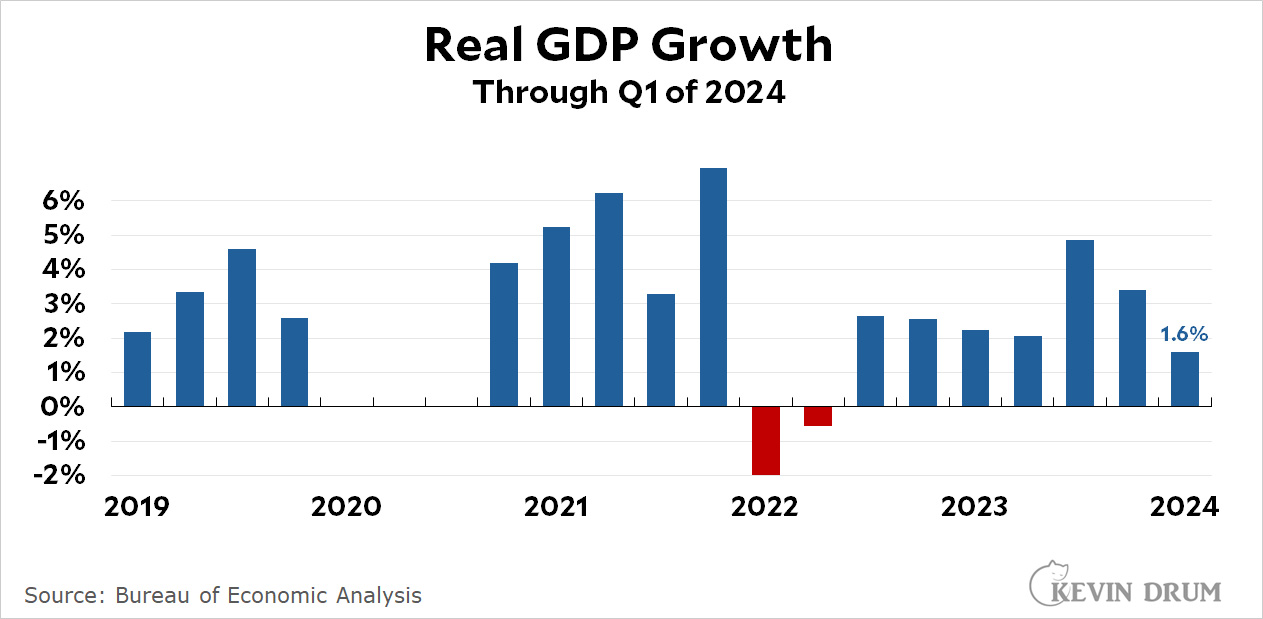

The Atlanta Fed should hang its head in shame. GDP growth in Q1 clocked in way below their forecast, rising only 1.6% in the first quarter:

Is this good news or bad news? We have to play the usual game here: it's bad news because it suggests the economy is getting weak. But it's good news because it means the Fed might reduce interest rates to help restore strong growth. Flip a coin.

Is this good news or bad news? We have to play the usual game here: it's bad news because it suggests the economy is getting weak. But it's good news because it means the Fed might reduce interest rates to help restore strong growth. Flip a coin.

I'd be interested in seeing the trends in the revisions. Harder to find than I thought it would be.

Government spending dropped--the last of the Covid funds have been spent, and allocation drama in the House. The defense package will increase gov't. spending here, so push numbers back up a bit.

Consumer spending on goods down a bit too--though I wouldn't bet on a price war.

From first estimate (3.3%) to final (3.4%) for 4th quarter 2023 real gdp, only rose 0.1%.

thanks.

In all fairness, to the atlanta fed, they got nominal gdp growth correct. They missed on the inflation rate. (Real gdp=nominal gdp- inflation) The atlanta fed is focused on the job of measuring nominal gdp.

Look at chained-PCE. Over the long term it is going down, but because the last two months were over 4% annualized, it had a strong effect on Q1 real GDP.

If the GDP actually grew 1.6% in a single quarter, that's an astonishingly high growth rate. On the other hand, if the GDP grew at a 1.6% ANNUAL RATE, that's fairly anemic.

The distinction is at least as important as always adjusting for inflation.

Which is it? 1.6% per quarter is 6.4% annually.

I'm fairly sure it's 1.6% annual rate, but Kevin didn't say that.

He didn’t state the Atlanta Fed predicted 2.7%, either. I don’t know why he can’t be bothered to explain it for a larger audience.

The distinction is at least as important as always adjusting for inflation.

In theory, sure, but the annualized rate is always how quarterly numbers are given in the US (though not always elsewhere) so presumably Kevin figures his readers are familiar with this methodology.

Is this good news or bad news?

I'd guess on balance "bad" though probably only mildly so. The Fed has been too spooked by the stubbornness of inflation to aggressively lower rates any time soon, I think. It's going to take more than a single quarter of subdued growth. But that in turn could mean that, yet again, they could be slow on the draw (that is, dawdle while the economy weakens). I'm not even sure this number guarantees we'll get any cut at all this year. As of a few days ago a lot of pundits thought rate cuts were likely off the table until after the election.

But I write "mildly" because it's only a single quarter; it's subject to revision; even if valid a single quarter of sub 2% growth is very far from a disaster; and yes, it's probably a number consistent with weakening inflation (and we may indeed get a rate cut out of...who knows?).