The macroeconomic dynamic duo of Christina Romer and David Romer has a new paper out. It starts with a question:

This paper revisits one of the fundamental questions of macroeconomics: Does monetary policy matter?

I didn't even realize this was an open issue. Luckily, the answer is "yes," and R&R go on to estimate the size and latency of monetary policy on three economic variables. Note that their study is limited to contractionary episodes explicitly engineered to fight inflation:

- In response to a contractionary monetary policy shock, the unemployment rate rises gradually—starting about 5 months after the shock. The maximum impact is a rise of 1.6 percentage points after 27 months.

- Real GDP starts to fall noticeably starting about two quarters after a contractionary shock. After 9 quarters, it is 4.4 percent below what it otherwise would have been.

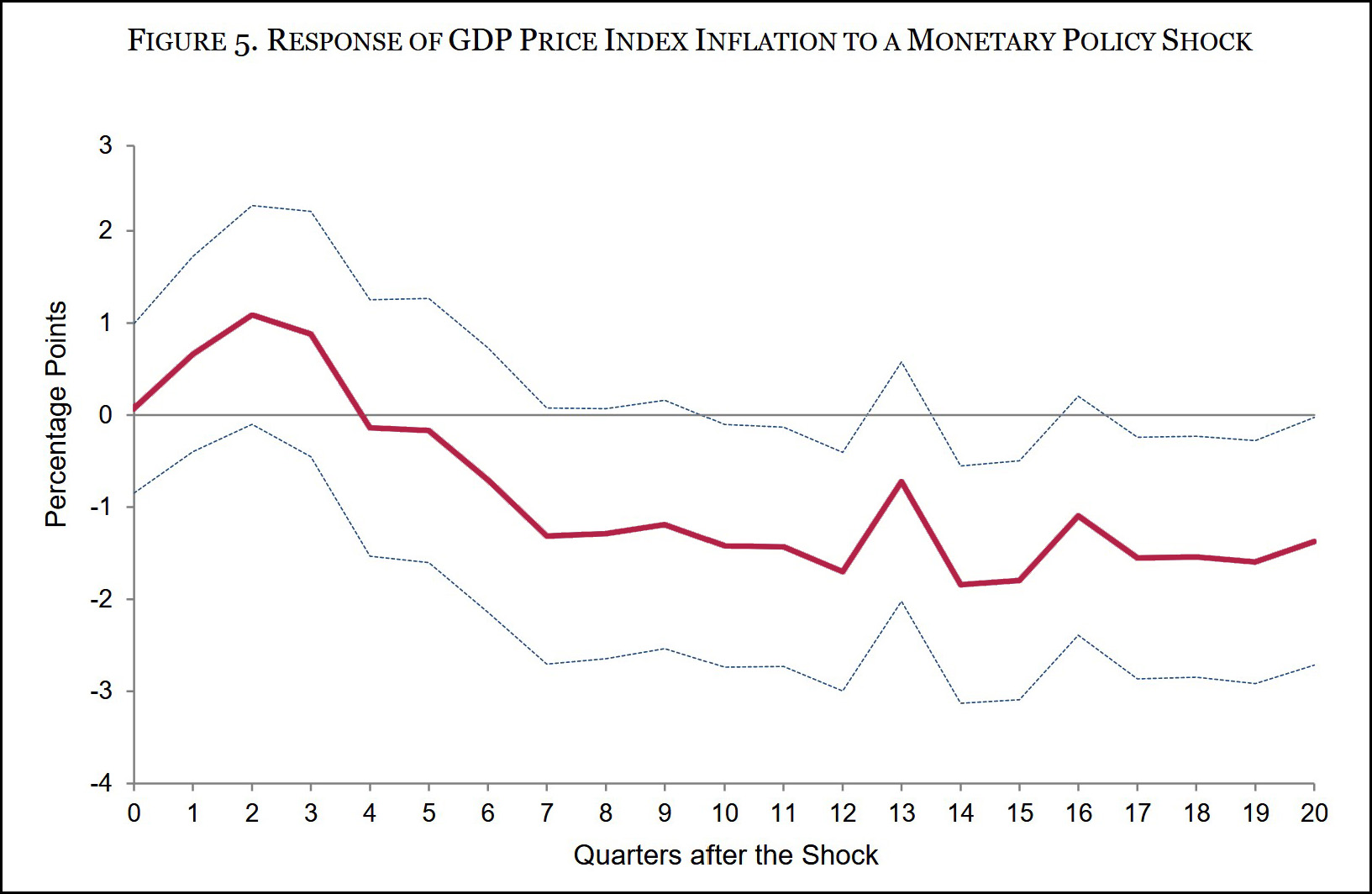

- Inflation begins to fall below the baseline path one year after the shock. Inflation continues to fall over the second and third years after the shock, and then levels off. A contractionary monetary policy shock leads to a permanent reduction in inflation of about 1.5 percentage points.

