In comments last night, skeptonomist accused me of rarely being interested in showing income inequality. This cut me to the core, but there's truth to it and it's worth showing you why.

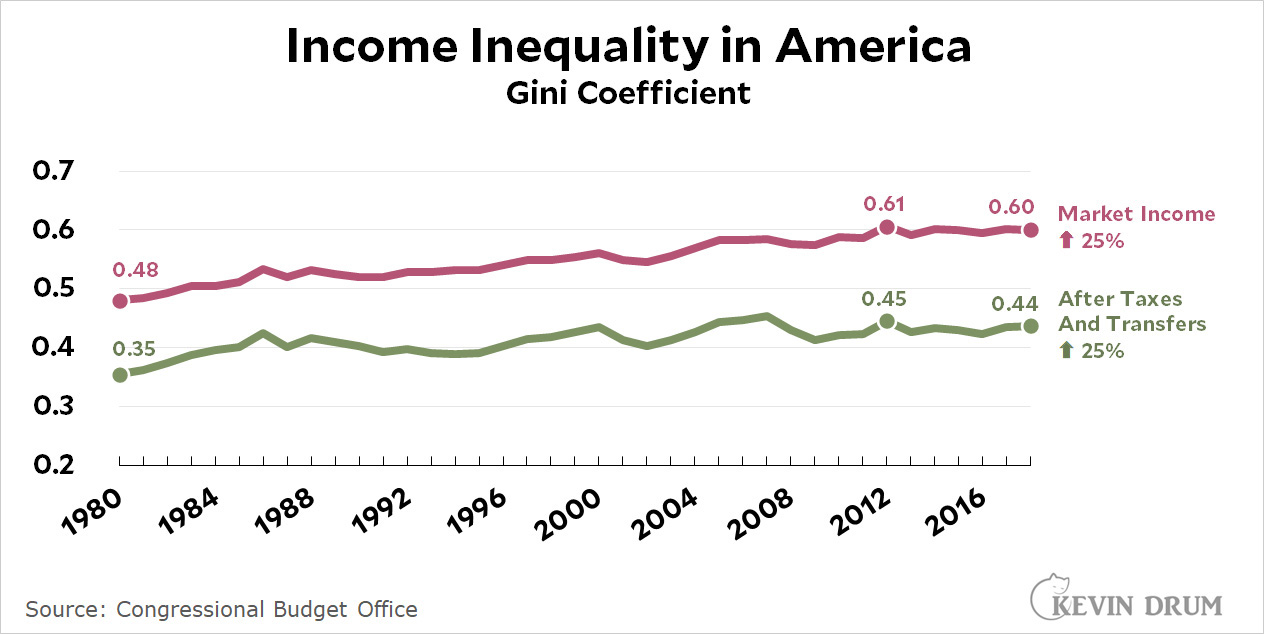

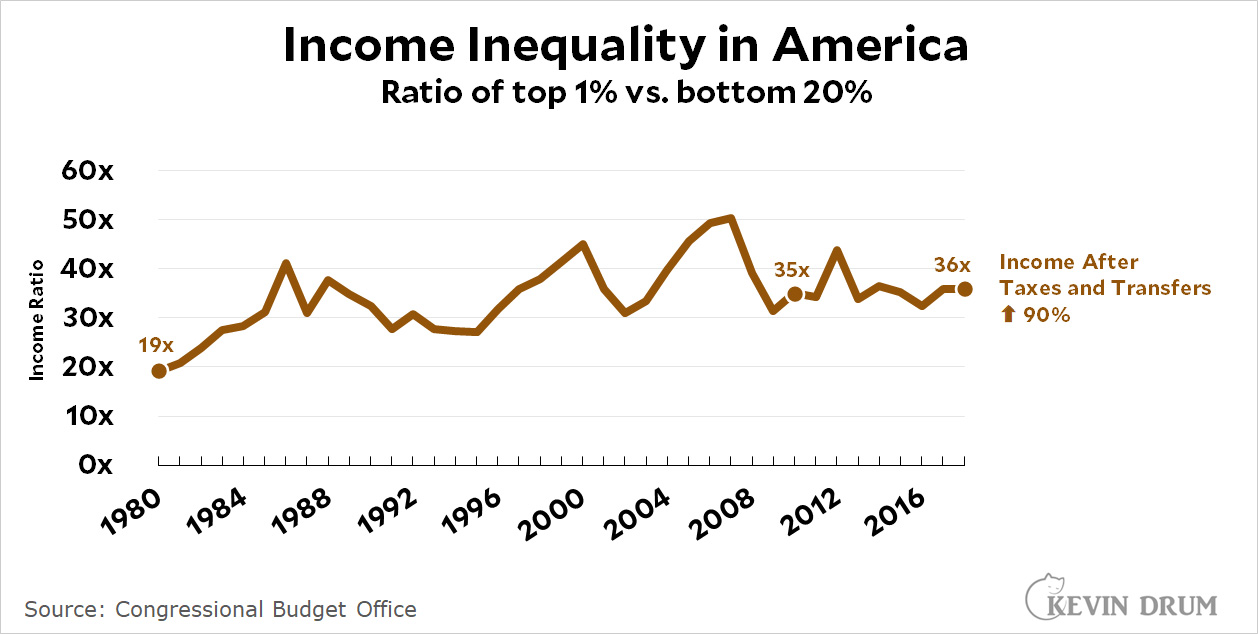

The single best set of numbers for income inequality come from the CBO. There are two reasons: (a) they collect a broad set of income figures, including capital gains and means-tested benefits, and (b) they include figures for the top 1%, which is where inequality has risen the most. So without further ado, here are two charts based on CBO income figures:

The top chart shows the GINI coefficient, which is the most common measure of income inequality. It's much lower (i.e., better) when you include taxes and transfers, which is just what you'd expect, but it's been rising steadily since the Reagan era either way.

The top chart shows the GINI coefficient, which is the most common measure of income inequality. It's much lower (i.e., better) when you include taxes and transfers, which is just what you'd expect, but it's been rising steadily since the Reagan era either way.

GINI is a little abstract for most people, so the bottom chart is a simple comparison of income between the top 1% and the bottom 20%. It shows much the same thing as the GINI chart but with even stronger growth.

But now take a closer look at these charts. They show income inequality growing strongly starting with Reagan and then peaking during the housing boom of the aughts. Then income inequality declines during the Great Recession and hasn't changed much since. In 2010, at the end of the recession, the average top one-percenter had an income 35x higher than the average bottom quintiler. By 2018 that had gone up only to 36x. Likewise, since 2012 GINI hasn't budged.

