Exciting news today: the Fed has released its report on the failure of Silicon Valley Bank. You're already salivating, aren't you?

I've read through it, but I want to say up front that it presents me with a problem. I've taken a very public stance that SVB didn't really do anything seriously wrong, and this means I need to be doubly careful about how I interpret the Fed's report. I don't want to cherry pick just the bits that support my view, but neither do I want to bend over backward in the other direction out of a misguided sense of fairness. And the Fed report makes this balancing act especially hard because it says a lot of different things. If you have a point you want to make, you can find it somewhere.

So I'm going to do my best, but just beware that anybody with an axe to grind can find excerpts in this report to support their view, whatever it happens to be.

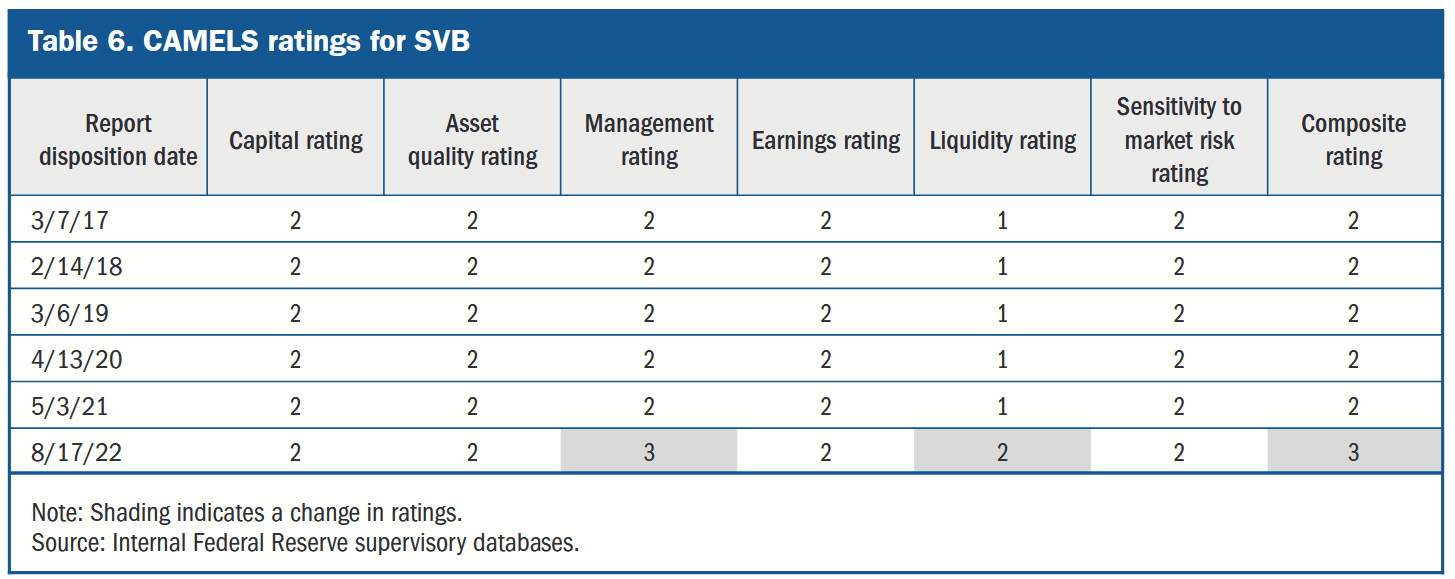

Let's start off with a chart:

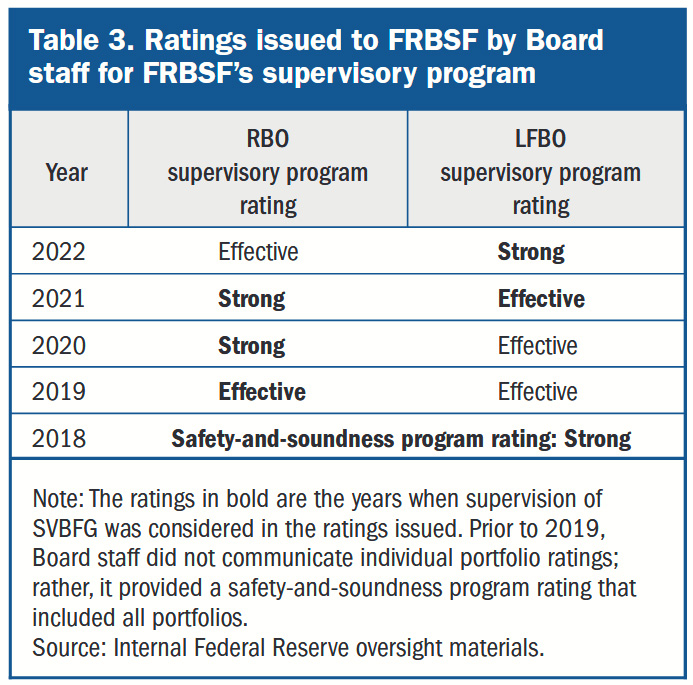

This shows SVB's ratings from 2017 through late 2022. During this entire time both its capital and liquidity ratings were either excellent or good. In early 2021 supervisors wrote a warning about SVB's liquidity management and stress testing (though not about its actual liquidity position) but there was nothing after that. Here are the Fed's ratings of SVB's supervision programs:

