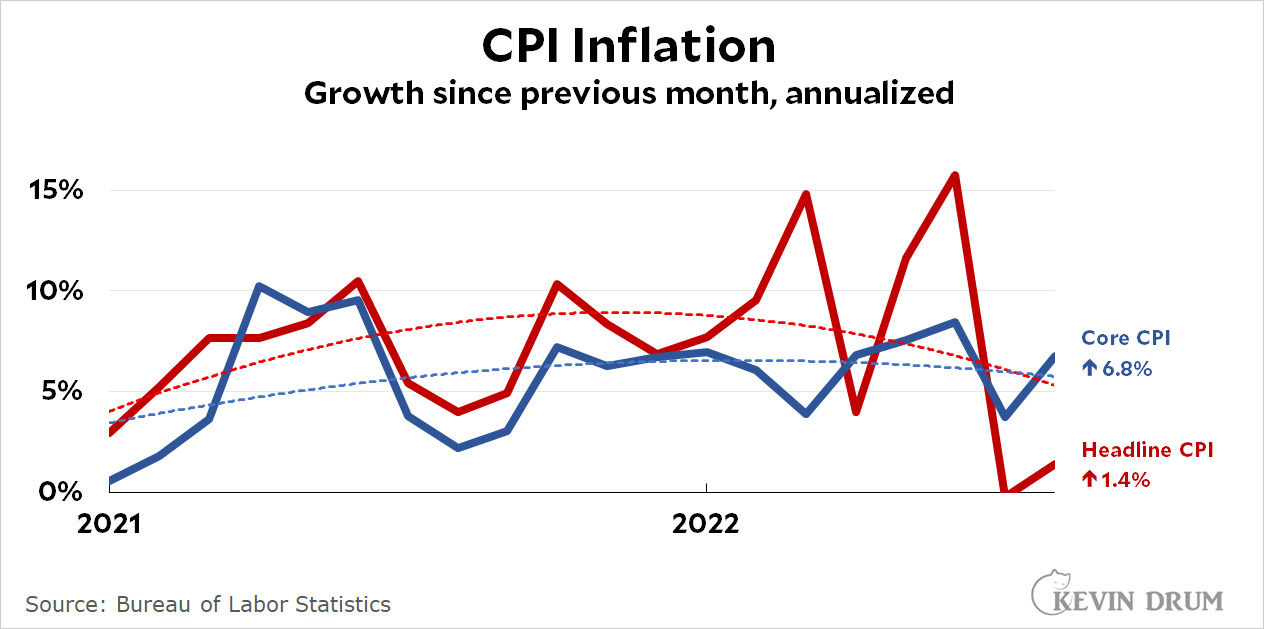

The BLS announced the CPI for August today, and the month-over-month figure was nearly as low as it was last month:

On a year-over-year basis, headline inflation came in at 8.2%, down from 8.5% in July.

On a year-over-year basis, headline inflation came in at 8.2%, down from 8.5% in July.

As always, the trendline is the thing to watch. The trend for headline inflation continues to come down nicely, but core CPI has been relatively flat at around 6% for nearly a year now. That's not good news, and it's odd since the PCE core rate is both lower and dropping faster.

Gasoline was down substantially in August, but food prices continued to be stubbornly high. Food was up 10% on an annualized basis.

On a positive note, blue-collar wages were up 4.4%, and with inflation so low that translates to a 3.9% real increase. As usual, though, what's good for workers is bad for the Fed, since it means now they'll be fretting about growing labor costs.

The Fed goal is 2% annual inflation. Respectfully, 8.3% annual inflation, with 6.3% core inflation is not subdued.

I believe the Fed will make another significant rate increase, in their effort to lower inflation.

I see the Republiqan Senatorial Qampaign Qommittee has checked in.

Thanks in advance for dumping Medicare & Social Security, brah!

