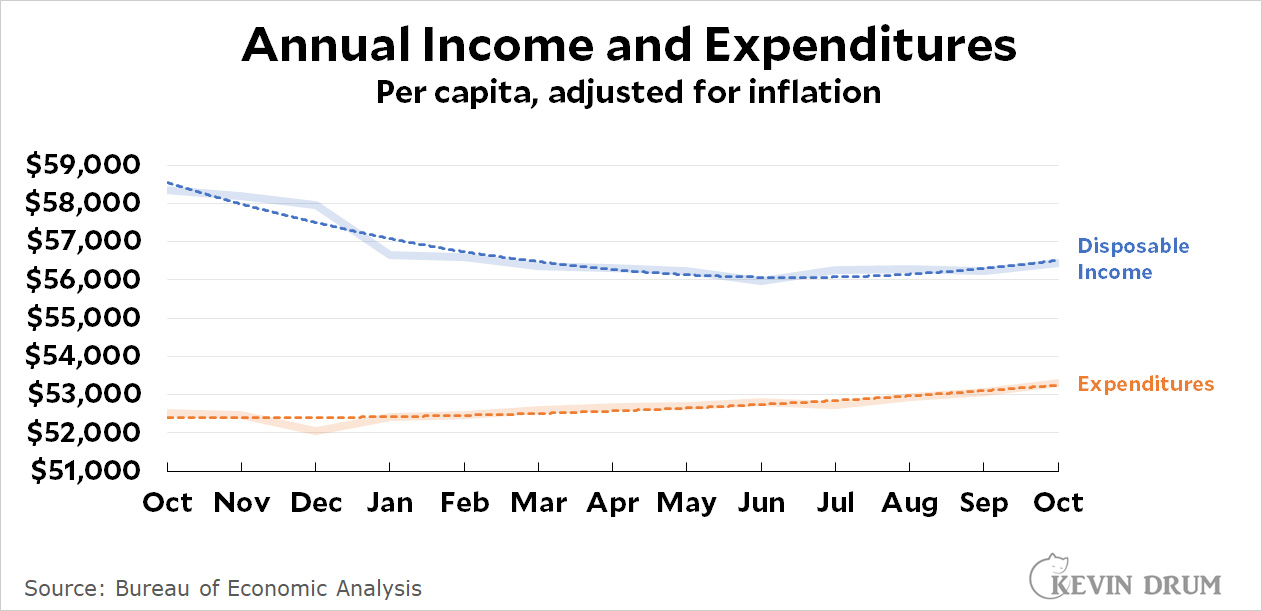

Income and spending data were released today along with the inflation figures. Here's the latest:

Adjusted for inflation and population, month-over-month disposable personal income went up 4.2% (on an annualized basis) while personal spending went up 5.8%. On a dollar basis, that's an income increase of +$2,400 and a spending increase of +$3,100.

Adjusted for inflation and population, month-over-month disposable personal income went up 4.2% (on an annualized basis) while personal spending went up 5.8%. On a dollar basis, that's an income increase of +$2,400 and a spending increase of +$3,100.

On a year-over-year basis things are even worse: income was down -$1,900 while spending was up +$800. On a household basis, the difference is more dramatic yet: real income is down -$6,000 while real spending has gone up +$1,100. That's a change in the household balance sheet since a year ago of -$7,100.¹ This obviously isn't sustainable, and when savings run out it will hit a brick wall. Regardless of anything the Fed has or hasn't done, consumer spending will pull back and the economy will slow down. Toss in the Fed's rate increases, which will start to have an effect next year, and the economy will go into a ditch.

¹A big part of the decrease in disposable personal income is due to the end of the Child Tax Credit in January, as well as some COVID-related items. BEA is a little vague about this because they don't know for sure what accounted for the big December-January decrease.

POSTSCRIPT: If these numbers look a little high to you, it's because they're means, not medians, so they're skewed upward by the income and expenditures of all the gazillionaires. Normally I'd give you medians instead, but the BEA doesn't report them that way.

My cousin could truly receive money in their spare time on their laptop. their best friend had been doing this 4 only about 12 months and by now cleared the debt. in their mini mansion and bought a great Car.

That is what we do.. https://earningblue.blogspot.com/

Trans Jeffrey?

So due the numbers count Musk's impulse purchases?

It's not only a matter of savings running out, but of consumers turning to debt to fund everyday living expenses. The latter has the potential to cause even greater problems as they quickly find more and more of their income has to be used to pay interest on credit card balances.

Is there disaggregated data to show that the increase in consumer debt is due to spending on consumables, as opposed to durable goods, home improvement, and similar?

My income went up in October because I received money in my spare time. I have cleared my debt own a great car and a mini mansion!!

That is what I do

For SOME of us income went up and spending went down............/s