.

These are averages across nine postwar monetary events. But what about our current one? Romer and Romer conclude that:

- We have indeed had a contractionary monetary policy shock.

- It started around July of 2022.

- The shock was a little larger than average.

- The shock will raise unemployment about two points between now and the middle of next year.

- Real GDP has already been affected. It will probably turn negative in autumn.

- Interest rate hikes haven't affected inflation yet. They won't have a significant effect until winter.

In other words, Romer and Romer are even pessimistic than me: I've been assuming that the Fed's interest rate hikes have had no impact on inflation yet, but will start to very soon. R&R think an effect is still several months away, though they acknowledge that inflation may be more sensitive to expectations than in the past, and also that there is "substantial uncertainty about the effects of monetary shocks on inflation."

If we get away with unemployment of 6% and GDP growth of -2% for a couple of quarters, we should consider ourselves lucky. As for inflation, it should easily drop to 2% or lower over the next year.

Of course, there's more to the economy than just Fed policy. It's always possible that other factors (oil, famine, plague, asset bubbles, political games, etc.) could make things either better or worse.

I guess we can all praise Powell for putting Donald Trump back in office.

I've been saying that since Powell began his crash-the-economy kick. The timing is just about perfect.

1) We can't visit the parallel universe where inflation is both high and shows no sign of coming down (and is maybe even accelerating). Voters hate inflation.

2) I'm aware Kevin thinks inflation would have come down on its own with zero tightening. This seems a minority view.

3) In a reasonable polity, Congress would have taken action to curb inflation in the near term, perhaps via nudging up taxes at some point last year. This might have enabled the Fed to refrain from aggressive action.. In America we don't dare talk about doing raising taxes, and in any event our Congress is highly dysfunctional. The onus falls completely on the Fed. That's not Powell's fault.

Congress did remove a massive amount of demand from the economy with the expiration of various stimulous plan policies over the last 12'ish months. Perhaps they should have done a bit more, bit they certainly did do something. The Fed knew this demand would be pulled away, so they were absolutely not 'forced' to do anything by Congressional inaction.

Congress did remove a massive amount of demand from the economy with the expiration of various stimulous plan policies...

It is true the various stimulus plans weren't designed to last forever. That's your idea of congressional "doing something"?

The Fed knew this demand would be pulled away, so they were absolutely not 'forced' to do anything by Congressional inaction.

Sure. They weren't "forced" to fight inflation. They could have let it rage indefinitely.

Once inflation expectations become embedded, stimulus is no longer necessary; inflation becomes self-reinforcing and entrenched. That's what happened in the 1970s, and that, I believe, is what the Fed has been trying to head off. Maybe they were right. Maybe they were wrong. We'll probably never know either way.

(I'm aware not everybody thinks action was required to bring down inflation. Kevin's one of them. Larry Summers and Jerome Powell disagree. I guess that's the core of the debate.)

You can assign whatever moral judgement you want to congress and their fiscal policies, but you said congress should have done something with fiscal policy in 2022 to slow the economy...and they did. But you dont want to give them credit because reasons.

Given that fiscal policy was contracting at the exact time that you feel fiscal policy should have been contracting, your statement that Powell and the Fed were on their own doesnt make a bit of sense.

The IRA legislation did include the tax increases you demanded, although you can certainly argue that you wanted even higher taxes.

Clearly the Fed felt that they must take action in addition to the economic brakes being applied by fiscal policy changes in 2022. But its wrong to say that Congress did nothing and Powell (and the rest of the Fed) should not be blamed for the actions they decided to take. The Fed knew that fiscal policy was restrictive in 2022 and 2023 and that this would impact supply and demand to some degree.

