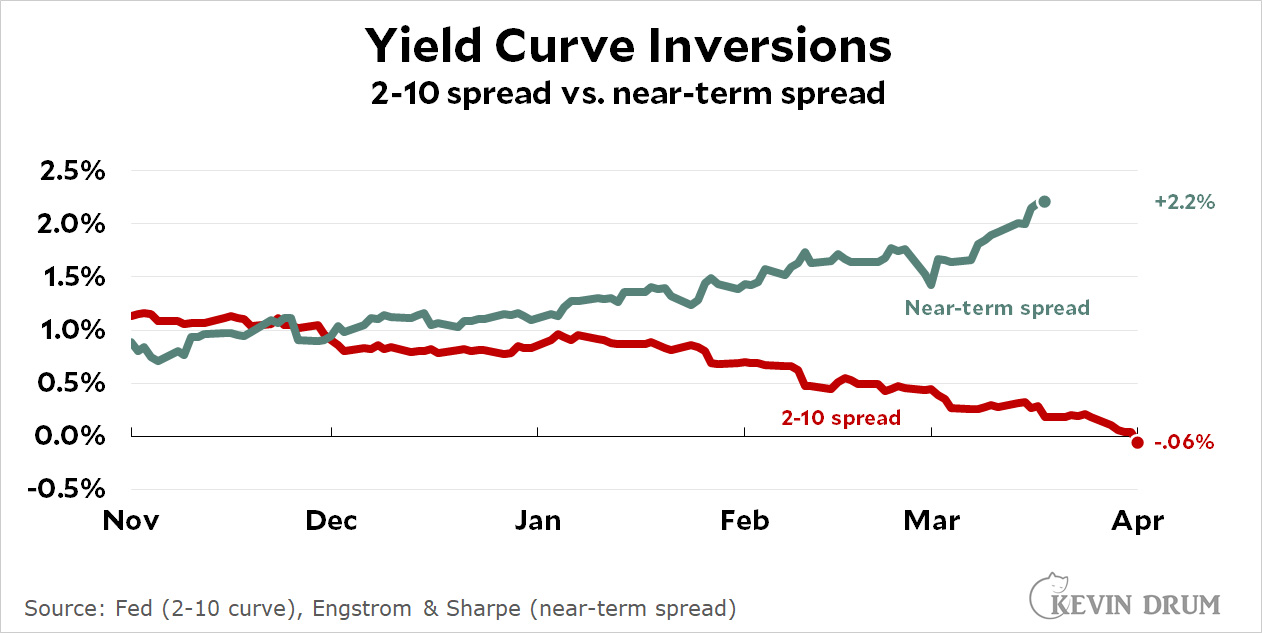

Yesterday the yield curve inverted: interest rates on 10-year Treasuries were lower than rates on 2-year Treasuries. This upends the normal order of the universe, in which you have to offer higher rates to investors to get them to buy long-term bonds. This has long been taken as a sign that we're in an economic twilight zone and are about to enter a recession.

But the the Fed says fuggedaboutit. The conventional 2-10 yield spread is useless as a recession indicator. Instead we should look at the near-term yield spread, which is currently extremely healthy:

The near-term spread was created a few years ago by a couple of Fed economists looking for a better predictor of recessions. They came up with a "more intuitive" metric that "gauges the slope of the Treasury term structure":

The near-term spread was created a few years ago by a couple of Fed economists looking for a better predictor of recessions. They came up with a "more intuitive" metric that "gauges the slope of the Treasury term structure":

[This] be interpreted as a measure of the market’s expectations for the trajectory of conventional near-term monetary policy. When negative, it indicates market participants expect monetary policy to ease on net over the next several quarters, presumably because they expect monetary policymakers to respond to the threat or onset of a recession. [Thus, when positive, it means investors think the Fed isn't worried about a recession. -kd] The predictive power of our near-term forward spread indicates that, when market participants expected—and priced in—a monetary policy easing over the next 18 months, their fears were validated more often than not.

