After the pandemic started we immediately passed a $3.5 trillion rescue bill. Later we passed two more rescue bills, bringing the total to over $6 trillion. Was that responsible for the spike in inflation that began in 2021?

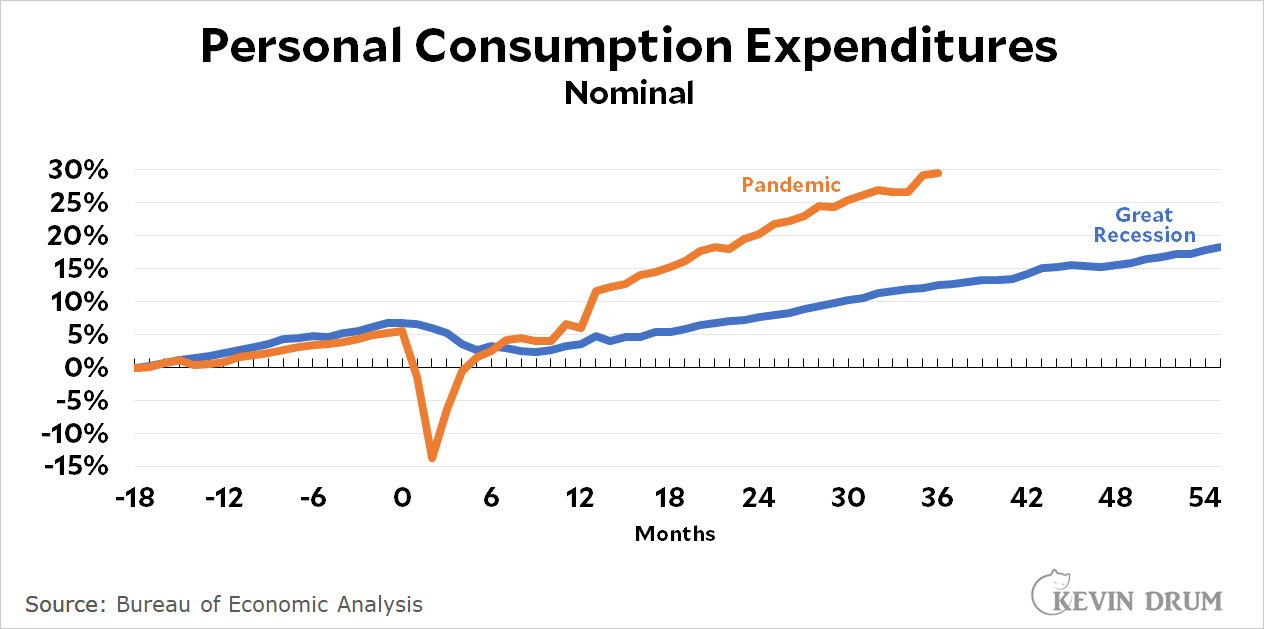

Yes and no. It was responsible for some of the inflation, but for a very specific reason: it kept consumer spending strong at a time when supply was constricted. Take a look at consumer spending during the pandemic vs. the Great Recession:

Following the Great Recession, nominal consumer spending grew slowly for many years thanks to inadequate stimulus. Conversely, consumer spending during and after the pandemic grew nicely, keeping the economy in good shape and helping millions of people avoid poverty and homelessness. So hooray for the COVID rescue packages!

Following the Great Recession, nominal consumer spending grew slowly for many years thanks to inadequate stimulus. Conversely, consumer spending during and after the pandemic grew nicely, keeping the economy in good shape and helping millions of people avoid poverty and homelessness. So hooray for the COVID rescue packages!