MontyTheClipArtMongoose (fun name BTW) - As a Democrat, I would prefer we have a plan (policy, communications, regulation etc) to address inflation (note, inflation is not easy to tackle), rather than name calling when someone point out that inflation came in at 3 times higher than the goal, that is not my opinion.

First, you're as much a Democrat as Dick Morris or the Dessicated Corpse of Pat Caddell or Joe Losermann.

Second, the generalized goal is 2% inflation, as has been the case since Pro-Domme Gerald Ford was in the White House, but historically it has been kept unnecessarily lower than that because of the Stagflation Monster Always Under the Bed.

Third, being that the goal is 2%, but been kept unnaturally lower for decades, a spike, after a plandemic, that was mismanaged for its first year, is actually a healthy corrective. Especially as Team Summers seems to be wrong, again, about the permanence of higher than desired inflation.

MontyTheClipArtMongoose - it is true that I don't call myself a progressive: then again, I vote for Democrats and that, I believe, defines my politics.

My point, the current inflation figures are not, as the article states, subdued and will likely result in a Fed rate hike. We will see...

They can be both subdued and result in a rate hike.

8.2% over last year but only 1.4% over last month. I agree the Fed may rate hike but inflation with continued lockdowns in China and the war raging on plus increasing climate change danage seems like something that is not really a result of or can be altered much by policy. The Inflation Reduction Act puts modest downward pressure on inflation. Not much longer and the year-over-year will go back to a far less scary number because the spending has worked its way through the economy.

I give you credit for engaging with Monty. I'd do so more often if I understood his words.

What does it say about our relative intelligence that I find him perfectly understandable practically all the time?

Yeah, no, you're not a democrat in any meaningful sense of the term. Everybody here knows this and it's useless to pretend otherwise. Doing so makes you a -- wait for it -- concern troll. Gee, who here has called you on your concern trolling before?

Keep your eyes on the trendline while the cups are shuffled…

Kevin basically makes up the trendlines

I would like to see some explanation of how these curves are generated. I know how to fit a least squares *line*, but I'm not sure what formula generates Kevin's curves.

You can fit quadratics, cubics, etc. with least-squares method as well.

That's why i don't like the calculus justification for least squares and prefer the projection of an image from the row space to the column space of a linear operator instead; the higher the degree the polynomial the more the columns and that's all there is to it.

The Masturnaters, Cohn & Silver, plus Dave "Back" Wasserman & the sundry & various Matts (Bruenig, Yglesias, Boxer, et. al.), are using this as evidence to further unskew the polls showing a post-Dobbs Democrat dyke against the Red Wave & instead a 2004 Indonesian Tsunami for the GQP.

Let a thousand investigations of Hunter Biden's laptop & a joebiden impeachment over the Afghanistan withdrawal bloom.

Yglesias can eat shit but the Nates are good at what they do.

And what a shame it is that the Nates of our world don't stick to their wheelhouse.

You'd prefer overconfidence at Dem polling numbers* culminating in a nasty surprise in November?

No thanks. I want Democratic voters good and scared about the prospect of a strong GOP performance, because such an occurrence is far from an impossibility—unless Dems get to the polls.

*Worked out great in 2016.

Not overconfidence, but poopooing good numbers can prove as depressive (& suppressive) as heralding bad numbers.

We need to admit we're ahead, but the only polls that matter are on November 8.

So, following the link, the month-over-month last month for core was 0.3. This month is given as 0.6. An interesting definition of nearly as low when it was twice as large… Over the last several months it is given as:

0.5 0.3 0.6 0.6 0.7 0.3 0.6

So by Kevinreasoning it is also very nearly as high as the month before that, and just as high as the two months further back and … clearly … transitory.

and the headline month to month is 0.1% since gasoline prices have fallen....

I'm a bit surprised that core bounced right back up--looks like it's being driven by new cars, health care services, and rent (shelter in general).

Car manufacturers did just announce big price increases recently--and I'm guessing that will be the last round for a while. Costs for health care services will probably keep rising, maybe not as fast, for the next few months--lots of burn out and pandemic delayed medical care will all play a role. Rent and housing in general--don't know...