This shows SVB's ratings from 2017 through late 2022. During this entire time both its capital and liquidity ratings were either excellent or good. In early 2021 supervisors wrote a warning about SVB's liquidity management and stress testing (though not about its actual liquidity position) but there was nothing after that. Here are the Fed's ratings of SVB's supervision programs:

In 2021, because of SVB's rapid growth, supervision switched from RBO (regional banks) to LFBO (large banks). However, the bank's supervision rating, even under the LFBO rules, improved in 2022 from Effective to Strong.¹

In 2021, because of SVB's rapid growth, supervision switched from RBO (regional banks) to LFBO (large banks). However, the bank's supervision rating, even under the LFBO rules, improved in 2022 from Effective to Strong.¹

This is the basic finding of the report: all along, supervisors gave SVB good ratings in virtually every area, with some exceptions for governance. However, in retrospect the Fed now says a lot of things were missed. For example, "Based on the severity of the six findings from the 2021 liquidity examination . . . a more negative assessment (e.g., “Deficient-1” for Liquidity) would have been supportable."

This is typical of the report. Virtually every quantitative assessment of SVB is relatively positive, including both its capital and liquidity positions. But these are all followed by vague suggestions ("would have been supportable," "would have been reasonable," "likely not appropriate," etc.) that these assessments might have been too sunny. This makes the report extremely difficult to evaluate.

Here, for example, is one of the few quantitative assessments that's negative. It involves our old friend, the Liquidity Coverage Ratio:

An analysis of SVBFG’s December 2022 capital and liquidity levels against the pre-2019 requirements suggests that SVBFG would have had to hold more high-quality liquid assets (HQLA) under the prior set of requirements. For example, under the pre-2019 regime, SVBFG would have been subject to the full LCR and would have had an approximately 9 percent shortfall of HQLA in December 2022, and estimates for February 2023 show an even larger shortfall (approximately 17 percent).

Under the old rules, SVB would have been 9% under the LCR requirement. This may show that the old rules shouldn't have been changed, but even a 9% shortfall in one liquidity sub-metric is hardly a mark of doom.

Generally speaking, what this report shows is that SVB was basically solvent and in fairly good shape. In late 2022 the Fed began to be concerned about SVB's deposit outflow and its Regulation YY liquidity position and intended to write a warning about it, but that was far too late to have made any difference. In the event, the warning wasn't issued before SVB's failure.

Now I want to highlight the main reason I'm unhappy with this report. Here's an excerpt from Michael Barr's personal comments in the introduction:

We [] need to be attentive to the particular risks that firms with rapid growth, concentrated business models, or other special factors might pose regardless of asset size.

....We need to evaluate how we supervise and regulate a bank’s management of interest rate risk....In addition, we are also going to evaluate how we supervise and regulate liquidity risk, starting with the risks of uninsured deposits...and the treatment of held to maturity securities....We should require a broader set of firms to take into account unrealized gains or losses on available-for-sale securities.

In other words, the lesson of SVB is that we should address the very specific issues of SVB, rather than trying to figure out how—if at all—its problems were due to larger regulatory issues.

As best as I can tell, the Fed identified nothing in this report that actually led to SVB's demise. Its overall management was mediocre, but its capital and liquidity positions were generally fine with only minor shortcomings. It was arguably slow to react to its deposit outflows, but in the end it did the right thing. There was really nothing in its financials that predicted a sudden bank run.

And when the run happened, of course SVB's liquidity position became untenable. No stress test in the world can account for a sudden panic overtaking a bank's customers, and no improvements in SVB's financial position would have saved it once the run began. Quite the contrary. It was SVB's announcement of a plan to address its problems that caused the run in the first place. How do you plan for that?

¹Oddly, SVB's rating went down under the RBO rules. I don't understand this.

Well, in analyzing your analysis of the analysis of the SVB bank, it does sound as if the bank was in some trouble. My quick take is that a bank should not over-rely on a low number of high capital depositors and if that means you lose their business so be it. My other quick take is that banks are still subject and exposed to bank runs and insurance needs need to be adjusted accordingly (by the Fed). In others news, and I was hoping you were going to post something about it, is Alito. That is some chutzpah, he claims to know the leaker of the Dobbs opinion, this is, the man that we all know beyond a reasonable doubt leaked the Hobby Lobby decision is weaponizing the matter. So what this old crank is attempting to do is rationalize his own behavior at the expense of others while targeting the liberal judges. And to be clear, he probably does has some suspicions that may or may not be well based but he most certainly does not know who leaked the opinion. I honestly don’t think this endears him with anybody in the court except of course Thomas.