There was only one problem:

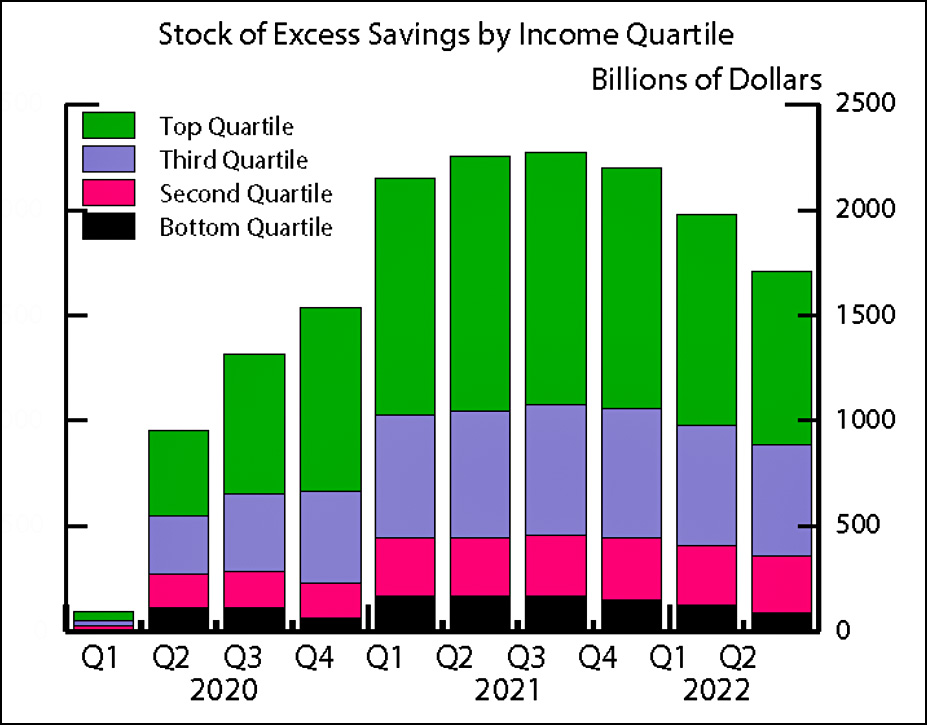

We gave too much money to people who didn't need it: middle and upper-middle class folks who hadn't lost their jobs. The lower half of the income spectrum never had a lot of excess savings in the first place, and in any case they mostly spent it on things like food and rent, which had little effect on inflation. The upper half, by contrast, peaked at close to $2 trillion in excess savings. And since they already had money for food and rent, they mostly bought consumer goods and services that were constrained by supply. So inflation shot up.

We gave too much money to people who didn't need it: middle and upper-middle class folks who hadn't lost their jobs. The lower half of the income spectrum never had a lot of excess savings in the first place, and in any case they mostly spent it on things like food and rent, which had little effect on inflation. The upper half, by contrast, peaked at close to $2 trillion in excess savings. And since they already had money for food and rent, they mostly bought consumer goods and services that were constrained by supply. So inflation shot up.

This was a situation that screamed out for means testing. We could have easily cut payments to the upper half by a trillion dollars with no adverse effects on either the economy or the individuals themselves. And on the upside, we would have created less inflationary pressure.

Inflation is declining now as supply constraints disappear and even high-income consumers eat through their excess savings. But we probably could have avoided our inflation spike altogether if we had been more careful about who we gave rescue funding to. Giving it to the well-off did nothing but cause problems.

I would have to be convinced that the upper quartile had increased savings due to additional income from rescue spending. It seems much more likely that they saved the money that they would have spent on travel, entertainment and restaurants.

These things are rarely 100% either way. Probably some saved it all. And some spent it all. And some saved a portion and spent a portion. Also, the "upper quartile" includes everthing from the CEO of Goldman Sachs to a high school administrator.

would the ceo of goldman sachs et al really be within the upper quartile? i thought the payments were capped at $150,000 for a married couple. in other words in order to qualify for payments your annual income had to be south of $150,000 for married couple, half that for a single person.

If the ceo of Goldman Sachs is filing a tax form that says he makes less than $150,000 a year, --I can totally believe it.

would the ceo of goldman sachs et al really be within the upper quartile?

Definitely. That man has an income in the tens of millions. A measly 90K or so gets one into the upper quartile in America these days.

i thought the payments were capped at $150,000 for a married couple.

