When you look at some sort of domestic trend or other, it's often helpful to look also at the rest of the world. This was one of the things that tipped me off about the connection between lead and crime, for example. Everyone knew that crime in the US had dropped during the '90s, and this had prompted a rash of theories to explain it: drugs, policing, abortion, broken windows, a growing economy, etc. But it turned out that crime was also down in Canada. And Germany. And Britain. And Australia. And all over the rest of the world. Clearly something had to be going on that wasn't unique to the US.

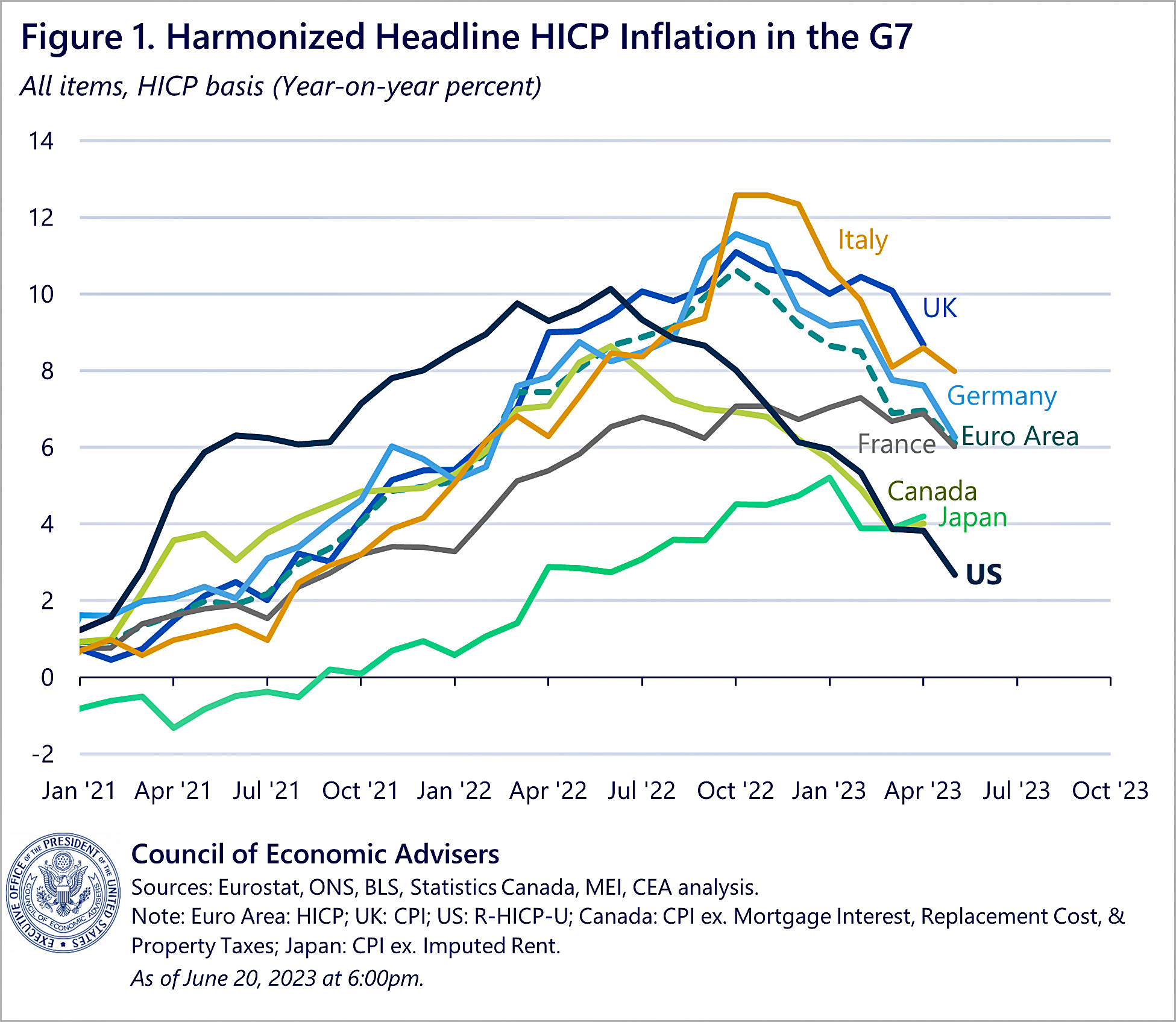

Today, the CEA does a similar exercise for inflation in the G7 large economies (mostly Europe). Here it is:

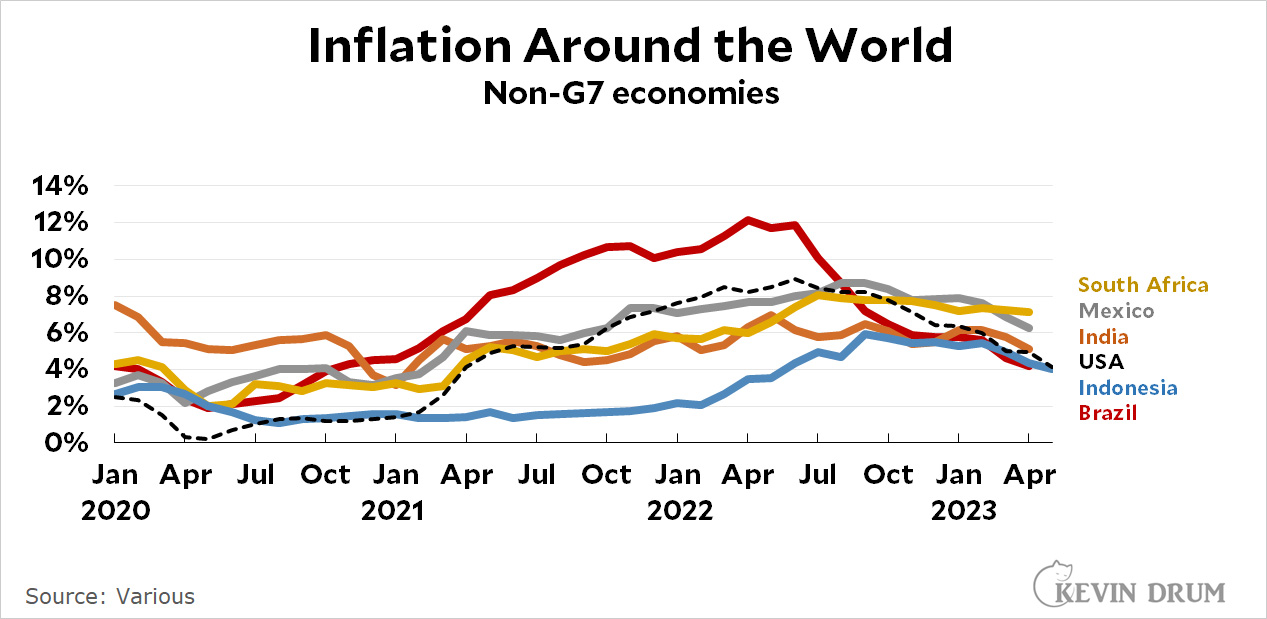

This got me curious about smaller, less central economies. So I grabbed a few inflation rates from other continents:

This got me curious about smaller, less central economies. So I grabbed a few inflation rates from other continents:

Obviously there are differences, but not big ones. What this means is that inflation in the US almost certainly has little to do with domestic policies like the stimulus bill or easy money from the Fed. Inflation is a global phenomena, hitting everyone at roughly the same time and then declining at roughly the same time.

Obviously there are differences, but not big ones. What this means is that inflation in the US almost certainly has little to do with domestic policies like the stimulus bill or easy money from the Fed. Inflation is a global phenomena, hitting everyone at roughly the same time and then declining at roughly the same time.

In other words, it's COVID. It's supply chains. It's shortages. It's oil prices.

There can still be idiosyncratic explanations for parts of the picture. In the US, eviction moratoriums at the start of the pandemic pushed up rental prices. Stimulus spending was higher than in many places and probably added a point or two to the inflation rate temporarily.

But these are small things. In a nutshell, it's COVID. It's supply chains. It's shortages. It's oil prices. Those things are all going away naturally, and inflation will shortly go away along with them.

The Fed and the economists who love it have been obsessed with wages and unemployment for a long but their explanations have never made sense. The data are simply not consistent with their explanations. This is true for the inflation of the 70's and 80's as well. The Fed (and other central banks) failed to control inflation then despite raising federal funds for years on end, to astronomical levels compared to the present. The idea that the Fed controls inflation by adjusting interest rates is just empirically false - a fantasy.