I'm not here to tell you that growing income inequality is no longer a problem, but it's certainly calmed down over the past decade or so. This is probably why you don't hear as much about it as you did during the Occupy Wall Street days at Zuccotti Park.

Slowing GDP growth related to investment declines as the last gasp of the industrial revolution spit in 2000. It's structural and not something that can be helped. It's where the old left died in the 90's(with the Unabomber giving the eulogy). Where degrowth began.

I’m a late career professional and I make what consider good money for what I do. The hourly employees where I work have a decent salary and plenty of opportunity for overtime. Should they make more in comparison to me or the executives at this company? Sure, why not? Stock compensation exaggerates the inequality issue. Taking that away won’t really change anything. Will it?

I recall digging into this years ago, and I concluded that there was also a decent jump in the late 60's. is there a reason you started your chart at 1980?

I can't speak for Kevin, but you've got to start your chart somewhere, and 35 years seems a long enough span to show the increasing inequality effect. Most of the analysis I've seen over the years suggests inequality began to increase significantly (after 35+ years of post-war moderation) starting in the early 70s. So, your suggested timeline sounds about right to me. I've always figured the dramatic increase in oil prices had a lot to do with it. When a commodity that critical to the economy (especially the economy of the early 70s) gets scarcer, something's gotta give. In America we mostly chose to insulate the affluent from the effects of the energy crunch. Which means, yes, more inequality.

Reaganomics was when capitol won over labor. It was also when unions lost their power.