A number of components of the $5 trillion+ in pandemic-related stimulus were not means-tested, most prominently Paytech Protection (I recall people kvetching about Tom Brady's receipt of funds) and the child credit. If the government is spending multi-tillions juicing the economy, it's a pretty safe bet that plenty of it will end up in the pockets of the affluent. Which is why, although I don't disagree with Kevin that means-testing might have been helpful in theory, the only practical way to go about this would have been a claw-back (ie, tax increases on the rich).

and the child credit.

Sorry, this is wrong. While provided to the vast bulk of families with children, the was a phase-out provision affecting more affluent Americans.

Nonetheless, millions of households in the top quartile were entitled to (and did receive) payments under the legislation.

Paycheck Protection, though, absolutely did put cash into the pockets of many highly affluent people.

Drum has a strong tendency that has emerged rather clearly with his inflation denialis to black-and-white monocausalism. Pity really. It was okay for his obsession with lead, but in the messy and multi-causal world of microeconomics, it constantly leads him astray.

Equally besides the savings arising from non-spending on trvel, entertainment and restaurants, there is the additional stimulus case that application of means testing

(1) takes time to do

(2) takes time in design and of course political argument

(3) may have undercut getting the rapid agreement at the time (see 2)

In his comments about inflation and its causes I think Kevin is correct. His advocacy of means testing is less grounded.

In the case of emergency funding it is way too complicated to do means testing in a reasonably fair way. Every interest gourd would lobby for themselves. Too much time would be lost and the economic calamity would by that much more severe.

Means testing sounds great on paper but it is messy and expensive and vulnerable to fraud (adding more cost) and almost inevitably unjust to some people. Means testing of an emergency measure is pretty much guaranteed to be a disaster. Hence it is not done when fighting a depression is the primary goal.

Drum has a simplistic and rather limited understanding of inflation, which he then overdraws in making assertions that are fundamentally wrong-headed in being exceissively framed as either-or and rooted in fundamentally mono-causal framing.

His "trend lines" are farcical.

Don't like Kevin's charts? Get the eff off his blog. Easy-peasy..

And then the conversion to an echo chamber will be one step closer to completion.

Agree with your point on means testing. Drum may be right on an economic level but not on a political one. What possible reason would Republicans (and even some Democrats) have to support such measures if everyone did not benefit equally, not to mention the public support as well? It wouldn't have been there.

Bottom line is, if you want to any kind of UBI program,. everyone's got to get a check or it won't pass.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

The lower the income, the greater the percentage of income that is immediately spent. It is spent on shelter, food and gasoline (although a lot of people weren't driving to work during the pandemic). These are some of the things which were leading inflation. More affluent people were buying houses, but the stimulus payments were too small to affect this - it was the low mortgage rates.

So while the stimulus program probably did help to increase inequality, it is unlikely that means testing would have magically prevented inflation. The fact is that there were shortages of things that people have to have, and this includes lower-income people. Even if there had been no stimulus it is not guaranteed that there would have been no inflation. It was a very tricky situation, and Congress does not have the knowledge to fine-tune fiscal policy - even if not controlled by Trump and McConnell.

The Fed has never displayed this fine-tuning ability either. It is remarkable how the fact that the Fed failed to control inflation for years during the 70's and 80's is ignored.

Remarkable because the Truism is something the Left holds but is not a conclusion supported in econometric analysis.

So no, just because the Left hold the idea dear does not make it a fact - at best it is an arguable assertion (at best).

Nice assertion yourself. Any plan to back it up?

"Giving it to the well-off did nothing but cause problems."

Well, it made the program politically possible, so I wouldn't say it did nothing. The notion that a program targeted only to low-income people would ever have happened is just naive.

Totally agree.

The notion that a program targeted only to low-income people would ever have happened is just naive.

IIRC there was a stimulus plan in the wake of the Great Recession that was means-tested. So, maybe it would've been possible. I agree that "only poor people" would've been a heavy political lift. But that's not the same as "exclude rich people." (In other words, it probably gets greenlit provided the middle class aren't shut out.)

