It's a well-known fact that in the United States rich people have much longer life expectancies than poor people. Much of this is attributed to our private health care system, which does a lousy job of treating the uninusured and underinsured.

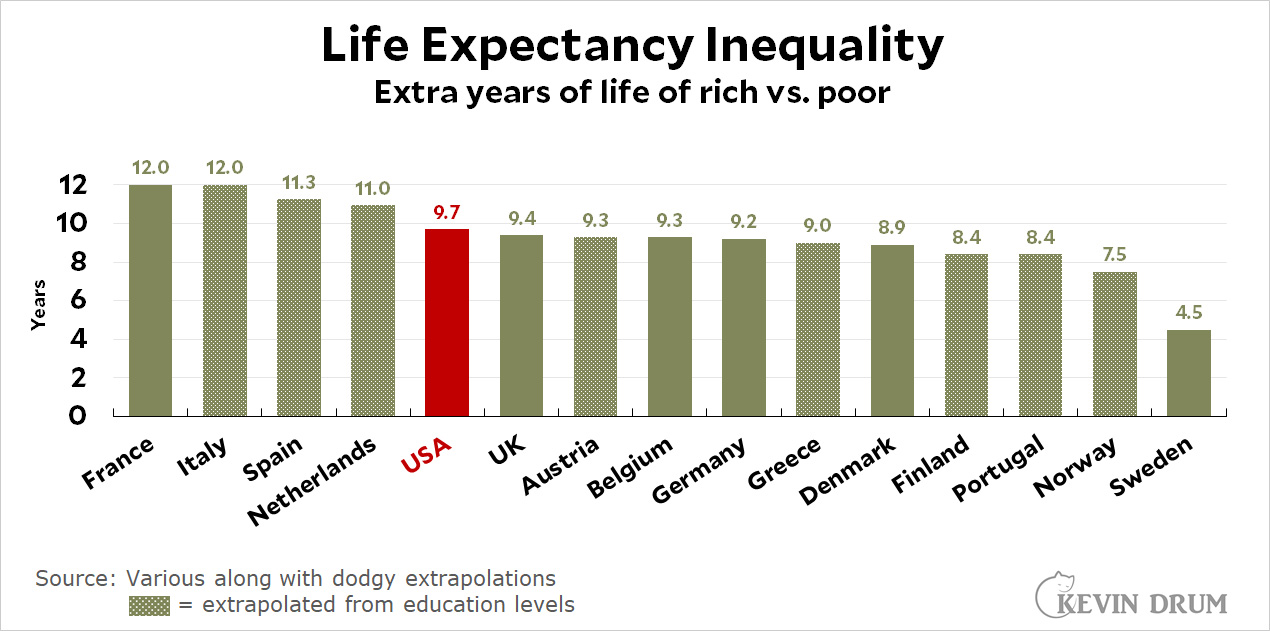

That got me curious: do other countries with national health care systems do better? In a nutshell, not really:

The rich live about ten years longer than the poor in the US. In France it's about 12 years. The UK and Belgium are a little over 9 years. Only Sweden, at around 4 years, does significantly better.

The rich live about ten years longer than the poor in the US. In France it's about 12 years. The UK and Belgium are a little over 9 years. Only Sweden, at around 4 years, does significantly better.

The numbers in the chart above are taken from various sources, not all of which agree with each other, and in some cases are roughly extrapolated from education levels, which are a decent but imperfect proxy for income differences. Don't take any of them as gospel.

That said, they're in the right ballpark. The problem of low lifespans for the poor is universal and has little to do with the details of health care systems. It's much more foundational than that, and it's one reason why increasing retirement ages is a bad idea. It might help put pension systems like Social Security on a sounder footing, but it does so on the backs of the poor. Raising the retirement age to 68 takes a much bigger toll on someone who will live to age 76 than it does to someone who will live to age 88.

The problem of low lifespans for the poor is universal and has little to do with the details of health care systems.

I strongly suspect America's numbers would look a lot worse if the country didn't provide robust, universal healthcare for its older population. As much of a shitshow as it is, healthcare in the US (thanks goodness) at least is universally extended to the elderly.

I think a crucial piece of information is the infant mortality rate. A higher infant mortality rate will bring down the life expectancy of any country. Do people poor people in the US really die on average 10 years younger than rice people?

Shoot, "rich" people. I don't actually know any rice people.

I'm a rice person, and you know me.

😊😊😊

Do people poor people in the US really die on average 10 years younger than rice people?

That statistic doesn't seem implausible to me. For one thing, more poor people than rich people die in infancy. So, sure, you're right: infant mortality does (obviously) affect average life expectancy.

My guess* is, though, if you looked at life expectancy for those who've made it beyond infancy (say, age 4), you'd still see a large gap in the US, and in other rich countries. In other words, the rich-poor life expectancy disparity is not mostly a function of higher infant mortality, at least in high income nations. (Though I.M. does play some role: mortality is surely higher for the poor up and down the age spectrum).