The various fiscal policies over the last few years have been a smashing success. Deep recession avoided, food insecurity and poverty measures looked good, wages/jobs/growth all look really good, fiscal stimulus was massive, delivered quickly then mostly removed as the economy recovered. Not perfect, but pretty great.

but you said congress should have done something with fiscal policy in 2022 to slow the economy...and they did.

Enacting five trillion in stimulus is "slowing the economy" because they could've enacted forty trillion in stimulus?

Uh, ok.

The various fiscal policies over the last few years have been a smashing success.

I agree. I'm just not under the illusion they're anti-inflationary. They're just the opposite. The intellectually honest case is something like "They caused inflation but higher inflation is worth it to have employment fully recovered in a mere two years."

This is an entirely different issue, of course, than the debate about how long it would've taken inflation to subside on its own, has the Fed tightened too much, should they have done nothing, etc. It wouldn't violate the laws of physics for a policy to be justified in cost-benefit terms, but nonetheless cause some downstream effects (ie, inflation) that merit further action.

"Enacting five trillion in stimulus is "slowing the economy" because they could've enacted forty trillion in stimulus?"

Ending 5 trillion in stimulus is slowing the economy. Obviously it isnt the stimulus that is contractionary, its the end of that stimulus.

A reduction in spending and the end of tax cuts reduces demand and slows the economy.

This is really simple.

In terms of the point you are trying to make, a reduction in stimulus measures works just like a tax increase. Arbitrarily you have decided that one type of reduction in demand doesnt count....because reasons.

There was much concern in 2022 that the Fed should not act too quickly or at too large a scale because fiscal policy was already contractionary.

I'll leave it there, this is pretty simple.

I award a point to jdubs in this thread.

I score it a win for jdubs.

Ending 5 trillion in stimulus is slowing the economy. Obviously it isnt the stimulus that is contractionary, its the end of that stimulus.

The fact that most of the stimulus spending had an end date is indeed anti-stimulative. But the discussion we commenced regards Congressional action to slow the economy. Pretty obviously the actions that were taken by Congress—the various spending programs (totalling around $5 trillion IIRC) did not act to slow the economy. Their express purpose was to stimulate the economy. You're playing word games. I mean, by your absurd "reasoning," the fact that Congress didn't enact a bill last month to send $50,000 checks to all Americans is likewise anti-stimulative! lol

There was much concern in 2022 that the Fed should not act too quickly

There still is. I'm not sure what that has to do with our disagreement as to whether or not Congress took action to slow the economy.

The bottom line is: A) Congress massively stimulated the economy. This was probably a good thing on net, even though it helped spike inflation; and, B) Congress has not undertaken any measures (such as tax increases or spending cuts) to cool the economy, so, if you believe inflation has become excessive and action must be taken (I think that's a reasonable view, though on the whole I'm agnostic) the only other major player capable of taking action is the Federal Reserve.

It is indeed simple.

So just to be clear....

The Fed said in 2020 that they would lower rates in 2020 during the crisis and raise rates later when the crisis had passed.

It is your postion that the Fed raising rates in 2022 and 2023 doesnt count as taking action to slow the economy because they said in the past that rates would increase in the future.

To use your logic, the the fact that they didnt keep rates low and instead allowed rates to increase doesnt count as an action.

And somehow it is everyone else playing word games?

If i set my house furnace on a timer to heat the house up for a few hours then turn off to let the house cool. What is happening when the furnace turns off? Is is not an action and will it have no impact on the temp because i had the foresight to do it in the past?

Preposterously you tell us that turning the furnace off only 'counts' if you did not think to do it when you turned it on.

If the neighbor decides to smash your windows to let in some cooler air, it is likely that you forced him to take action by preprogramming the furnace to shut off instead of manually turning the furnace off at the same time.

lol, ok. sure.

I still think that restrictive fiscal policy impacts the economy even if it was planned in the past. Interest rate increases also have an impact, even if they are telegraphed or planned in the past.

you are looking to blame someone and creating a bizarre argument to justify the blame. odd

Five trillion is gross; nobody, you included, ever mentions net after lost income during the pandemic, when unemployment spiked and many businesses were shuttered or saw huge reductions in revenues.

Funny how when oil prices fell, inflation expectations disappeared. Oil prices do not incorporate inflation expectations, and especially in the 70's, the price of oil is a huge component of inflation.

Do you know of any analysis that can identify ‘expectations-driven inflation’ reliably, with low false positives for price increases driven by one-time events (e.g. pandemics-disrupted supply, war, drought)?