I've assumed Alito leaked Dobbs himself. Motive, means, and opportunity. I see no reason to change that opinion.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit

this article... https://createmaxwealth.blogspot.com

All banks are subject to runs - that is really the point of deposit insurance (which is not US Fed, it is the FDIC) is to help enable more stability.

The concentration of depositors in near total alignment also with lending sector and also on jumbo deposits well above the deposit insurance limit are a quite unusual set of circumstnces.

Drum I think is right that the SVB case is extremely specific and not one which you can really draw big regulatory conclusions out of.

Predictably, the CNN webpage headline reads "Fed autopsy on SVB details grave mismanagement".

Drama Llama-ism of cable news.

"No stress test in the world can account for a sudden panic overtaking a bank's customers, and no improvements in SVB's financial position would have saved it once the run began." I hope somebody's looking into whether Peter Thiel shorted SVB stock or some such.

That was my assessment at the start of the kerfuffle but I'm no expert...

Isn't there a problem when so many deposits are held by super-wealthy individuals whose balances far exceed the FDIC maximum.

NPR: The ten largest accounts at Silicon Valley Bank held a total of $13.3 billion.

Also: [B]ackstopping the uninsured deposits will cost the FDIC's insurance fund an estimated $19.6 billion.

https://www.npr.org/2023/04/27/1171996094/silicon-valley-bank-signature-bank-failures-deposits-fdic

Little people — blogger, and readers of blogs — had no reason to run.

Super wealthy is not an analytical term - but the large deposits where broadly company deposits, not personal deposits.

Regardless the fundamental is that SVB by data had an extremely unusual depositor profile and that the huge percentage of uninsured deposits was a problem. No analytical utility to engage in inaccurate Lefty populist framing.

Kevin continues to beat his horse to death, that SVB did nothing wrong and was simply a victim of circumstances outside its control, or maybe it was because of vindictive high tech VC's who purposely predicated a run on the bank without any real evidence of potential collapse.

SVB failed, full stop! They had negative equity due to unrealized losses of a substantial portion of their assets (long T bonds). This is really no different than if they had massive losses due to a highly speculative loan portfolio, which would have required a balance sheet loss provision driving their equity negative. At the end of the day, if depositors had endless patients, the T bills valuation would likely have fixed itself in a few years due to lower inflation / lower T bill yields, but the run on the bank accelerated because social media dramatically increased the speed of the collapse compared with what we saw in 2008/2009 or previous bank collapses.

Were the Feds asleep to some extent? Did legislation relaxing bank regulations contributed to this? Yes to both questions. Was management primarily to blame? Absolutely. They chased yield and ignored risk. Full Stop!

T-bills are the safest investment--until they are not. The Fed can't actually say this.

Regulators were fine with SVB--basically until the run started. The report is 20:20 hindsight (ok, maybe not that good).

"T-bills are the safest investment--until they are not .."

T-bills would have been fine. They are short term and don't lose a lot of value when interest rates rise. The problem was T-bonds and other long term bonds. They lose a lot of value when interest rates rise. Which they did.

My bad...thanks for the clarification...

They were tanked by a bank run from a particular business network. That network was either weirdly panicky or playing a game, it isn't clear which.

If your contention is that banks need to defend against that sort of thing, you should say so. The Fed kinda sorta gestures in that direction, with

so you'd have some company, but your complaint seems to be far more diffuse than that.

In any case, I would agree with that - any entity needs to evaluate its own risks, and if a lot of their trade comes from a group of customers who move as a pack, that's a risk. But that's (a) a small part of this story, (b) retrospective, and (c) I seriously doubt any other bank in the country had been doing that sort of analysis - they move in packs, too.

"...There was really nothing in its financials that predicted a sudden bank run."

Just that the bank had a lot of uninsured deposits and was hopelessly insolvent. Who in their right mind would leave uninsured money in a hopelessly insolvent bank?

Pretty much any time you have to have a fire sale of assets, you won’t get top dollar, no? Could any bank, even one solvent at time t, withstand a run of the magnitude and velocity of the SVB run?

The network that ran on Bailey’s Building and Loan was the townfolk of Bedford Falls, where everybody knew everybody. Those networks still exist in small towns, but runs are a thing of the past, not because of changes in how banks operate, but because FDIC.

