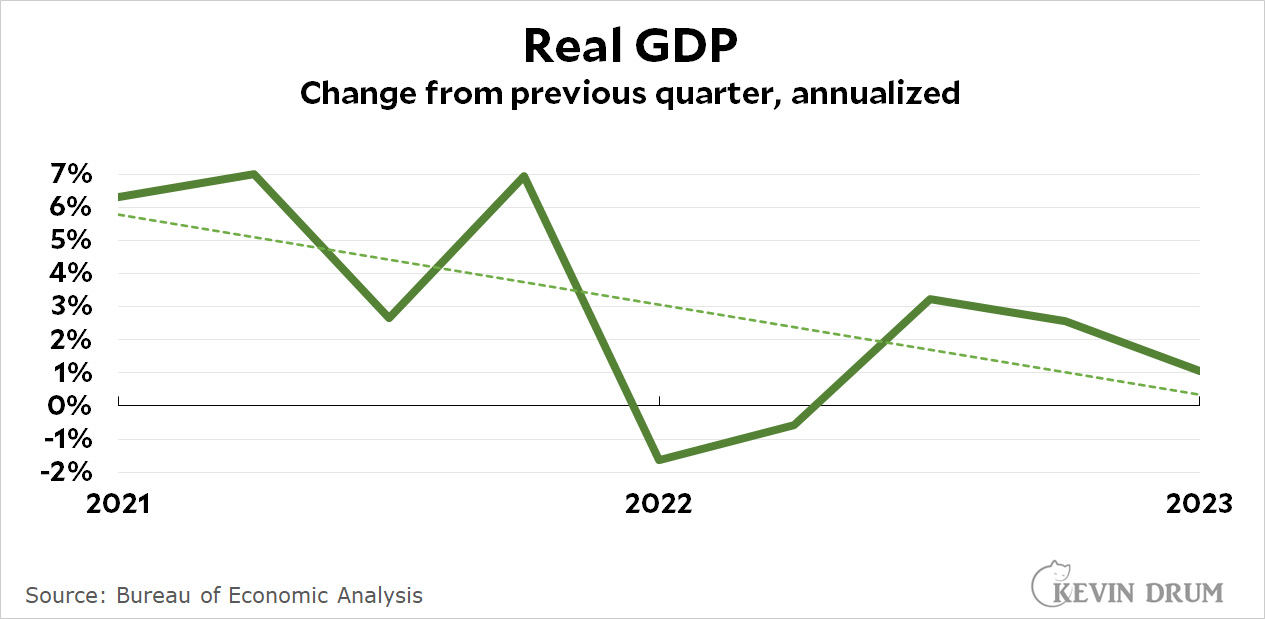

The first-quarter GDP number was released today, and it's not great:

The Q1 number clocked in at 1.1%, which is pretty anemic. Unfortunately, I can't think of any good reason why this should improve next quarter, when the Fed's interest rate hikes are going to start kicking in and personal savings will be even further depleted. We'll see.

The Q1 number clocked in at 1.1%, which is pretty anemic. Unfortunately, I can't think of any good reason why this should improve next quarter, when the Fed's interest rate hikes are going to start kicking in and personal savings will be even further depleted. We'll see.

We still got 6 more quarters to go to tank Biden's re-election. C'mon Fed, you can do it!

yup

If you genuinely believe that the Fed can decide elections by raising or lowering interest rates and the Fed is filled with people who prefer Republicans to Democrats...

1) I will make a tinfoil hat for you.

2) Maybe there is something wrong with a financial system that puts this power into the hands of a small group of people.

With half the board of governors being Democrats, an the chair, while nominally a Republican, having been reappointed to the post by the current, Democratic president, and first appointed to the board by the then, Democratic president.

That’s some impressive three-dimensional jujitsu going on.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit

this article... https://createmaxwealth.blogspot.com

GDP growth typically must be framed in conjunction with inflation. While I HOPE next quarter's data looks better, 1% GDP growth and 5% annual inflation might lead to stagnant demand and perhaps stagflation...

Just to be clear, 1+% is the inflation adjusted rate. The actual rate of GDP growth was 5.1%, 1+% higher than the rate of inflation.

The Fed's interest rate hikes already started to kick in. Months ago.

FFS stop with that misleading crap. It hasn't even been consistent between your own posts, as another commenter pointed out the last time you brought it up.

Interestingly, construction and manufacturing employment finally fell in March. These sectors are highly sensitive to interest rate hikes but, likely due to backlogs, employment kept humming along through months and months and months of rate hikes.

These reductions might disappear in April....or maybe not.

That's definitely a sectoral example where the delay would/could apply. It takes a number of months for structures to be built, and sometimes more for them to have gone through a permitting approval process (and a lending approval process), etc. A lag makes sense.

Consumer demand that involves debt in any way, other short-term lending, behavior (investment decisions for example) that are influenced by expectations, and things of that nature are all more or less instantaneous.