I and other commenters here have pointed out that the post-WWII inflation spiked to 20%, and ended with little monetary or fiscal intervention. If that high a peak didn’t trigger an expectations spiral, why would the recent inflation peak half that size do so?

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit

this article... https://createmaxwealth.blogspot.com

Having carefully established how worthless are economists' "expectations", Politico proceeded to waste several hundred words gleefully telling us that economists expected a recession later this year.

I honestly don't think recession matters as much as gas prices. Unemployment can be rising, but if gas is $2,95 / gallon, Biden wins.

And, of course, to those lofty thinkers at the Fed, politics doesn't exist. All those silly weak-brained rubes who worry about things like "rights" and "democracy" just don't understand that only macroeconomic equations are real. So when the desired contraction takes place, unemployment rises, and economic growth goes negative, the Wise Men will smile knowingly and send congratulatory telegrams to each other, while trump, mcconnell, and mccarthy scream about how Joe Biden has destroyed jobs, jobs, jobs and the economy and the Price at the Pump. The Fedsters will have no comment on this other than "pffft, not our concern" because they are above such pedestrian worries. Their job is done. Carry on.

Exactly

David Romer: "We still don't understand inflation."

That's not an indictment of his/their skills; it's a humble admission that we -- meaning everyone -- do not fully understand all the mechanisms of economics, in particular inflation.

It's kind of funny how people are taking Romers' work, therefore.

If all you had to do was look back to the past to predict the future, then fuckit, it does not matter one bit whether inflation is driven by capital, demand, supply, or exogenous events. Because, all it takes to understand inflation is to look back and extrapolate, right?

"We still don't understand inflation."

FWIW Dean Baker suggests Q2 GDP numbers are likely to be better:

https://twitter.com/DeanBaker13/status/1651571525957603332

We're at full employment... and that is bad. Must have more poor and unemployed people.

The markets are predicting inflation will drop below 3% soon and stay there for the rest of the decade.

The market is not predicting a serious recession.

Of course, the markets can be wrong but they have a better track record than you, or I, or Christina Romer and David Romer.

Predictions are hard, especially about the future.

Love the "Predictions are hard, especially about the future."

Markets do not have a good track record. For example the stock market continues to go up until it crashes - if the market knew what it was doing, it wouldn't go through boom and crash cycles. Not that economists do any better - their predictions are usually wrong for any distance in the future. Since they are never unanimous a few may get the prediction of a recession or not-recession right, but that doesn't mean the predictions of those particular economists can be relied on.

Hmmm... if you thought there would be a serious recession, you would predict that inflation will drop...

There were recessions in the 70's but inflation was not reversed (until oil price quit rising). That's why it was called "stagflation".

The market is not predicting a serious recession.

I'm aware the markets are not predicting an extended period of high inflation. But what do you by the above? Stock market? Relatedly, does your use of "serious" imply you think the market may be predicting a mild recession? I personally think a mild recession is pretty likely, though, given where we are in our political cycle, I'd strongly prefer we avoid one altogether.

To be honest, as a former automatic control system engineer, I do not believe any of this. In order to believe a prediction like this, you need to believe that 1) they have a sufficiently accurate model of the dynamics of a system as complex (and noisy) as the Entire US Economy 2) the single control variable that they possess has sufficient authority to move the state of the system to the desire point 3) they have accurate, timely sensor data sufficient to update the model of the system.

I expect that this prediction will be wrong. And they will either never mention it again or provide some excuse why it went wrong.

The people are the modern-day version of Soothsayers. Yes - I believe that they can accurately predict certain things. For example, if you print money with reckless abandon, you will eventually devalue that money. For some value of "reckless" and "eventually." But their models are massively over-complicated for such basic predictions. And that is because these models exist to advance other policy arguments, in the guise of providing predictions.

"In order to believe a prediction like this, you need to believe that 1) they have a sufficiently accurate model of the dynamics of a system as complex (and noisy) as the Entire US Economy 2) the single control variable that they possess has sufficient authority to move the state of the system to the desire point 3) they have accurate, timely sensor data sufficient to update the model of the system."

This! I don't understand why so many people don't understand this, even on an intuitive level. It's part of why I'm so frustrated with Kevin's constant assertions that the Fed's interest rate hikes haven't had any effect yet (they have), and with the broader attention focus on the Fed prime rate as The Single Thing That Matters.