I have read suggestions that SVB should have hedged against interest-rate increases. Unlike insurance, hedges are not legally binding contracts, they are just negative correlations that have been observed in the past, and that one bets will persist in the future. Would that be enough to assure large depositors that they needn’t withdraw their funds?

Since the authorities always cave and bail out the losers anyway, we ought to just regularize the process, and add higher tiers of deposit insurance, with higher, risk-based premiums.

This is probably not a mainstream view, but I view the SVB collapse as a complete failure by the Fed, in its role as the liquidity provider of last resort. This fails Bagehot's Rule of bank runs, from the aftermath of the Panic of 1832: "to avert panic, central banks should lend early and freely (ie without limit), to solvent firms..." The Fed believed SVB to be solvent (and indeed it appears that it was), it was just illiquid and should have been supported.

This has been the Fed's most basic job since it took over from Rockefeller after 1905. Why wasn't the discount window open to get them through the run?

Good question and I don’t know the real answer but from all appearances it seems that the Fed got caught unawares and what I mean by that is that they did not have contingency plans and then it become too late.

Kevin attempts to dismiss the 9% (@ Dec '22) and 17% (@ Feb '23)shortfall in a key liquidity metric, but this is a key finding and completely contradicts the early hot-takes from bank lobbyists (and Kevin) which insisted that regulatory changes were not to be blamed.for the bank failure.

This is not an insignificant sub-metric that nobody would have cared about if SVB had been subject to the requirements . We can guess at their significance based in how quickly after the failure that the bank industry flooded the zone with inititial takes that SVB likely would have met these requirements if they had been subject to them.

But now we know that SVB would have failed these requirements and as acknowledged in the Fed report, SVB would have managed their assets differently if they had been subject to stricter requirements.

While we cant predict what would have happened in the alternate universe where SVB was forced (by stricter regs) to hold more high quality assets, disclose losses earlier and take action sooner to fix the balance sheet shortfalls....we can be certain that it isnt a meaningless 'submetric' that can be safely forgotten about.

Remember that the guess that SVB would have passed all of the prior, stricter regulations was the key argument used to insist that 'nothing could have been done to prevent the failure, lets blame depositors and management and move on'.

Now that the Fed tells us that SVB would not have passed the regs, these regulations are only mere submetrics that nobody really cares about and wouldnt have mattered anyway.

When you have your mind made up, talking points drafted and a story crafted, the facts dont really matter.

As a former bank examiner and a current bank CFO, I am continually shocked at how stupid our examiners and Wall Street Analysts are.

Remember that in early March as SVB was failing, Wall Street analysts had buy recommendations of SVB.

The other thing that boggles my mind is the idea that SVB got a 1 in ANYTHING. It is a truism that getting a 1 in anything means that you are spending too much time bending over for the regulators. The best rating a great bank should get is 2's across the board.

This is just additional evidence that Wall Street and the Regulators don't understand that unrealized losses are REAL LOSSES. Just because you are showing good GAAP income doesn't mean you are actually making money.

Look at this scenario

Start of year

Investments $1,000,000

During the year

Revenue $100,000

Expenses $50,000

End of year

Investments $600,000

Was that a good year or a bad year?

The value of your net worth went by $400,000

But your got more revenue than expenses, so it appears your "Income" is $50,000.

IF you listed your investments as Held To Maturity then your GAAP income would be $50,000.

If you listed your investments as Mark To Market then your GAAP income would be a LOSS of $400,000.

SVB showed "income" of $50k in this case.

Is that reality?

Shouldn't the regulators have known?

Shouldn't Wall Street have known?

I for one would never want to use a medicine that was produced under GMP with a rating of 2 in everything!

What a stupid maxim!

"No stress test in the world can account for a sudden panic overtaking a bank's customers".

The bank run happened because a) it had a lot of uninsured deposits; and b) the Fed raised interest rates, suddenly devaluing its long-term investments. This made it doubtful if depositors would get their money back, so they withdrew. This is a predictable train of events. Again, most commercial banks make their money with long-term loans (such as mortgages) or investments, which pay more, so saying they should only have short-term investments is not a solution.

If the Fed is going to be suddenly raising interest rates, the regulations should have stress tests that disclose the high ratio of uninsured deposits. This was the unusual factor, not the long-term assets, which are normal for banks. I don't know offhand who exactly was responsible for the stress tests, but if SVB passed them, they were not good enough.

When deposit insurance was instituted in 1933 it brought an end to the bank runs that had been going on for three years. This would not have worked if there had been a large amount of deposits not covered by the insurance.

I read the excerpts a little differently. Implicitly, the report admits that the bank was graded on a curve like a Harvard student who can't be allowed to fail. One suspects that grading on a curve was standard practice.

The final note about problems that need more attention is exactly how the end of such a report is supposed to be: Ideas and proposals on how to improve performance for the next crisis; what the military calls an after-action report.