*Strictly a guess: I don't pretend to be a public health expert.

For a numbers/analytics person with access to the detailed data, this is an easily parsed problem. Separating infant mortality from the length-of-life question seems critical to understanding the whole picture.

Kevin, are you reading these comments?

The WHO tables will not let you down. Here's a link to one such table:

https://www.who.int/data/gho/data/indicators/indicator-details/GHO/gho-ghe-life-tables-by-who-region-global-health-estimates

WHO breaks the death rate down in several ways, BTW, this is jus one of them.

Another big chunk is going to be risky behavior by young people.

Drugs, crime, etc.

If you want to understand the equity impact of raising the retirement age from 65 to 68 then you should look at life expectancy at 65.

I strongly suspect most of the difference will be eliminated.

I found this in a 2015 report from the National Academies of Science, Engineering, and Medicine: https://www.ncbi.nlm.nih.gov/books/NBK321309/figure/fig_3-2/

It's a projection for the cohort born in 1960, but for that group, it says yes, the top quintile in the United States live more than ten years longer than the bottom quintile, just looking at people who've reached age 50.

Anecdotal for sure, but the poorer side of my family definitely dies earlier than the richer side of my family. And since they're all in my family, I know that culturally both sides are about the same in terms of exercise, diet, bad habits (smoking, etc.) and access to healthcare. The only things that can explain it is different genes and/or wealth disparities (the richer side has about twice the income and wealth as the poorer side).

Regarding putting SS on a sounder footing:

Uncap FICA!

This might be hardish to explain, but I think it would be a winner.

I don't think it would be hard to explain at all. "Most people pay Social Security taxes on their entire income. But did you know that people who make 6 figures don't? Why should they be exempt from paying the exact same share into Social Security like you do? Everyone pays in on their whole income, and everyone gets a check when they retire." Bam. 4 sentences easily squeezable into a 30 second commercial.

The reason that they are exempt from paying the extra "share" is that payouts are also capped. If you want to uncap the payments, do you also want to uncap the payouts? That will mean that people with massive private pensions or investments may be getting massive SS payments, as well.

SS was intended to be a sort of minimal public pension to ensure that those without other means of support did not become destitute at retirement. Those with higher incomes were expected to make their own plans for retirement to maintain their standard of living as desired.

Regarding putting SS on a sounder footing. We are 30 trillion in debt, and I don't know how much longer the $ will be the world's reserve currency. We need to reign in spending.

The total national debt today is $26.7T not $30T. No reason to inflate it by 15% to make your point.

The US has had debt since 1835. If we've managed to live with it for 186 years, even predating the dollar being used as the world's reserve currency, we can continue to live with it never being paid off or down. And thus Social Security, which would be self-sufficient if there was no FICA cap, doesn't need to be "reigned in" as part of some misguided effort to pay off the national debt.

https://www.marketplace.org/2021/12/02/when-was-the-last-time-we-paid-down-the-national-debt/

But it has never been 26.7T. That number alarms as much as 30T. I hope you are right.

I don't know how much longer the $ will be the world's reserve currency.

It's likely to remain so until China jettisons capital controls, which won't happen until the Communist Party loses power.

Can the Communist Party lose power?

Well I hear that Hungary is paying Russia in rubles. The petrodollar is part is a piece of the reserve currency. I don't understand why China jettisoning capital controls would be the trigger that starts the world not using dollars as they do now.

Hungary is Paying Russia for oil and gas, if I didn't make that clear.

Just to add on to Austin's point, from the Marketplace piece he cites:

"The last time the amount of debt held by the public shrank was back in 2001, according to Wendy Edelberg, a senior fellow in economic studies at the Brookings Institution and director of the Hamilton Project, an economic policy initiative.

Edelberg said from 1998 to 2001, that amount was reduced each year.

"Since the early 2000s, the national debt has consistently increased. Edelberg and Primo said a series of events and decisions, including tax cuts, the U.S. wars in Iraq and Afghanistan and the 2007–2009 financial crisis, have all pushed the debt higher. "

Not that the Clinton years were perfect nor that it even makes sense to fetishize deficits and debt but you'll notice that ALL of the big events listed that cranked up our debt were a result of actions taken by a two term Republican President with a GOP Congress for most of it while they were also harping on "getting Social Security on a sounder footing." In other words this is not about concern about deficits or debt but about policy choices, prioritizing tax cuts MOSTLY for the richest among us, unfettered financial markets that sometimes crash and completely unnecessary, indeed, immoral wars, over people's health and safety.

"Reign in spending." This is always the cry of the rightwing ignorant/malicious cohort. Never a call to tax the obscene, polity-warping treasure troves of the uber-wealthy. How is it that other countries have higher social spending but less debt? Or again, how is it that Japan carries twice the debt we do (proportionally) without apparent ill effect? Lisa, it's all about a twisted moral deference toward the rich, and a punitive nastiness toward those who don't make out like bandits in the capitalist environment. Wake up. Look into the ways more social-democratic countries handle their poverty levels. But if you won't do that, then STFU.

