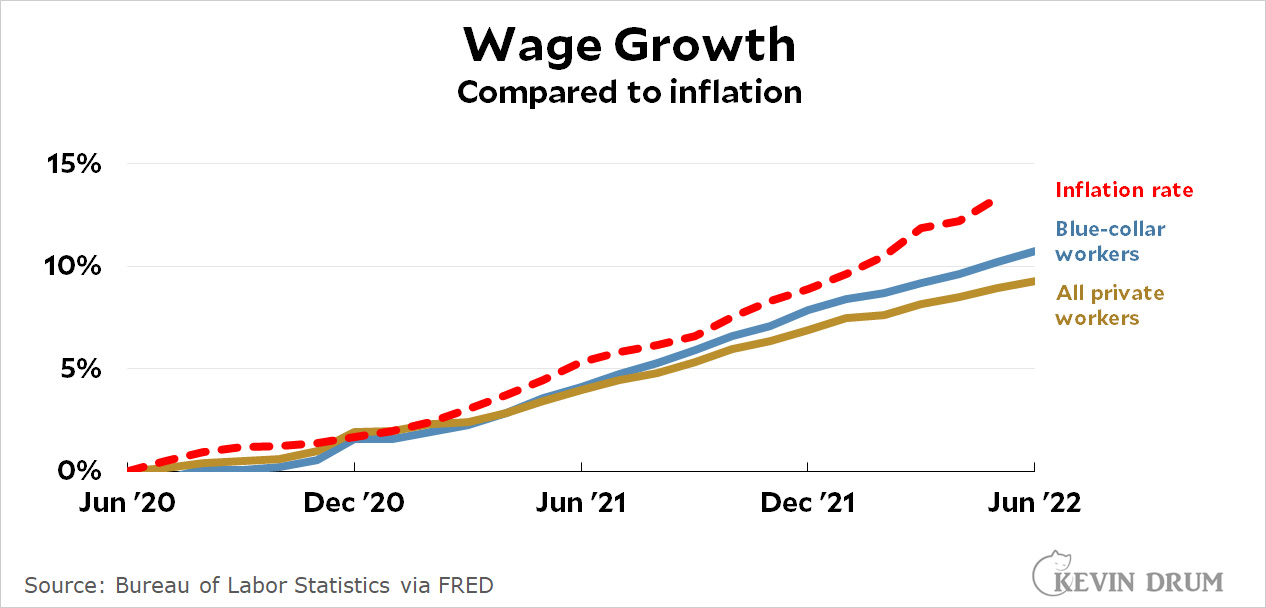

So here are two charts that show what's been happening to wages over the past two years. First up is a chart showing the growth of wages alongside the growth rate of inflation:

Next is a chart of hourly wages that's been adjusted for inflation:

Next is a chart of hourly wages that's been adjusted for inflation:

Either way you look at it, wages are down. Unless you can eat a nominal dollar—and you can't—this is the real state of earnings in the US for the past two years.

Either way you look at it, wages are down. Unless you can eat a nominal dollar—and you can't—this is the real state of earnings in the US for the past two years.

For the individual, this hurts. Combine that with loss of child tax credit increase, etc., then it is bad....

For the economy, more new jobs yet fewer people working....so less total amount of cash to go around? That should lower some inflationary pressures but hurt growth. Though if it forces wages up, that would be good.

If boomer retirement in full swing, the expect a draw down of savings that will take money out of markets and put it into, well, local super markets, etc. Taxes on wealthy also drive markets to some extent (not the super market).

The devil's in the details, and the bottom 10% of workers might have had some real wage gains after inflation. But overall . . . ouch. No real wage gains for either blue collar or the average private sector worker since June 2020.

It looks like there was a little tiny boomlet in real wage growth in December 2020, which then got washed away by rising inflation.

Few people eat the CPI basket of goods either. Inflation adjustments are useful, but if people have debt, or fixed costs, or are able to make substitutions in any part of the spending....the CPI adjustments are also very misleading.

Hard to square the inflation adjusted charts showing people falling behind with the bank balance, liabilities and asset charts showing people across the income spectrum are getting ahead.

I don't know that it's accurate to say that inflation adjusted wages are a good measure of how people are doing, considering thr limitations of that single stat.

The stimulus checks have provided a buffer, as did the increased refundable child tax credits. But they are gone now, and savings rate has dropped.

The savings rate may be lower than right after the repeated stimulus checks, but savings have not dropped if i recall correctly.

What is the current savings rate compared to pre covid? According the inflation fetishers constant drumbeats, it must be dramatically lower.....but is it?

fyi:

https://tradingeconomics.com/united-states/personal-savings

Savings rate has dipped lower than pre-covid

I had read elsewhere that the personal savings rate showed a decline due to capital gains taxes being paid in 2022. For the savings statistic, capital gains are excluded from the calculation, but the associated tax does show as a reduction.

Often not a big deal, but significant following the market gains of 2021.

Mistaking capital gains for savings reductions can lead to bad conclusions.

No other way to look at other than averages but yes a person like myself that bikes to work and get groceries etc, and rarely drives is not being impacted by inflation as much.

So companies aren't compensating workers enough to make any real gains due to inflation. They're actually effectively paying their workers *less* than before the pandemic. And yet prices and corporate profits are at historic highs. Funny how that works.

My wages haven’t changed in a long time, but I’m salaried. They change once per year. If part time workers get more hours or if full timers get overtime, why is that a bad thing? Everyone wants a raise. I thought the whole point was that we wanted good paying jobs for more people. Now suddenly, this is a catastrophe!

So this is really bad.

“Governor Tom Wolf announced today that GLG, the world’s insight network, is locating its third major U.S. office and first Pennsylvania operation in Philadelphia’s historic district and plans to create 250 good-paying jobs within the next three years.”

No more good paying jobs!

I believe this is the third leg of that equation. [h]ttps://fred.stlouisfed.org/series/CP

Wages continue to fall behind inflation. Wages are still increasing.

Maybe, maybe not. Wages may be at the start of monthly growth that will accelerate yry later in the year.

The time since June 2020 has brought rapidly increasing employment, which could tend to drive average pay down. Also, the surge in food and energy costs during 2022 is probably about more money going from the United States into global markets, and I don't see how U>S workers' pay could keep up with that, as most of their employers are being hurt as well.

Nope, if real inflation is 4%, wages are at a historical bump. Why you guys follow the cpi con blows me away. Look at the difference in price between Meyers and Kroger.......

Just think if you didn't buy a car in 2021, inflation was 2.9 for the year with 5% gain.

"An awful lot of people still don't seem to get the fact that you have to adjust wages for inflation to see how people are doing. A 5% wage increase is good if the inflation rate is 2% but bad if the inflation rate is 8%."

Wages are notoriously 'sticky' and will lag inflation both on the upside and down. A year from now they will catch up with the past couple of years' inflation; and a lot of people will be pointing fingers and blaming wage growth as inflationary!