As the first comment said, the idea that the excess savings arose principally because of stimulus is questionable in the maths and further to go beyond making it politically possible, the application of means testing

(1) takes time to do [so would have slowed both effect and ease, impacting without doubt the most vulnerable for rather questionable savings]

(2) takes time in design and of course political argument

(3) may have undercut getting the rapid agreement at the time (see 2)

Rather than post-facto deciding the appropriate response would have been to do the usual Left approach of an over-designed, cumbersome programme tailored and targeted, it is rather more realistic to simply allow for over-shoot and be ready to take corrective action (as in some mixture of taxes, higher rates and easing on fiscal to avoid overheating).

And to stop Inflation Denialism and Minimising as a stupid political reaction, and rather adopt: small overshoot, corrective action needed to cool but no big deal - end cost is lower.

Which fits the facts, and gives more confidence than the inflation denialism of a certain fringe of the Left, representing largely political knee-jerking of feeling that overshoot can not be admitted rather than treating it calmly as an issue that is addressable and worth the cost.

The last round of stimulus was really the most ridiculous. I'm all for shoveling cash out the door when it is needed but the economy was on its way back and we are still giving out bags of cash to people who don't need it? I don't know, it seems like an alternative mechanism to help the poor needed to be figured out.

This kind of revisionist history is easy 2 years after the fact.

But in Jan/Feb 2021 it wasnt obvious that the economy was in recovery mode, in fact recent job numbers looked very weak. In Feb 2021 we knew that Nov jobs had just been reduced to a minimal increase, Dec jobs were negative and Jan jobs were near 0. That was a really bad sign.

The bad jobs news combined with incredibly high Covid deaths and no certainty as to just begun vaccine rollout was the reason that the 3rd stimulus program happened.

Even today you cant say that the economy would have been fine without the 3rd stimulus and certainly nobody could have said this at the time given the actual economic and pandemic situation in early 2021.

"This was a situation that screamed out for means testing. We could have easily cut payments to the upper half by a trillion dollars with no adverse effects on either the economy or the individuals themselves."

A gentle reminder that the whole Tea Party movement rose out of the suggestion that some unfortunate folks with their properties under water should get special government assistance.

Well, the growth line after the Great Recession appears to have the same slope as prior. So the economy returned to its previous rate of growth.

On the other hand, the pandemic stimulus line has a markedly higher slope than prior. Hyper-stimulated would seem more apt than “good shape.”

After the 2008 crises, there was a crash, then growth returned to "normal"--but starting at a lower level and a little below normal. It took years to get to where we were before the crises, and we weren't getting close to the pre-crises trend line.

With Covid, we got back on trend in ca. 12 months. We're riding maybe a littler higher than the trend line after recovery, but not by much. Probably not sustainable long term, but in we're still recovering from the 2008 crash. Work force participation still on the low side.

I would assert it is quite a bit higher than pre-COVID trend line. In the 18 months prior to COVID, it was going at about 5% every 18 months. At that rate, overall growth sans COVID/stimulous would have been at 10% 18 months post compared with 15% actual and 15% at 36 months post-COVID rather than the 30% actual.

The slope is noticeably steeper following the pandemic drop, but note that, unusually for Kevin, the plot is change in nominal expenditures. It doesn’t necessarily mean excessive consumption of real goods and services.

KD: "The lower half of the income spectrum never had a lot of excess savings in the first place, and in any case they mostly spent it on things like food and rent, which had little effect on inflation. The upper half,... already had money for food and rent, they mostly bought consumer goods and services that were constrained by supply."

Food supply was constrained. There were empty shelves all over the store, and not just for hand sanitizers, disinfectants, and paper towels. In places, almost all cans of soup were sold, and in that same aisle, only condiments and spices were available to "eat".

I am unaware of any grocery stores that literally had nothing to eat in them but “condiments and spices.” Are there any pictures of these grocery stores? Any sources you can cite of grocery stores that didn’t just lack soup but also all produce, bread, dairy, meat, frozens, cereals, pastas, snacks, … literally nothing on the shelves but condiments and spices? If not, I call bullshit on your concern trolling. A store being out of a particular category or even entire aisle of food doesn’t automatically mean that people were unable to find any food at all in that store.