Obamacare was signed into law in 2010. That's a big part of it. Crashing bubbles tend to ameliorate income inequality, but you'd expect the pre Great Recession trend to reemerge. And I reckon the ACA is the single biggest part of the reason it mostly hasn't. Despite its significant deficiencies, the landmark legislation was the biggest redistributive measure since LBJ was president.

Boomers retiring and taking Social Security plays into this too.

It looks like both measures have been similar since the late 80s That's when Reagan really un-did the New Deal. The big blips since then have been times of widespread financial crime like 2000 and 2007.

While income inequality is important for its own reasons, and we should pay attention to it, it is odd to me to have a post about income inequality without even mentioning wealth inequality. Wealth inequality was a major driver behind OWS, not just income inequality. And it's still a major problem.

TBH, I think it's the ur-problem for most of our problems.

My thought too. Wealth inequality has soared since the Great Recession. Even in the current bear market, stocks are up 5-6x since 2009. Real estate prices are way up too. Most of those gains have gone to the well-off. That said, it's hard to see how the wealth inequality gap can be closed in the short term without an economic collapse that brings down asset prices.

I'd be interested in seeing inequality trends for urban vs. rural, which would align with the intractable political divide we live with. I've heard the rurals are doing better now, post-pandemic, but I haven't seen data around that. There are two inequality gaps worth looking at: one, between the groups (urbans tend to be wealthier than rurals), and within the groups (inequality within the rurals tends to be higher than within the urbans).

My argument would be that inequality is not just a matter of dollars and cents but also a kind of tide that washes through the economy and society. In other words, it's surely a good thing that "growing income inequality" has "calmed down" (in other words, the first derivative is under control right?), but the problem is that once it reaches a certain level it affects lots of other stuff. As a small example, inequality is not getting worse, perhaps, but it's already at such a level that a certain segment of society has enough extra cash on hand to pay coaches under the table to get their kids into Ivy League schools. This isn't "worse", but I would argue it's behavior that was enabled by inequality reaching a certain level and staying there.

Kinda like Larry Summers on Ezra Klein a while back explaining that inflation will continue because people have saved up a lot of money from Covid stimulus! (Being ironic here... longtime readers of KD know that household savings are back to zilch, no matter what Summers says... and I wish Ezra had pushed back on this).

By the way, if you didn't know, my reference to getting into Ivy League schools comes from this story. USC stole all the (deserved) thunder and few people noticed that the Harvard fencing coach took $1.5 million for his house (and some other stuff) which was worth a lot less...

https://www.wbur.org/news/2020/12/07/brand-zhao-indictment-harvard-college-bribery-scheme

Different measures show things like inequality differently. Kevin sometimes talks about aspects of inequality, especially CEO compensation and profits, but the measures and the time limits that he usually chooses tend to minimize what has happened since around 1973.

Up till then workers, specifically the BLS category of "production and non-supervisory workers" who are about 60% of non-farm payrolls, were getting at least an equal share of GDP growth, and their real wages were increasing, but after that real wages actually declined until the 90's.

https://skeptometrics.org/BLS_B8_Min_Pov.png

There has been some improvement since the 90's, but obviously workers have still been falling behind in terms of GDP growth. Compare the slope for manufacturing workers (blue curve) with the green GDP curve before and after 1973. We know who has been getting the growth of GDP since then - it is mostly the 1%. There are many measures which show this. It's true that this diagram only shows actual wages and not government benefits, which have been growing for low-income workers, but the point is that the "neoliberal" (or Reaganomics?) economy which Kevin seems to favor and which we have had over the last 50 years has been a major change, causing inequality, wealth accumulation at the top and relative stagnation of real wages.

Inequality decreased from WW II until around 1960-70, but wages had actually grown in parallel with GDP through the history of the US until around 1973. This is shown with a wage index from the Economic History Association (EH.net):

https://skeptometrics.org/WageIndex.png

My diagrams are done with the CPI and if they are done with the PCE there is more of an upward slope of everything, but the relation betwen the curves is the same - inequality is independent of the inflation index.