The authors doubled down on their prediction here. More importantly, earlier this week Fed Chair Jerome Powell himself sang the praises of near-term spreads:

On Monday, Powell cited the steepening gap between the forward-implied rate on three-month Treasury bills versus the current three-month level as a tell-tale sign that the bond market has actually given an economic all-clear. Powell’s message at the National Association for Business Economic was unmistakable: the Fed has plenty of room to aggressively jack up rates to fight inflation without choking growth.

Let me get this straight. When the near-term spread is positive, it means that investors think the Fed isn't worried about a recession. Fed chair Jerome Powell then suggested this means the Fed shouldn't be too worried about a recession.

That sounds a little circular to me, but what do I know? In the meantime, I'll point out a problem: The 2-10 spread is easily available on a daily basis. Conversely, the near-term spread is based on a complicated calculation and is only available when someone decides to calculate it. This means that news outlets can obsessively keep track of the 2-10 spread but they generally have no idea of what the near-term spread is. Until that changes, no one is going to pay attention to it.

I have always viewed the yield curve as irrelevant. Of course late stage business cycle spending is getting stale. But the late stage is just the metaphor for what was driving the spending, running out of gas.

Circular analysis works because economies still run quite a bit on emotion.

I was thinking the same thing, sounds like circular nonsense. All the Fed has to do is whatever the near-term spread predicts they will and not only will the market be happy, but the spread will have 100% accuracy. Presto!

...the near-term spread is based on a complicated calculation and is only available when someone decides to calculate it.

Oh noes! A complicated calculation?!?! Oh, whatever are our highly educated and informed professional financial and business journalists to do?!? How can they possibly process and summarize information for their readers/viewers if it is not spoon-fed to them by some intern running a simple program on a laptop in a back room somewhere at the Fed? I mean, be realistic here ...!

The 3-month gap between the reference points -- the projected yield rate in 6 months and the current 3-month yield rate -- seems to indicate the divergence between what the Fed's signaled expectations and the market's expectations, IMO.

I would imagine that the proponents of the new indicator have back tested it against historical data and found it to be a superior indicator.

Click on the first link to read the paper. Indeed, they did.

But out-of-sample predictive success is what counts; https://xkcd.com/1122/

Most of the time, back testing is worthless.

You find far more false positives than real positives.

"it means that investors think the Fed isn't worried about a recession. Fed chair Jerome Powell then suggested this means the Fed shouldn't be too worried"

I tought I taw Heisenberg's puddy tat here somewhere . . .

Whatever they do in hindsight it always looks like overreaction or too little too late, so the goal is to come up with metrics that are so confusing that they can choose one and compare it to what they did to be able to say, "See, we did the right thing."

Of course, an inverted yield curve signals bad economic times ahead.

But the 2/10 curve got "lucky" a few times. Did the yield curve REALLY predict the Arab Oil Embargo? Did it also predict Covid?

If it did, then we have figured out a way that God communicates with us.

Why does it have to "invert"? Does a recession really depend on a few basis points?

We found the 2/10 by trial and error.

But think of things another way. Right now the market is predicting a 70% chance of Fed Funds being at 350-375 or higher in July 2023. Most people think higher interest rates make it tougher to borrow and expand or buy a new house or car.

The 10 year TIP is at -0.423% and a 10 Year Treasury is at 2.337 for an expected 10 year inflation rate of 2.75%. We are going to get something like 7% for the next year or so. That means expected inflation is going to drop to 2% or below in a couple of years. What is going to reduce inflation that much? Getting the supply chain fixed and peace in Ukraine will help. But a bad economy would also help.

During the 90's when the economy was the best in our lifetimes, rates were pretty flat.

So, the answer is: It is complicated.

Anyone who thinks it isn't complicated either doesn't understand or has a direct link with the almighty.

PS: I used to run billion dollar (single digit) investment portfolios for a big international bank.

It is complicated. But supply-chain problems should affect price levels, not the price-change slope. So if shipping delays, container shortages, etc. persist at the current level, prices affected by those supply-chain issues should stabilize at roughly the current level.

To understand recursion, first you must understand recursion...

Easy enough just look at Fed Funds vs 2 Year spread. Or 3 mo Bs 6 mo Bs 1 year. Bs. All tell the same tell.

3mo bills Vs 6mo bill vs year bills. Awful spellcheck.