It wasn't gasoline. Clothing, durables.

Kevin was talking about the all-items month-to-month change, which was only 0.1 percent, and that's almost as low as last month's increase, which was no increase at all.

But core inflation is not where the Federal Reserve can lighten up. And food prices keep climbing in a big way.

Nope. Food prices and rent have softened noticeably over the summer. Core CPI is a laggard. Come back by December......

But per Kevin, at least when energy was rising, tells us to focus on the core rather than the overall…

Oh, yeah, I know. He'll bounce around, and it's hard to keep track.

Kevin should report the difference between his trendline and the actual data for both overall and core CPI over the course of the time period he uses. I say this because if you use a linear trendline you might get a smaller difference (i.e. better fit), and different conclusion from Kevin. Core CPI inflation is still too high.

This inflation (which is not "low"!) is really hurting my family. Unfortunately, I work in higher ed which is hit by its own downward pushing forces and so I have had no change in income since 2019 and no increases in sight in the near future. I think the claimed 10% rise in food YOY is underselling it. Almost everything my household buys in groceries is up 50-100% since 2020.

My grocery expenses for the second quarter 2022 were 5% lower than in the second quarter 2020. I'm sure some things are higher, but somehow we're not paying more overall.

Mine are up about 30% since 2020. Like climate change, I guess it depends on where you live.

Groceries are still going up. We buy pretty much the same things every week and each time it is more than the last. And emails from the gas company are basically telling us the heating bills are going to be off the charts this year as well.

No they are not.

All the prices at my grocery store jumped in the spring and haven't moved since. It would be interesting to know if middle priced restaurant sales have slumped. The easiest way to deal with food inflation is to eat at home. Pack a lunch. Otherwise this is really a no impact issue to me.

Step 1: Give money to everyone

Step 2: Lock in low, fixed interest rates

Step 3: Raise rents in perpetuity

Life lesson #1: People that work hard are suckers

Life lesson #2: People that borrow money and grift are winners!!!!

I understand that I'm conservative and essentially nobody else on this blog is, but I'll never understand how we can look at the same thing and see something so totally different.

Stimulating the economy is one thing, saturating it is something else.

What are you looking at? I'll agree some people are getting money for nothing, as I have at times, but working for pay is still what most people do for most of their income.

I was bored at home during the pandemic and came across a real estate website (Biggerpockets) when I was trying to figure out why real estate prices were going up so much while nobody was actually working.

As you can imagine, there was a lot of discussion and debate, but the argument that carried the most weight for me was that the infusion of money into the economy would cause inflation and would increase rents dramatically.

Basically, borrow as much money as you can at historically low fixed rates (2-3% back then) and pay it back with inflated dollars over the next 30 years.

Please understand, I believe that there needed to be stimulus. It's just that many people (myself included) felt that there was too much. Everything went crazy. Used cars, collectibles, real estate, etc.

In the end, I'm not saying I'm exactly right, but I will say that I'm VERY thankful that I came across that website and I wish I would've come across it even earlier in the pandemic.

It's been an extraordinary couple of years...

If we had got less stimulus I'd probably be homeless (not related to rent inflation) so fuck right off.

It brings me great joy to learn that such a rude Internet hero is such a loser.

You live in the richest country in the history of the world (by a lot), so look for your bootstraps and see if you can't get your stuff together, tough guy. LOL!!!!

The biggest loser remains your Florida-New Jersey God-King.

Before 2020, I woul go out for lunch a few times a week. $40. I would go to a nicer restaurant for inner a few times a month. $150 for me alone. I would go to baseball games in another city. $500 with hotel and food. I’d travel to visit my elderly mother which required hotel and restaurants and gas. You get the point. I didn’t spend that money in 2020 to 2021. I worked full time as an essential worker. I didn’t get even one stimulus check. I made too much money.

