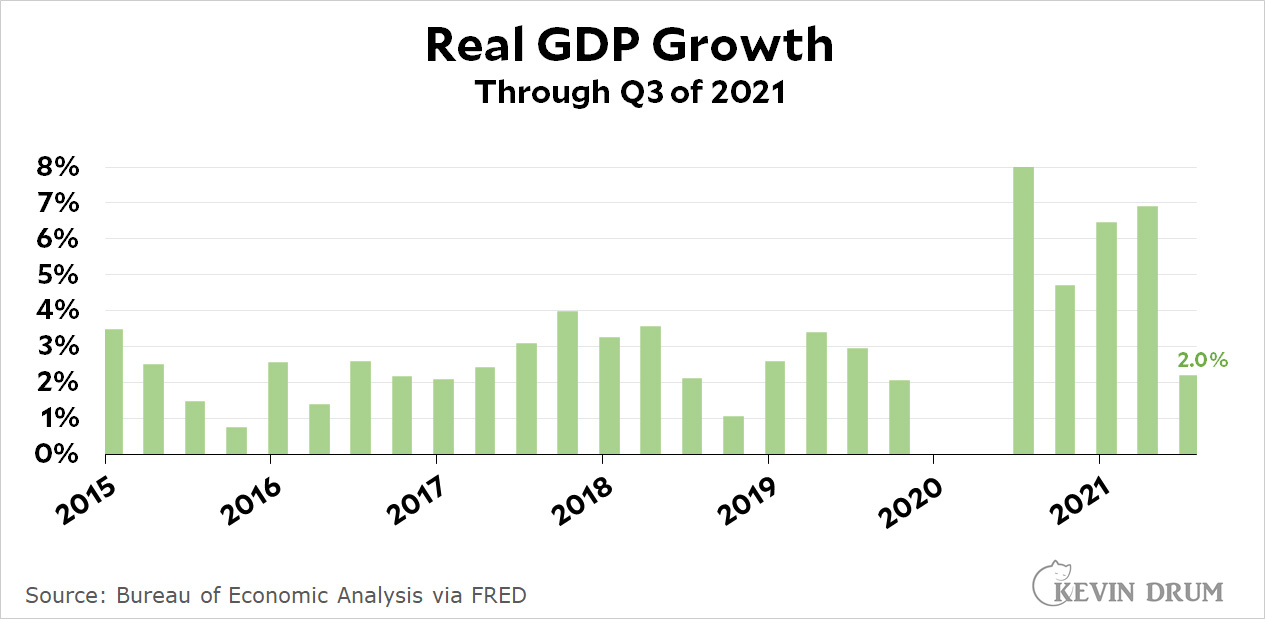

Economic growth slowed down in Q3, presumably due to the renewed outbreak of COVID-19:

With Delta under control and supply chain issues starting to get resolved, higher growth should probably resume in the final quarter of the year.

With Delta under control and supply chain issues starting to get resolved, higher growth should probably resume in the final quarter of the year.

The silver lining to this slowdown is that it's yet more evidence that the economy isn't overheating. This means that inflation should probably begin to taper down over the next few months.

The silver lining to this slowdown is that it's yet more evidence that the economy isn't overheating.

Relatedly, another silver lining is it might well mean higher growth in 2022 than otherwise would have been the case. At the beginning of the year the consensus estimate was somewhere in the range of US GDP up over 6% in 2021. That pretty clearly would have led to a significantly slower 2022.

This is squarely at the feet of mega-asshole Republican governors like DeSantis and Abbot who allowed a deadly disease to rip through their states and spread across the country while actively and proudly thwarting any attempt to deal with it. They owe us one quarter's worth of GDP growth, the bastards. I demand reparations.

here, here!!!

So....back to normalish growth.

Let the pearl clutching commence!!!

It is not necessary to have "overheating" to have inflation. In the 70's and 80's there was inflation combined with recession - evidently Kevin has never heard of "stagflation". The inflation at that time was caused by commodity shortages, mostly oil. Contrary to common assumptions inflation was not caused by wage demands of uppity workers - real wages actually declined during the inflation.

This time we have commodity shortages caused both by primary supply (e.g. computer chips, houses) and supply-chain problems, combined with pent-up demand from the easing of pandemic restrictions. Labor shortages contribute, but those are likely to ease if and when the pandemic danger eases and workers get through any excess money from the stimulus payments. No one is deliberately withholding supply, as OPEC was in the 70's, so hopefully the inflationary pressures will eventually pass.

The inflationary pressures are actually fairly simple and obvious, though not so easy to solve quickly. Yet even economists, not to mention Kevin, persist in framing things in terms of moronic oversimplifications such as "overheating". Of course conservatives have an interest in calling out the perpetual supposed dangers of increasing wages, or otherwise supplying money to lower-income people.

+1

North Koreans Ordered to Eat Less Food Until 2025,

https://torontosun.com/news/world/starve-to-death-kim-jong-un-ordered-north-koreans-to-eat-less-food-until-2025/wcm/14fc18b9-0d33-41cb-8d02-2866e31b1383/

If you're so emaciated you can hardly move it's difficult to overthrow the government, on the other hand it's also difficult to resist an invasion.

Nope. It's pce/inventory issues. Just normal auto production and growth is 4-6% annualized.

Meanwhile a professional rather than civilian assessment: https://news.google.com/articles/CBMiTGh0dHBzOi8vZmluYW5jZS55YWhvby5jb20vbmV3cy9nb2xkbWFuLXNhY2hzLWJyaW5ncy1mb3J3YXJkLXUtMDczNDUyNDAzLmh0bWzSAVRodHRwczovL2ZpbmFuY2UueWFob28uY29tL2FtcGh0bWwvbmV3cy9nb2xkbWFuLXNhY2hzLWJyaW5ncy1mb3J3YXJkLXUtMDczNDUyNDAzLmh0bWw?hl=en-US&gl=US&ceid=US%3Aen