A lot of things are more global than anyone wants to admit. Remember the housing boom and bust? People loved to blame things like policies to encourage Black homeownership, but, of course, the boom was in many countries, as was the bust.

You can't really use info from the 1918 flu pandemic to see if pandemics typically cause inflation, because of all the chaos of post-WWI economic changes. But given all the abrupt shifts to labor and supply chains in 2020, it is not at all surprising to think that the pandemic was behind inflation, and it just takes a long time to resolve. People often talk about the major economic changes that happened after the Black Death - rising wages in Western Europe, entrenched serfdom in Eastern Europe. Pandemics just mess with economies.

"But given all the abrupt shifts to labor and supply chains in 2020, it is not at all surprising to think that the pandemic was behind inflation"

This. I'd go further, though--it would be astonishing if the pandemic were *not* the explanation behind pretty much every recent big shift or disturbance in pre-pandemic trends. The pandemic is the biggest single thing to happen to humanity since World War II.

But I was assured by campaign fliers last fall that inflation was all Joe Biden's fault.

While I won’t suggest central banks explicitly coordinate, do they act randomly relative to one another?

No, but the sheer size of the US economy means that the US generally leads. The Euro bloc is economically big and powerful enough that it doesn't have to follow where the Fed leads, as is China, but smaller countries generally are forced to pretty much follow the Fed.

I was actually wondering about this the other day as was reading Canadisn and other inflation rates. Seems obvious it’s. Ovid and the Ukraine war messing with inflation. We also had a major Avian flu screwing with eggs. What interest rates may do is temp expectations. No idea but that may be the game.

Oh dear - well if one is motivated to reason away ideologically uncomfortable facts, then one will do so.

It is rather precious to simply assert Covid and supply chains (real enough factors) and utterly hand-waive away the impacts of government stimulus actions or "income support" (as if demand happens magically...). These things are intimately linked, not magically springing from a Covid-Zeus head.

None of that is to say the enormous stimuli enacted across developed markets - and indeed middle-income markets was not a proper bet to make. It was. But it did have conseiquences. Inflationary ones. Acceptable and correct bet to make.

What is not helpful is then to adopt the ridiculous pretence there was not the consequence on the overshoot and thus no need to tailor.

Looks like a good deal of projection in those first two paragraphs.

That the amount of stimulus doesnt appear to play a role in the inflation that followed is easily handwaived away and replaced with a data-free, explanation-free, faith based argument.

The same logic that insists fiscal policy is to blame no matter what the data appears to say, have struggled to explain the actual inflation that occurred as well as the falling rates of inflation over the last many months. Their continual failure to predict the future and explain the past doesnt cause them to reconsider their faith based approach.

But it is no problem, handwaiving and condescension solves these dilemmas!

It is rather precious to simply assert Covid and supply chains (real enough factors) and utterly hand-waive away the impacts of government stimulus actions or "income support" (as if demand happens magically.

The quantity of goods and services produced by the US economy in 2020 shrank by nearly 3% relative to 2019. The global economy as a whole saw a slightly larger drop. When the quantity of goods and services available for purchase shrinks, we'd expect to see inflationary pressures, absent a commensurate drop in incomes. But we didn't see such a decline, because governments and central banks took countervailing action. You're not wrong, then, to cite stimulative measures for inflation, but Kevin's not wrong, either, to cite the pandemic. They're two sides of the same coin. He's more right than you, though, as to the likely duration (brief) and required remedy (do nothing, and allow conditions to return to normal), at least based on the evidence, which suggests that inflationary expectations have not (and had not) become embedded in the major economies. I admit to being nervous enough about this latter bit (and its possible effect on US domestic politics) to have welcomed the Fed's tightening. But it sure looks like this policy wasn't truly necessary to bring down inflation. What the Fed has done has hastened the arrival of lower inflation.

Inflation occurs if the nominal demand remains above real production.

Demand exceeding supply. Immaculate conception of demand does not occur.

Where enormous stoppages in production occur, normally one is seeing as well demand destruction (job losses, income losses).

However European, American etc etc. income support programs, company support programs all supported enormous amounts of current income that on a market basi would have evaported.