I never claimed stores had nothing to offer in the *entire store* but condiments and spices. That assertion you refute is a straw man. I wrote that "in that same aisle" as soup, there wasn't much else. In 2020 there were lots of stores in that condition and reports about it. The food supply was *constrained*, not so much by declining food production, but supply chain issues. Constrained (Kevin's term) is not the same thing as extinguished.

PICTURES OF EMPTY STORES:

https://www.usatoday.com/story/news/nation/2020/03/16/coronavirus-us-pictures-low-traffic-empty-grocery-store-shelves/5057550002/

https://www.universityofcalifornia.edu/news/food-supply-strong-enough-weather-covid-19

SUPPLY CHAIN ISSUES AFFECTING FOOD AVAILABILITY (no pictures)

https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/us-food-supply-chain-disruptions-and-implications-from-covid-19

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7264576/

https://www2.deloitte.com/ch/en/pages/consumer-business/articles/covid19-has-broken-the-global-food-supply-chain.html

To state the obvious, hindsight's 20/20 and when the pandemic arrived, inflation was a distant memory that had last been problematic nearly 40 years in the past. Much fresher were the memories of grindingly slow growth held down by inadequate demand. And the scale of the economic crisis rapidly engulfing the country really was gigantic: unemployment approached, what, 30%? And so we erred on the side of "getting as much money into people's hands as quickly as possible." Also, I'm not sure we have the finely-tuned databases to both rapidly pump money into the economy and do so on a precise and accurate means-tested basis. Everything I've read about the government's systems suggest they tend to be clusterfuckish.

I suspect doing as Kevin says would have required clawing back money from the affluent via the income tax (but that's just a guess).

There’s no way we were going to claw back the money via income tax. Republicans, centrist Democrats and whatever Sinemanchin considers itself to be wouldn’t allow it. And even if by some miracle the income tax had been raised, everyone knows by now that the IRS can’t enforce anything and so the upper middle class and rich people all would’ve just lied on their tax returns… like they did to get their PPP loans.

There’s no way we were going to claw back the money via income tax.

Correct. Which I believe reinforces my view that Kevin is speculating about an extremely implausible policy. If Americans want highly effective and efficient governance, they have to invest in the systems (software, IT equipment, highly-trained and properly managed technocrats) that will deliver this. Mostly they haven't. Because trans/China/immigrants/guns/Muslims/Socialism.

Anyway, I just spent some time with Chat/GPT. The direct stimulus payments from all three major rounds of pandemic stimulus were indeed means-tested (only those < 75K eligible). And the enhanced unemployment benefits were capped at $600/week, which by definition is a progressively structured benefit, in that such money: A) only flows to the unemployed; B) is a much bigger lifty for a low-paid worker than a highly paid worker; C) is subject to income tax, which mechanically reduces the benefit to the affluent.

I'd say the main provision that was "wasteful" was the Paycheck Protection plan, since some of this money inevitably went to firms—owned by affluent people—who didn't need subsidies to bring their workers back. These programs cost approximately $600 billion, or about 12% of the total we spent.

Again, I reckon the cleanest and most technically feasible way to reduce the net stimulative impact of the pandemic spending would have been an income tax surcharge.

You are going to trust Chat/GPT? I certainly hope it provided verifiable sources.

You are going to trust Chat/GPT? I certainly hope it provided verifiable sources.

I use it frequently enough to have developed a sense as to when the results are plausible, and not. In this case it provided a detailed breakdown of the spending componenents and programs. Also, "trust" become less of an issue when asking it about a non-esotheric topic. I'd be leery of any results I get about, say, 5th century Japan. But the pandemic is a recent event I lived through, and the economic measures taken by the government were heavily covered by the media.

You are conflating the upper middle class with the rich. The upper middle class has nearly all of their income reported on w2 forms; hard for them to lie. The rich don't.

Kevin's post suggest that he is using the term "upper middle class" for the top 25% of households, whose income is more than $80K (in 2006 dollars, see wikipedia: https://en.wikipedia.org/wiki/Upper_middle_class_in_the_United_States).