I saved money during that time. I could go on vacation and eat out more now, but… I don’t. I did buy a new bed and replaced some flooring in my home this year. Is this acceptable behavior to you?

So, you're saying you didn't need magical checks to show up in the mail? Me neither. Thanks for proving my point.

Too bad that loser, Special Newb, can't get his shiite together like us, right?

Jeebus, you all are a RUDE bunch. I come on looking for legitimate dialogue, but end up with this nonsense.

Call me a troll all you'd like, you people have zero social skills.

people like you and me don’t get magical money that way. We get tax cuts and deductions. You’ll be fine. If you aren’t getting called nasty names here, you aren’t trying hard enough.

Given that people like me changed their spending habits, that companies and supply chains didn’t adapt very well, given the war in Ukraine, and that these costs are increasing worldwide, it’s hard for me to imagine that the tax cuts given to poor people (magical checks) in 2020 to 2021are the root cause. That money is long gone so…

Vehicle prices went crazy because of a fire at a large semiconductor factory in Japan which put a major crunch on the supply of new vehicles.

Stimulus was not responsible for the auto industry's adoption of just-in-time inventory management, which proved disastrous.

First I've heard of the fire. Interesting. Too bad it's so difficult to find real news like that while the major network news just yells at each other and calls each other names.

Well, much like the food supply, a little diversity in production is probably a good idea for moments like those.

Having said that, I'm guessing stimulus played a part. There was no fire in the classic comic book factory or the classic baseball card factory. (Please understand that I'm not trying to be snarky, so I apologize if it comes off like that). Just that prices in lots of things that would lend themselves to being considered bought by disposable income, went crazy.

Do you think that laid-off restaurant and hospitality-sector workers were using stimulus money to buy high-priced collectibles?

No, they were buying reefer, sextoys, & bitcoin.

“Life lesson #1: People that work hard are suckers

Life lesson #2: People that borrow money and grift are winners!!!!”

Good thing the conservative Republican Party has never rewarded people who don’t work hard with gobs of federal cash and tax cuts, not have they ever favored borrowers or grifters by giving them more power.

Austin, I hope we can agree that it's disgusting when it happens on both sides. I'm no longer a Republican, but I am still conservative (I don't really consider many Republicans to actually be conservative). I dream of a legitimate 3rd party (or more), but that's just dreaming in the US, sadly....

Your lifelessons don't seem to follow from the actual events of the last few years.

In spite of a deadly pandemic and the most dramatic economic freefall in history, we ended up with a booming recovery, low unemployment, rising levels of wealth across broad sections of society, higher wages, reductions in poverty, increases in health insurance coverage, etc...

People that worked hard benefitted over the past few years. People that borrowed money also may have benefitted if they invested in US assets or companies....but this is not a bad thing. Obviously, not every person in the country did well and not every investment was a good one.

The urge to always see one's self as the victim is a key part of modern conservatism.....but give it a rest.

LOL. I actually borrowed the money, so no victimhood here. Just pointing out how I was "Kingmade" by the loose money (of course not as much as the Washington cronies (on both sides of the aisle) were.

Again, stimulus, not saturation. There is such a thing as too much of a good thing, no?

What’s your evidence that there was ‘too much’ stimulus [sic]? The money sent out by government must be offset by lost earnings and business revenues that many experienced during the Covid-19 pandemic. Only that excess (if any) would actually be stimulus; otherwise it is only replacement for the spending that would have occurred out of income. I haven’t seen this calculation, have you?

No. 2 sounds like a conversation between El Jefe Maximo & Justin Kennedy.

Not really familiar with either. MontyMongoose, I'm not gonna lie, you know a lot about a lot. Not sure how accurate it all is, but I keep things very simple.

El Jefe = Donald Trump

Justin Kennedy = Supreme Anthony Kennedy's son & El Jefe's connect at Deutsche Bank

For the record, I thought it was obvious who you were talking about. So do most people here, I would wager.