I completely agree with pflash's comments.

Let's add another thing: From the early 1940s until the 80s, the bottom 90% of US households had 60 to 65% of total personal income. It fell during recessions and went up during expansions. The general trend was up; if you graphed it in the 1970s you'd have thought the average would be 65% by now. The last number I saw was 49%. This missing 15% of personal income ($3T/yr) has mostly gone to the top 0.1%. It's not like households at the 92% level have seen a big jump in income.

This 15% represents about $30k/yr per bottom 90% household. Since virtually all the missing income would have been wages, this amounts to about $320 billion/yr in lost Social Security taxes. The total in lost revenue to the trust fund over the last 4 decades must be $5T or more.

So here's a plan for Social Security. Increase taxes on high income people to recover the $320B/yr and tax the wealth of the very rich to recover the $5T to $10T they've effectively stolen from SS. Then you can lower the retirement age, increase the benefits (since the rich also got rid of private pensions), and improve the finances of the bottom 90% and their employers by abolishing the FICA tax.

If we assume that education = income, have we assumed that everyone who dies before High School or college graduation is low income?

If so, this analysis is......not useful?

Compared to 19 similar OECD countries, U.S. babies were three times more likely to die from extreme immaturity and 2.3 times more likely to experience sudden infant death syndrome between 2001 and 2010, the most recent years for which comparable data is available across all the countries. If the U.S. had kept pace with the OECD’s overall decline in infant mortality since 1960, that would have resulted in about 300,000 fewer infant deaths in America over the course of 50 years, the report found.

Some of the the OECD infant death is real and yet, a portion of the difference is a mirage.

For example, in the US, if a baby takes on breath that is counted as a live birth. In the Netherlands, only when the baby leaves the hospital does it count as a live birth. I don't know how large this accounting difference is, but its not zero....

The report addresses that. It notes that the majority relates to poverty.

Health care is only one of the factors the result in the lifespan gap, between rich and poor.

Violent death, especially for young males, is far more common in the US. From a cold statistical basis, the impact of someone dying very young, at say 17, is FAR more numerically impactful than the extra year or two better medical care might provide.

Similarly, American's drive more than Europeans: accordingly, more Americans die in cars. This impact is more common for poorer Americans.

etc

Good points.

I would like to suggest a different possible explanation for the gap. If you are in poor health, you will find it difficult to become highly educated; being a university student, particularly at the post graduate level, is generally hard work, often involving years of poor nutrition. It takes a fairly robust constitution going on to complete a higher education. The people who are physically unable to complete a degree, or degrees, are likely to have inherently lower life expectancies, regardless of the quality of medical care.

I have a question!

Healthiness as a lifestyle has been a general thing since the 70s, only increasing in popularity over time.

So, is there data showing an effect of nutritional supplements on longevity?

I believe an interesting figure to compare would be life expectancy at 65. That would eliminate factors like infant mortality (where the US is clearly a "leader"!) and accidents/suicides which I suspect are also higher among the poor (maybe not suicides though?).

But a lot of the disadvantage for the poor is likely established by the time they reach 65 (when they do get regular healthcare--if they know how to take advantage of it): They are more vulnerable to environmental stress and stress from hard labor and unhealthy work conditions--we ought to have a younger retirement age for people of some occupations (coal miners, construction workers etc.)

And just to further complicate the parsing of the problem, the disadvantage for the poorer working folks is often manifested in health issues some years later which were caused by environmental stresses earlier in life. So looking at life expectancy at and after age 65 would still be complicated by the combination of:

(a) the direct effects of economic circumstances at and around the time of death, and

(b) the cumulative effects realized from disadvantages long before reaching the age to be included in the analysis.

The gap between rich/poor may be just as bad, but Europe slides the entire scale up.

Take Spain, for example. Their overall life expectancy is 5 FULL YEARS higher than the overall US life expectancy. The poor resident of Spain is only 4 years worse off than the rich resident of the US!

It would be nice to chart this to be able to see both the rich people's span and the poor people's span.

There's not mystery here if you look at studies of cognitive ability. Cognitive ability is closely correlated with income, for reasons which are obvious enough to most people, although progressives will dispute them.

Assuming, broadly speaking, that poorer people have lower cognitive ability and less impulse control (and that's been proven over and over), everything else clicks into place: High rates of smoking and excessive drinking and drug use, poor diets, higher rates of committing and becoming victims of crime, more dangerous low-skill professions, less job stability, more stress, a much higher proportion of people in the criminal justice system, little or no savings, etc.

As the graph shows, these factors are universal -- a generous welfare state can perhaps reduce the disparity somewhat, but not by much. Amazing how many seemingly puzzling problems get a lot easier to understand once one admits, as our host has admirably done, that IQ is real, and it matters.