Well I earn 100K but the covid money went straight to college tuition for my daughter. I was still cash flow negative all year.

Sucks in so many ways to be a widower...

Whoa. This brings back memories of me trying to explain why we didn't need to give out money to people who didn't need it, and why we could have given more to people who did.

Part of the point of the marginal utility of a dollar KD brought up a few days ago comes back to how that dollar is used. The poorer you are, the more likely that dollar is recirculated into the economy directly.

It's more or less the same principle guiding the low fiscal multiplier of a tax cut for the rich. Cut their federal taxes and (almost) nothing happens. At the state level, however, such fiscal multipliers are negative when you cut their taxes. See: Kansas.

If you extend these principles further, having a guaranteed basic income creates inherently more stable economies by ensuring people don't have to shrink their budgets based on losing employment or having children, etc.

It's so fucking obvious, but no, people have been brainwashed into accepting the paradigm of a good work ethic as a necessary part of the human condition.

(>ლ)

Louchbury is about to pomposity you, D-Ohrk

Days later...

I just wanted to point out that I have no beef with inflation insofar that it may or may not be tied, even partially, with stimulus.

The point of the program(s) was to avoid a repeat of the Great Recession and it worked. It could have worked better if it were means-tested. What we got instead were long lines of vehicles waiting to receive free food because people had to make choices of rent over food.

As I have said from the start, inflation was exogenous and temporary -- or a long as the externalities existed and could not be sufficiently ameliorated or attenuated. I don't think anyone's under the impression, KD included, that the stimulus had an outsized effect on inflation. That is, after all, a conservative talking point that makes little sense.

We must have sent a lot of stimulus checks to Hungarians who didn’t need them; inflation is running at 25% there …

https://tradingeconomics.com/country-list/inflation-rate?continent=europe

+1

These charts exclude capital gains.

It isnt at all clear that slightly less stimulus money for the wealthy would have impacted demand for goods and services in any meaningful way.

Yes. This post by Kevin is very heavy on Monday Morning QBing.

I never understood why the Democrats didn't frame a message around rescinding corporate tax breaks, and very high end earners, to pay for the money heading out the door? That 2018 cut was hated by pretty much everyone--Make killing it a cornerstone of a recovery message. Maybe focus on a VAT or something? Given that limited shipping capacity was driving much of inflation, push down on corporate profits focused on the 'elites' so that shipping can be redirected toward products that are purchased by more people. Or give people vouchers that they could use for job training, their kids tutoring/home care, higher education, IDK something that 'slow rolls' into the economy rather than a bomb of cash to people who do not need it.

Because Trump would have vetoed the first two tranches. They probably could have pulled it off in the third tranche, but by then the majority had drastically shrunk and Nancy had the same kind of problem Kevin has now.

Is my memory failing me yet again? My recollection is that (in the first few rounds at least) money was shot out of a cannon willy-nilly because there simply wasn't time to do means testing. Getting the rent money after you've been evicted strikes me as ineffective, given the the justification for putting it out there.

Fundamentally this seems right, the extra spending probably caused some of the current inflation. The thing is, this spending was set to disappear so the Fed intervention seems harsh. Interest rates today are already higher than inflation so the Fed is already constraining economic growth. Now as to KD’s suggestion on better disposition of the spending? Easier said than done. I can think of several reasons why such an approach would not work including setting a bureaucracy, political support, missed assignments. One of the reasons SSA remains popular is because everyone is on it. Once you start to means test programs the term “welfare” gets tossed around and support erodes. I actually think the Covid support programs were quite successful in spite of generating a modicum of inflation. That said, we definitely need to go after the criminal element that abused the relief programs.

As an upper middle class consumer, note that I did not personally receive a stimulus check, since it was means-tested. Although my wife did collect stimulus unemployment benefits for 6 months. And two of my three kids also got a stimulus check. Most of the increase in my savings came from the fact that the stock market didn't tank, and, in fact, kept increasing nicely due to the stimulus.

A good solid GPI for the lower quartile and a decent minimum wage would be great for my savings. The upper classes are always going to benefit, so using the fact that they benefited a lot isn't a great argument.