Demand was maintined by stimuli far above natural market level - an appropriate reaction to the Pandemic but with conseiquences.

Without such, demand would have been destroyed - of course also there would have been mass unemployment and all the attendant negatives....

Rambling on about supply chains, etc ignores that this pressure came from the income support. Fundamentally stimulus pushed demand against constrained supply or maintained normal demand against abnormal supply.

Thus inflation.

The cash overhangs and any number of facts which Drum and the other Left inflation denialists fraction - in what rather seems a misplaced feeling that in order to defend the stimuli they must hand waive away minimise, deny inflation and its origin (certainly not monocausal, of course due to confluence of factors, but fundamentally at root enabled by a tidal waive in all developed and even most middle income economies of support money on government borrowings).

As it would seem admitting the slightest error in overshoot is perceived as heritically siding with the reactionary MAGA or similar (even if one has said it was the appropriate bet to make, and right thing to do, and merely observes that post-facto one has to trim the sails in order to right the boat to stable setting).

Look at responses to my mild note of criticism over the months on inflation - accusations of Trumpish Fox MAGAism and the like- pure tribalism really.

As for last note, "hastened the arrival of lower inflation" yes or one can have the view that US Fed and ECB have worked to ensure such, as by the comparatives available with Central Banks that have not responded with alacrity, e.g. Turkey, Bank of England as two examples, inflation shows by multiple metrics fundamental signs of entrenchment (of course nothing occurs in a vacuum so there are other policy error factors for both national territories).

Rambling on about supply chains, etc ignores that this pressure came from the income support.

Just as "rambling on" about stimulus ignores supply side problems. Both need to be cited for an accurate picture. But again, we have no reason to think that, absent stimulus, the global economy wouldn't have eventually returned to a normal, non-depressed level of output. Which suggests inflation would have declined absent monetary tightening. How long that process would have taken is hard to say. I suspect a more leisurely return to acceptable levels of inflation would have been damaging to Joe Biden's reelection prospects. So Democrats probably owe Jerome Powell a measure of gratitude (provided he hasn't overdone it, which isn't clear yet).

Fundamentally stimulus pushed demand against constrained supply

Correct. As I noted above, demand support and reduced output are two sides of the same coin. To put it slightly differently, let's imagine the various governments and central banks in question had engaged in the same stimulative measures, but these measures had been matched by a contemporaneous increase in the supply of goods and services. What happens then? We wouldn't have seen an inflation spike, that's what.

Two sides of the same coin.

I didn’t read all of this back-and-forth, but I didn’t see any acknowledgment that some unknown fraction of stimulus was replacement for lost personal and business income. It cannot be assumed that every dollar (pound, euro, …) of stimulus added to the trend level of demand. Also, some fraction was saved, not spent. If you have data on national incomes net of stimulus, lost wages and lost business revenues, please post it, or links.

"In other words, it's COVID. It's supply chains. It's shortages. It's oil prices."

I would say the above is partially true, but incomplete.

1. There are similar OECD countries (South Korea, Singapore, Switzerland) that did not experience a material rise in inflation, but were still exposed to the same supply chain challenges and global energy prices. How do you explain this difference without national policy?

2. If you look at the chart, the US had inflation much earlier than Italy or the UK. Then our inflation has fallen much faster than Italy or the UK. Once again, all three countries were exposed to the same supply chain challenges and global energy prices, yet have performed differently.

3. There are several economists or, so called, experts that attribute some of US inflation to policy.

Therefore, US policy seemingly had a role in our inflation.

Again, there are significant structural differences among national economies.

1 and 2 are really the same argument. In both cases, it is not a good assumption that every country in the world had the exact same covid experience, faced the exact same supply chain disruptions and experienced the exact same Ukraine war related supply problems.

That aside, is the argument that US fiscal policy didnt cause larger inflation than seen elsewhere, but did cause the same level of inflation to begin and end earlier than other countries? Splitting the hairs of the angels dancing on a head of a pin?

jdubs

Point 1 is some OECD countries, facing similar supply chain and energy price changes, still had very little to no inflation.

Point 2 some OECD countries, also facing similar supply chain and energy price changes, had very different inflation impacts (start, length of time, significance).

Point 1 is no inflation and point 2 is very different inflation.

Absent national policy differences, how can you explain the aforementioned variation?