But it's a very complex system (duh), and some very broad things are obvious (print tons of money -> eventually devalue that money). It's why the Fed's extremely aggressive rate hikes were either being done by (1) rather stupid people who thought they were the sole controllers on inflation/recession/deflation/whatever else, or (2) people of a certain economic class who only care about what's good for that class, whether intentionally or because they've got blinders on.

The Fed has shown us for decades that they're the latter, not the former. And what would you expect? They're big bankers.

The assumption that the Fed controls everything with interest rates seems to have become the governing dogma in the 60's when economists on both the right (Friedman and Schwarz) and left (Samuelson) came to the "theoretical" conclusion that technocrats (or Maestros) could regulate the economy this way without messy political action. Evidence that this doesn't work (very high inflation in the 70's and the Great Recession, caused largely by central bank attempts to stimulate housing) has simply been ignored. Now economists (not just the Fed) are talking about how unemployment must go up despite the fact that inflation is already coming down, without any increase in unemployment.

I disagree. The important thing is that They have a control variable sufficient to move the state of the system.

Knowing that the models suck and that the measurements suck, the question remains whether one can make usable estimates of where the state of the system will be in two years, with confidence intervals. And a way to partially test that is to make a prediction and see how correct it is.

Except that "control variable" doesn't actually control it.

My ominous feeling is that it's not so much about inflation but about the party being over. All that quantitative easing led to far too many gazillions of dollars rushing around the world in a search for 0.01% more, or going into cryptos and NFTs and other intangibles, or otherwise becoming untethered to the real world. That being said, it's painful to think of all the money uselessly floating up there, but imagine the disaster if it were to fall to Earth. If Jeff Bezos converts his assets into toilet paper, the rest of humanity will have to wipe its asses with old newspapers. For a thousand years. Not to speak of the disaster if hedge funds and billionaires start investing in farmland, because when that happens we're all screwed.

Very related, but not directly on point: the Fed also just released their analysis of the SVB bank run:

https://www.federalreserve.gov/publications/review-of-the-federal-reserves-supervision-and-regulation-of-silicon-valley-bank.htm

You have to love how the Saudis, Iranians and the Russians all thought if they reduced their output again oil prices would continue to rise to prices they find acceptable. And yet all their production cuts do is simply create the impression among traders a recession is on the way and demand will slacken, causing prices to fall yet again. Prices are already falling where I live (especially after seasonal fuel switchover). Pretty soon these countries will be the oil-producer that don't produce any oil!

There is certainly evidence that Fed interest rate "shocks" can cause unemployment, but this does not prove that such action causes inflation to go down. Inflation has already started down because supply constrictions have eased, certainly not because unemployment has increased - it is still very low. It is quite possible that inflation will continue down to near Fed target without increase in unemployment. For one thing supply can be cyclic - short supply and high prices can cause overproduction. This is a possibility, not a prediction - no one can really predict these things.

The Romer paper appears to start from the assumption that Fed action controls inflation by acting on unemployment, ignoring the effects of supply constriction. That assumption is probably false and the present instance is just another example.

Today, Krugman writes about the Biden Economy. Or the effect of the economy on the 2024 election.

I see three distinct trends:

The fed is going to drive us into a recession this summer. So in November 2024, we should be out of the recession and seeing reasonable growth again.

Opec would far prefer a Republican president to a Democrat, so they will be tightening oil supplies to drive up inflation.

The Inflation Reduction Act is driving economic growth while slowing reducing demand for oil. And it's effect will get stronger during 2024.

The fed is going to drive us into a recession this summer. So in November 2024, we should be out of the recession and seeing reasonable growth again.

Krugman himself has written that the effect on the election of the electorate's perception of the economy has generally calcified by mid year. I think it's far from clear a recession will sink Joe Biden. But for the country's sake (at least based on past cycles) we'd better hope voters perceive the economy to be decent/strong/strengthening etc by July 2024 or so.

If we enter recession later this year, but it lingers until late summer of 2024, I fear Trump will get back in office.

If it's clear we're in recession by mid summer of this year, though, and it's equally obvious we've exited that recession by, say, May of 2024 (and there's media coverage describing "rapid, strong recover" by the middle of next summer), I think Biden's a pretty strong favorite.