Yes. Was wondering why I’f no means testing why I got squat? There was an IRS income limit in all the bills. Not saying I wanted or needed just that I did not get it.

If the stimulus hadn't been structured that way, odds are most people in the bottom quartiles would have gotten $50 each and told to be grateful for it.

I didn’t receive any money from the government. Did Mr. Drum? That child tax credit was a boondoggle though. No one even cared! Hilarious.

I’m going to go ahead and spend a few bucks now… new recliner from Ethan Allen! Nice.

That child tax credit was a boondoggle though.

If by "boondoggle" you mean "cut child poverty in America by 70%" sure. But who cares about children, anyway? They don't vote amirite?

You’d think it would be a political winner, but it wasn’t. No one cared enough to argue for it except a few lefty bloggers. Welcome to America.

“Whatever the reason, beneficiaries couldn’t and didn’t save the credit.”

Didn’t.

https://www.vox.com/future-perfect/2022/4/18/23026908/child-tax-credit-joe-manchin-policy-feedback-partisan

Its pretty clearly a ridiculous argument to say that because Joe Manchin and the Republicans didnt support it, nobody cared about it.

You’d think it would be a political winner, but it wasn’t.

Democrats stupidly and cravenly sunset that program. I think had they not done so, it would've become solidly popular in the fullness of time. Similar to Obamacare. The public is harder to educate than once upon a time, because Murdoch.

Did you pay taxes? I guess your taxable income was higher than the cutoff. Lucky you. Now, go away.

I am one of the lucky who did not loose a nickel of income due to the pandemic and was living quite comfortably with spendable income to spare. I argued at the time that, because there was no time to work out means testing, the recovery payments should have been made just as they were, but subject to a 100% tax rate for anyone whose taxable income exceeded their income the prior year. Of course, that is not perfectly equitable, and some people would get away with gaming the system, or just cheating, but there is no perfect solution.

From Kevin’s source:

Since KD has refused to entertain the possibility of a lab leak, and since this cognitive bias has led many to ignore mainstream reporting that helps to inform people about the problem with lab safety in China and around the world, here are two stories covered by WaPo last week.

"Research with exotic viruses risks a deadly outbreak, scientists warn"

[...]

"China’s struggles with lab safety carry danger of another pandemic"

[...]

As I have repeatedly stated, no one has ever found, in the wild, a closer relative to SARS-CoV-2 than RaTG13 (96.2% matching) from WIV. Only ignorance will lead you down the path of having high confidence that the origin of SARS-CoV-2 was a natural spillover at a wet market.

I think your hobby horse is dead.

I think a lot of ppl have it in their minds that if they shut up and wait, they'll be proven to be correct. It's a lot easier than to engage in a debate on the merits of each facet of the details for different theories.

it’s hard to see how upper middle class and wealthy people not getting a few thousand extra bucks would have prevented inflation. It probably DID inflate the stock market, but if they had been excluded from the payments, wouldn’t the pent up demand for all sorts of things that were in short supply due to supply chain disruption combined with skyrocketing oil and food commodity prices (due in large part to the Ukraine war) still have caused inflation?

Stimulus checks were definitely means-tested. Neither my job nor my wife's job were affected by the pandemic, aside from both of us working from home and no longer commuting. We still got a couple hundred dollars from the first stimulus check, which we donated to the local food bank. And nothing from the second or third rounds of stimulus.

I don't remember what all else was in the stimulus packages; maybe the PPP loans could have been better targeted at keeping bottom-half people employed, and not lining the pockets of the very-well-off.

But I don't see stimulus checks increasing the savings rates of the top 5% at all. Because they didn't get any.

My web search is far from comprehensive, but I don’t recall Kevin showing the same reticence towards stimulus at the time. If anything he was saying there should be more: https://www.motherjones.com/kevin-drum/2020/03/other-countries-are-spending-more-than-us-on-coronavirus-rescue-packages/

How is CA doing on improving that supply constraint for rent? There's been a lot of multifamily nationally actually coming online, but not CA and some other places. Those places are still getting rent increases which is still keeping inflation high.