If we just concentrate on the minor gains in real wages that workers have made over the last 10-30 years we are missing the huge changes in the economy which have slanted things away from workers. Contrary to the claims of conservatives and globalizers, the changes have not improved GDP growth. Not only are gains not trickling down, there is less to trickle.

Dude, that is because of the IR end and population slowdown. Inequality as you state it was a fact of capitalism before the GD. It is a natural part of the system.

I suspect that the behavior of the tails of the distribution tell a different story; examine the 1000 or 10000 richest Americans' percentage of wealth, and I would suspect that has climbed steeply.

Most people don't care about statistical analysis of income inequality. People feel the impact of a reduced standard of living based on what their income will buy them and their families. This has eroded for the middle class, and has gotten worse in recent months due to inflation, which hits lower income people far worse than the wealthy. People also feel that their children will not have it any better, or may fare worse than them.

People feel the impact of a reduced standard of living based on what their income will buy them and their families.

Reduced material standard of living may be a factor over the last year or so (declining real wages) but I think the bigger problem over the last several decades has been reduced economic security. The impression one gets is that it's far easier for Americans to fall out of the middle class than for the denizens of other high income countries. Not enough stuff isn't a big problem in the US. It's more an issue of unaffordable services (healthcare, childcare, higher education), housing insecurity, crushing commutes (in essence not enough time; we can add inadequate PTO to this list) and insufficient preparation for retirement.

US political economy, to a greater degree than most other high income countries, favors the rich over the non-rich.

With three kids starting careers, I think about this often.

Let's start with the old "kids doing better than their parents." From what I see in human history, there is really no basis for kids doing better (socio-economically) than their parents. For along time due to infant mortality rates, it was actually a statistical certainty that a child would do worse than their parents, as their parents had already survived to child bearing age, and it was far from certain a kid would do so.

In societies with class structures, the entire system was set up to have kids of the upper class stay upper class, and if you were in the lower classes you stayed there.

This whole concept of doing better seems to me to be (a) recent, and (b) super dependent upon the weird random situation that is North America, where in the past hundred or so years the availability of good land was unique.

Now that land in the US, for sure, is no longer as unique, I don't see any reason why anyone would assume that children would do better than their parents. Kids may have better tech, but I don't think that's what people mean.

The only breaks on capitalism cramming everyone into a 1 to 100 ranking, with 50% of the population in, well, to be obvious, the "bottom 50" is to what degree the society agrees on social programs, such as health care and education.

It makes me grind my teeth to hear conservatives wax on about opportunity, as if opportunity is a one way street. Capitalism results in a two way street, period.

Income is going to be unequal unless laws are put in place to disgorge wealth from the wealthy, under what economic system which exists would any other result occur?

It's not great if inequality is as high as it is, even if it's not much higher than ten years ago. It was bad then, and it's still bad.

I updated my plot of the Census family income percentiles which I had shown earlier and this at least partially bears out Kevin's claim that lower-income growth has been good recently:

https://skeptometrics.org/FamilyIncomepctiles.png

Since about 2013 to 2020 anyway family income for all percentiles has actually grown faster than GDP/family. Of course one reason for this is that GDP growth in the recovery since 2010 was historically slow, but over those seven years income growth rate was similar to the pre-1970 rate. We can hope that this (short) trend will continue but there has been no obvious fundamental change in the power of wage-earners. Real wages are now decreasing, and as Kevin says it is possible that the Fed will cause a gratuitous recession. The next financial crash, whenever it happens, will also change things.

"This whole concept of doing better seems to me to be (a) recent, and (b) super dependent upon the weird random situation that is North America, where in the past hundred or so years the availability of good land was unique."

"Recent" if you mean since the Scientific/Industrial Revolution. North America was a leader, but in spite of horrendous wars Europe progressed too. In the last 50 years most of the rest of the planet started advancing as well. The GDP of Bangladesh in 1970 (in 2020 dollars) was $100; today it's $2700. When I first lived in China in 1986 it was $282; now it's $10,000.

Brad DeLong's new book focuses on this general topic, from what I understand. He pegs the breakout starting in about 1870.

PS—If you don't mind my asking, where in China did you live?