Core inflation this month is mostly driven by estimated housing increases over the spring and early summer.

Considering this data is many months out of date and it doesn't actually reflect actual housing costs paid by Americans.....

I guess we must continue to engineer a recession!! Because some statistics!

The PCE rate shows even softer inflation. The need for more rate hikes isn't really supported by much data. But higher unemployment and lower wages for the bottom 95% is always a price we are willing to pay.

No, the trendline is not what is important - it does not predict the future. Does Kevin have some theoretical model which gives the course of inflation over time? If so he should apply it to the historical data and see how it works. Economists have been trying to predict inflation for a long time and they almost always get it wrong.

The good new is that overall inflation has been nearly zero over the last two months - the CPI has scarcely increased. It is highly misleading to keep talking about the year/year numbers of over 8% as the media do because that is an artifact of what the CPI was doing earlier in the year. The last two months may not give an accurate prediction of future inflation, but they are more predictive than what was happening further back in time.

The bad news, as Kevin says, is that monthly core inflation remains high, and food inflation even higher. Total inflation is being kept low by a fall in oil price. But a rise in oil price was a major part of what raised the CPI over the last year.

I expect energy prices to skyrocket once again, but not due to anything Biden has control over. It's looking like Putin wants to cut Europe off completely from importing his gas, and as we inch ever closer to winter, European demand will make the prices surge.

Not much for the US. US is a LNG exporter and the transit costs often make it prohibitive to ship to Europe.

I expect Europe's travails will exert downward pressure on inflation, globally, but hitting consumer spending in a region with nearly 250 million high income households. It's also not clear how energy demand will spread outwards from Europe, since substitutes for Russian natural gas are highly limited: there's not much that can be bought.

Food will never go down much again because of climate change.

Stop. Growing. Almonds.

Not even a replacement level nut.

Food and rent are a 4th quarter collapse coming to a government bean counter near you.

It's not apparent that anything either government or the Fed does will reduce the prices of food. Droughts, floods and war in Ukraine have caused massive shortages in the production of everything from wheat to olive oil, and the situation is going to get worse. Democrats could be doing a better job of explaining this to Americans instead of wringing their hands about how much they feel inflationary pain.

They could also take the opportunity of noting how fatuous are right-wing claims that increased CO2 in the atmosphere will actually increase food production because plants love the stuff.

Food inflation barely grew in August.

Food price changes can't really be about demand, can they? Sure, there are more people every year so I guess that means we need more food all the time. Is it labor shortage on farms and war in Ukraine? Oh well. I don't go to restaurants anymore for dinner. Problem solved.

Au contraire, I’m sure food is a perfectly normal free market, such that when prices are low, everyone eats five or six meals a day, and when prices are high, one or none.

Hell has a brand new angel,

https://www.rawstory.com/ken-starr-2658204541/

Something killed Ken Starr.

The only good republican is a dead republican. But take a look at this whacko!

WALLED LAKE, Mich. – The 21-year-old daughter of a man who police said killed his wife, the family dog and severely injured his 25-year-old daughter said her father was radicalized by QAnon. QAnon is an online conspiracy that believes in a pedophilic cult of the elite that planned the COVID pandemic and stole the election. Rebecca Lanis, 21, said QAnon radicalized her father and sent him over the edge. “He started reading about the stolen election and Trump and then he started getting deeper into it and then when the vaccines came out and COVID, he started reading all that,” Rebecca Lanis said.

Yikes!

https://www.clickondetroit.com/news/local/2022/09/12/daughter-says-qanon-radicalized-walled-lake-father-before-he-killed-mother-dog-injured-sister/

& the beclowned restaurant gunman in Pennsylvania!

I have been refreshing the Clinton Kill List to see when he's added to the count.

I am sure the surgeon for Kenny Boi's procedure attended synagogue with the cousin of the daughter of the boyfriend of Sen. Hillary Clinton's press aide (2003-04).